Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer these 3 questions. Question 13 (6 points) **The Present Value (value in year 0) of MT Company's cash flows listed below at a

Please answer these 3 questions.

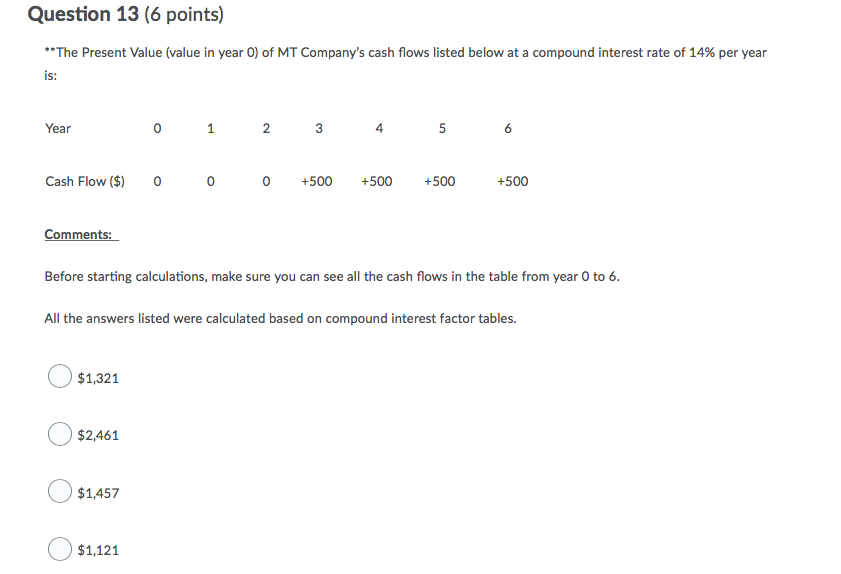

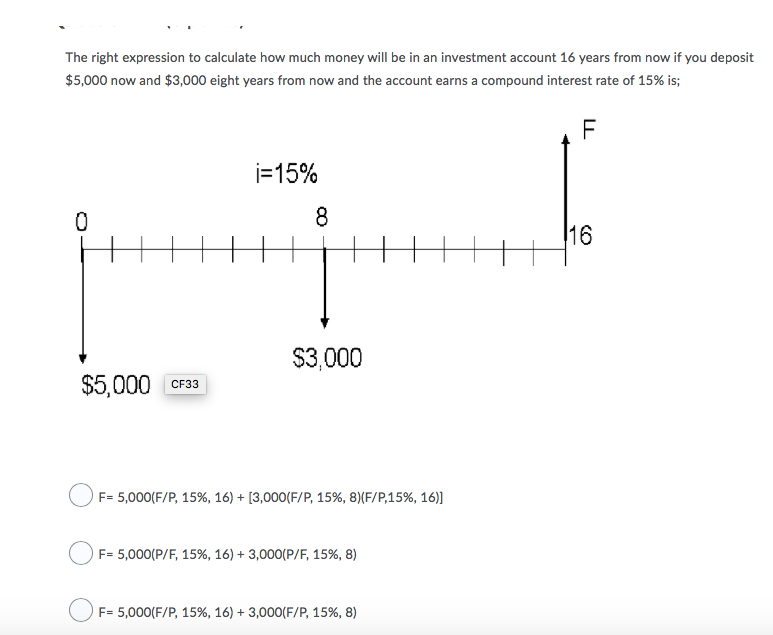

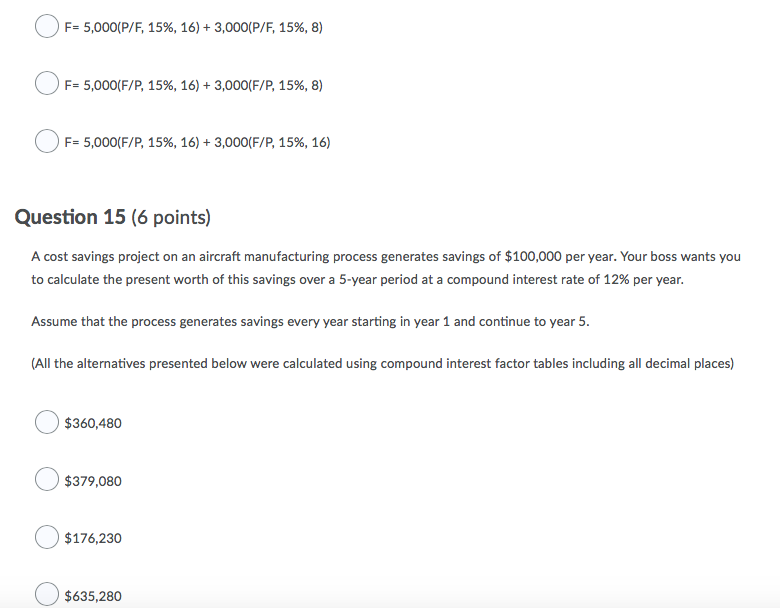

Question 13 (6 points) **The Present Value (value in year 0) of MT Company's cash flows listed below at a compound interest rate of 14% per year is: Year 0 1 2 3 4 5 6 Cash Flow ($) 0 0 0 +500 +500 +500 +500 Comments: Before starting calculations, make sure you can see all the cash flows in the table from year 0 to 6. All the answers listed were calculated based on compound interest factor tables. $1,321 $2,461 $1,457 $1,121 The right expression to calculate how much money will be in an investment account 16 years from now if you deposit $5,000 now and $3,000 eight years from now and the account earns a compound interest rate of 15% is; i=15% 8 HHHHHHHHHHHHHH16 $3,000 $5,000 CF33 F-5,000(F/P, 15%, 16) + [3,000(F/P, 15%, 8)(F/P,15%, 16)] ( F= 5,000(P/F, 15%, 16) + 3,000(P/F, 15%, 8) O F= 5,000(F/P, 15%, 16) + 3,000(F/P, 15%, 8) ( F= 5,000(P/F, 15%, 16) + 3,000(P/F, 15%, 8) ( F= 5,000(F/P, 15%, 16) + 3,000(F/P, 15%, 8) O F= 5,000(F/P, 15%, 16) + 3,000(F/P, 15%, 16) Question 15 (6 points) A cost savings project on an aircraft manufacturing process generates savings of $100,000 per year. Your boss wants you to calculate the present worth of this savings over a 5-year period at a compound interest rate of 12% per year. Assume that the process generates savings every year starting in year 1 and continue to year 5. (All the alternatives presented below were calculated using compound interest factor tables including all decimal places) $360,480 $379,080 O $176,230 $635,280Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started