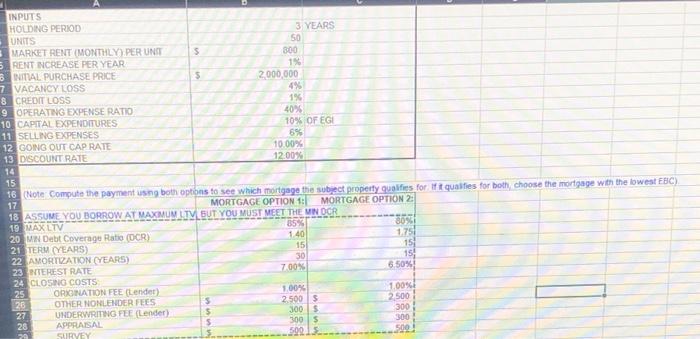

please answer the yellow boxes. I am totally lost

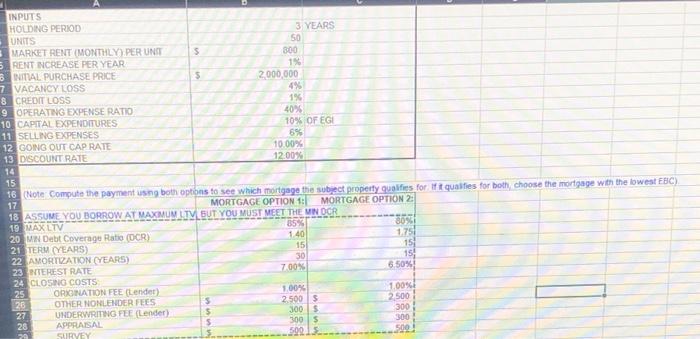

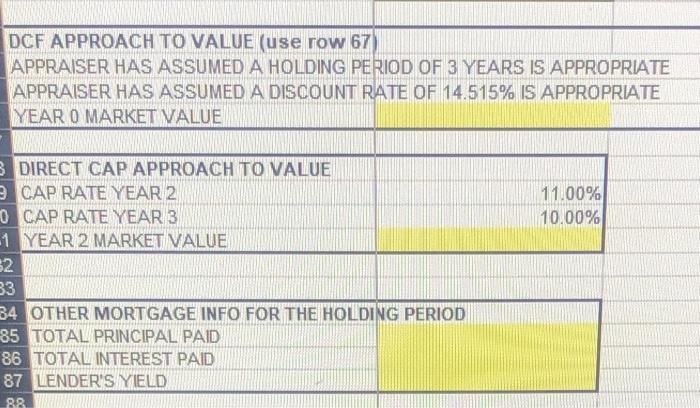

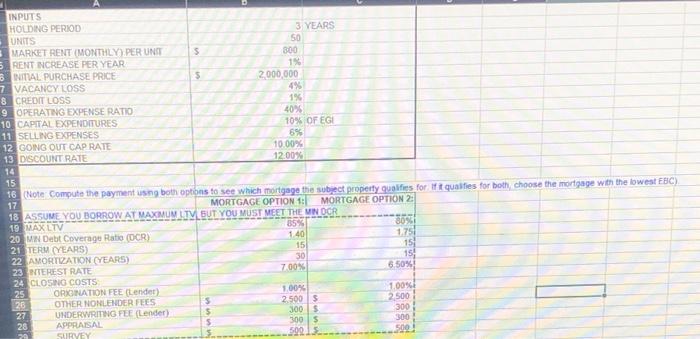

$ INPUTS HOLDING PERIOD 3 YEARS UNITS 50 MARKET RENT (MONTHLY) PER UNIT 800 5 RENT INCREASE PER YEAR 1% B INITIAL PURCHASE PRICE $ 2,000,000 7 VACANCY LOSS 4% 8 CREDIT LOSS 1% 9 OPERATING EXPENSE RATIO 4025 10 CAPITAL EXPENDITURES 10% OF EGI 11 SELLING EXPENSES 6% 12 GOING OUT CAP RATE 10.00% 13 DISCOUNT RATE 12.00% 14 15 16 (Note: Compute the payment using both options to see which mortgage the subject property qualifiers for qualifies for both, choose the mortgage with the lowest EBC) 17 MORTGAGE OPTION 1: MORTGAGE OPTION 2 18 ASSUME YOU BORROW AT MAXIMUM LTV BUT YOU MUST MEET THE MN OCR 19 MAX LTV 85% BOS 20 MN Debt Coverage Ratio (DCR) 1.40 1.75 21 TERM (YEARS) 15 15 22 AMORTIZATION (YEARS) 30 154 23 NTEREST RATE 700% 6.50% 24 CLOSING COSTS ORXONATION FEE Lender) 1.00 1.00% OTHER NONLENDER FEES 5 2.500S 2.500 27 UNDERWRITING FEE (Lender) 300S 300 300 28 3005 APPRAISAL 70 SURVEY 500 500 M DCF APPROACH TO VALUE (use row 67) APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE YEAR O MARKET VALUE 11.00% 10.00% DIRECT CAP APPROACH TO VALUE 3 CAP RATE YEAR 2 0 CAP RATE YEAR 3 1 YEAR 2 MARKET VALUE 2 33 B4 OTHER MORTGAGE INFO FOR THE HOLDING PERIOD 85 TOTAL PRINCIPAL PAID 86 TOTAL INTEREST PAID 87 LENDER'S YIELD 88 $ INPUTS HOLDING PERIOD 3 YEARS UNITS 50 MARKET RENT (MONTHLY) PER UNIT 800 5 RENT INCREASE PER YEAR 1% B INITIAL PURCHASE PRICE $ 2,000,000 7 VACANCY LOSS 4% 8 CREDIT LOSS 1% 9 OPERATING EXPENSE RATIO 4025 10 CAPITAL EXPENDITURES 10% OF EGI 11 SELLING EXPENSES 6% 12 GOING OUT CAP RATE 10.00% 13 DISCOUNT RATE 12.00% 14 15 16 (Note: Compute the payment using both options to see which mortgage the subject property qualifiers for qualifies for both, choose the mortgage with the lowest EBC) 17 MORTGAGE OPTION 1: MORTGAGE OPTION 2 18 ASSUME YOU BORROW AT MAXIMUM LTV BUT YOU MUST MEET THE MN OCR 19 MAX LTV 85% BOS 20 MN Debt Coverage Ratio (DCR) 1.40 1.75 21 TERM (YEARS) 15 15 22 AMORTIZATION (YEARS) 30 154 23 NTEREST RATE 700% 6.50% 24 CLOSING COSTS ORXONATION FEE Lender) 1.00 1.00% OTHER NONLENDER FEES 5 2.500S 2.500 27 UNDERWRITING FEE (Lender) 300S 300 300 28 3005 APPRAISAL 70 SURVEY 500 500 M DCF APPROACH TO VALUE (use row 67) APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE YEAR O MARKET VALUE 11.00% 10.00% DIRECT CAP APPROACH TO VALUE 3 CAP RATE YEAR 2 0 CAP RATE YEAR 3 1 YEAR 2 MARKET VALUE 2 33 B4 OTHER MORTGAGE INFO FOR THE HOLDING PERIOD 85 TOTAL PRINCIPAL PAID 86 TOTAL INTEREST PAID 87 LENDER'S YIELD 88