Answered step by step

Verified Expert Solution

Question

1 Approved Answer

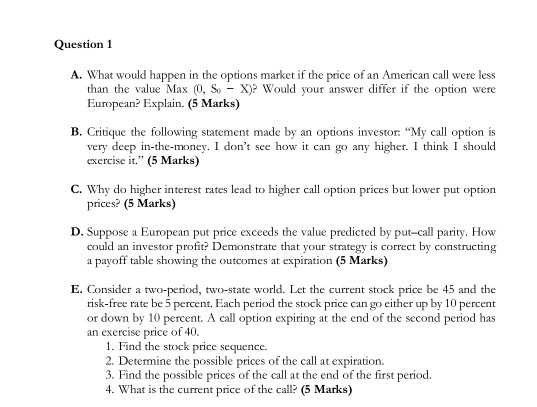

please answer the questions from A to E. Explain all answers into details. it can be hand written Question 1 A. What would happen in

please answer the questions from A to E. Explain all answers into details. it can be hand written

Question 1 A. What would happen in the options market if the price of an American call were less than the value Max (0, S. - x)? Would your answer differ if the option were European? Explain. (5 Marks) B. Critique the following statement made by an options investor. "My call option is very deep in-the-money. I don't see how it can go any higher. I think I should exercise it." (5 Marks) C. Why do higher interest rates lead to higher call option prices but lower put option prices? (5 Marks) D. Suppose a European put price exceeds the value predicted by put-call parity. How could an investor profit? Demonstrate that your strategy is correct by constructing a payoff table showing the outcomes at expiration (5 Marks) E. Consider a two-period, two-state world. Let the current stock price be 45 and the risk-free rate be 5 percent. Each period the stock price can go either up by 10 percent or down by 10 percent. A call option expiring at the end of the second period has an exercise price of 40. 1. Find the stock price sequence. 2. Determine the possible prices of the call at expiration 3. Find the possible prices of the call at the end of the first period. 4. What is the current price of the callStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started