Answered step by step

Verified Expert Solution

Question

1 Approved Answer

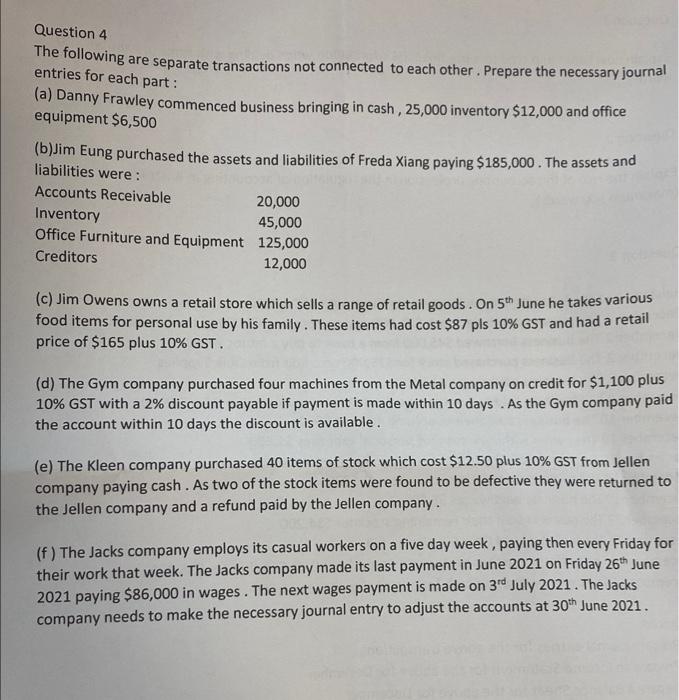

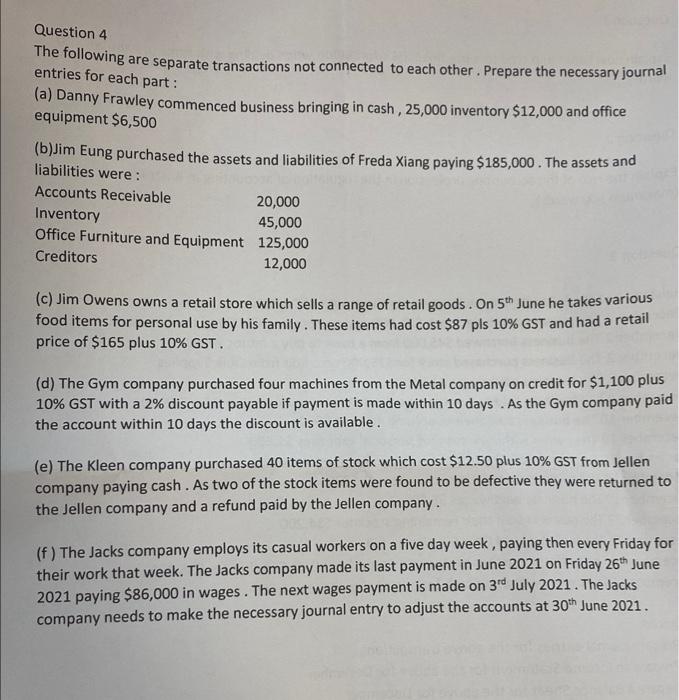

please answer this question by typing. no handwritten answer. Question 4 The following are separate transactions not connected to each other. Prepare the necessary journal

please answer this question by typing.

Question 4 The following are separate transactions not connected to each other. Prepare the necessary journal entries for each part: (a) Danny Frawley commenced business bringing in cash , 25,000 inventory $12,000 and office equipment $6,500 (b)Jim Eung purchased the assets and liabilities of Freda Xiang paying $185,000. The assets and liabilities were : Accounts Receivable 20,000 Inventory 45,000 Office Furniture and Equipment 125,000 Creditors 12,000 (c) Jim Owens owns a retail store which sells a range of retail goods. On 5th June he takes various food items for personal use by his family. These items had cost $87 pls 10% GST and had a retail price of $165 plus 10% GST. (d) The Gym company purchased four machines from the Metal company on credit for $1,100 plus 10% GST with a 2% discount payable if payment is made within 10 days. As the Gym company paid the account within 10 days the discount is available. (e) The Kleen company purchased 40 items of stock which cost $12.50 plus 10% GST from Jellen company paying cash. As two of the stock items were found to be defective they were returned to the Jellen company and a refund paid by the Jellen company. (f) The Jacks company employs its casual workers on a five day week , paying then every Friday for their work that week. The Jacks company made its last payment in June 2021 on Friday 26th June 2021 paying $86,000 in wages. The next wages payment is made on 3rd July 2021. The Jacks company needs to make the necessary journal entry to adjust the accounts at 30th June 2021 no handwritten answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started