Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the questions. please put the calculations in an excel sheet or form. - Analyze the differences between gross working capital, net working capital,

please answer the questions. please put the calculations in an excel sheet or form.

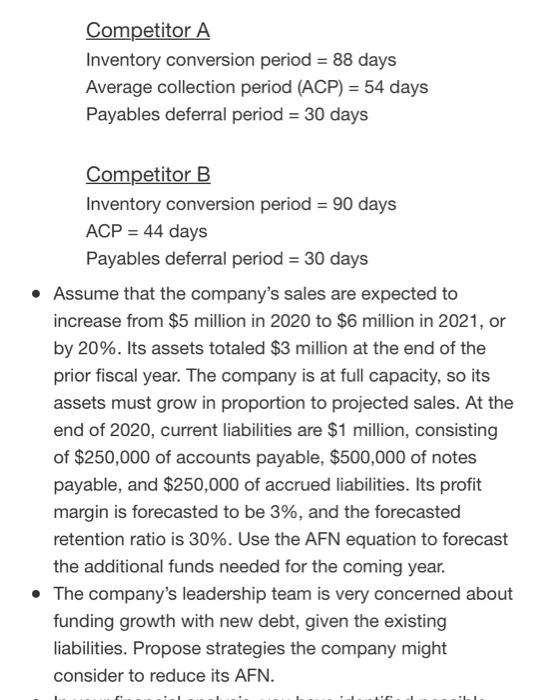

- Analyze the differences between gross working capital, net working capital, and net operating working capital and their relationship to the cash conversion cycle. - The company owner is considering a new venture that would require an additional $50,000 every month in inventory from a supplier over the next year. (Note: Use your creativity to come up with such a venture that can serve as a basis for your recommendations.) Explain the various short-term financing options available, including the advantages and disadvantages of each source. What do you recommend and why? - Assume that the company has an inventory conversion period of 64 days, an average collection period of 28 days, and a payables deferral period of 41 days. - What is the length of the cash conversion cycle? - If annual sales are $2,578,235 and all sales are on credit, what is the investment in accounts receivable? - How many times per year does the company turn over its inventory? Assume that the cost of goods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio. - Compare the cash conversion cycles of two competitors of your company using the following facts: Competitor A Inventory conversion period =88 days Average collection period (ACP)=54 days Payables deferral period =30 days Competitor B Inventory conversion period =90 days ACP=44 days Payables deferral period =30 days - Assume that the company's sales are expected to increase from $5 million in 2020 to $6 million in 2021 , or by 20%. Its assets totaled $3 million at the end of the prior fiscal year. The company is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2020 , current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 3%, and the forecasted retention ratio is 30%. Use the AFN equation to forecast the additional funds needed for the coming year. - The company's leadership team is very concerned about funding growth with new debt, given the existing liabilities. Propose strategies the company might consider to reduce its AFN. - Analyze the differences between gross working capital, net working capital, and net operating working capital and their relationship to the cash conversion cycle. - The company owner is considering a new venture that would require an additional $50,000 every month in inventory from a supplier over the next year. (Note: Use your creativity to come up with such a venture that can serve as a basis for your recommendations.) Explain the various short-term financing options available, including the advantages and disadvantages of each source. What do you recommend and why? - Assume that the company has an inventory conversion period of 64 days, an average collection period of 28 days, and a payables deferral period of 41 days. - What is the length of the cash conversion cycle? - If annual sales are $2,578,235 and all sales are on credit, what is the investment in accounts receivable? - How many times per year does the company turn over its inventory? Assume that the cost of goods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio. - Compare the cash conversion cycles of two competitors of your company using the following facts: Competitor A Inventory conversion period =88 days Average collection period (ACP)=54 days Payables deferral period =30 days Competitor B Inventory conversion period =90 days ACP=44 days Payables deferral period =30 days - Assume that the company's sales are expected to increase from $5 million in 2020 to $6 million in 2021 , or by 20%. Its assets totaled $3 million at the end of the prior fiscal year. The company is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2020 , current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 3%, and the forecasted retention ratio is 30%. Use the AFN equation to forecast the additional funds needed for the coming year. - The company's leadership team is very concerned about funding growth with new debt, given the existing liabilities. Propose strategies the company might consider to reduce its AFN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started