Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer these asap no details required just need the right answers Multiple Choice - Select the most correct response for each question. 1 The

please answer these asap

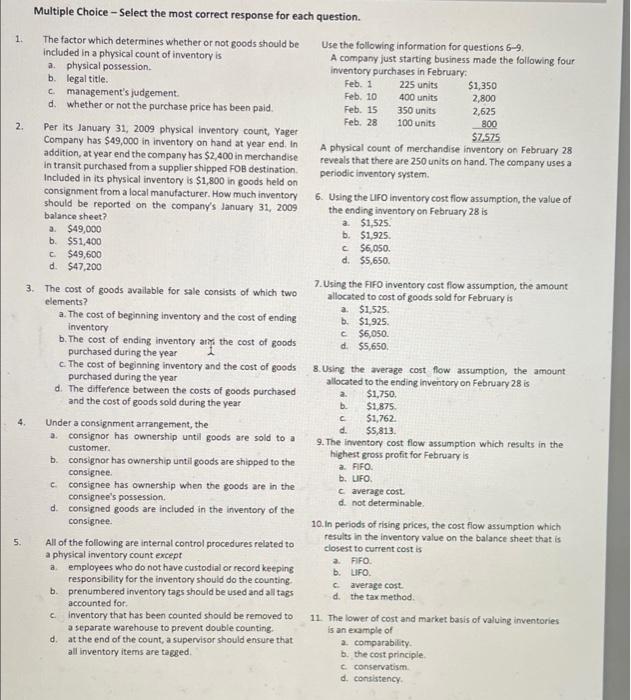

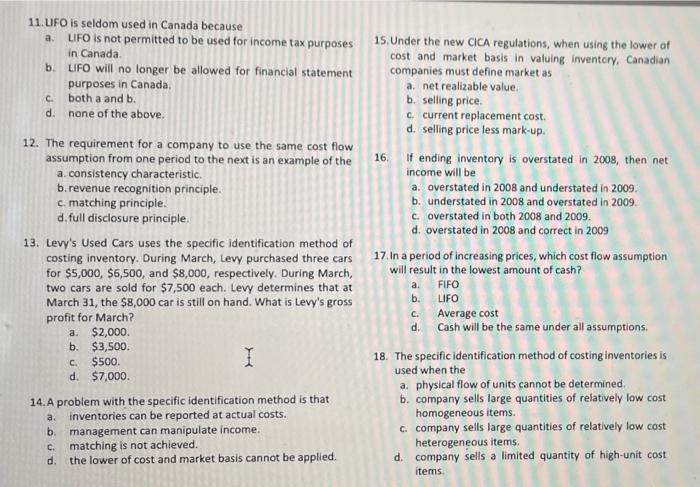

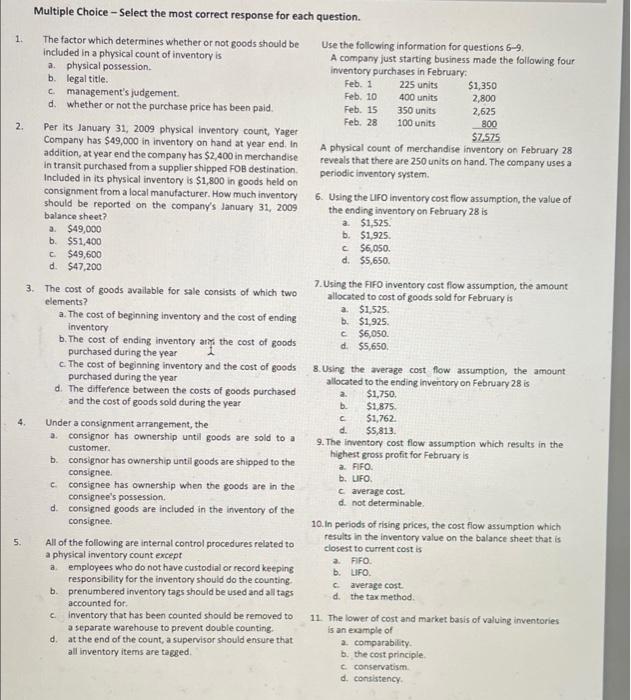

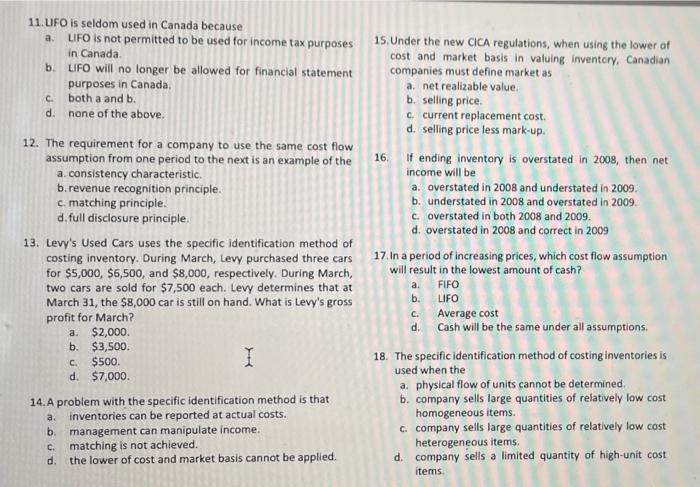

Multiple Choice - Select the most correct response for each question. 1 The factor which determines whether or not goods should be Use the following information for questions 6-9 included in a physical count of inventory is A company just starting business made the following four a. physical possession. inventory purchases in February b. legal title. Feb. 1 225 units $1,350 c management's judgement. Feb. 10 400 units 2,800 d. Whether or not the purchase price has been paid. Feb. 15 350 units 2,625 Feb. 28 100 units 2. Per its January 31, 2009 physical inventory count, Yager 800 $7.575 Company has $49,000 in inventory on hand at year end. In A physical count of merchandise inventory on February 28 addition, at year end the company has $2,400 in merchandise reveals that there are 250 units on hand. The company uses a in transit purchased from a supplier shipped FOB destination Included in its physical inventory is $1,800 in goods held on periodic inventory system consignment from a local manufacturer. How much inventory 6. Using the LIFO inventory cost flow assumption, the value of should be reported on the company's January 31, 2009 the ending inventory on February 28 is balance sheet? a $1,525. a. $49,000 b. $1.925 b $51,400 $6,050. c$49,600 d. $5,650 d $47,200 7. Using the FIFO inventory cost flow assumption, the amount 3. The cost of goods available for sale consists of which two allocated to cost of goods sold for February is elements? a $1,525. a. The cost of beginning inventory and the cost of ending b. $1,925. Inventory c$6,050 b. The cost of ending inventory and the cost of goods d $5,650 purchased during the year c. The cost of beginning inventory and the cost of goods 8. Using the average cost flow assumption, the amount purchased during the year allocated to the ending inventory on February 28 is d. The difference between the costs of goods purchased a $1,750 and the cost of goods sold during the year b. $1.875 C $1,762 4. Under a consignment arrangement, the d. $5,813. a consignor has ownership until goods are sold to a 9. The inventory cost flow assumption which results in the customer highest gross profit for February is b. consignor has ownership until goods are shipped to the a FIFO consignee. b. UFO consignee has ownership when the goods are in the caverage cost consignee's possession. d. consigned goods are included in the inventory of the d. not determinable consignee 10. In periods of rising prices, the cost flow assumption which 5. All of the following are internal control procedures related to results in the inventory value on the balance sheet that is closest to current cost is a physical inventory count except a FIFO a employees who do not have custodial or record keeping b. UFO responsibility for the inventory should do the counting caverage cost b. prenumbered inventory tags should be used and all tags d. the tax method accounted for Inventory that has been counted should be removed to 11. The lower of cost and market basis of valuing inventories a separate warehouse to prevent double counting, is an example of d. at the end of the count, a supervisor should ensure that 2. compara lity all inventory items are tagged b. the cost principle conservatism d. consistency C c. 11. LIFO is seldom used in Canada because a. LIFO is not permitted to be used for income tax purposes in Canada b. LIFO will no longer be allowed for financial statement purposes in Canada both a and b. none of the above. . d 12. The requirement for a company to use the same cost flow assumption from one period to the next is an example of the a.consistency characteristic. b.revenue recognition principle. c. matching principle. d. full disclosure principle. 13. Levy's Used Cars uses the specific identification method of costing inventory. During March, Levy purchased three cars for $5,000, $6,500, and $8,000, respectively. During March, two cars are sold for $7,500 each. Levy determines that at March 31, the $8,000 car is still on hand. What is Levy's gross profit for March? a. $2,000. b. $3,500. $500. I d. $7,000. 15. Under the new CICA regulations, when using the lower of cost and market basis in valuing inventory, Canadian companies must define market as a. net realizable value b. selling price. c current replacement cost. d. selling price less mark-up. 16. If ending inventory is overstated in 2008, then net income will be a. overstated in 2008 and understated in 2009. b. understated in 2008 and overstated in 2009. c. overstated in both 2008 and 2009. d. overstated in 2008 and correct in 2009 17. In a period of increasing prices, which cost flow assumption will result in the lowest amount of cash? a. FIFO b. LIFO c. Average cost d. Cash will be the same under all assumptions. 18. The specific identification method of costing inventories is used when the a physical flow of units cannot be determined b. company sells large quantities of relatively low cost homogeneous items. c. company sells large quantities of relatively low cost heterogeneous items. d. company sells a limited quantity of high-unit cost items C 14. A problem with the specific identification method is that a inventories can be reported at actual costs. b. management can manipulate income. C. matching is not achieved. d. the lower of cost and market basis cannot be applied no details required

just need the right answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started