Answered step by step

Verified Expert Solution

Question

1 Approved Answer

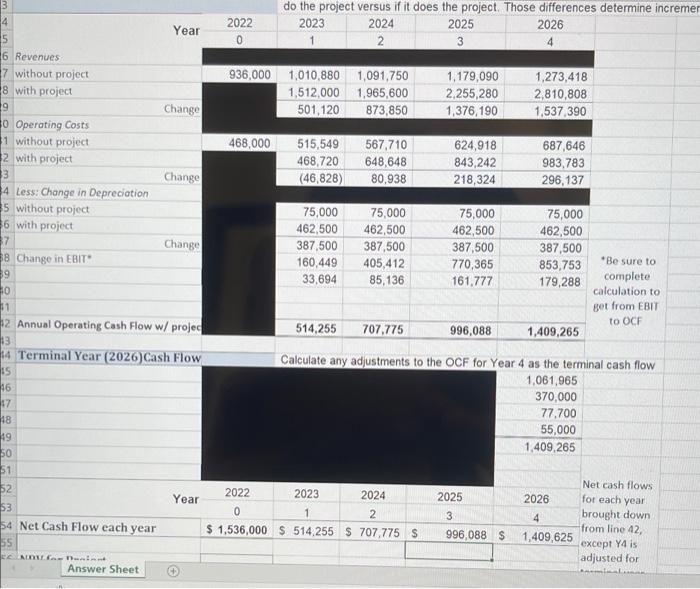

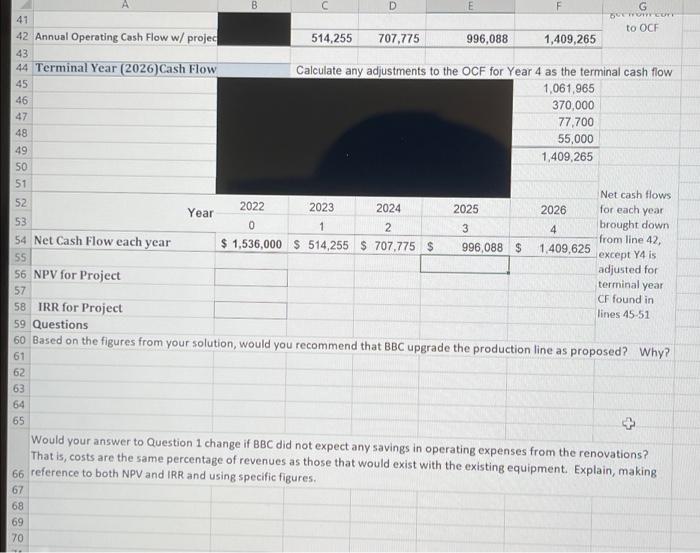

please answer the short answer questions and if can someone find NPV and IRR that would be helpful I am lost 456789 Year 6 Revenues

please answer the short answer questions and if can someone find NPV and IRR that would be helpful I am lost

456789 Year 6 Revenues 7 without project 8 with project Change 0 Operating Costs $1 without project 2 with project 3 Change 4 Less: Change in Depreciation 5 without project 6 with project 37 Change 38 Change in EBIT 89 10 $1 12 Annual Operating Cash Flow w/ projec 13 14 Terminal Year (2026) Cash Flow 15 46 17 48 49 50 51 52 Year 53 54 Net Cash Flow each year 55 NOV for Daint Answer Sheet do the project versus if it does the project. Those differences determine incremer 2022 2023 2024 2026 2025 3 0 2 4 936,000 1,010,880 1,091,750 1,179,090 1,273,418 1,512,000 1,965,600 2,255,280 2,810,808 501,120 873,850 1,376,190 1,537,390 468,000 515,549 567,710 624,918 687,646 468,720 648,648 843,242 983,783 (46,828) 80,938 218,324 296,137 75,000 75,000 75,000 75,000 462,500 462,500 462,500 462,500 387,500 387,500 387,500 387,500 160,449 405,412 770,365 853,753 33,694 85,136 161,777 179,288 "Be sure to completel calculation to get from EBIT to OCF 514,255 707,775 996,088 1,409,265 Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 1,061,965 370,000 77,700 55,000 1,409,265 2022 2024 2025 2026 2023 1 0 2 3 4 Net cash flows for each year brought down from line 42, except Y4 is adjusted for $1,536,000 $ 514,255 $ 707,775 S 996,088 $ 1,409,625 D E F G ger mon com to OCF 42 Annual Operating Cash Flow w/ projec 514,255 707,775 996,088 1,409,265 43 44 Terminal Year (2026) Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 1,061,965 46 370,000 47 77,700 48 55,000 49 1,409,265 50 51 52 2022 2026 Net cash flows for each year brought down Year 2025 3 2023 2024 1 2 $1,536,000 $ 514,255 $707,775 $ 53 0 54 Net Cash Flow each 4 1,409,625 year 996,088 $ 55 from line 42, except Y4 is adjusted for terminal year CF found in 56 NPV for Project 57 58 IRR for Project lines 45-51 59 Questions 60 Based on the figures from your solution, would you recommend that BBC upgrade the production line as proposed? Why? 61 62 63 64 65 Would your answer to Question 1 change if BBC did not expect any savings in operating expenses from the renovations? That is, costs are the same percentage of revenues as those that would exist with the existing equipment. Explain, making 66 reference to both NPV and IRR and using specific figures. 67 68 69 70 1 2 3 4 450 B 456789 Year 6 Revenues 7 without project 8 with project Change 0 Operating Costs $1 without project 2 with project 3 Change 4 Less: Change in Depreciation 5 without project 6 with project 37 Change 38 Change in EBIT 89 10 $1 12 Annual Operating Cash Flow w/ projec 13 14 Terminal Year (2026) Cash Flow 15 46 17 48 49 50 51 52 Year 53 54 Net Cash Flow each year 55 NOV for Daint Answer Sheet do the project versus if it does the project. Those differences determine incremer 2022 2023 2024 2026 2025 3 0 2 4 936,000 1,010,880 1,091,750 1,179,090 1,273,418 1,512,000 1,965,600 2,255,280 2,810,808 501,120 873,850 1,376,190 1,537,390 468,000 515,549 567,710 624,918 687,646 468,720 648,648 843,242 983,783 (46,828) 80,938 218,324 296,137 75,000 75,000 75,000 75,000 462,500 462,500 462,500 462,500 387,500 387,500 387,500 387,500 160,449 405,412 770,365 853,753 33,694 85,136 161,777 179,288 "Be sure to completel calculation to get from EBIT to OCF 514,255 707,775 996,088 1,409,265 Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 1,061,965 370,000 77,700 55,000 1,409,265 2022 2024 2025 2026 2023 1 0 2 3 4 Net cash flows for each year brought down from line 42, except Y4 is adjusted for $1,536,000 $ 514,255 $ 707,775 S 996,088 $ 1,409,625 D E F G ger mon com to OCF 42 Annual Operating Cash Flow w/ projec 514,255 707,775 996,088 1,409,265 43 44 Terminal Year (2026) Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 1,061,965 46 370,000 47 77,700 48 55,000 49 1,409,265 50 51 52 2022 2026 Net cash flows for each year brought down Year 2025 3 2023 2024 1 2 $1,536,000 $ 514,255 $707,775 $ 53 0 54 Net Cash Flow each 4 1,409,625 year 996,088 $ 55 from line 42, except Y4 is adjusted for terminal year CF found in 56 NPV for Project 57 58 IRR for Project lines 45-51 59 Questions 60 Based on the figures from your solution, would you recommend that BBC upgrade the production line as proposed? Why? 61 62 63 64 65 Would your answer to Question 1 change if BBC did not expect any savings in operating expenses from the renovations? That is, costs are the same percentage of revenues as those that would exist with the existing equipment. Explain, making 66 reference to both NPV and IRR and using specific figures. 67 68 69 70 1 2 3 4 450 B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started