Please answer this four question in Asap. thank you!

New questions

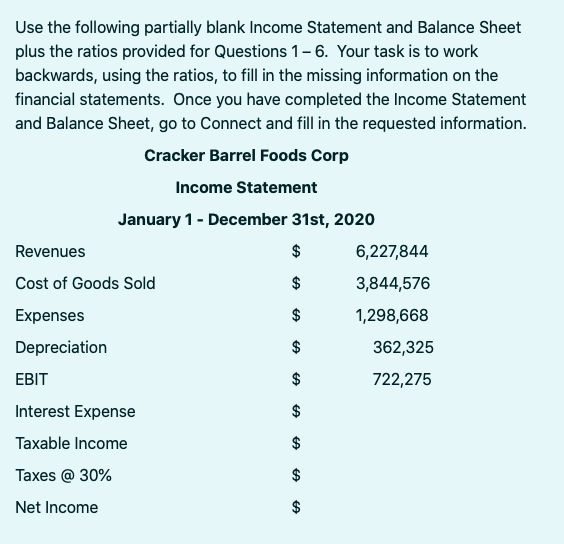

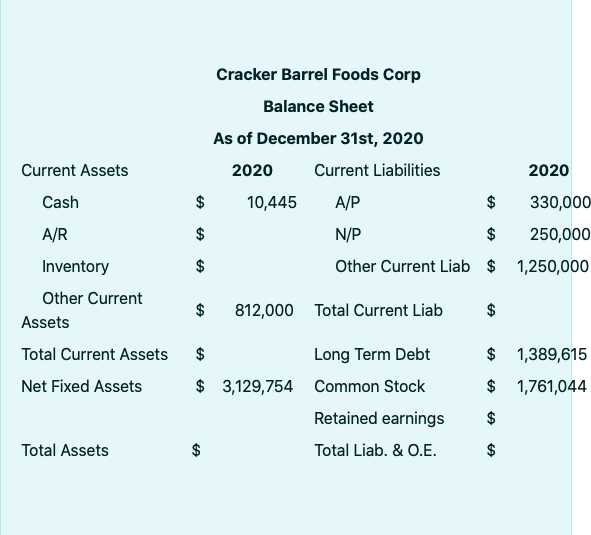

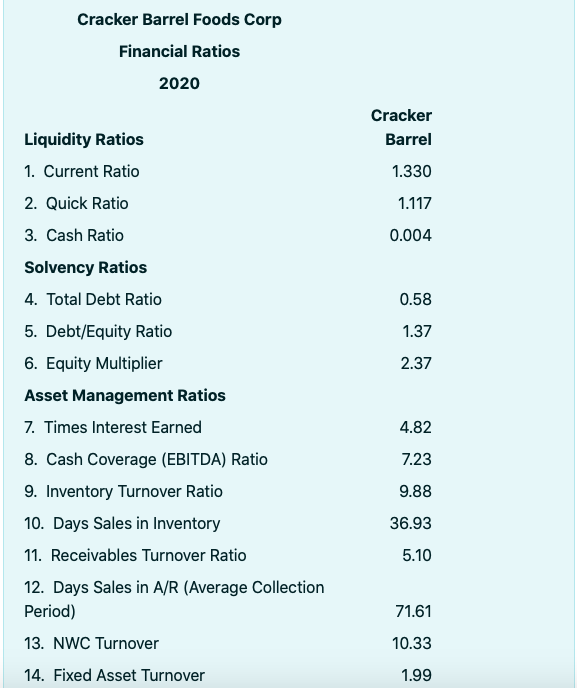

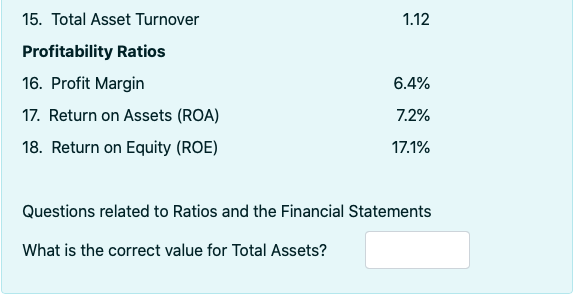

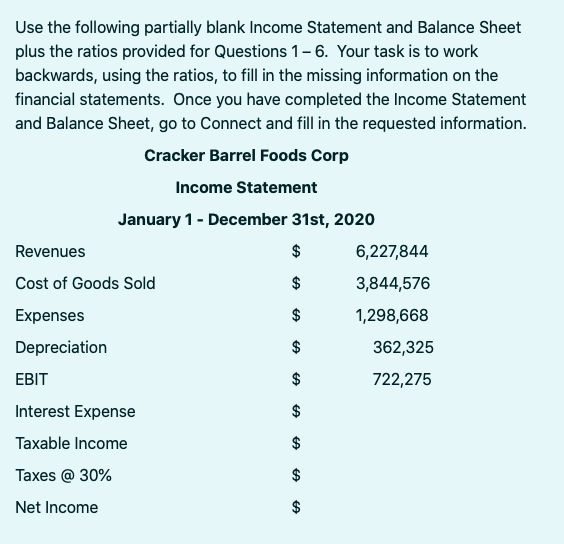

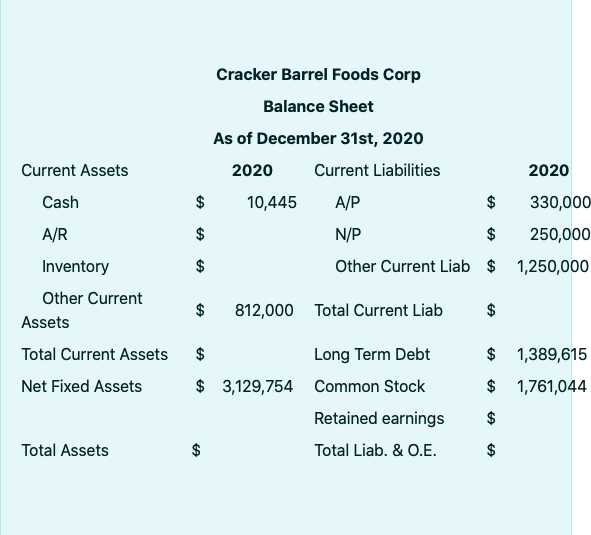

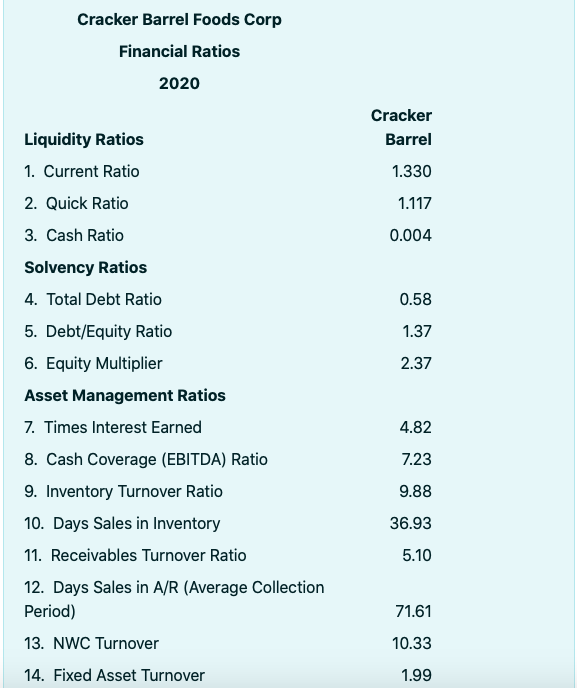

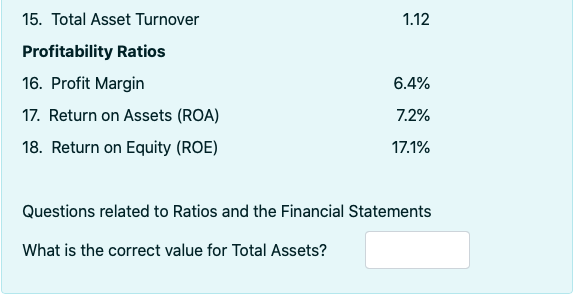

Use the following partially blank Income Statement and Balance Sheet plus the ratios provided for Questions 1-6. Your task is to work backwards, using the ratios, to fill in the missing information on the financial statements. Once you have completed the Income Statement and Balance Sheet, go to Connect and fill in the requested information. Cracker Barrel Foods Corp Income Statement January 1 - December 31st, 2020 Revenues $ 6,227,844 Cost of Goods Sold $ 3,844,576 Expenses $ 1,298,668 Depreciation $ 362,325 EBIT $ 722,275 Interest Expense Taxable income Taxes @ 30% $ $ Net Income Cracker Barrel Foods Corp Balance Sheet As of December 31st, 2020 2020 Current Liabilities 2020 $ 10,445 A/P $ 330,000 N/P $ 250,000 Other Current Liab $ 1,250,000 Current Assets Cash A/R Inventory Other Current Assets Total Current Assets Net Fixed Assets $ 812,000 Total Current Liab $ $ 1,389,615 $ 1,761,044 $ Long Term Debt $ 3,129,754 Common Stock Retained earnings $ Total Liab. & O.E. $ Total Assets $ Cracker Barrel Foods Corp Financial Ratios 2020 Cracker Barrel 1.330 1.117 0.004 0.58 1.37 2.37 Liquidity Ratios 1. Current Ratio 2. Quick Ratio 3. Cash Ratio Solvency Ratios 4. Total Debt Ratio 5. Debt/Equity Ratio 6. Equity Multiplier Asset Management Ratios 7. Times Interest Earned 8. Cash Coverage (EBITDA) Ratio 9. Inventory Turnover Ratio 10. Days Sales in Inventory 11. Receivables Turnover Ratio 12. Days Sales in A/R (Average Collection Period) 13. NWC Turnover 4.82 7.23 9.88 36.93 5.10 71.61 10.33 14. Fixed Asset Turnover 1.99 1.12 15. Total Asset Turnover Profitability Ratios 16. Profit Margin 17. Return on Assets (ROA) 18. Return on Equity (ROE) 6.4% 7.2% 17.1% Questions related to Ratios and the Financial Statements What is the correct value for Total Assets? Questions related to Ratios and the Financial Statements What is the correct value for Total Liabilities and Owner's Equity? What is the future value of an investment worth $6,250 for 9 years earning 6.1 percent compounded annually? (nearest dollar without dollar sign ($) or comma, e.g. 15000) X Your friend just invested $5,000 in an account that pays 3 percent simple interest over three years. What is the value of investment by end of year 3? (nearest dollar without dollar sign ($) or comma, e.g. 15000) x Your friend just invested $5,000 in an account that pays 3 percent simple interest over three years. How much more can he make if the interest compounded annually. (nearest dollar without dollar sign ($) or comma, e.g. 15000) 1270 x