Please answer this partially correct answer in Asap. thank you!

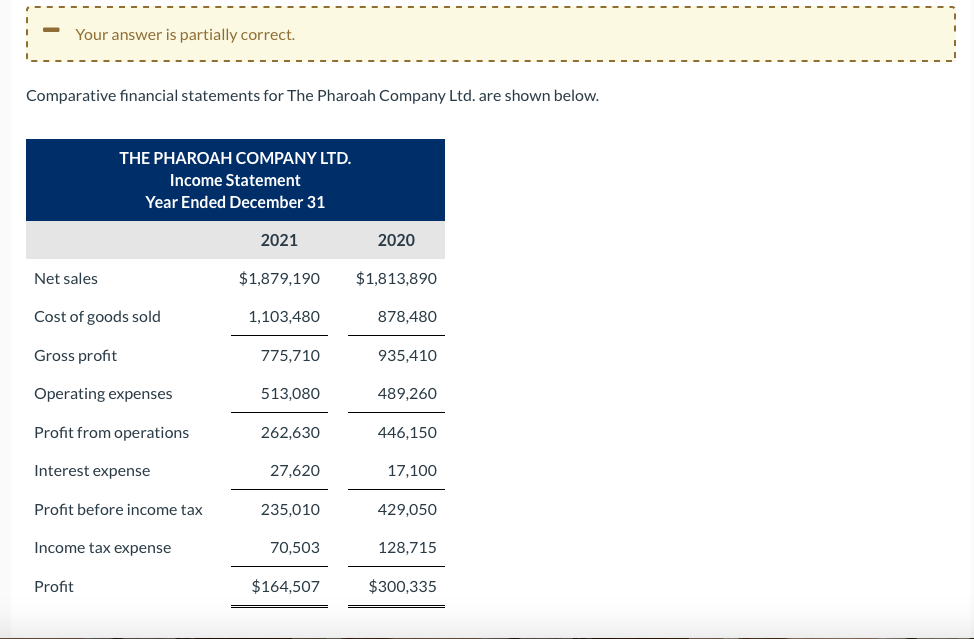

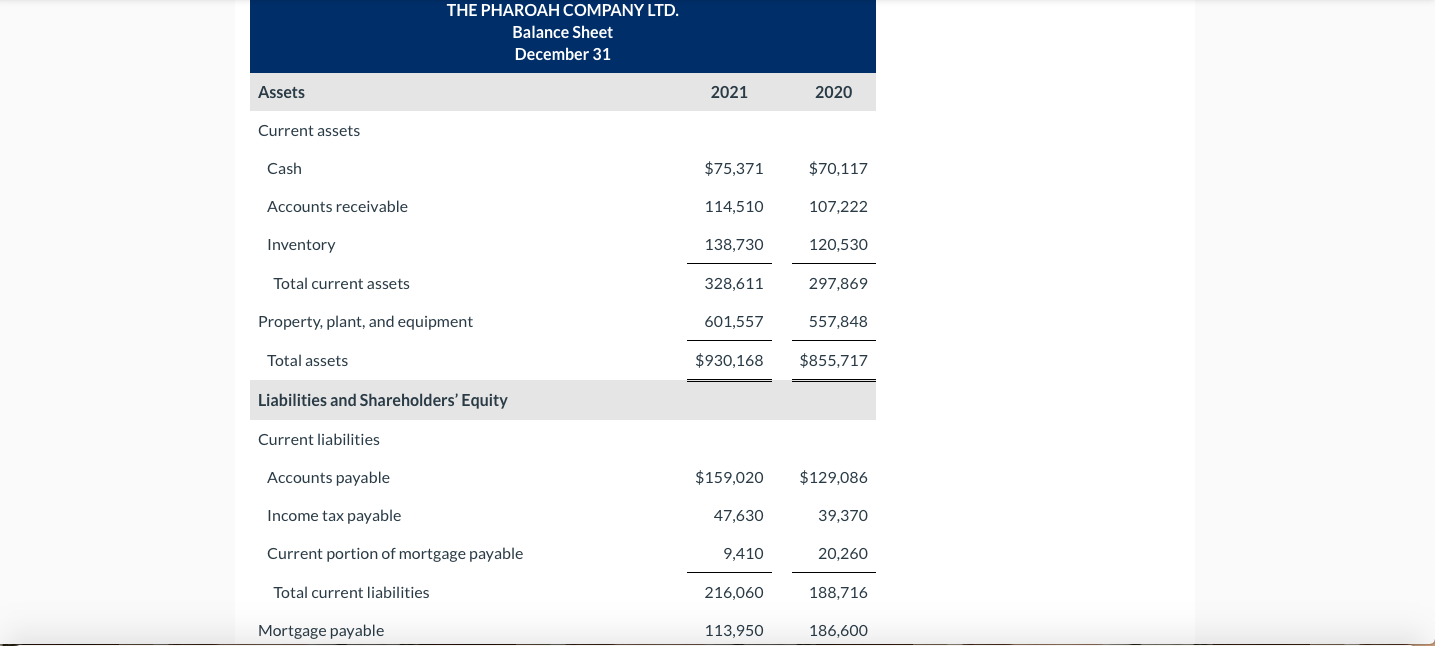

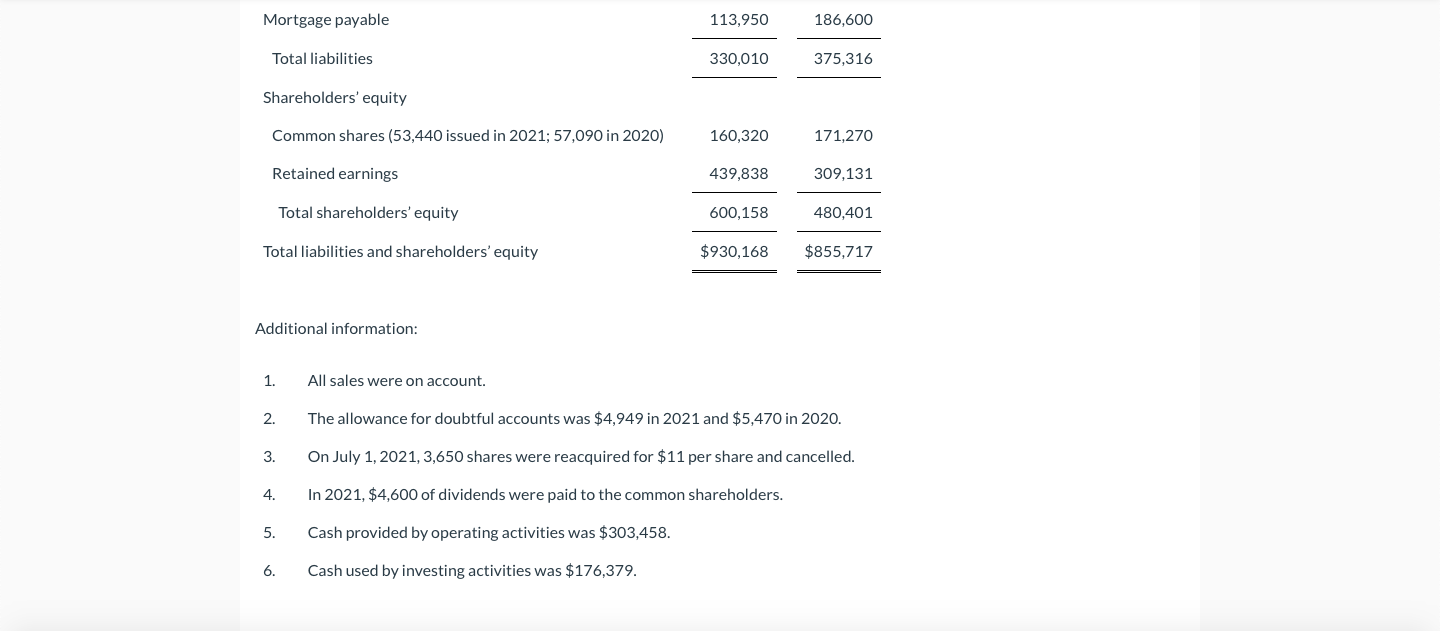

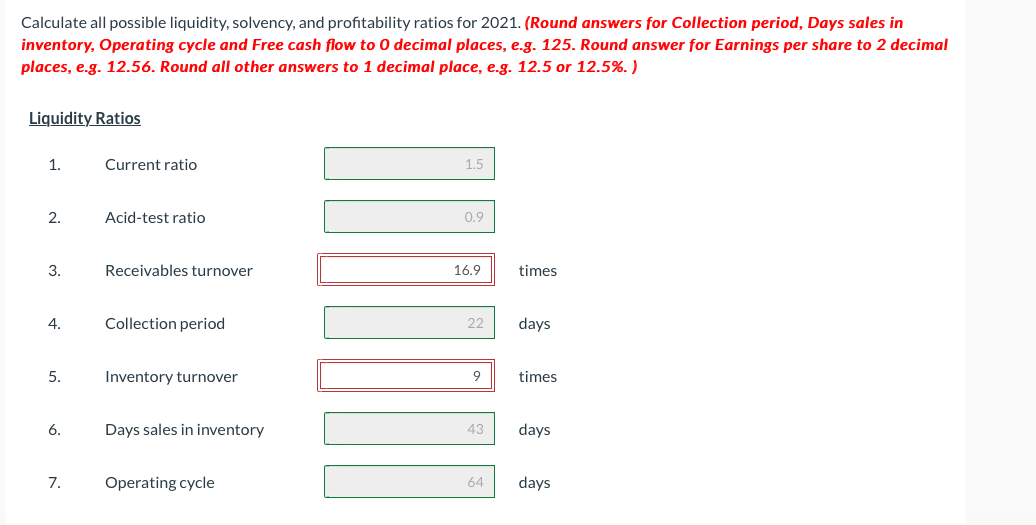

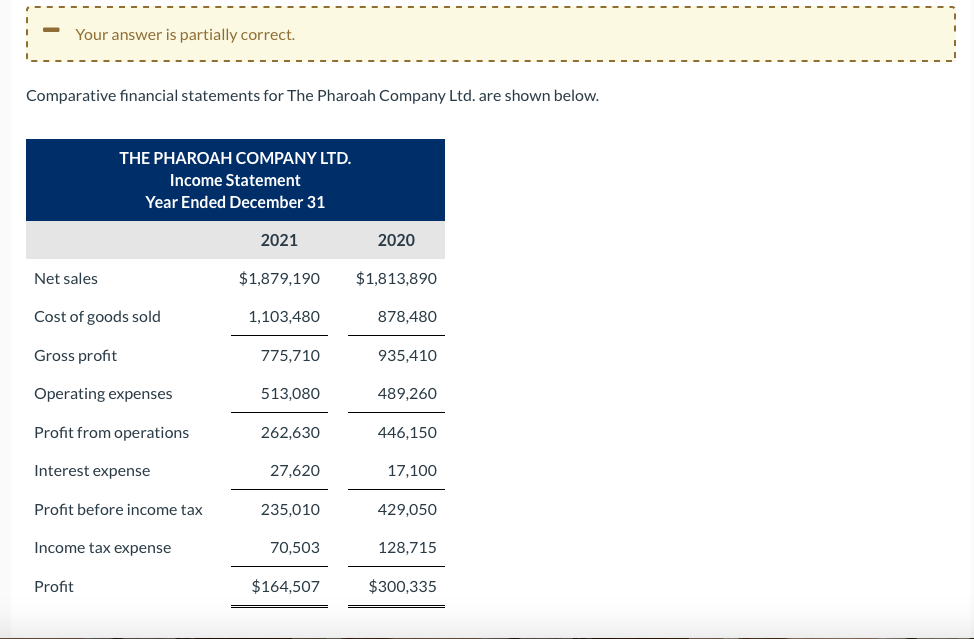

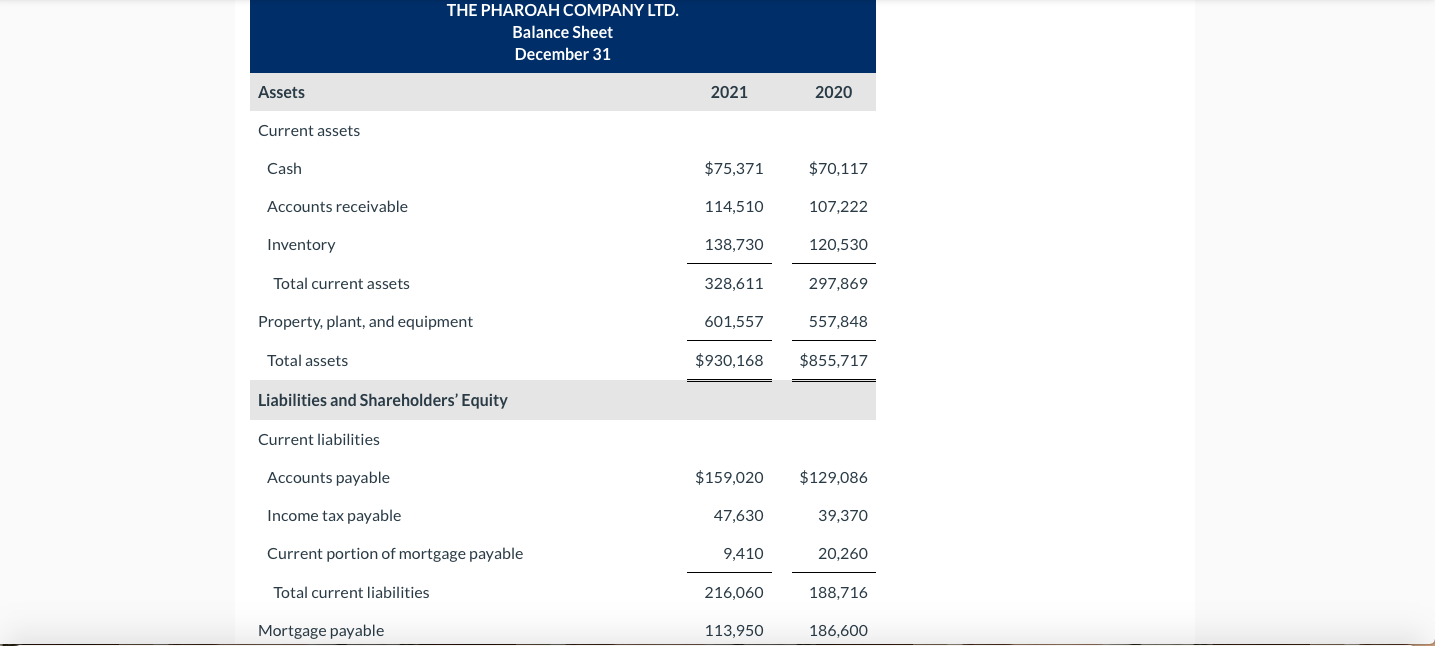

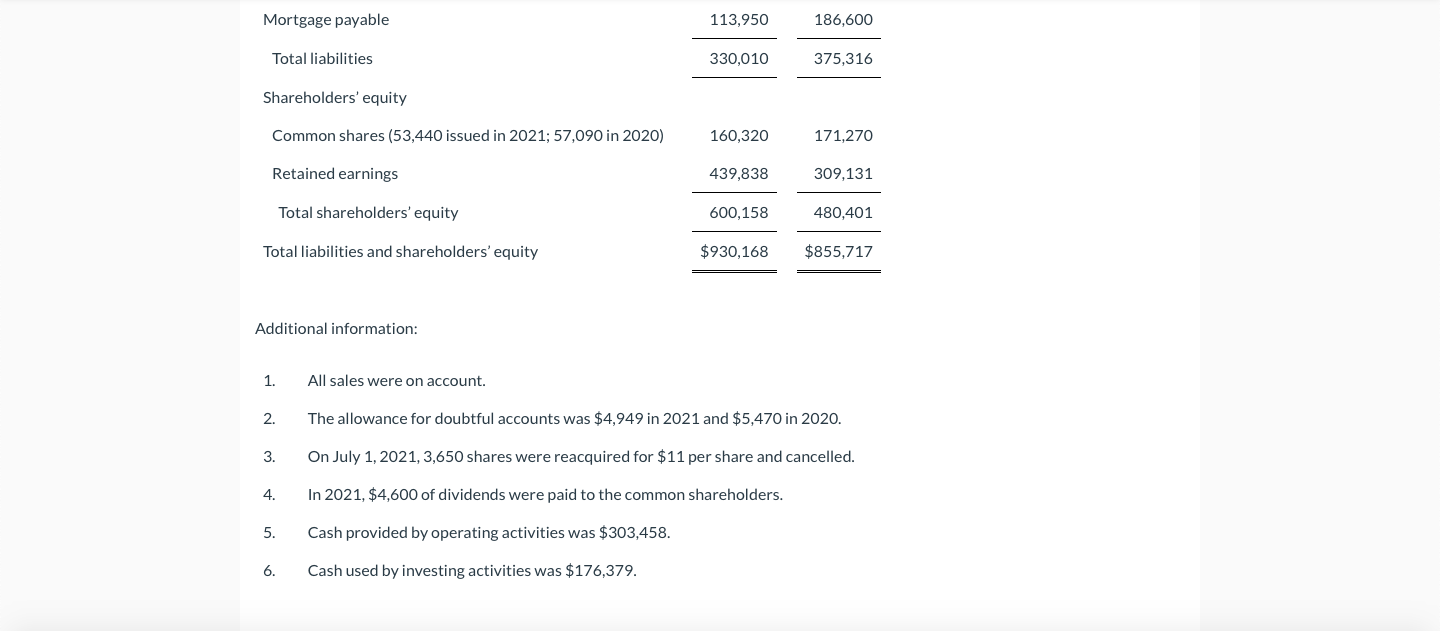

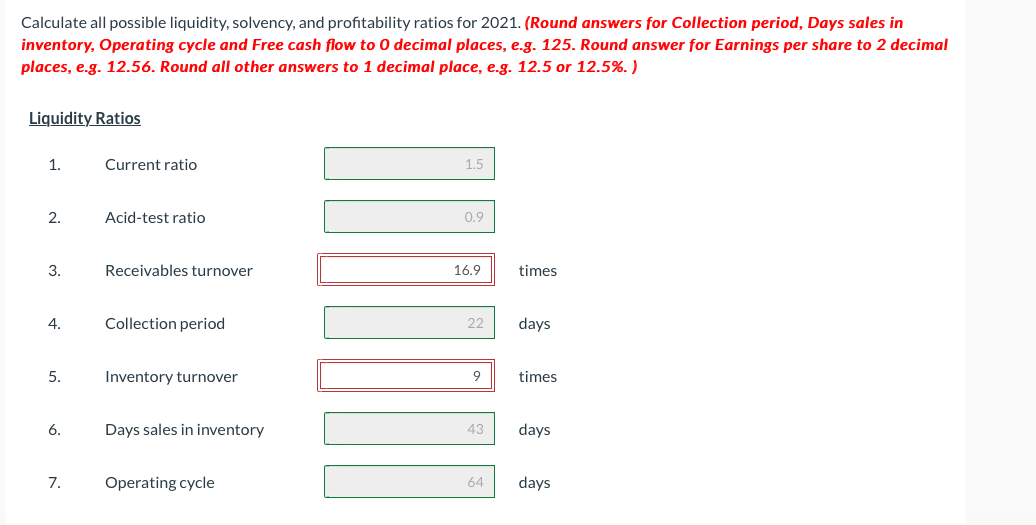

Your answer is partially correct. Comparative financial statements for The Pharoah Company Ltd. are shown below. THE PHAROAH COMPANY LTD. Income Statement Year Ended December 31 2021 2020 Net sales $1,879,190 $1,813,890 Cost of goods sold 1,103,480 878,480 Gross profit 775,710 935,410 Operating expenses 513,080 489,260 Profit from operations 262,630 446,150 Interest expense 27,620 17,100 Profit before income tax 235,010 429,050 Income tax expense 70,503 128,715 Profit $164,507 $300,335 THE PHAROAH COMPANY LTD. Balance Sheet December 31 Assets 2021 2020 Current assets Cash $75,371 $70,117 Accounts receivable 114.510 107,222 Inventory 138,730 120,530 Total current assets 328,611 297,869 Property, plant, and equipment 601,557 557,848 Total assets $930,168 $855,717 Liabilities and Shareholders' Equity Current liabilities Accounts payable $159,020 $129,086 Income tax payable 47,630 39,370 Current portion of mortgage payable 9,410 20,260 Total current liabilities 216,060 188,716 Mortgage payable 113,950 186,600 Mortgage payable 113,950 186,600 Total liabilities 330,010 375,316 Shareholders' equity Common shares (53,440 issued in 2021; 57,090 in 2020) 160,320 171,270 Retained earnings 439,838 309,131 Total shareholders' equity 600,158 480,401 Total liabilities and shareholders' equity $930,168 $855,717 Additional information: 1. All sales were on account. 2. The allowance for doubtful accounts was $4,949 in 2021 and $5,470 in 2020. 3. On July 1, 2021, 3,650 shares were reacquired for $11 per share and cancelled. 4. In 2021, $4,600 of dividends were paid to the common shareholders. 5. Cash provided by operating activities was $303,458. 6. Cash used by investing activities was $176,379. Calculate all possible liquidity, solvency, and profitability ratios for 2021. (Round answers for Collection period, Days sales in inventory, Operating cycle and Free cash flow to O decimal places, e.g. 125. Round answer for Earnings per share to 2 decimal places, e.g. 12.56. Round all other answers to 1 decimal place, e.g. 12.5 or 12.5%.) Liquidity Ratios 1. Current ratio 1.5 2. Acid-test ratio 0.9 3. Receivables turnover 16.9 times 4. Collection period 22 days 5. Inventory turnover 9 times 6. Days sales in inventory 43 days 7. Operating cycle 64 days Solvency Ratios 8. Debt to total assets 12.3 % 9 Interest coverage 9.5 times 10. Free cash flow 1.27.079 Profitability Ratios 11. Gross profit margin 41.3 % 12. Profit margin 8.8 % 13. Asset turnover 2.1 times 14. Return on assets 17.7 % 15. Return on equity 27.4. % 16. Earnings per share $ 2.98 17. Payout ratio 2.9 %