please answer this question

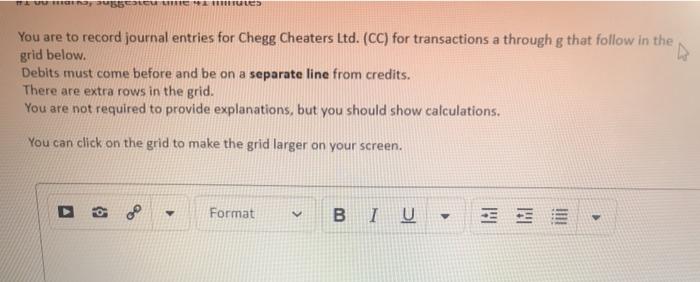

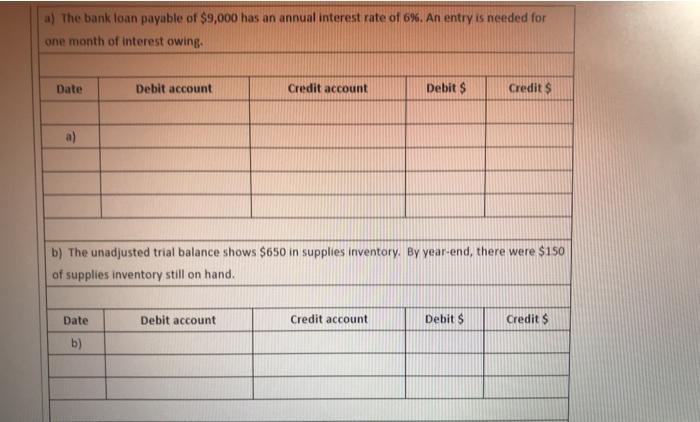

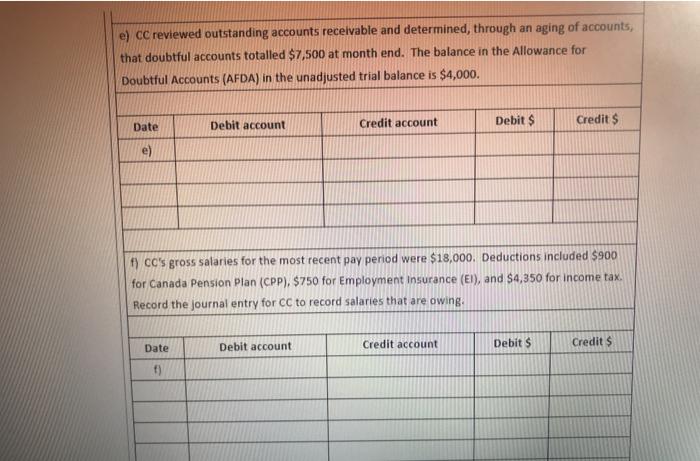

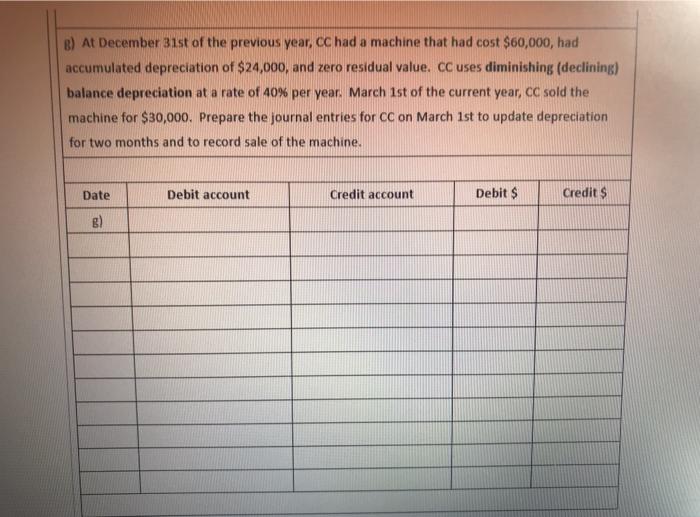

Ar55FOC LINE UUED You are to record journal entries for Chegg Cheaters Ltd. (CC) for transactions a through g that follow in the grid below. Debits must come before and be on a separate line from credits. There are extra rows in the grid. You are not required to provide explanations, but you should show calculations. You can click on the grid to make the grid larger on your screen. Doo Format V BIU - a) The bank loan payable of $9,000 has an annual interest rate of 6%. An entry is needed for one month of interest owing. Date Debit account Credit account Debit $ Credit $ a) b) The unadjusted trial balance shows $650 in supplies inventory. By year-end, there were $150 of supplies inventory still on hand. Date Debit account Credit account Debit $ Credit $ b) c) Paid salaries of $4,500. This amount includes $1,500 owing in salaries payable. Date Debit account Credit account Debit $ Credits d) cc uses the perpetual inventory method and records sales, sales returns, and related entries under IFRS presuming an expected sales return of 49. A customer returned to CC merchandise that had been sold for cash of $500. The goods had cost CC $200 and were restored to Inventory. Prepare the journal entries for CC. Debit account Credit account Debits Credit $ Date d) e) CC reviewed outstanding accounts receivable and determined, through an aging of accounts, that doubtful accounts totalled $7,500 at month end. The balance in the Allowance for Doubtful Accounts (AFDA) in the unadjusted trial balance is $4,000. Debit account Date Debit $ Credit account Credits e) f) cc's gross salaries for the most recent pay period were $18,000. Deductions included $900 for Canada Pension Plan (CPP), $750 for Employment Insurance (EI), and $4,350 for income tax. Record the journal entry for CC to record salaries that are owing: Debit account Date Credit account Debits Credits f) B) At December 31st of the previous year, CC had a machine that had cost $60,000, had accumulated depreciation of $24,000, and zero residual value. Cc uses diminishing (declining) balance depreciation at a rate of 40% per year. March 1st of the current year, CC sold the machine for $30,000. Prepare the journal entries for CC on March 1st to update depreciation for two months and to record sale of the machine. Date Debit account Credit account Debit $ Credit $ B)