please answer the word questions in the first picture. im having a litte trouble understanding! thank you

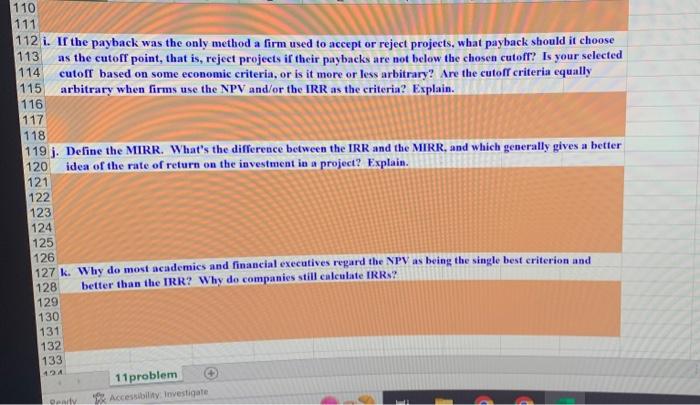

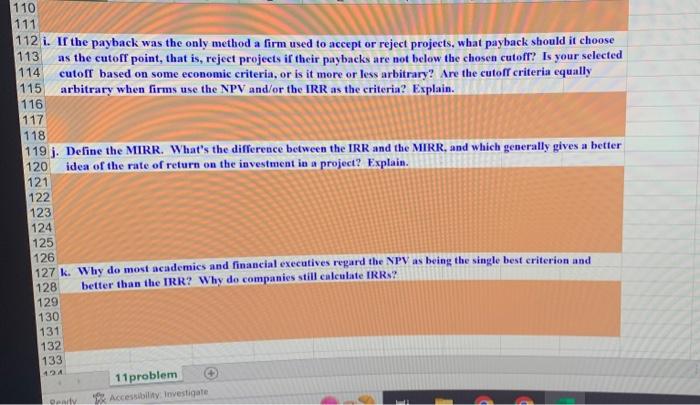

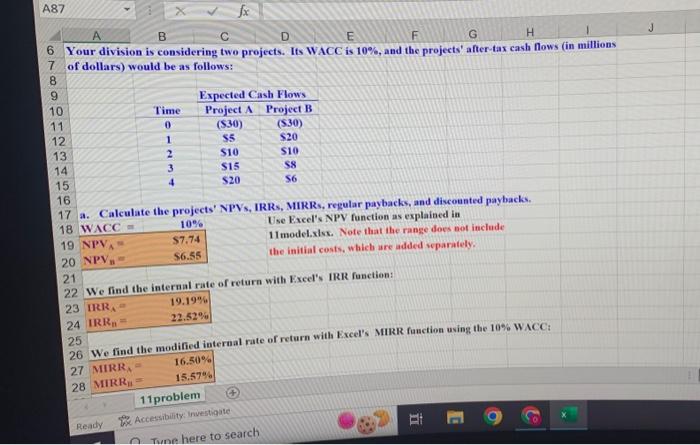

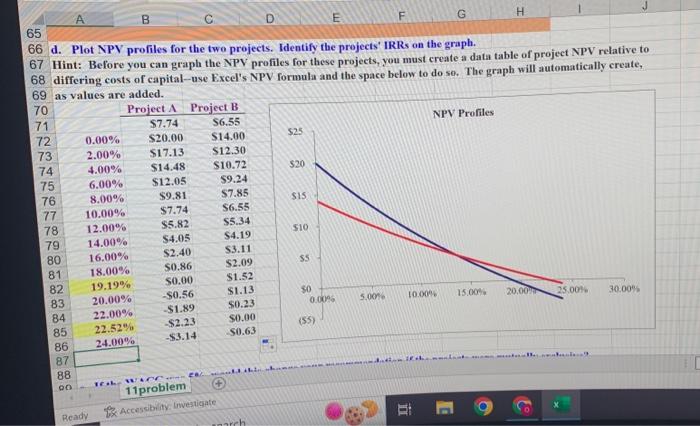

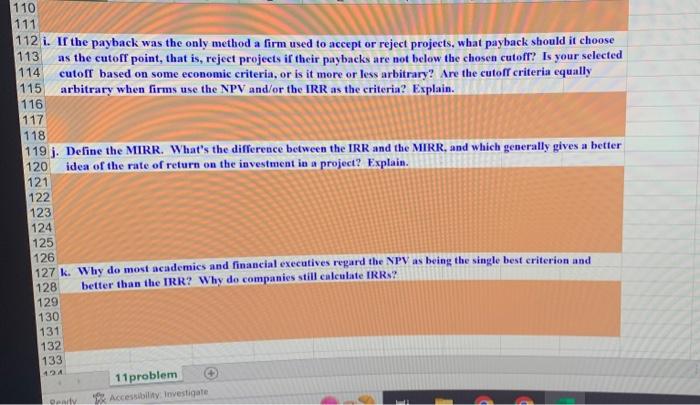

i. If the payback was the only method a firm used to accept or reject projects, what payback should it choose as the cutoff point, that is, reject projects if their paybacks are not below the chosen cutofr: Is your selected cutoff based on some economic criteria, or is it more or less arbitrary? Are the cutoff criteria equally arbitrary when firms use the NPV and/or the IRIR as the criteria? Explain. j. Define the MIRR. What's the difference between the IRR and the MIRR, and which generally gives a better idea of the rate of return on the investment in a project? Explain. Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: a. Calculate the projects' NPVs, IRRs, MIRRs, regular paybacks, and discounted paybacks. Use Excel's NPV function as explained in 11 model.xlos. Note that the range does not inclade the initial costs, which are added wparately. s. find the interaal rafe of return with Kxcel's IRR fanction: 24 25 d. Plot NPV profiles for the two projects. Identify the projects' IRRs on the graph. Hint: Before you can graph the NPV profiles for these projects, you must create a data table of project NPV relative to differing costs of capital-use Excel's NPV formula and the space below to do so. The graph will autematically create, i. If the payback was the only method a firm used to accept or reject projects, what payback should it choose as the cutoff point, that is, reject projects if their paybacks are not below the chosen cutofr: Is your selected cutoff based on some economic criteria, or is it more or less arbitrary? Are the cutoff criteria equally arbitrary when firms use the NPV and/or the IRIR as the criteria? Explain. j. Define the MIRR. What's the difference between the IRR and the MIRR, and which generally gives a better idea of the rate of return on the investment in a project? Explain. Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: a. Calculate the projects' NPVs, IRRs, MIRRs, regular paybacks, and discounted paybacks. Use Excel's NPV function as explained in 11 model.xlos. Note that the range does not inclade the initial costs, which are added wparately. s. find the interaal rafe of return with Kxcel's IRR fanction: 24 25 d. Plot NPV profiles for the two projects. Identify the projects' IRRs on the graph. Hint: Before you can graph the NPV profiles for these projects, you must create a data table of project NPV relative to differing costs of capital-use Excel's NPV formula and the space below to do so. The graph will autematically create