Answered step by step

Verified Expert Solution

Question

1 Approved Answer

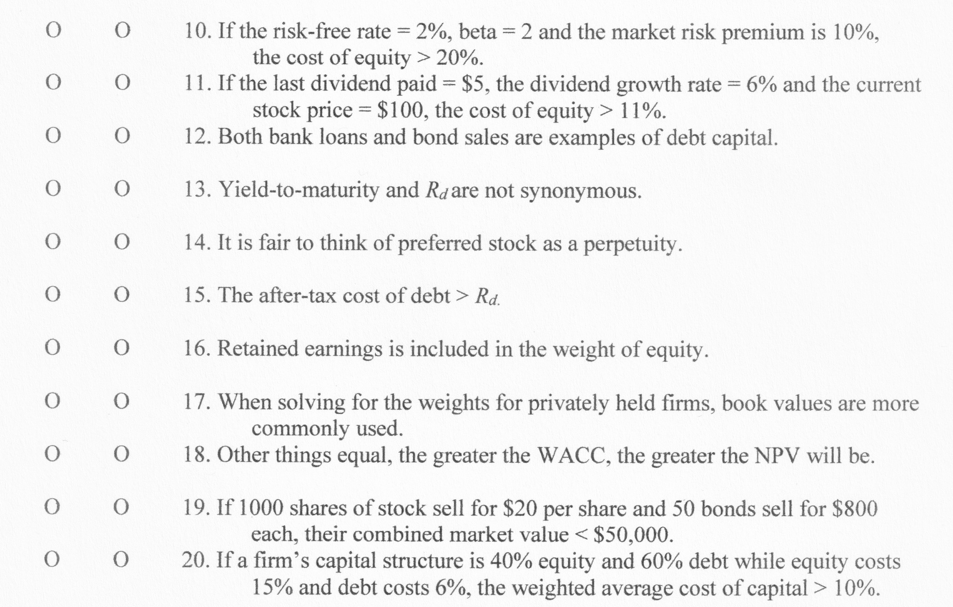

Please answer the True or False Questions. O O O O 10. If the risk-free rate = 2%, beta = 2 and the market risk

Please answer the True or False Questions.

O O O O 10. If the risk-free rate = 2%, beta = 2 and the market risk premium is 10%, the cost of equity > 20%. 11. If the last dividend paid = $5, the dividend growth rate = 6% and the current stock price = $100, the cost of equity > 11%. 12. Both bank loans and bond sales are examples of debt capital. o O O O 13. Yield-to-maturity and Rd are not synonymous. O O 14. It is fair to think of preferred stock as a perpetuity. O O 15. The after-tax cost of debt > Rd. O O 16. Retained earnings is included in the weight of equity. O O 17. When solving for the weights for privately held firms, book values are more commonly used. 18. Other things equal, the greater the WACC, the greater the NPV will be. O O O O 19. If 1000 shares of stock sell for $20 per share and 50 bonds sell for $800 each, their combined market value 10%. O OStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started