Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer the whole question correctly and neatly I will provide like. CASE: CASH FLOW PROBLEM? A recent graduate from ACCT 1510 has given you

Please Answer the whole question correctly and neatly I will provide like.

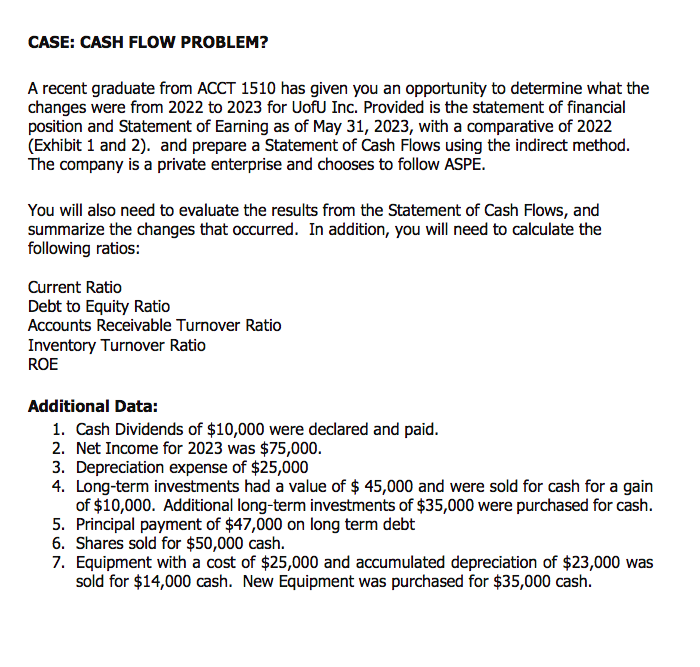

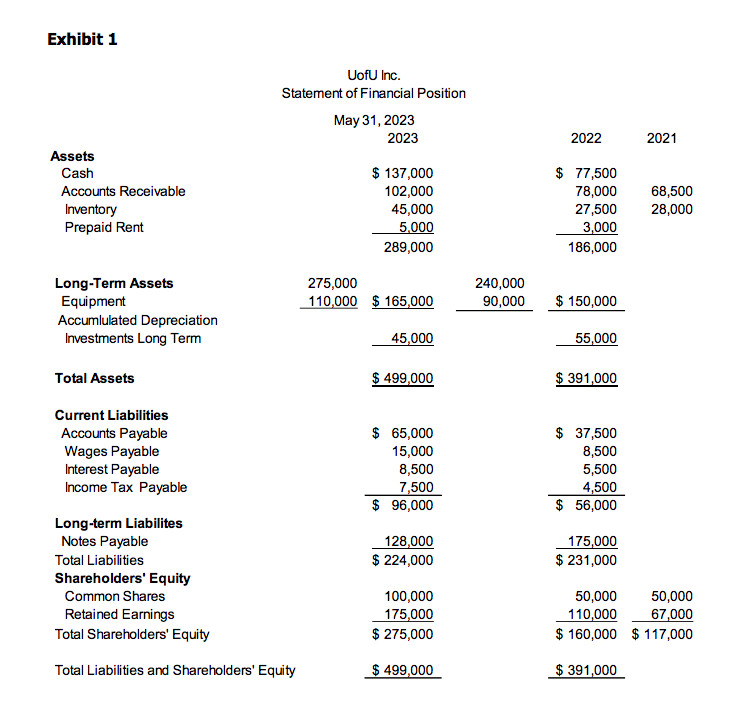

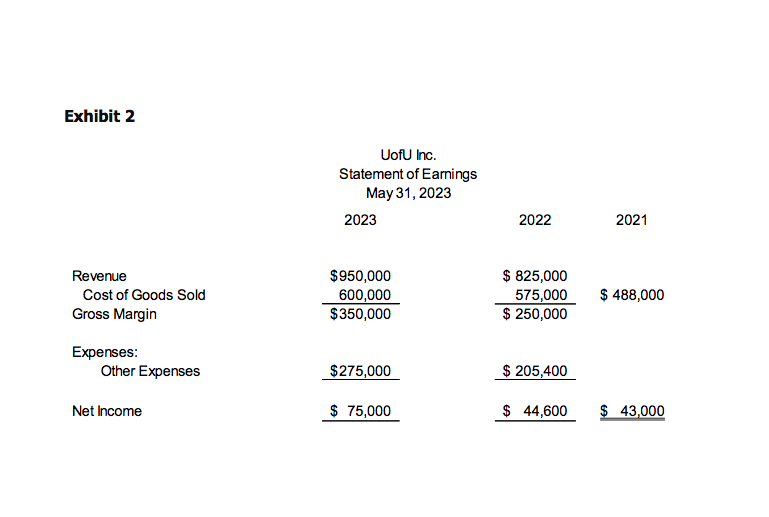

CASE: CASH FLOW PROBLEM? A recent graduate from ACCT 1510 has given you an opportunity to determine what the changes were from 2022 to 2023 for UofU Inc. Provided is the statement of financial position and Statement of Earning as of May 31, 2023, with a comparative of 2022 (Exhibit 1 and 2). and prepare a Statement of Cash Flows using the indirect method. The company is a private enterprise and chooses to follow ASPE. You will also need to evaluate the results from the Statement of Cash Flows, and summarize the changes that occurred. In addition, you will need to calculate the following ratios: Current Ratio Debt to Equity Ratio Accounts Receivable Turnover Ratio Inventory Turnover Ratio ROE Additional Data: 1. Cash Dividends of $10,000 were declared and paid. 2. Net Income for 2023 was $75,000. 3. Depreciation expense of $25,000 4. Long-term investments had a value of $45,000 and were sold for cash for a gain of $10,000. Additional long-term investments of $35,000 were purchased for cash. 5. Principal payment of $47,000 on long term debt 6. Shares sold for $50,000 cash. 7. Equipment with a cost of $25,000 and accumulated depreciation of $23,000 was sold for $14,000 cash. New Equipment was purchased for $35,000 cash. Exhibit 1 UofU Inc. Statement of Financial Position May 31, 2023 2023 20222021 Assets Cash Accounts Receivable Inventory Prepaid Rent Long-Term Assets Equipment Accumlulated Depreciation Investments Long Term Total Assets Current Liabilities Accounts Payable Wages Payable Interest Payable Income Tax Payable Long-term Liabilites Notes Payable Total Liabilities Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $137,000102,00045,0005,000289,000 275,000 110,000 $77,500 78,00068,500 \begin{tabular}{rr} 27,500 & 28,000 \\ 3,000 & \\ \hline \end{tabular} 186,000 \begin{tabular}{lr} 240,000 \\ 90,000 \\ \hline \end{tabular} $150,000 45,000 55,000 $499,000 $391,000 $65,00015,0008,5007,500$96,000 \$ 37,500 8,500 5,5004,500$56,000 $224,000128,000 $231,000175,000 100,000175,000$275,000 $499,000 $391,000 Exhibit 2 UofU Inc. Statement of Earnings May 31,2023 2023 $950,000600,000$350,000 Expenses: Other Expenses Net Income 2022 2021 $825,000575,000$250,000$488,000 $205,400 $44,600$43,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started