please answer the three questions here. I will post the others in a new question. apologies for posting too many questions in one request.

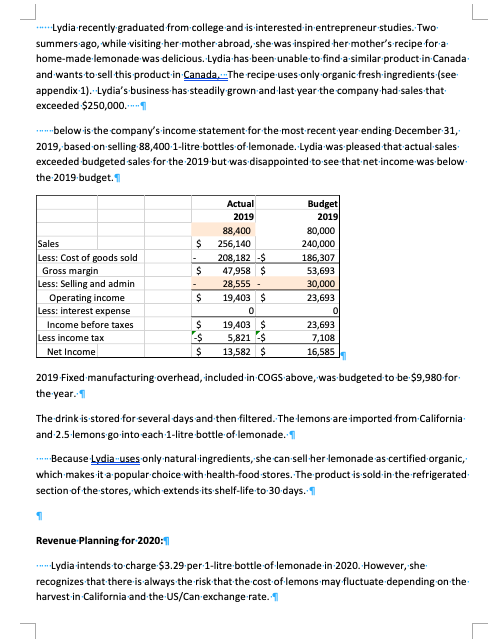

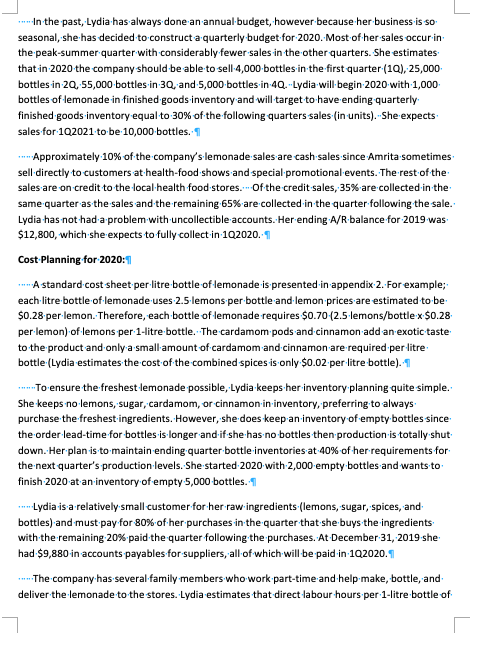

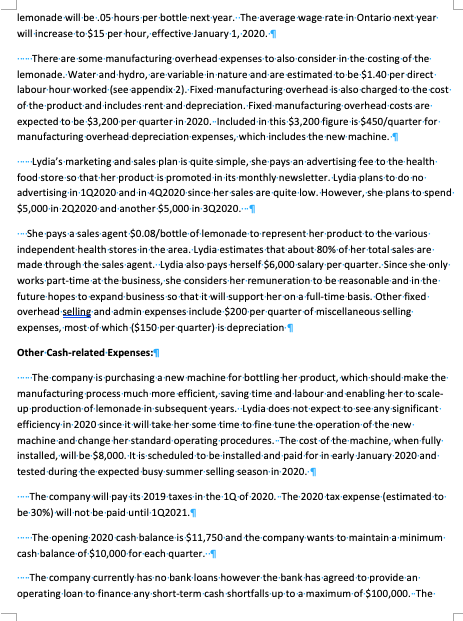

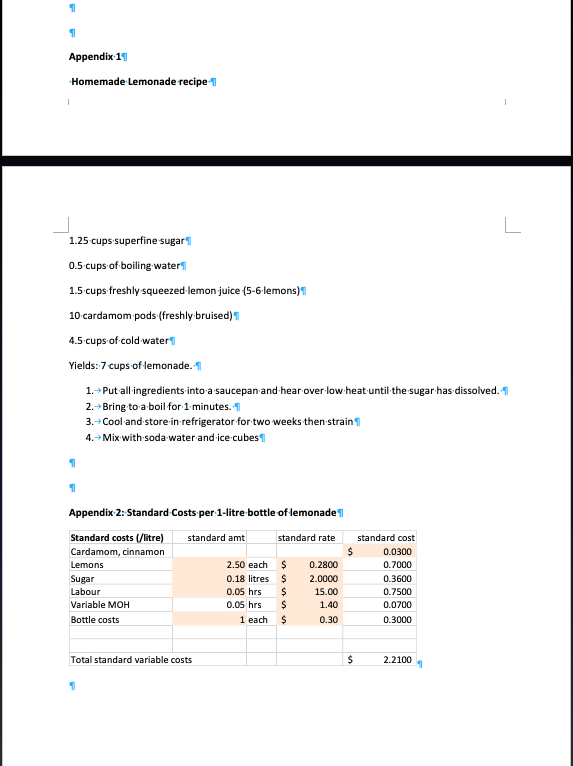

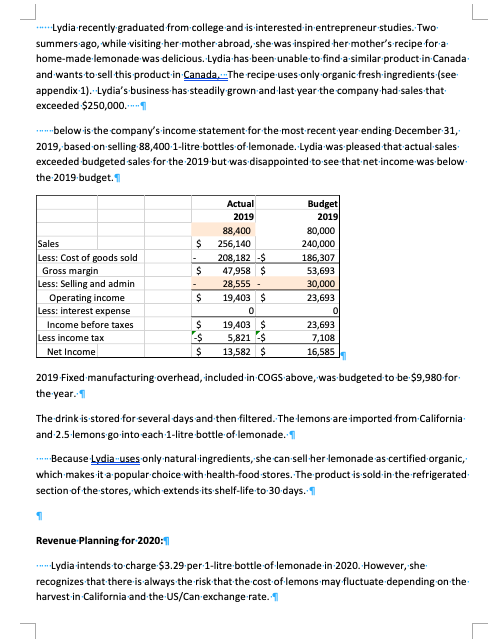

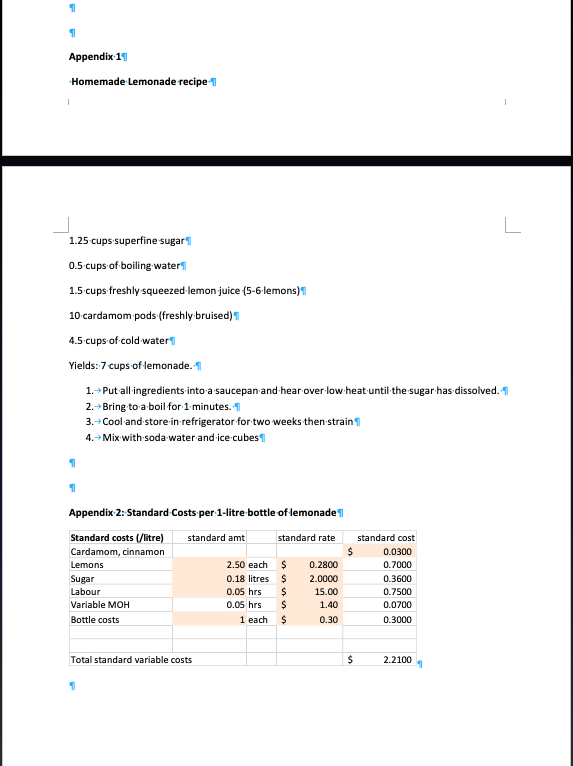

...Lydia recently graduated from college and is interested in entrepreneur studies. Two summers ago, while visiting her mother abroad, she was inspired her mother's recipe for a home-made lemonade was delicious. Lydia has been unable to find a similar product in Canada and wants to sell this product in Canada. The recipe uses only organic fresh ingredients (see appendix 1). Lydia's business has steadily grown and last year the company had sales that exceeded $250,000...1 below is the company's income statement for the most recent year ending December 31, 2019, based on selling 88,400 1-litre bottles of lemonade. Lydia was pleased that actual sales exceeded budgeted sales for the 2019 but was disappointed to see that net income was below the 2019 budget. 1 $ Sales Less: Cost of goods sold Gross margin Less: Selling and admin Operating income Less: interest expense Income before taxes Less income tax Net Income Actual 2019 88,400 256,140 208,182 $ 47,958 $ 28,555 19,403 $ 0 19,403 $ 5,821 $ 13,582 $ Budget 2019 80,000 240,000 186,307 53,693 30,000 23,693 0 23,693 7,108 16,585 $ $ $ $ 2019 Fixed manufacturing overhead, included in COGS above, was budgeted to be $9,980 for the year. 1 The drink is stored for several days and then filtered. The lemons are imported from California and 2.5-lemons go into each 1-litre bottle of lemonade. 1 Because Lydia uses only natural ingredients, she can sell her lemonade as certified organic, which makes it a popular choice with health-food stores. The product is sold in the refrigerated section of the stores, which extends its-shelf-life to-30 days. 1 Revenue Planning for 2020:4 Lydia intends to charge $3.29.per 1-litre bottle of lemonade in 2020. However, she recognizes that there is always the risk that the cost of lemons may fluctuate depending on the harvest in California and the US/Can-exchange rate. 1 In the past, Lydia has always done an annual budget, however because her business is so seasonal, she has decided to construct a quarterly budget for 2020. Most of her sales occur in the peak-summer quarter with considerably fewer sales in the other quarters. She estimates that in 2020 the company should be able to sell 4,000 bottles in the first quarter (10),25,000 bottles in 20, 55,000 bottles-in-30, and 5,000 bottles in 4Q.-Lydia will begin 2020 with 1,000 bottles of lemonade in finished goods inventory and will target to have ending quarterly finished goods inventory equal to -30% of the following quarters sales (in units). She expects sales for 102021 to be 10,000 bottles. 1 - Approximately 10% of the company's lemonade sales are cash sales since Amrita-sometimes sell directly to customers at health-food shows and special promotional events. The rest of the sales are on credit to the local health food stores. Of the credit sales, 35% are collected in the same quarter as the sales and the remaining 65% are collected in the quarter following the sale. Lydia has not had a problem with uncollectible accounts. Her ending A/R balance for 2019 was $12,800, which she expects to fully collect in 102020. 1 Cost Planning for 2020:1 A standard cost sheet per litre bottle of lemonade is presented in appendix 2. For example; each litre bottle of lemonade uses 2.5-lemons per bottle and lemon prices are estimated to be $0.28 per lemon. Therefore, each bottle of lemonade requires $0.70 (2.5 lemons/bottlex $0.28 per lemon) of lemons per 1-litre bottle. The cardamom-pods and cinnamon add an exotic taste to the product and only a small amount of cardamom and cinnamon are required per litre bottle (Lydia estimates the cost of the combined spices is only $0.02 per litre bottle). 1 To ensure the freshest lemonade possible, Lydia keeps her inventory planning quite simple. She keeps no lemons, sugar, cardamom, or cinnamon-in-inventory, preferring to always purchase the freshest ingredients. However, she does keep an inventory of empty bottles since the order lead-time for bottles is longer and if she has no bottles then production is totally shut down. Her plan is to maintain ending quarter bottle inventories at 40% of her requirements for the next quarter's production levels. She started 2020 with 2,000 empty bottles and wants to finish 2020 at an inventory of empty 5,000 bottles. 1 Lydia is a relatively small customer for her raw ingredients (lemons, sugar, spices, and bottles) and must pay for 80% of her purchases in the quarter that she buys the ingredients: with the remaining 20% paid the quarter following the purchases. At December 31, 2019 she had $9,880 in accounts payables for suppliers, all of which will be paid in 102020. ...The company has several family members who work part-time and help make, bottle, and deliver the lemonade to the stores. Lydia estimates that direct labour hours per 1-litre bottle of lemonade will be.05 hours per bottle next year. The average wage rate in Ontario next year will increase to $15 per hour, effective January 1, 2020.1 There are some manufacturing overhead expenses to also consider in the costing of the lemonade. Water and hydro, are variable in nature and are estimated to be $1.40 per direct labour hour worked (see appendix 2). Fixed manufacturing overhead is also charged to the cost of the product and includes rent and depreciation. Fixed manufacturing overhead costs are: expected to be $3,200 per quarter in 2020.-Included in this $3,200 figure is $450/quarter for manufacturing overhead depreciation expenses, which includes the new machine. 1 Lydia's marketing and sales plan is quite simple, she pays an advertising fee to the health food store so that her product is promoted in its monthly newsletter. Lydia plans to do no advertising in 102020 and in 402020-since her sales are quite low. However, she plans to spend $5,000-in 202020 and another $5,000 in 302020.-4 She pays a sales agent $0.08/bottle of lemonade to represent her product to the various independent health stores in the area. Lydia estimates that about 80% of her total sales are made through the sales agent. Lydia also pays herself-$6,000 salary per quarter. Since she only works part-time at the business, she considers her remuneration to be reasonable and in the future hopes to expand business so that it will support her on a full-time basis. Other fixed overhead selling and admin expenses include $200 per quarter of miscellaneous selling expenses, most of which ($150 per quarter) is depreciation 1 Other Cash-related Expenses: The company is purchasing a new machine for bottling her product, which should make the manufacturing process much more efficient, saving time and labour and enabling her to scale- up production of lemonade-in-subsequent years. Lydia does not expect to see any significant efficiency in 2020 since it will take her some time to fine tune the operation of the new machine and change her standard operating procedures. The cost of the machine, when fully installed, will be $8,000. It is scheduled to be installed and paid for in early January 2020 and tested during the expected busy summer selling season in 2020.4 The company will pay its 2019 taxes in the 10 of 2020. The 2020 tax expense (estimated to be 30%) will not be paid until 192021.9 The opening 2020 cash balance is $11,750 and the company wants to maintain a minimum cash balance of $10,000 for each quarter. 1 The company currently has no bank loans however the bank has agreed to provide an operating loan to finance any short-term cash shortfalls up to a maximum of $100,000. The rate charged to be charged on the loan is 6% per year (1.5% per quarter). Other conditions of the loan are that the company will only borrow at the start of each quarter and will only borrow in $5,000 increments. For example, in 10 the company might decide to borrow $5,000, $10,000, $15,000, etc. at the beginning of the month. The company will only repay its loan at the end of a quarter and only in $5,000 increments ($5,000, $10,000, $15,000, etc.) The loan may be partially repaid in $5,000 increments if the company has cash balances in excess of its minimum $10,000 cash balance requirement. Interest is accrued quarterly but is only paid- when the loan is fully repaid. -No interest is charged on interest outstanding from previous quarters. 1 1 Other financial data: The December 31, 2019 account balances for some selected balance accounts are; Property, plant and equipment $30,000; and accumulated depreciation $3,500; and common stock $4,000.-1 11 Run a sensitivity analysis on the most important cost to the company next year and assume that this cost might increase or decrease by 10%. What factors might affect the increase or decrease? --Summarize your analysis and comment on why you selected the cost you did to analyze. Interpret the results. In your opinion are there any other variables that should be tested for sensitivity and explain why21 11 Appendix 19 Homemade Lemonade recipe 1 L 1.25 cups superfine sugar 0.5 cups of boiling water 1.5 cups freshly squeezed lemon juice (5-6 lemons) 10 cardamom pods (freshly bruised) 4.5 cups of cold water Yields:7 cups of lemonade. 1. Put all ingredients into a saucepan and hear over low heat until the sugar has dissolved.-4 2.-Bring to a boil for 1 minutes. 1 3.- Cool and store-in-refrigerator for two weeks then strain 4.-Mixwith-soda water and ice cubes 1 Appendix 2: Standard Costs per 1-litre bottle of lemonade Standard costs (/litre) standard amt standard rate Cardamom, cinnamon Lemons 2.50 each $ 0.2800 Sugar 0.18 litres $ 2.0000 Labour 0.05 hrs $ 15.00 Variable MOH 0.05 hrs $ 1.40 Bottle costs 1 each $ 0.30 standard cost 0.0300 0.7000 0.3600 0.7500 0.0700 0.3000 Total standard variable costs $ 2.2100 1) Run a sensitivity analysis on the most important cost to the company next year and assume that this cost might increase or decrease by 10%. What factors might affect the increase or decrease? Sa........ comment on why do anal opinion are the and expl t: marks) ...Lydia recently graduated from college and is interested in entrepreneur studies. Two summers ago, while visiting her mother abroad, she was inspired her mother's recipe for a home-made lemonade was delicious. Lydia has been unable to find a similar product in Canada and wants to sell this product in Canada. The recipe uses only organic fresh ingredients (see appendix 1). Lydia's business has steadily grown and last year the company had sales that exceeded $250,000...1 below is the company's income statement for the most recent year ending December 31, 2019, based on selling 88,400 1-litre bottles of lemonade. Lydia was pleased that actual sales exceeded budgeted sales for the 2019 but was disappointed to see that net income was below the 2019 budget. 1 $ Sales Less: Cost of goods sold Gross margin Less: Selling and admin Operating income Less: interest expense Income before taxes Less income tax Net Income Actual 2019 88,400 256,140 208,182 $ 47,958 $ 28,555 19,403 $ 0 19,403 $ 5,821 $ 13,582 $ Budget 2019 80,000 240,000 186,307 53,693 30,000 23,693 0 23,693 7,108 16,585 $ $ $ $ 2019 Fixed manufacturing overhead, included in COGS above, was budgeted to be $9,980 for the year. 1 The drink is stored for several days and then filtered. The lemons are imported from California and 2.5-lemons go into each 1-litre bottle of lemonade. 1 Because Lydia uses only natural ingredients, she can sell her lemonade as certified organic, which makes it a popular choice with health-food stores. The product is sold in the refrigerated section of the stores, which extends its-shelf-life to-30 days. 1 Revenue Planning for 2020:4 Lydia intends to charge $3.29.per 1-litre bottle of lemonade in 2020. However, she recognizes that there is always the risk that the cost of lemons may fluctuate depending on the harvest in California and the US/Can-exchange rate. 1 In the past, Lydia has always done an annual budget, however because her business is so seasonal, she has decided to construct a quarterly budget for 2020. Most of her sales occur in the peak-summer quarter with considerably fewer sales in the other quarters. She estimates that in 2020 the company should be able to sell 4,000 bottles in the first quarter (10),25,000 bottles in 20, 55,000 bottles-in-30, and 5,000 bottles in 4Q.-Lydia will begin 2020 with 1,000 bottles of lemonade in finished goods inventory and will target to have ending quarterly finished goods inventory equal to -30% of the following quarters sales (in units). She expects sales for 102021 to be 10,000 bottles. 1 - Approximately 10% of the company's lemonade sales are cash sales since Amrita-sometimes sell directly to customers at health-food shows and special promotional events. The rest of the sales are on credit to the local health food stores. Of the credit sales, 35% are collected in the same quarter as the sales and the remaining 65% are collected in the quarter following the sale. Lydia has not had a problem with uncollectible accounts. Her ending A/R balance for 2019 was $12,800, which she expects to fully collect in 102020. 1 Cost Planning for 2020:1 A standard cost sheet per litre bottle of lemonade is presented in appendix 2. For example; each litre bottle of lemonade uses 2.5-lemons per bottle and lemon prices are estimated to be $0.28 per lemon. Therefore, each bottle of lemonade requires $0.70 (2.5 lemons/bottlex $0.28 per lemon) of lemons per 1-litre bottle. The cardamom-pods and cinnamon add an exotic taste to the product and only a small amount of cardamom and cinnamon are required per litre bottle (Lydia estimates the cost of the combined spices is only $0.02 per litre bottle). 1 To ensure the freshest lemonade possible, Lydia keeps her inventory planning quite simple. She keeps no lemons, sugar, cardamom, or cinnamon-in-inventory, preferring to always purchase the freshest ingredients. However, she does keep an inventory of empty bottles since the order lead-time for bottles is longer and if she has no bottles then production is totally shut down. Her plan is to maintain ending quarter bottle inventories at 40% of her requirements for the next quarter's production levels. She started 2020 with 2,000 empty bottles and wants to finish 2020 at an inventory of empty 5,000 bottles. 1 Lydia is a relatively small customer for her raw ingredients (lemons, sugar, spices, and bottles) and must pay for 80% of her purchases in the quarter that she buys the ingredients: with the remaining 20% paid the quarter following the purchases. At December 31, 2019 she had $9,880 in accounts payables for suppliers, all of which will be paid in 102020. ...The company has several family members who work part-time and help make, bottle, and deliver the lemonade to the stores. Lydia estimates that direct labour hours per 1-litre bottle of lemonade will be.05 hours per bottle next year. The average wage rate in Ontario next year will increase to $15 per hour, effective January 1, 2020.1 There are some manufacturing overhead expenses to also consider in the costing of the lemonade. Water and hydro, are variable in nature and are estimated to be $1.40 per direct labour hour worked (see appendix 2). Fixed manufacturing overhead is also charged to the cost of the product and includes rent and depreciation. Fixed manufacturing overhead costs are: expected to be $3,200 per quarter in 2020.-Included in this $3,200 figure is $450/quarter for manufacturing overhead depreciation expenses, which includes the new machine. 1 Lydia's marketing and sales plan is quite simple, she pays an advertising fee to the health food store so that her product is promoted in its monthly newsletter. Lydia plans to do no advertising in 102020 and in 402020-since her sales are quite low. However, she plans to spend $5,000-in 202020 and another $5,000 in 302020.-4 She pays a sales agent $0.08/bottle of lemonade to represent her product to the various independent health stores in the area. Lydia estimates that about 80% of her total sales are made through the sales agent. Lydia also pays herself-$6,000 salary per quarter. Since she only works part-time at the business, she considers her remuneration to be reasonable and in the future hopes to expand business so that it will support her on a full-time basis. Other fixed overhead selling and admin expenses include $200 per quarter of miscellaneous selling expenses, most of which ($150 per quarter) is depreciation 1 Other Cash-related Expenses: The company is purchasing a new machine for bottling her product, which should make the manufacturing process much more efficient, saving time and labour and enabling her to scale- up production of lemonade-in-subsequent years. Lydia does not expect to see any significant efficiency in 2020 since it will take her some time to fine tune the operation of the new machine and change her standard operating procedures. The cost of the machine, when fully installed, will be $8,000. It is scheduled to be installed and paid for in early January 2020 and tested during the expected busy summer selling season in 2020.4 The company will pay its 2019 taxes in the 10 of 2020. The 2020 tax expense (estimated to be 30%) will not be paid until 192021.9 The opening 2020 cash balance is $11,750 and the company wants to maintain a minimum cash balance of $10,000 for each quarter. 1 The company currently has no bank loans however the bank has agreed to provide an operating loan to finance any short-term cash shortfalls up to a maximum of $100,000. The rate charged to be charged on the loan is 6% per year (1.5% per quarter). Other conditions of the loan are that the company will only borrow at the start of each quarter and will only borrow in $5,000 increments. For example, in 10 the company might decide to borrow $5,000, $10,000, $15,000, etc. at the beginning of the month. The company will only repay its loan at the end of a quarter and only in $5,000 increments ($5,000, $10,000, $15,000, etc.) The loan may be partially repaid in $5,000 increments if the company has cash balances in excess of its minimum $10,000 cash balance requirement. Interest is accrued quarterly but is only paid- when the loan is fully repaid. -No interest is charged on interest outstanding from previous quarters. 1 1 Other financial data: The December 31, 2019 account balances for some selected balance accounts are; Property, plant and equipment $30,000; and accumulated depreciation $3,500; and common stock $4,000.-1 11 Run a sensitivity analysis on the most important cost to the company next year and assume that this cost might increase or decrease by 10%. What factors might affect the increase or decrease? --Summarize your analysis and comment on why you selected the cost you did to analyze. Interpret the results. In your opinion are there any other variables that should be tested for sensitivity and explain why21 11 Appendix 19 Homemade Lemonade recipe 1 L 1.25 cups superfine sugar 0.5 cups of boiling water 1.5 cups freshly squeezed lemon juice (5-6 lemons) 10 cardamom pods (freshly bruised) 4.5 cups of cold water Yields:7 cups of lemonade. 1. Put all ingredients into a saucepan and hear over low heat until the sugar has dissolved.-4 2.-Bring to a boil for 1 minutes. 1 3.- Cool and store-in-refrigerator for two weeks then strain 4.-Mixwith-soda water and ice cubes 1 Appendix 2: Standard Costs per 1-litre bottle of lemonade Standard costs (/litre) standard amt standard rate Cardamom, cinnamon Lemons 2.50 each $ 0.2800 Sugar 0.18 litres $ 2.0000 Labour 0.05 hrs $ 15.00 Variable MOH 0.05 hrs $ 1.40 Bottle costs 1 each $ 0.30 standard cost 0.0300 0.7000 0.3600 0.7500 0.0700 0.3000 Total standard variable costs $ 2.2100 1) Run a sensitivity analysis on the most important cost to the company next year and assume that this cost might increase or decrease by 10%. What factors might affect the increase or decrease? Sa........ comment on why do anal opinion are the and expl t: marks)

please answer the three questions here. I will post the others in a new question. apologies for posting too many questions in one request.

please answer the three questions here. I will post the others in a new question. apologies for posting too many questions in one request.