Answered step by step

Verified Expert Solution

Question

1 Approved Answer

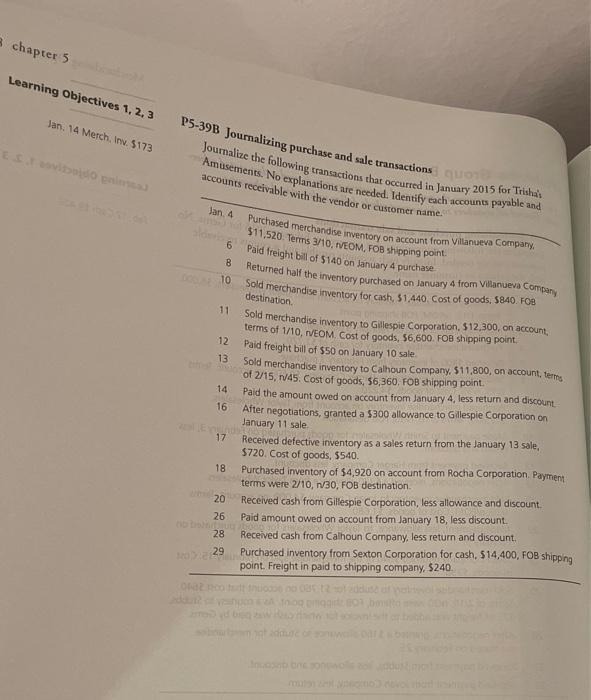

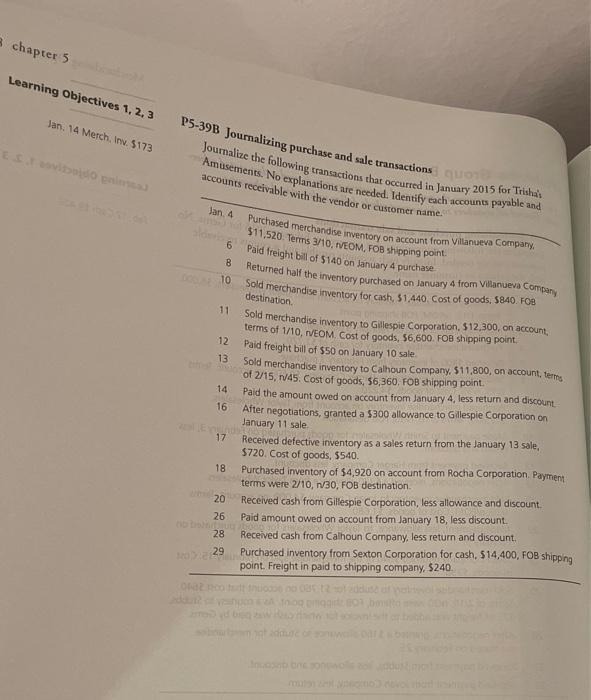

please answer this question in full detail please! do not use excel, please! chapter 5 Learning Objectives 1, 2, 3 Jan. 14 Merch, n. 5173

please answer this question in full detail please! do not use excel, please!

chapter 5 Learning Objectives 1, 2, 3 Jan. 14 Merch, n. 5173 P5-39B Journalizing purchase and sale transactions Journalize the following transactions that occurred in January 2015 for Trisha's Amusements. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Jan 4 Purchased merchandise inventory on account from Villanueva Company 6 $11,520 Terms 3/10, TVEOM. FOB shipping point Pald freight bill of $140 on January 4 purchase B Returned half the inventory purchased on January 4 from Villanueva company 10 11 Sold merchandise inventory for cash, 51,440 Cost of goods, 5840. FOB destination Sold merchandise inventory to Gillespie Corporation, 512,300, on account, terms of 1/10, VEOM. Cost of goods, 56,600. FOB shipping point Paid freight bill of $50 on January 10 sale Sold merchandise inventory to Calhoun Company, 511,800, on account, terme 12 13 14 16 17 18 of 2/15, 1445. Cost of goods, 56,360. FOB shipping point Paid the amount owed on account from January 4, less return and discount After negotiations, granted a $300 allowance to Gillespie Corporation on January 11 sale Received defective inventory as a sales return from the January 13 sale, $720. Cost of goods. 5540. Purchased inventory of $4,920 on account from Rocha Corporation Payment terms were 2/10, 1/30, FOB destination Received cash from Gillespie Corporation, less allowance and discount. Paid amount owed on account from January 18, less discount Received cash from Calhoun Company, less return and discount Purchased inventory from Sexton Corporation for cash, 514,400, FOB shipping point. Freight in paid to shipping company, $240. 20 26 28 29 or

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started