Answered step by step

Verified Expert Solution

Question

1 Approved Answer

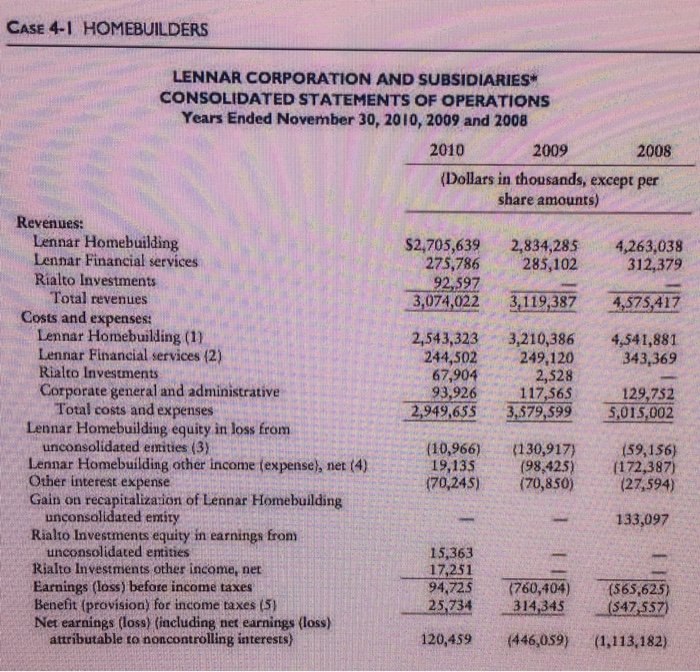

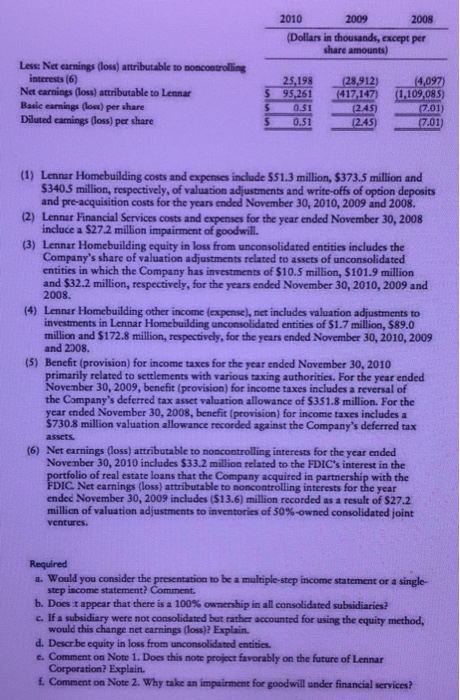

Please answer the required questions CASE 4-1 HOMEBUILDERS LENNAR CORPORATION AND SUBSIDIARIES* CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended November 30, 2010, 2009 and 2008 2010

Please answer the required questions

CASE 4-1 HOMEBUILDERS LENNAR CORPORATION AND SUBSIDIARIES* CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended November 30, 2010, 2009 and 2008 2010 2009 2008 (Dollars in thousands, except per share amounts) Revenues: Lennar Homebuilding Lennar Financial services Rialto Investments $2,705,639 2,834,285 4,263,038 275,786285,102 312,379 92-597 Total revenues 3,074,022 3,119.387 4,575,417 Costs and expenses: Lennar Homebuilding (1) Lennar Financial services (2) Rialto Investments Corporate general and administrative 2,543,323 3,210,386 4,541,881 244,502249,120 343,369 2,528 67,904 93,926 117565 129,752 Total costs and expenses Lennar Homebuilding equity in loss from 2,949,655 3.579,599 5,015,002 unconsolidated emities (3) Lennar Homebuilding other income (expensel, net (4) Other interest expense Gain on recapitalizaion of Lennar Homebuilding (10,966) 130,917 59,156) 19,135(98,425)(172,387) (70,245) (70,850)(27,594) unconsolidated emity Rialto Investments equity in earnings fron 133,097 unconsolidated etities Rialto Investments other income, net Earnings (loss) before income taxes Benefit (provision) for income taxes (5) Net earnings (loss) (including net earnings (loss) 15,363 17,251 94,725 760,404) (65,625) 25234 314.245-(547557) $47, attributable to noncontrolling interests) 120,459 (446,059) (1,113,182)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started