PLEASE answer this question, all information is provided.

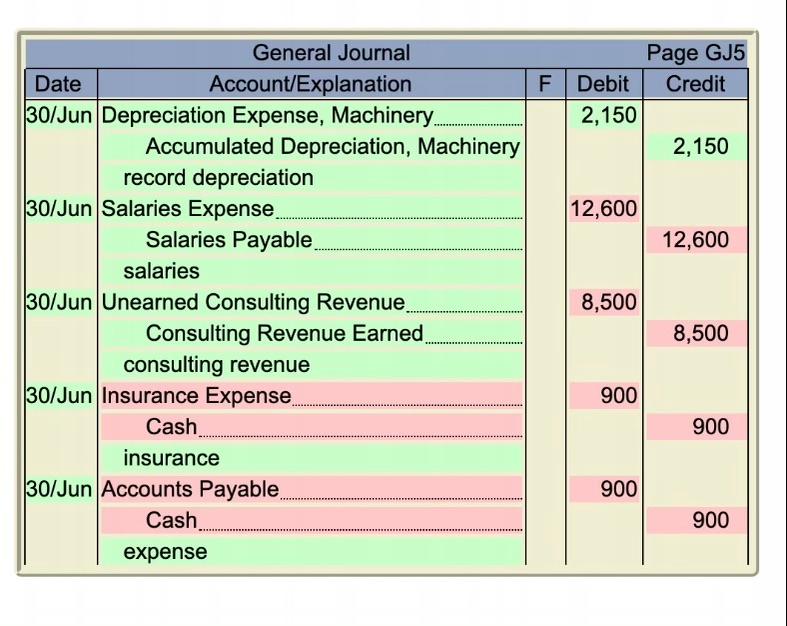

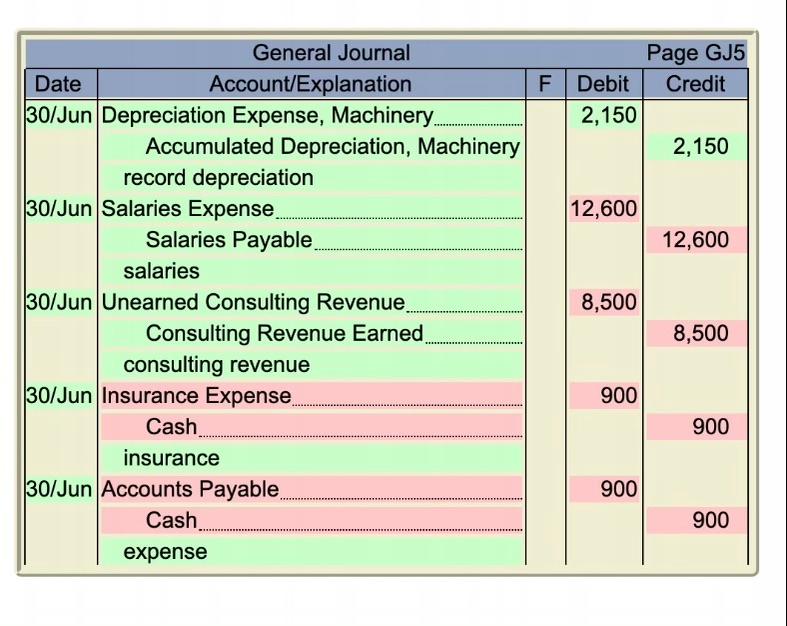

1.) Prepare the appropriate adjusting entries on June 30, 2014. HINT: Where might you look to find information to prepare the adjusting entries?

Previous Info:

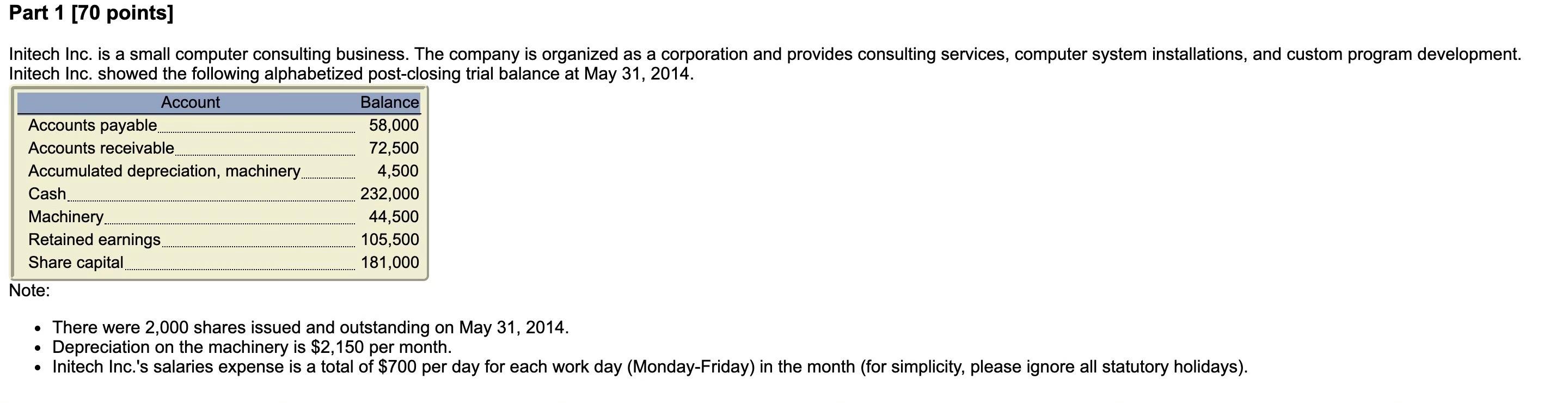

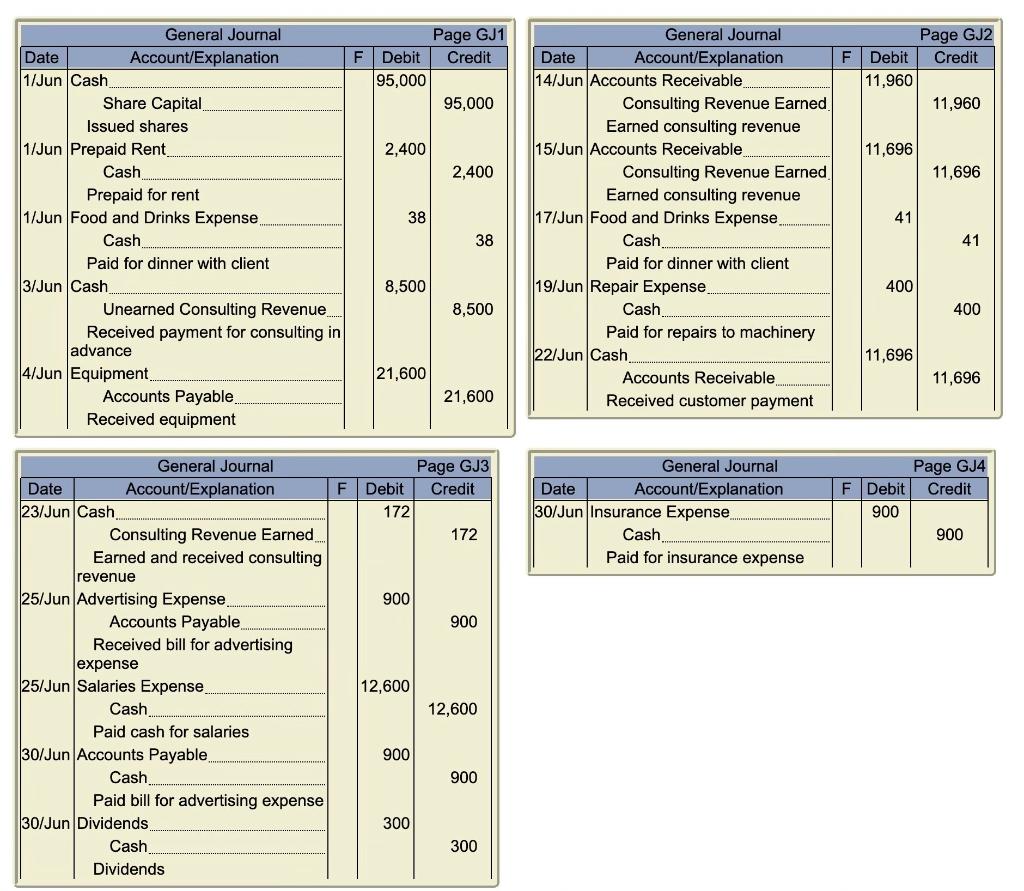

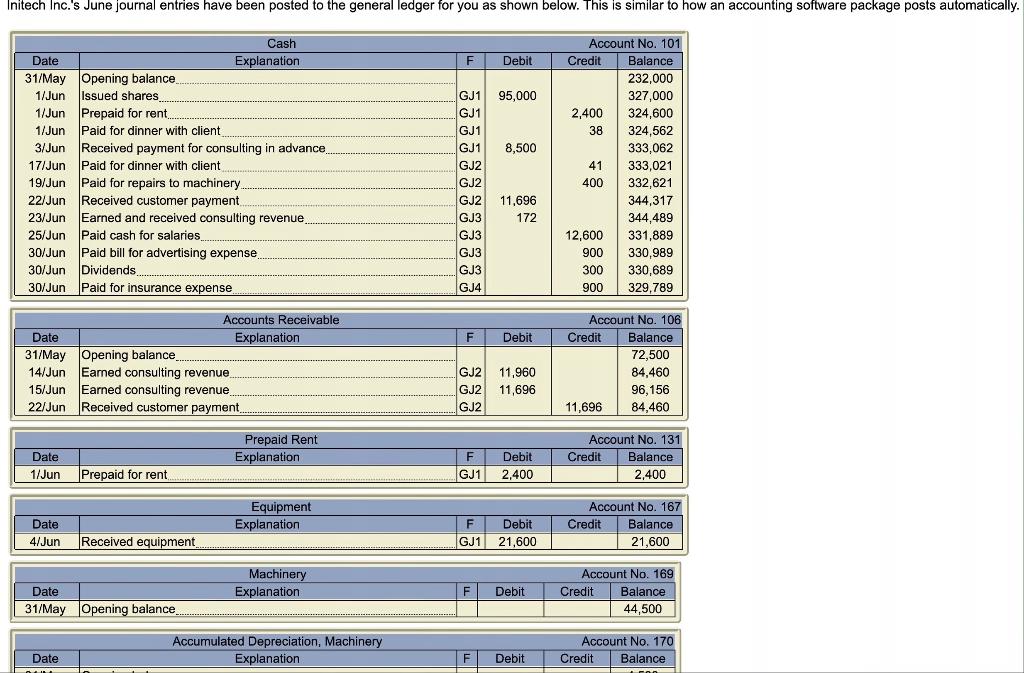

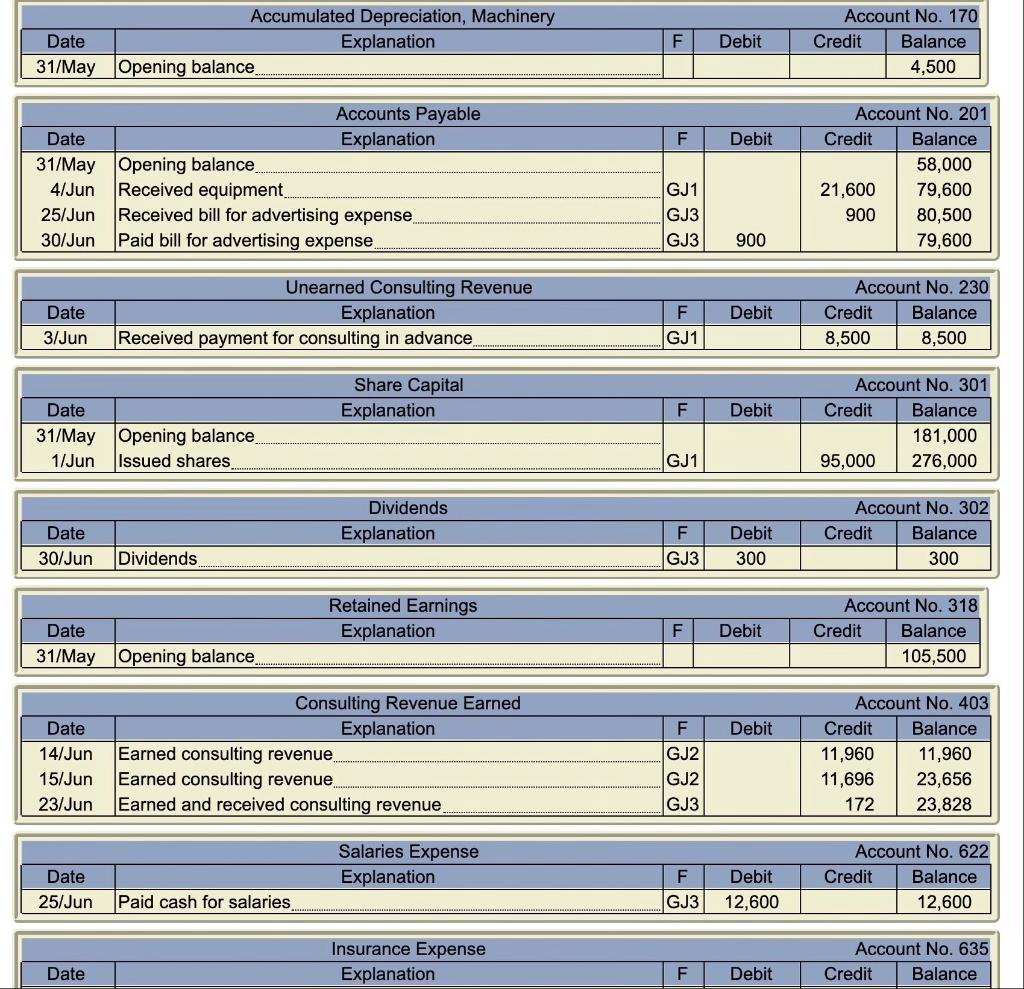

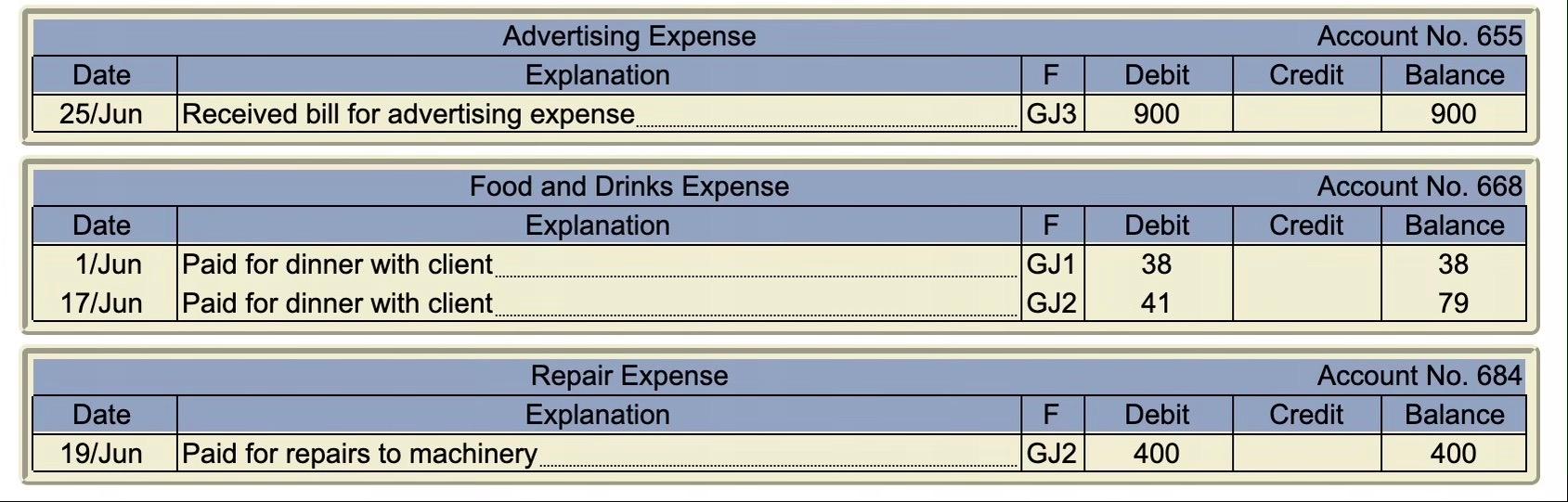

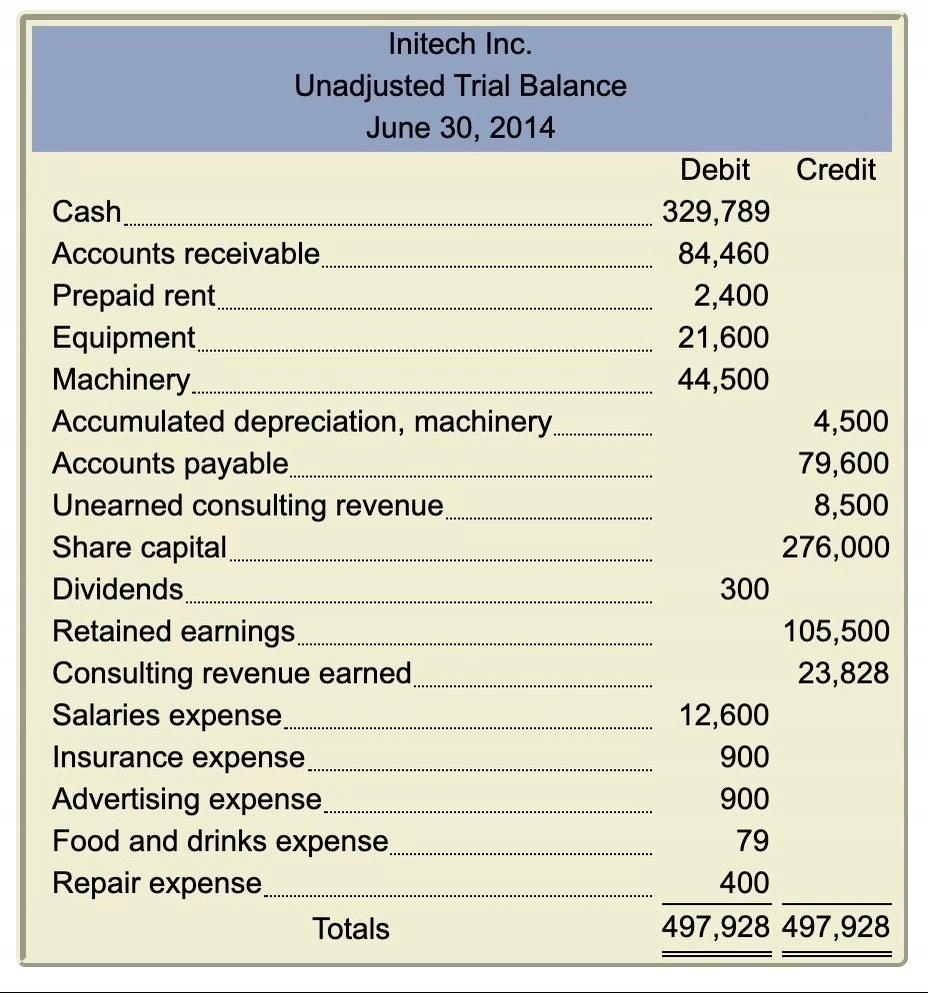

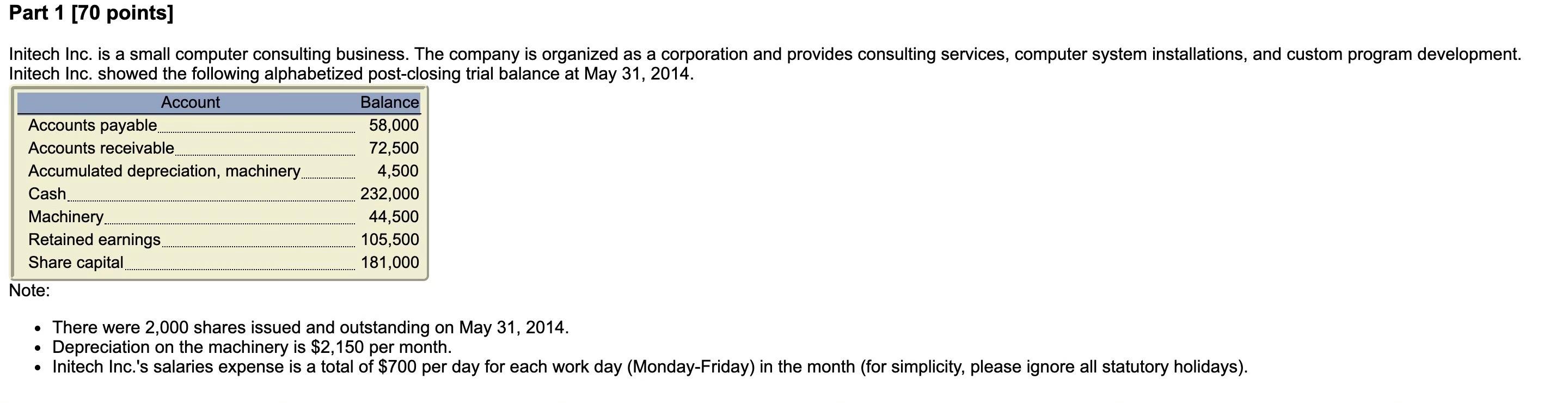

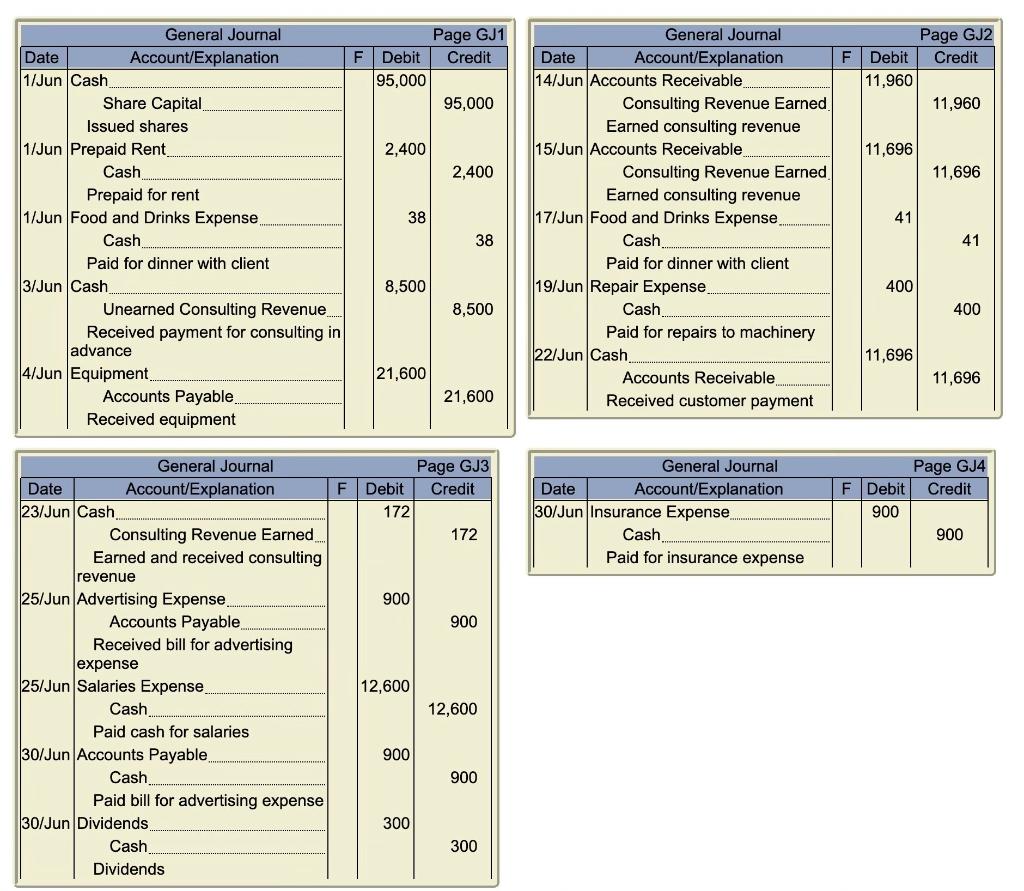

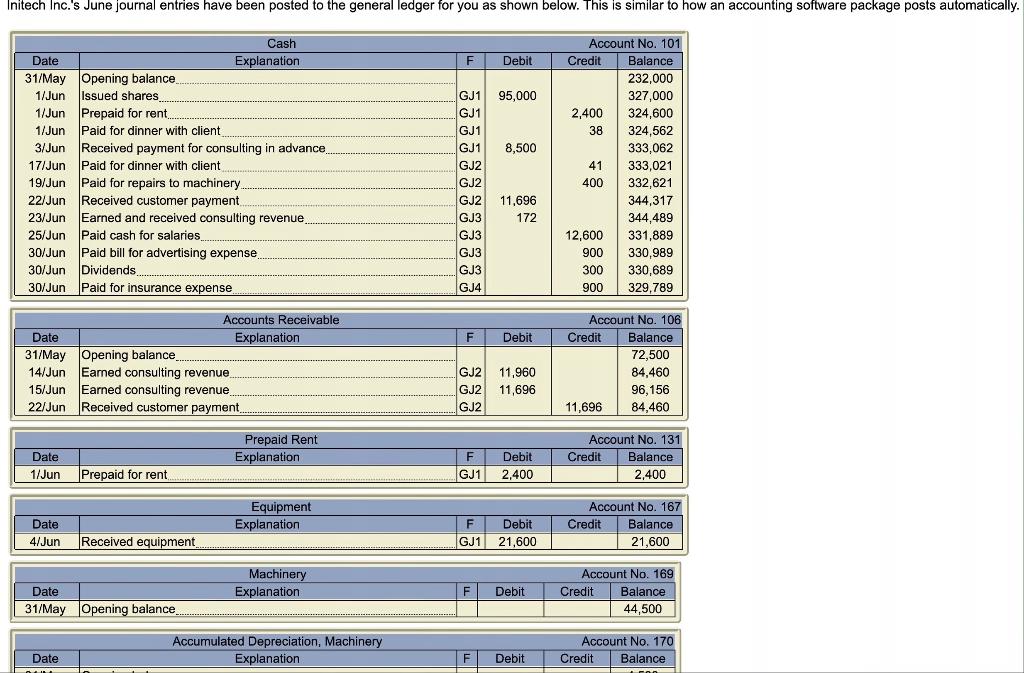

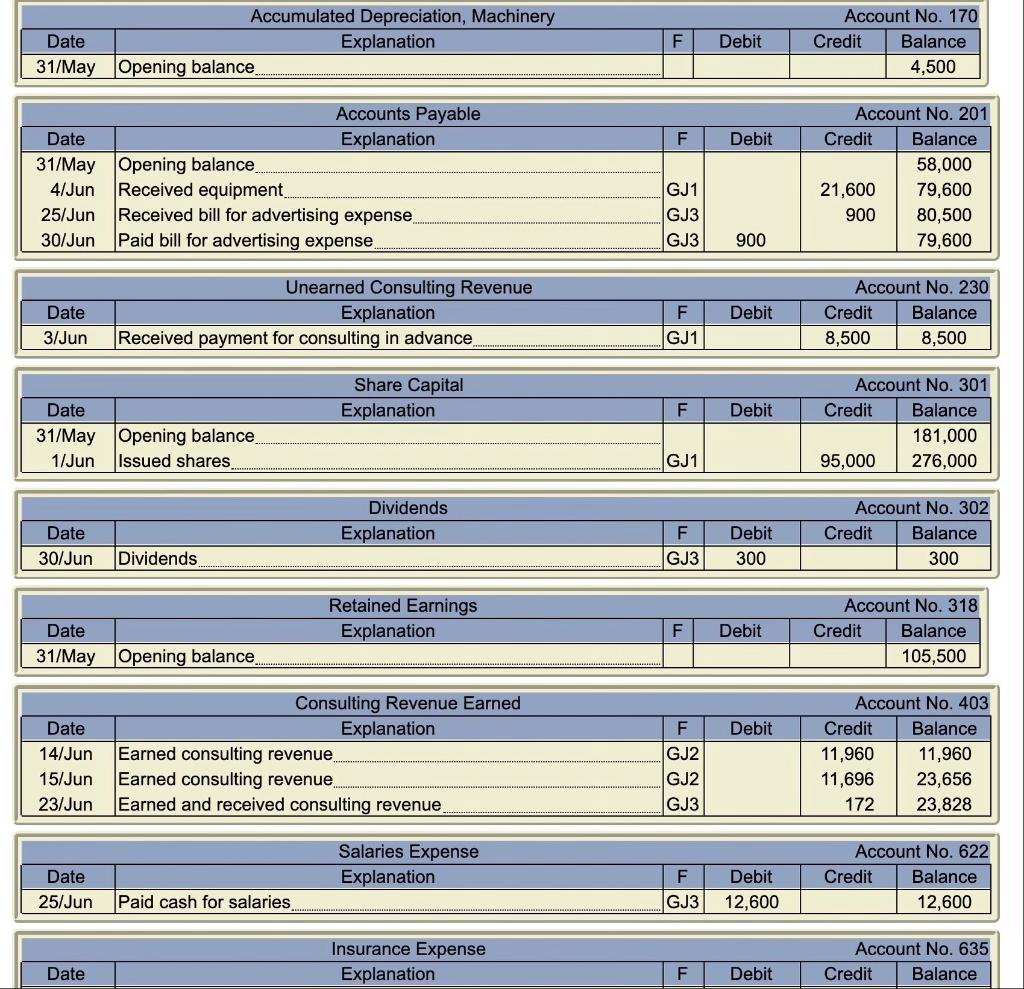

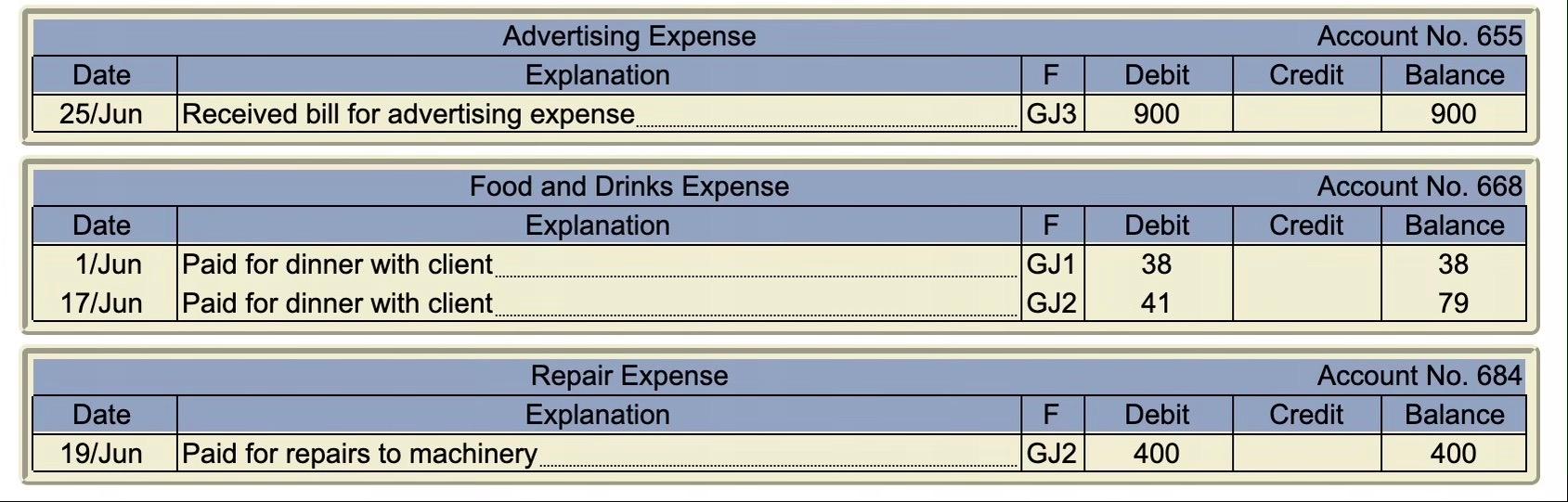

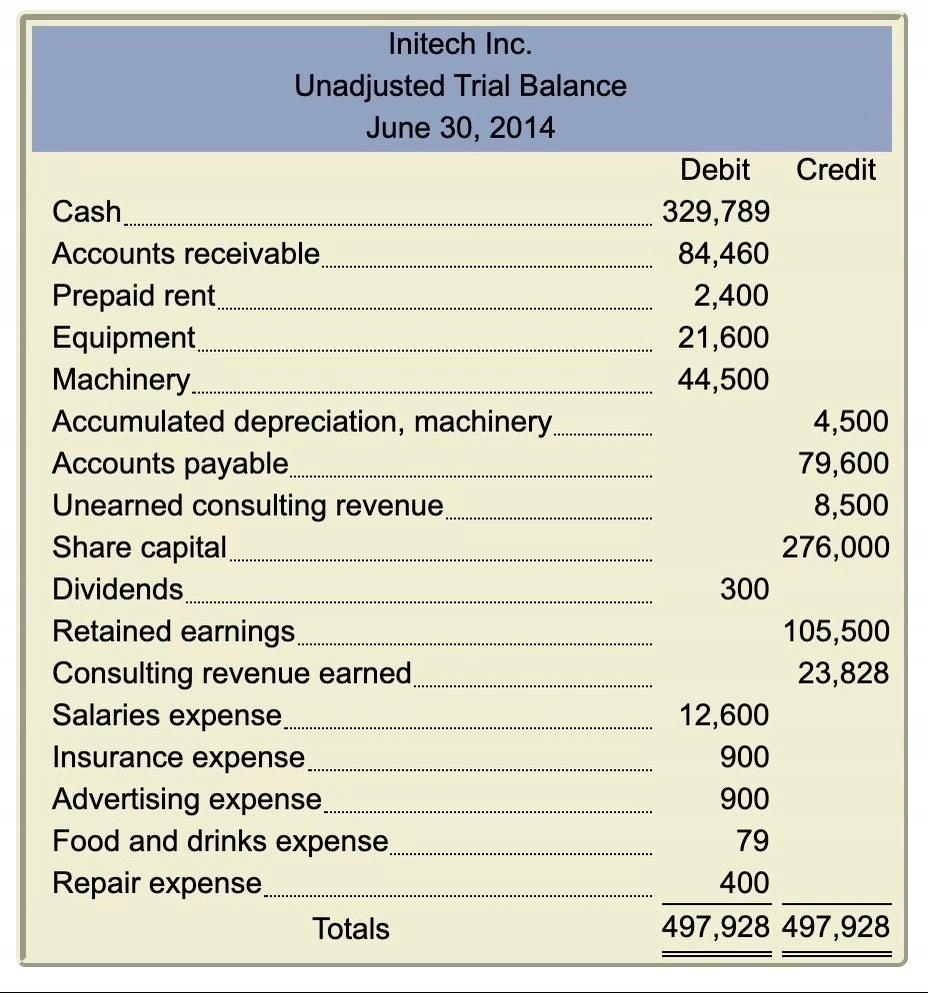

Page GJ5 F Debit Credit 2,150 2,150 12,600 12,600 General Journal Date Account/Explanation 30/Jun Depreciation Expense, Machinery Accumulated Depreciation, Machinery record depreciation 30/Jun Salaries Expense. Salaries Payable salaries 30/Jun Unearned Consulting Revenue. Consulting Revenue Earned consulting revenue 30/Jun Insurance Expense Cash insurance 30/Jun Accounts Payable Cash expense 8,500 8,500 900 900 900 900 Part 1 [70 points) Initech Inc. is a small computer consulting business. The company is organized as a corporation and provides consulting services, computer system installations, and custom program development. Initech Inc. showed the following alphabetized post-closing trial balance at May 31, 2014. Account Balance Accounts payable 58,000 Accounts receivable 72,500 Accumulated depreciation, machinery.. 4,500 Cash. 232,000 Machinery. 44,500 Retained earnings. 105,500 Share capital. 181,000 Note: There were 2,000 shares issued and outstanding on May 31, 2014. Depreciation on the machinery is $2,150 per month. Initech Inc.'s salaries expense is a total of $700 per day for each work day (Monday-Friday) in the month (for simplicity, please ignore all statutory holidays). F Page Gj1 F Debit Credit 95,000 95,000 Page GJ2 Debit Credit 11,960 11,960 2,400 11,696 2,400 11,696 38 General Journal Date Account/Explanation 1/Jun Cash Share Capital Issued shares 1/Jun Prepaid Rent Cash Prepaid for rent 1/Jun Food and Drinks Expense Cash Paid for dinner with client 3/Jun Cash Unearned Consulting Revenue Received payment for consulting in advance 4/Jun Equipment Accounts Payable Received equipment General Journal Date Account/Explanation 14/Jun Accounts Receivable Consulting Revenue Earned Earned consulting revenue 15/Jun Accounts Receivable Consulting Revenue Earned Earned consulting revenue 17/Jun Food and Drinks Expense Cash Paid for dinner with client 19/Jun Repair Expense Cash Paid for repairs to machinery 22/Jun Cash Accounts Receivable Received customer payment 41 38 41 8,500 400 8,500 400 11,696 21,600 11,696 21,600 Page GJ4 Credit F Page GJ3 Debit Credit 172 172 General Journal Date Account/Explanation 30/Jun Insurance Expense Cash Paid for insurance expense F Debit 900 900 900 900 General Journal Date Account/Explanation 23/Jun Cash Consulting Revenue Earned Earned and received consulting revenue 25/Jun Advertising Expense Accounts Payable Received bill for advertising expense 25/Jun Salaries Expense Cash Paid cash for salaries 30/Jun Accounts Payable Cash Paid bill for advertising expense 30/Jun Dividends Cash Dividends 12,600 12,600 900 900 300 300 Initech Inc.'s June journal entries have been posted to the general ledger for you as shown below. This is similar to how an accounting software package posts automatically. F Debit 95,000 8,500 Cash Date Explanation 31/May Opening balance 1/Jun Issued shares 1/Jun Prepaid for rent 1/Jun Paid for dinner with client 3/Jun Received payment for consulting in advance 17/Jun Paid for dinner with client 19/Jun Paid for repairs to machinery 22/Jun Received customer payment 23/Jun Earned and received consulting revenue. 25/Jun Paid cash for salaries 30/Jun Paid bill for advertising expense 30/Jun Dividends. 30/Jun Paid for insurance expense GJ1 GJ1 GJ1 GJ1 GJ2 GJ2 GJ2 GJ3 GJ3 GJ3 GJ3 GJ4 Account No. 101 Credit Balance 232,000 327,000 2,400 324,600 38 324,562 333,062 41 333,021 400 332,621 344,317 344,489 12,600 331,889 900 330,989 300 330,689 900 329,789 11,696 172 F Debit Accounts Receivable Date Explanation 31/May Opening balance 14/Jun Earned consulting revenue 15/Jun Earned consulting revenue 22/Jun Received customer payment . Account No. 106 Credit Balance 72,500 84,460 96,156 11,696 84,460 GJ2 GJ2 GJ2 11,960 11,696 Prepaid Rent Explanation Date 1/Jun F GJ1 Debit 2,400 Account No. 131 Credit Balance 2,400 Prepaid for rent Equipment Explanation Credit Date 4/Jun / F Debit GJ1 21,600 Account No. 167 Balance 21,600 Received equipment Machinery Explanation F Debit Date 31/May Opening balance Account No. 169 Credit Balance 44,500 Accumulated Depreciation, Machinery Explanation Account No. 170 Credit Balance Date F Debit Accumulated Depreciation, Machinery Date Explanation 31/May Opening balance F Debit Account No. 170 Credit Balance 4,500 F Debit Accounts Payable Date Explanation 31/May Opening balance 4/Jun Received equipment 25/Jun Received bill for advertising expense 30/Jun Paid bill for advertising expense, Account No. 201 Credit Balance 58,000 21,600 79,600 900 80,500 79,600 GJ1 GJ3 GJ3 900 Unearned Consulting Revenue Explanation Received payment for consulting in advance Date 3/Jun Debit F GJ1 Account No. 230 Credit Balance 8,500 8,500 Share Capital Explanation F Debit Date 31/May Opening balance 1/Jun Issued shares Account No. 301 Credit Balance 181,000 95,000 276,000 GJ1 Dividends Explanation Date 30/Jun F GJ3 Debit 300 Account No. 302 Credit Balance 300 Dividends Retained Earnings Explanation F Debit Date 31/May Opening balance Account No. 318 Credit Balance 105,500 Debit Date 14/Jun 15/Jun 23/Jun Consulting Revenue Earned Explanation Earned consulting revenue Earned consulting revenue Earned and received consulting revenue F GJ2 GJ2 GJ3 Account No. 403 Credit Balance 11,960 11,960 11,696 23,656 172 23,828 Salaries Expense Explanation Date 25/Jun F GJ3 Debit 12,600 Account No. 622 Credit Balance 12,600 Paid cash for salaries Insurance Expense Explanation Account No. 635 Credit Balance Date F Debit Date 25/Jun Advertising Expense Explanation Received bill for advertising expense. F GJ3 Debit 900 Account No. 655 Credit Balance 900 Date 1/Jun 17/Jun Food and Drinks Expense Explanation Paid for dinner with client Paid for dinner with client F GJ1 GJ2 Debit 38 41 Account No. 668 Credit Balance 38 79 Date 19/Jun Repair Expense Explanation Paid for repairs to machinery. F GJ2 Debit 400 Account No. 684 Credit Balance 400 Initech Inc. Unadjusted Trial Balance June 30, 2014 Cash. Accounts receivable Prepaid rent Equipment Machinery Accumulated depreciation, machinery. Accounts payable... Unearned consulting revenue. Share capital. Dividends Retained earnings. Consulting revenue earned. Salaries expense. Insurance expense. Advertising expense. Food and drinks expense. Repair expense. Totals Debit Credit 329,789 84,460 2,400 21,600 44,500 4,500 79,600 8,500 276,000 300 105,500 23,828 12,600 900 900 79 400 497,928 497,928 Page GJ5 F Debit Credit 2,150 2,150 12,600 12,600 General Journal Date Account/Explanation 30/Jun Depreciation Expense, Machinery Accumulated Depreciation, Machinery record depreciation 30/Jun Salaries Expense. Salaries Payable salaries 30/Jun Unearned Consulting Revenue. Consulting Revenue Earned consulting revenue 30/Jun Insurance Expense Cash insurance 30/Jun Accounts Payable Cash expense 8,500 8,500 900 900 900 900 Part 1 [70 points) Initech Inc. is a small computer consulting business. The company is organized as a corporation and provides consulting services, computer system installations, and custom program development. Initech Inc. showed the following alphabetized post-closing trial balance at May 31, 2014. Account Balance Accounts payable 58,000 Accounts receivable 72,500 Accumulated depreciation, machinery.. 4,500 Cash. 232,000 Machinery. 44,500 Retained earnings. 105,500 Share capital. 181,000 Note: There were 2,000 shares issued and outstanding on May 31, 2014. Depreciation on the machinery is $2,150 per month. Initech Inc.'s salaries expense is a total of $700 per day for each work day (Monday-Friday) in the month (for simplicity, please ignore all statutory holidays). F Page Gj1 F Debit Credit 95,000 95,000 Page GJ2 Debit Credit 11,960 11,960 2,400 11,696 2,400 11,696 38 General Journal Date Account/Explanation 1/Jun Cash Share Capital Issued shares 1/Jun Prepaid Rent Cash Prepaid for rent 1/Jun Food and Drinks Expense Cash Paid for dinner with client 3/Jun Cash Unearned Consulting Revenue Received payment for consulting in advance 4/Jun Equipment Accounts Payable Received equipment General Journal Date Account/Explanation 14/Jun Accounts Receivable Consulting Revenue Earned Earned consulting revenue 15/Jun Accounts Receivable Consulting Revenue Earned Earned consulting revenue 17/Jun Food and Drinks Expense Cash Paid for dinner with client 19/Jun Repair Expense Cash Paid for repairs to machinery 22/Jun Cash Accounts Receivable Received customer payment 41 38 41 8,500 400 8,500 400 11,696 21,600 11,696 21,600 Page GJ4 Credit F Page GJ3 Debit Credit 172 172 General Journal Date Account/Explanation 30/Jun Insurance Expense Cash Paid for insurance expense F Debit 900 900 900 900 General Journal Date Account/Explanation 23/Jun Cash Consulting Revenue Earned Earned and received consulting revenue 25/Jun Advertising Expense Accounts Payable Received bill for advertising expense 25/Jun Salaries Expense Cash Paid cash for salaries 30/Jun Accounts Payable Cash Paid bill for advertising expense 30/Jun Dividends Cash Dividends 12,600 12,600 900 900 300 300 Initech Inc.'s June journal entries have been posted to the general ledger for you as shown below. This is similar to how an accounting software package posts automatically. F Debit 95,000 8,500 Cash Date Explanation 31/May Opening balance 1/Jun Issued shares 1/Jun Prepaid for rent 1/Jun Paid for dinner with client 3/Jun Received payment for consulting in advance 17/Jun Paid for dinner with client 19/Jun Paid for repairs to machinery 22/Jun Received customer payment 23/Jun Earned and received consulting revenue. 25/Jun Paid cash for salaries 30/Jun Paid bill for advertising expense 30/Jun Dividends. 30/Jun Paid for insurance expense GJ1 GJ1 GJ1 GJ1 GJ2 GJ2 GJ2 GJ3 GJ3 GJ3 GJ3 GJ4 Account No. 101 Credit Balance 232,000 327,000 2,400 324,600 38 324,562 333,062 41 333,021 400 332,621 344,317 344,489 12,600 331,889 900 330,989 300 330,689 900 329,789 11,696 172 F Debit Accounts Receivable Date Explanation 31/May Opening balance 14/Jun Earned consulting revenue 15/Jun Earned consulting revenue 22/Jun Received customer payment . Account No. 106 Credit Balance 72,500 84,460 96,156 11,696 84,460 GJ2 GJ2 GJ2 11,960 11,696 Prepaid Rent Explanation Date 1/Jun F GJ1 Debit 2,400 Account No. 131 Credit Balance 2,400 Prepaid for rent Equipment Explanation Credit Date 4/Jun / F Debit GJ1 21,600 Account No. 167 Balance 21,600 Received equipment Machinery Explanation F Debit Date 31/May Opening balance Account No. 169 Credit Balance 44,500 Accumulated Depreciation, Machinery Explanation Account No. 170 Credit Balance Date F Debit Accumulated Depreciation, Machinery Date Explanation 31/May Opening balance F Debit Account No. 170 Credit Balance 4,500 F Debit Accounts Payable Date Explanation 31/May Opening balance 4/Jun Received equipment 25/Jun Received bill for advertising expense 30/Jun Paid bill for advertising expense, Account No. 201 Credit Balance 58,000 21,600 79,600 900 80,500 79,600 GJ1 GJ3 GJ3 900 Unearned Consulting Revenue Explanation Received payment for consulting in advance Date 3/Jun Debit F GJ1 Account No. 230 Credit Balance 8,500 8,500 Share Capital Explanation F Debit Date 31/May Opening balance 1/Jun Issued shares Account No. 301 Credit Balance 181,000 95,000 276,000 GJ1 Dividends Explanation Date 30/Jun F GJ3 Debit 300 Account No. 302 Credit Balance 300 Dividends Retained Earnings Explanation F Debit Date 31/May Opening balance Account No. 318 Credit Balance 105,500 Debit Date 14/Jun 15/Jun 23/Jun Consulting Revenue Earned Explanation Earned consulting revenue Earned consulting revenue Earned and received consulting revenue F GJ2 GJ2 GJ3 Account No. 403 Credit Balance 11,960 11,960 11,696 23,656 172 23,828 Salaries Expense Explanation Date 25/Jun F GJ3 Debit 12,600 Account No. 622 Credit Balance 12,600 Paid cash for salaries Insurance Expense Explanation Account No. 635 Credit Balance Date F Debit Date 25/Jun Advertising Expense Explanation Received bill for advertising expense. F GJ3 Debit 900 Account No. 655 Credit Balance 900 Date 1/Jun 17/Jun Food and Drinks Expense Explanation Paid for dinner with client Paid for dinner with client F GJ1 GJ2 Debit 38 41 Account No. 668 Credit Balance 38 79 Date 19/Jun Repair Expense Explanation Paid for repairs to machinery. F GJ2 Debit 400 Account No. 684 Credit Balance 400 Initech Inc. Unadjusted Trial Balance June 30, 2014 Cash. Accounts receivable Prepaid rent Equipment Machinery Accumulated depreciation, machinery. Accounts payable... Unearned consulting revenue. Share capital. Dividends Retained earnings. Consulting revenue earned. Salaries expense. Insurance expense. Advertising expense. Food and drinks expense. Repair expense. Totals Debit Credit 329,789 84,460 2,400 21,600 44,500 4,500 79,600 8,500 276,000 300 105,500 23,828 12,600 900 900 79 400 497,928 497,928