Answered step by step

Verified Expert Solution

Question

1 Approved Answer

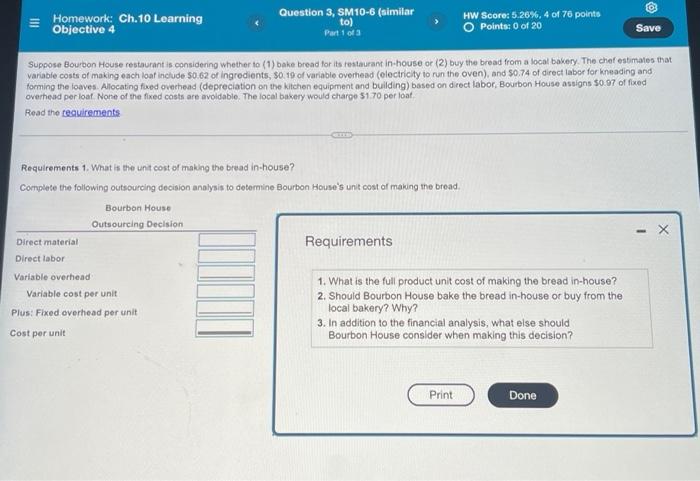

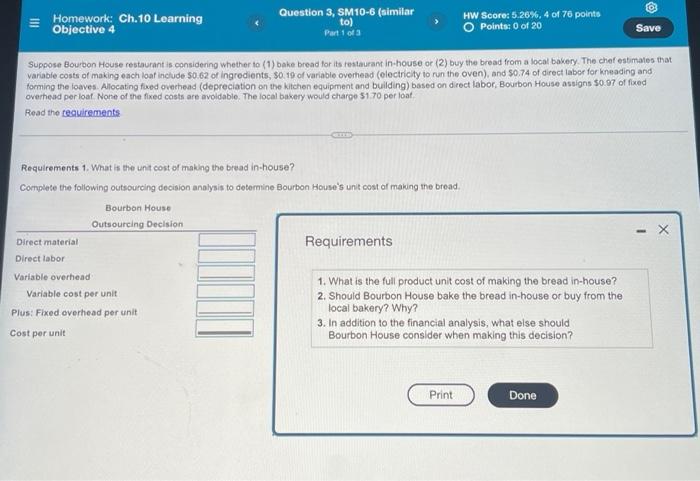

please answer the three questions Homework: Ch.10 Learning Objective 4 Question 3, SM10-6 (similar to) Part 1 of 3 HW Score: 5.26%, 4 of 76

please answer the three questions

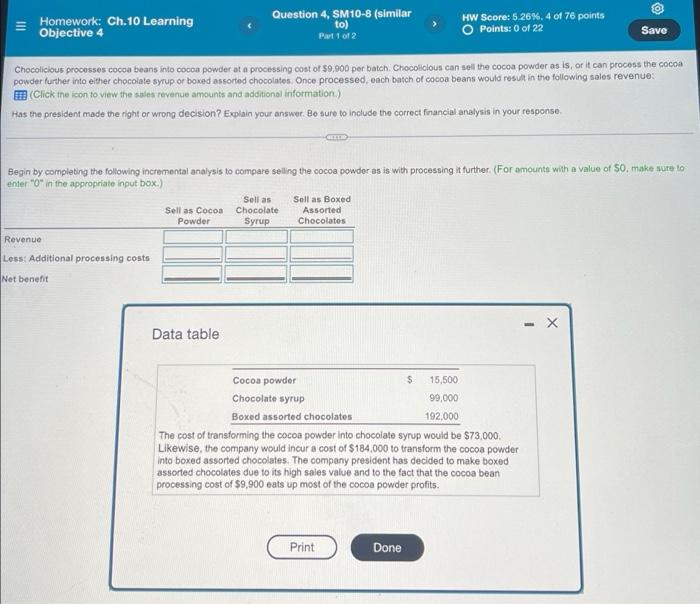

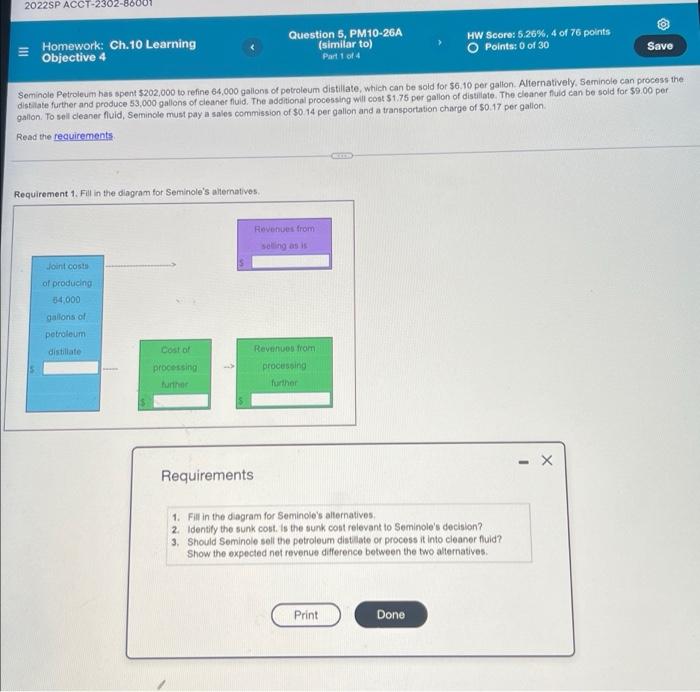

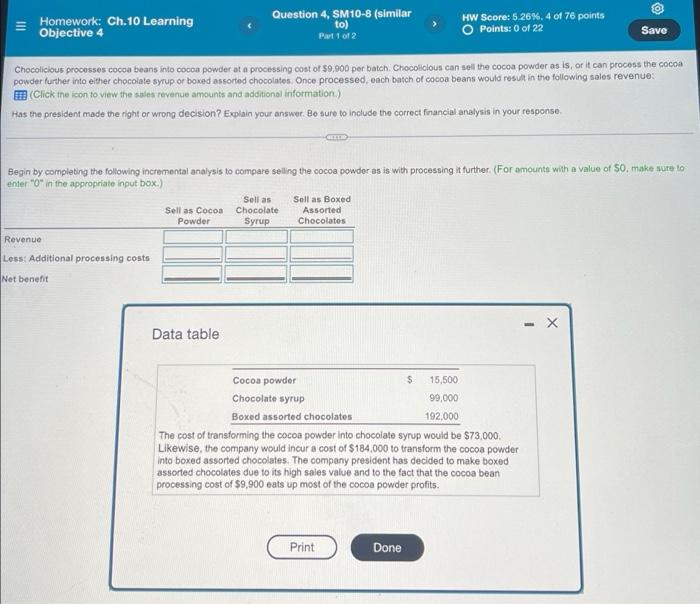

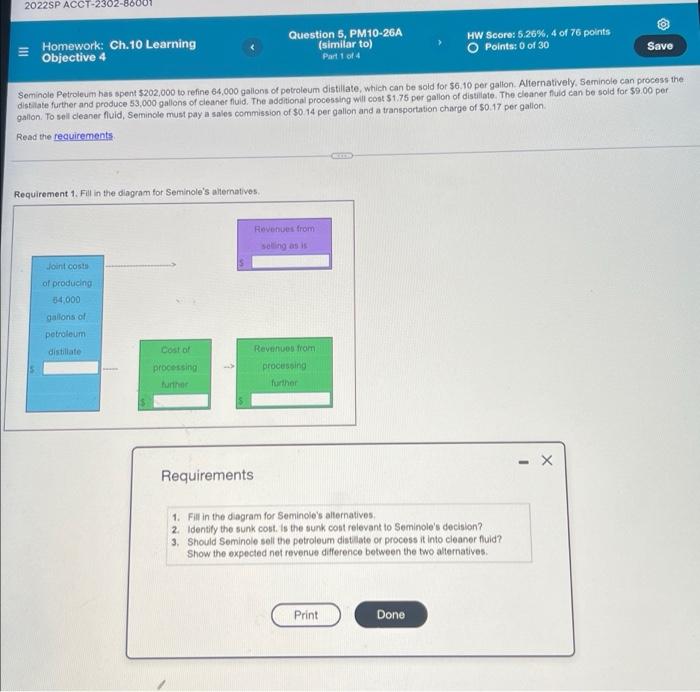

Homework: Ch.10 Learning Objective 4 Question 3, SM10-6 (similar to) Part 1 of 3 HW Score: 5.26%, 4 of 76 points O Points: 0 of 20 Save Suppose Bourbon House restaurant is considering whether to (1) bake bread for its restaurant in-house or (2) buy the bread from a local bakery. The chef estimates that variable costs of making each loaf include 50.62 of ingredients, $0.19 of variable overhead (electricity to run the oven), and $0.74 of direct labor for kneading and forming the loaves. Allocating fixed overhead (depreciation on the kitchen equipment and building) based on direct labor, Bourbon House assigns $0.97 of fixed overhead per loaf. None of the fixed costs are avoidable. The local bakery would charge $1.70 per loaf. Read the requirements Requirements 1. What is the unit cost of making the bread in-house? Complete the following outsourcing decision analysis to determine Bourbon House's unit cost of making the bread. Bourbon House Outsourcing Decision Direct material Requirements Direct labor Variable overhead 1. What is the full product unit cost of making the bread in-house? Variable cost per unit 2. Should Bourbon House bake the bread in-house or buy from the local bakery? Why? Plus: Fixed overhead per unit Cost per unit 3. In addition to the financial analysis, what else should Bourbon House consider when making this decision? Print Done Homework: Ch.10 Learning Objective 4 Question 4, SM10-8 (similar to) Part 1 of 2 HW Score: 5.26%, 4 of 76 points O Points: 0 of 22 Save Chocolicious processes cocoa beans into cocoa powder at a processing cost of $9,900 per batch. Chocolicious can sell the cocoa powder as is, or it can process the cocoa powder further into either chocolate syrup or boxed assorted chocolates. Once processed, each batch of cocoa beans would result in the following sales revenue: (Click the icon to view the sales revenue amounts and additional information.) Has the president made the right or wrong decision? Explain your answer. Be sure to include the correct financial analysis in your response. CETTE Begin by completing the following incremental analysis to compare selling the cocoa powder as is with processing it further. (For amounts with a value of SO, make sure to enter"0" in the appropriate input box.) Sell as Sell as Cocoa Chocolate Powder Sell as Boxed Assorted Chocolates Syrup Revenue Less: Additional processing costs Net benefit - X III Data table Cocoa powder 15,500 99,000 Chocolate syrup Boxed assorted chocolates 192,000 The cost of transforming the cocoa powder into chocolate syrup would be $73,000. Likewise, the company would incur a cost of $184,000 to transform the cocoa powder into boxed assorted chocolates. The company president has decided to make boxed assorted chocolates due to its high sales value and to the fact that the cocoa bean processing cost of $9,900 eats up most of the cocoa powder profits. Print Done $ 2022SP ACCT-2302-860 Homework: Ch.10 Learning Objective 4 Question 5, PM10-26A (similar to) Part 1 of 4 HW Score: 5.26%, 4 of 76 points O Points: 0 of 30 Save Seminole Petroleum has spent $202,000 to refine 64,000 gallons of petroleum distillate, which can be sold for $6.10 per gallon. Alternatively, Seminole can process the distillate further and produce 53,000 gallons of cleaner fluid. The additional processing will cost $1.75 per gallon of distillate. The cleaner fluid can be sold for $9.00 per gallon. To sell cleaner fluid, Seminole must pay a sales commission of $0.14 per gallon and a transportation charge of $0.17 per gallon. Read the requirements Requirement 1. Fill in the diagram for Seminole's alternatives. Revenues from selling as is Joint costs of producing 64,000 gallons of petroleum distillate Cost of processing Revenues from. processing further further Requirements 1. Fill in the diagram for Seminole's alternatives. 2. Identify the sunk cost. Is the sunk cost relevant to Seminole's decision? 3. Should Seminole sell the petroleum distillate or process it into cleaner fluid? Show the expected net revenue difference between the two alternatives. Print Done X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started