Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer these questions. Step by step Excel is the best. Thanks You work as the assistant to Michael Brown, a CFP with Securities Services,

please answer these questions. Step by step Excel is the best. Thanks

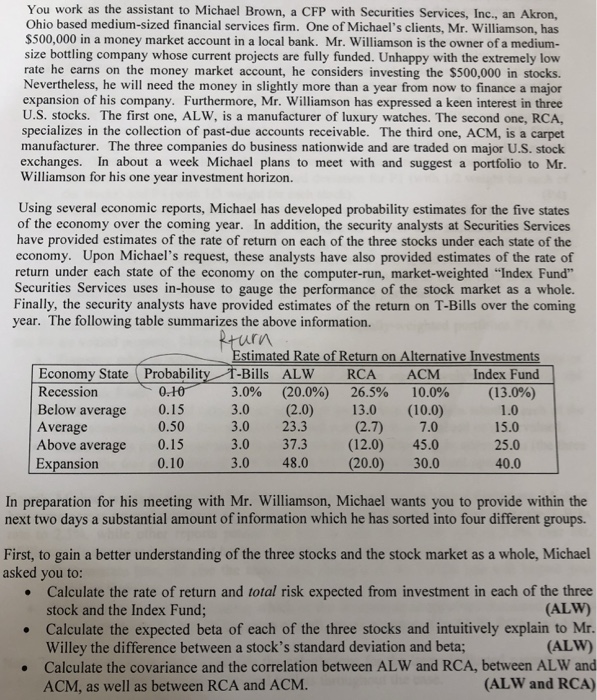

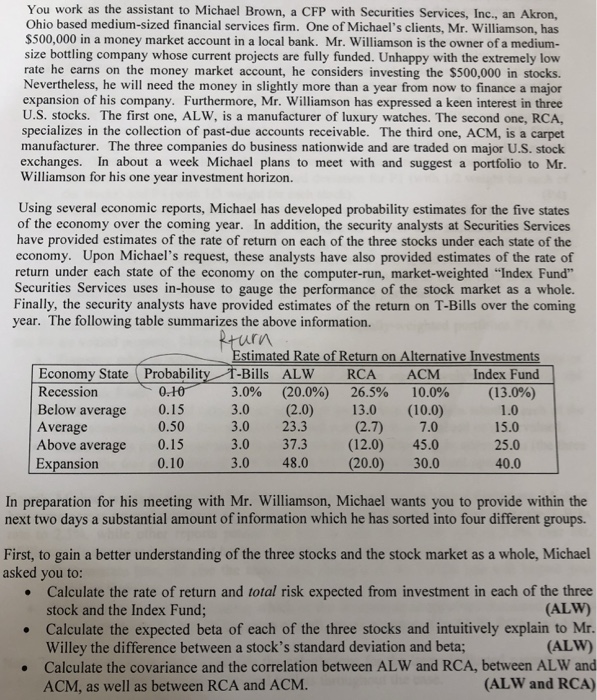

You work as the assistant to Michael Brown, a CFP with Securities Services, Inc., an Akron, Ohio based medium-sized financial services firm. One of Michael's clients, Mr. Williamson, has $500,000 in a money market account in a local bank. Mr. Williamson is the owner of a medium size bottling company whose current projects are fully funded. Unhappy with the extremely low rate he earns on the money market account, he considers investing the $500,000 in stocks. Nevertheless, he will need the money in slightly more than a year from now to finance a major expansion of his company. Furthermore, Mr. Williamson has expressed a keen interest in three U.S. stocks. The first one, ALW, is a manufacturer of luxury watches. The second one, RCA, specializes in the collection of past-due accounts receivable. The third one, ACM, is a carpet manufacturer. The three companies do business nationwide and are traded on major U.S. stock exchanges. In about a week Michael plans to meet with and suggest a portfolio to Williamson for his one year investment horizon. Using several economic reports, Michael has developed probability estimates for the five states of the economy over the coming year. In addition, the security analysts at Securities Services have provided estimates of the rate of return on each of the three stocks under each state of the economy. Upon Michael's request, these analysts have also provided estimates of the rate return under each state of the economy on the computer-run, market-weighted "Index Fund" Securities Services uses in-house to gauge the performance of the stock market as a whole. Finally, the security analysts have provided estimates of the return on T-Bills over the comin year. The following table summarizes the above information. rn Estimated Rate of Return on Alternative Investments Economy State Probability T-Bills ALW RCA ACM Index Fund Recession Below average 0.15 Average Above average 0.15 Expansion 0-10/ 0.50 0.10 3.0% (20.0%) 26.5% 10.0% 3.0 (2.0) 13.0 (10.0) 3.0 23.3 3.0 37.3 (12.0) 45.0 3.0 48.0 (20.0) 30.0 (13.0%) 1.0 15.0 25.0 40.0 (2.7) 7.0 In preparation for his meeting with Mr. Williamson, Michael wants you to provide within the next two days a substantial amount of information which he has sorted into four different groups. First, to gain a better understanding of the three stocks and the stock market as a whole, Michael asked you to: stock and the Index Fund; Willey the difference between a stock's standard deviation and beta; ACM, as well as between RCA and ACM Calculate the rate of return and total risk expected from investment in each of the three (ALW) Calculate the expected beta of each of the three stocks and intuitively explain to Mr (ALW) Calculate the covariance and the correlation between ALW and RCA, between ALW and (ALW and RCA)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started