Please answer the two questions below.

>Lower of Cost or Net Realizable Value

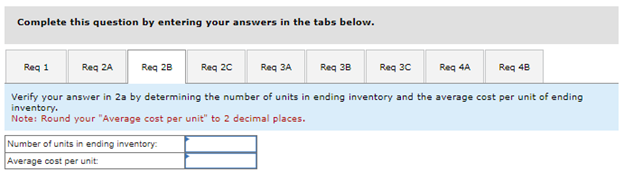

Req 2A: What is the total cost of ending inventory for inventory item #2? $96,768

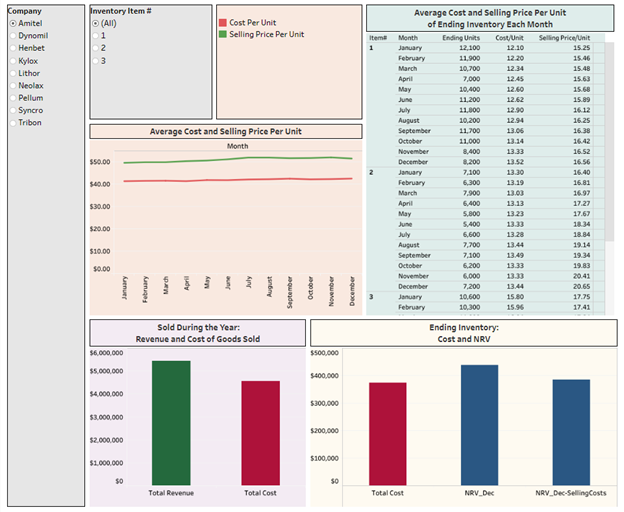

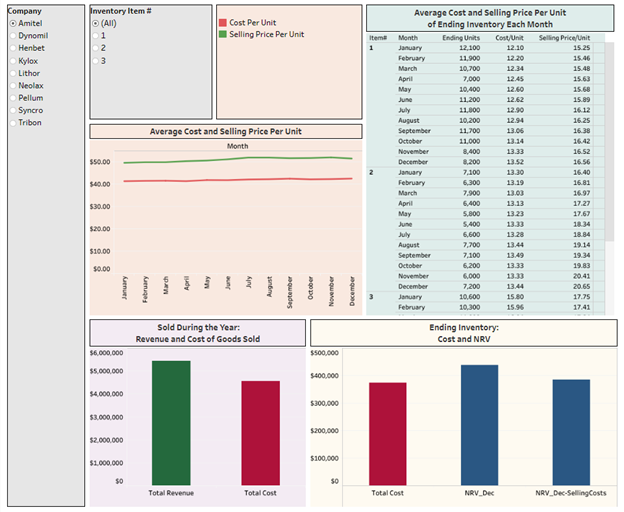

Particulars:

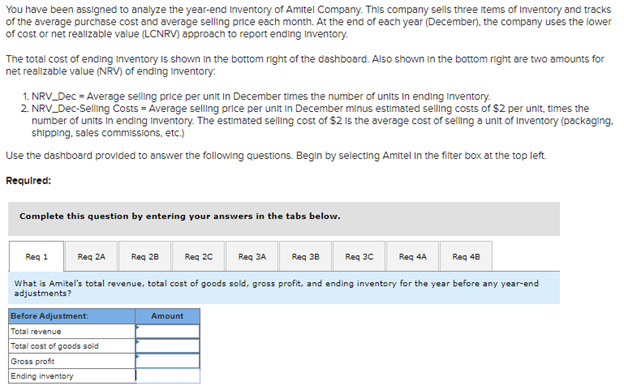

Sold during the year:

- (All): Total Rev= $5,436,698 & Total Cost= $4,543,080

- (Item 1): T/Rev= $1,987,377 & T/Cost= $1,587,548

- (Item 2): T/Rev= $1,471,578 & T/Cost= $1,059,521

- (Item 3): T/Rev= $1,977,743 & T/Cost= $1,896,011

Ending Inventory: Cost & NRV:

- (All): Total Cost= $374,060 - NRV_Dec= $436,860 - NRV_Dec-Selling Costs= $384,460

- (Item 1): T/Cost= $110,864 - NRV_Dec= $135,792 - NRV_Dec-Selling Costs= $119,392

- (Item 2): T/Cost= $96,768 - NRV_Dec= $148,680 - NRV_Dec-Selling Costs= $134,280

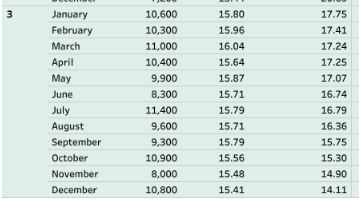

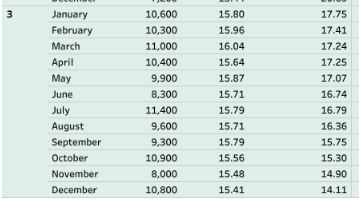

- (Item 3): T/Cost= $166,428 - NRV_Dec= $152,388 - NRV_Dec-Selling Costs= $130,788

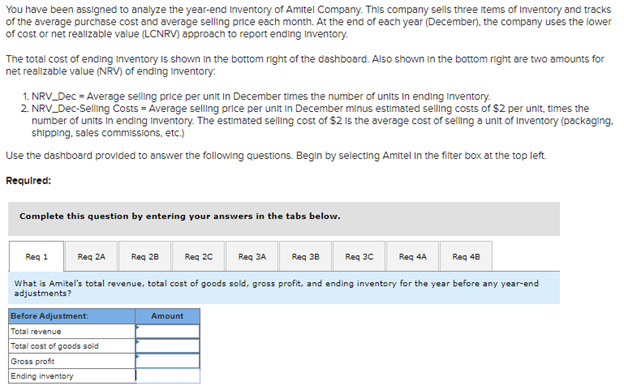

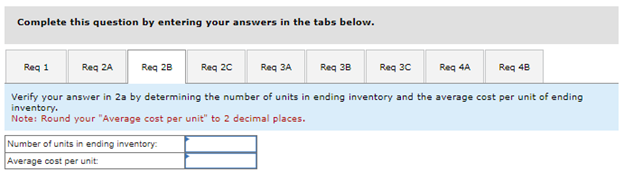

\begin{tabular}{lrrr|} \hline 3 & 10,600 & 15.80 & 17.75 \\ Jebruary & 10,300 & 15.96 & 17.41 \\ March & 11,000 & 16.04 & 17.24 \\ April & 10,400 & 15.64 & 17.25 \\ May & 9,900 & 15.87 & 17.07 \\ June & 8,300 & 15.71 & 16.74 \\ July & 11,400 & 15.79 & 16.79 \\ August & 9,600 & 15.71 & 16.36 \\ \hline September & 9,300 & 15.79 & 15.75 \\ \hline October & 10,900 & 15.56 & 15.30 \\ \hline November & 8,000 & 15.48 & 14.90 \\ \hline December & 10,800 & 15.41 & 14.11 \end{tabular} You have been assigned to analyze the year-end inventory of Amitel Company. This company sells three items of inventory and tracks of the average purchase cost and average selling price each month. At the end of each year (December), the company uses the lower of cost or net realizable value (LCNRV) approach to report ending inventory. The total cost of ending inventory is shown in the bottom right of the dashboard. Also shown in the bottom right are two amounts for net realizable value (NRV) of ending inventory: 1. NRV_Dec = Average selling price per unit in December times the number of units In ending Inventory. 2. NRV_Dec-Selling Costs = Average selling price per unit in December minus estimated selling costs of $2 per unit, times the number of units in ending inventory. The estimated selling cost of $2 is the average cost of selling a unit of inventory (packaging. shipping. sales commissions, etc.) Use the dashboard provided to answer the following questions. Begin by selecting Amitel in the filter box at the top left. Required: Complete this question by entering your answers in the tabs below. What is Amitel's total revenue, total cost of goods sold, gross profit, and ending inventory for the year before any year-end adjustments? Complete this question by entering your answers in the tabs below. Verify your answer in 2a by determining the number of units in ending inventory and the average cost per unit of ending inventory. Note: Round your "Average cost per unit" to 2 decimal places. \begin{tabular}{lrrr|} \hline 3 & 10,600 & 15.80 & 17.75 \\ Jebruary & 10,300 & 15.96 & 17.41 \\ March & 11,000 & 16.04 & 17.24 \\ April & 10,400 & 15.64 & 17.25 \\ May & 9,900 & 15.87 & 17.07 \\ June & 8,300 & 15.71 & 16.74 \\ July & 11,400 & 15.79 & 16.79 \\ August & 9,600 & 15.71 & 16.36 \\ \hline September & 9,300 & 15.79 & 15.75 \\ \hline October & 10,900 & 15.56 & 15.30 \\ \hline November & 8,000 & 15.48 & 14.90 \\ \hline December & 10,800 & 15.41 & 14.11 \end{tabular} You have been assigned to analyze the year-end inventory of Amitel Company. This company sells three items of inventory and tracks of the average purchase cost and average selling price each month. At the end of each year (December), the company uses the lower of cost or net realizable value (LCNRV) approach to report ending inventory. The total cost of ending inventory is shown in the bottom right of the dashboard. Also shown in the bottom right are two amounts for net realizable value (NRV) of ending inventory: 1. NRV_Dec = Average selling price per unit in December times the number of units In ending Inventory. 2. NRV_Dec-Selling Costs = Average selling price per unit in December minus estimated selling costs of $2 per unit, times the number of units in ending inventory. The estimated selling cost of $2 is the average cost of selling a unit of inventory (packaging. shipping. sales commissions, etc.) Use the dashboard provided to answer the following questions. Begin by selecting Amitel in the filter box at the top left. Required: Complete this question by entering your answers in the tabs below. What is Amitel's total revenue, total cost of goods sold, gross profit, and ending inventory for the year before any year-end adjustments? Complete this question by entering your answers in the tabs below. Verify your answer in 2a by determining the number of units in ending inventory and the average cost per unit of ending inventory. Note: Round your "Average cost per unit" to 2 decimal places