Answered step by step

Verified Expert Solution

Question

1 Approved Answer

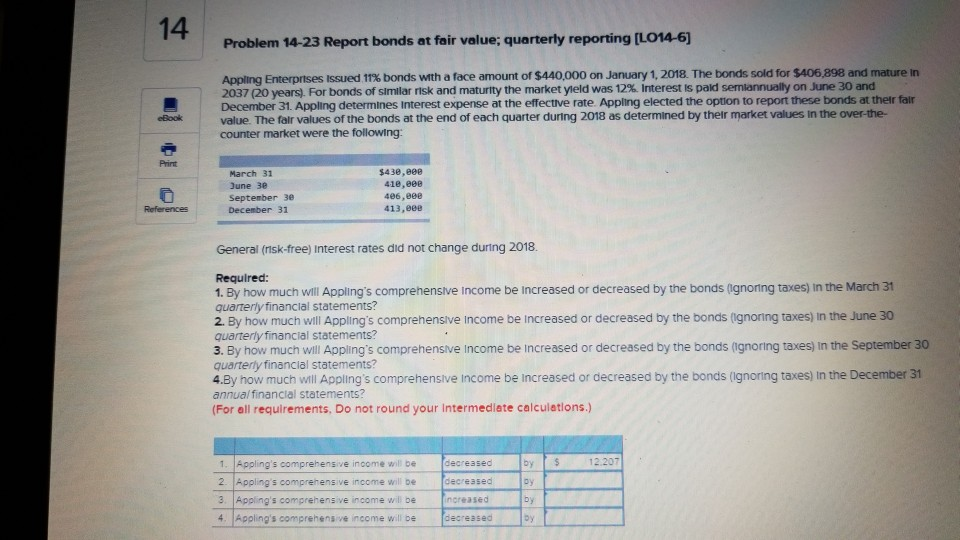

please answer these correctly. 14. 29. Req 1A Req 1B to 4 40. 14 Problem 14-23 Report bonds at fair value; quarterly reporting [L014-6) Appin

please answer these correctly.

14.

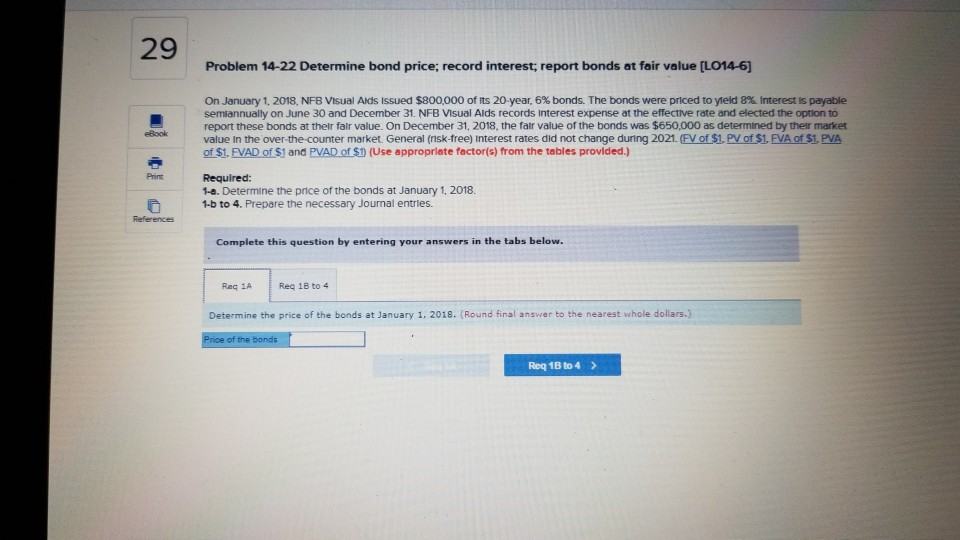

29. Req 1A

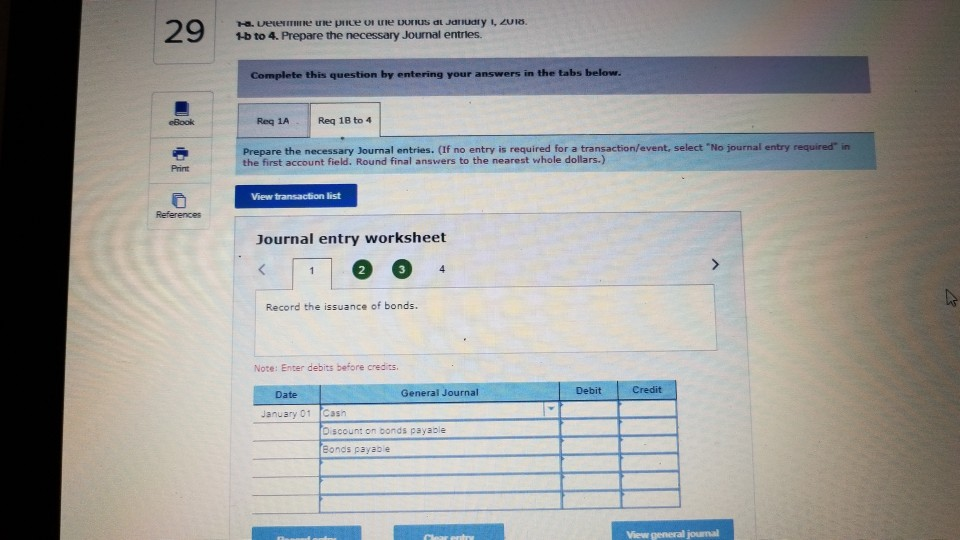

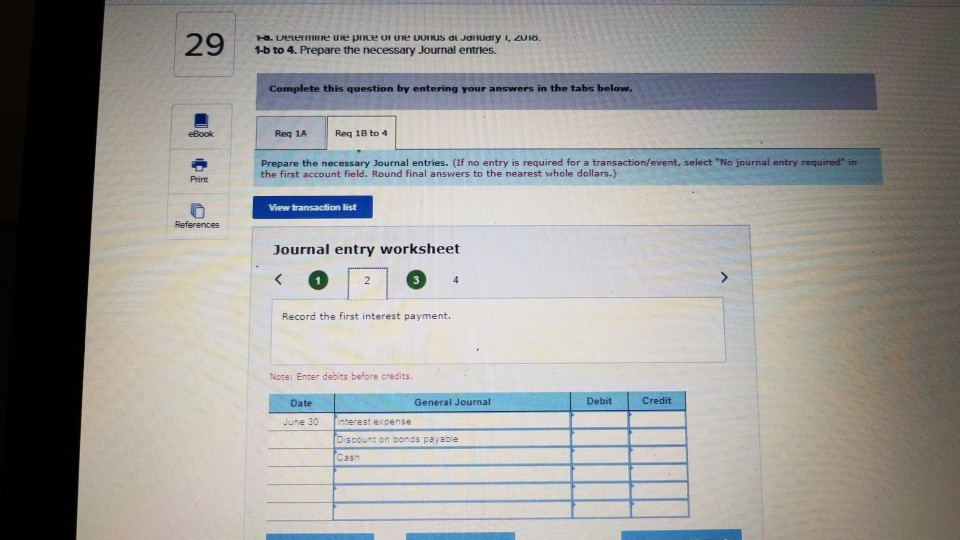

Req 1B to 4

40.

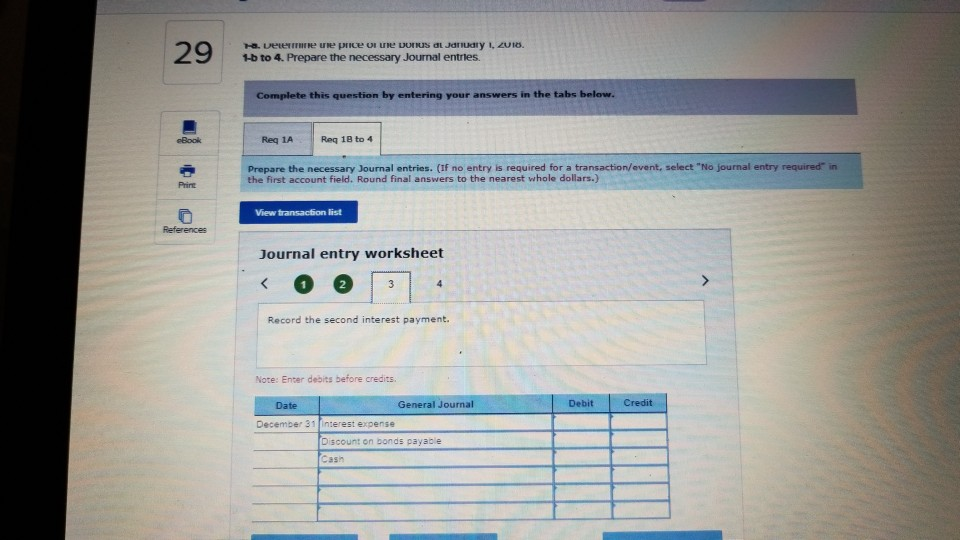

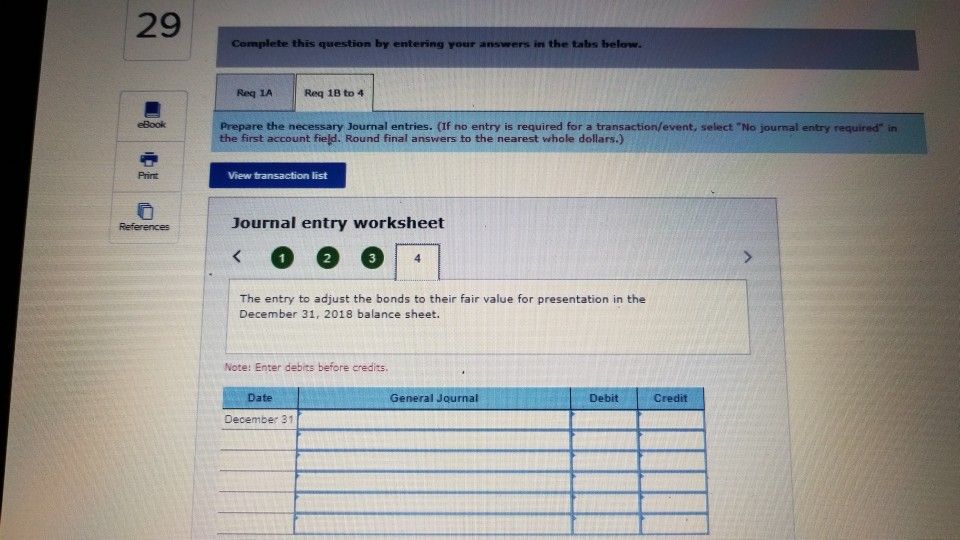

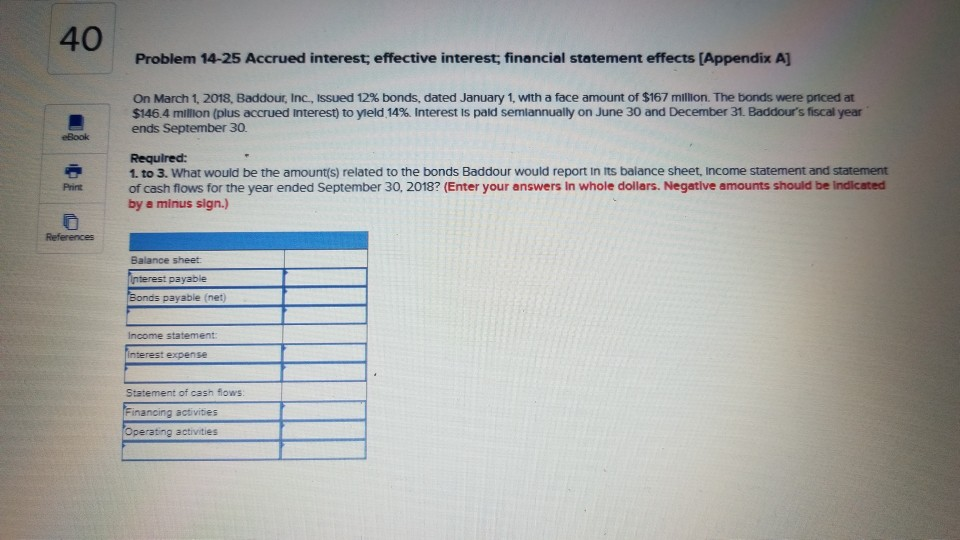

14 Problem 14-23 Report bonds at fair value; quarterly reporting [L014-6) Appin g Enterprises issued 11% bonds with a face amount of $440,000 on January 1, 2018. The bonds sold for $406,898 and mature in 2037 (20 years) For bonds of similar risk and maturity the market yeld was 12% Interest is pad semiannually on June 30 and December 31 Appl ng determines interest expense at the effective rate Appin elected the opor to report these bons at their fa r value. The fair values of the bonds at the end of each quarter durning 2018 as determined by their market valiues in the over-the counter market were the following: eBook Print $438,888 418,808 March 31 June 30 September 3e December 31 References 413,008 General (nsk-free) Interest rates did not change during 2018. Required: quarterly financial statements? quarterly financial statements? 3. By how much will Appling's comprehensive Income be Increased or decreased by the bonds (ignoring taxes) in the September 30 1. By how much will Appling's comprehensive income be increased or decreased by the bonds (gnoring taxes) in the March 31 2. By how much will Appiling's comprehensive income be increased or decreased by the bonds ignoring taxes) in the June 30 quarterly financial statements? 4.By how much will Appling's comprehensive Income be increased or decreased by the bonds (ignoring taxes) in the December 31 annualfinancial statements? (For all requirements, Do not round your Intermediate calculations.) 12.207 1. Appling's comprehensive income will be 2. Appling's comprehensive income will be decreased 3. Appling's comprehensive income will be 4. Appling's comprehens ve income willi be decreased by $ Dy ncreased by 29 Problem 14-22 Determine bond price; record interest, report bonds at fair value [LO14-6) On January 1, 208, NFB Visual Aids issued S800000 of its 20-yea. 6% bonds. The bords were priced to yield interest s payable report these bonds at thelr fair value. On December 31, 2018, the fair value of the bonds was $650,000 as determined by their market value in the over-the counter market. General (nsk-free) interest rates did not change during 2021 (FV of $1. PV of S1 FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1 (Use appropriete factor(s) from the tables provided.) Print Required: 1-s. Determine the price of the bonds at January 1, 2018. 1-b to 4. Prepare the necessary Journal entries. Complete this question by entering your answers in the tabs below Req 1B to 4 Determine the price of the bonds at January 1, 2018. (Round final answer to the nearest whole dollars.) of the bonds Req 1B to 4> 29 , a. 1-b to 4. Prepare the necessary Journal entries. Complete this question by entering your answers in the tabs below. Req 1AReq 18 to 4 Prepare the necessary Journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars.) Print View transaction list References Journal entry worksheet Record the issuance of bonds. Note: Enter debits before credits. Debit Credit Date General Journal January 01 Cash Discount on bonds payable Bonds payabe View general journal 2rtne Journal ermness ua 1-b to 4. Prepare the Complete this question by entering your answers in the tabs below. eBook Req 1A Req 1B to 4 Prepare the necessary Journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars.) Print View transaction list References Journal entry worksheet Record the first interest payment. Note: Enter debits before credits Date General Journal Debit Credit June 30 Interest expense scount on bonds payable 1-b to 4. Prepare the necessary Journal entries Complete this question by entering your answers in the tabs below. Req 1A Req 1B to 4 Prepare the necessary Journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars) Prirt View transaction list References Journal entry worksheet Record the second interest payment. Note: Enter debits before credits Date General Journal Debit Credit December 31 Interest expense Discount on bonds payable 29 Complete this question by entering your answers in the tabs below. Req 1AReq 1B to 4 eBook Prepare the necessary Journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollars.) Print View transaction list Journal entry worksheet References 2 3 The entry to adjust the bonds to their fair value for presentation in the December 31, 2018 balance sheet. Note: Enter debits before credits Date General Journal Debit Credit December 31 40 Problem 14-25 Accrued interest effective interest, financial statement effects [Appendix A] On March 1, 2018, Baddour, Inc., issued 12% bonds, dated January 1, with a face amount of $167 million. The bonds were priced at $146.4 mil lon plus accrued interest to yield 14%. Interest is paid seman ua on ne 30 and December 31, Ba cour si cal ear ends September 30. Required 1. to 3. What would be the amounts) related to the bonds Baddour would report in its balance sheet, income statement and statement of cash flows for the year ended September 30, 20187 (Enter your answers in whole dollars. Negative amounts should be dlated by minus sign.) Print References Balance sheet payable payable (net Income statement expense Statement of cash lows nancing actvites erating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started