Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER THIS QUESTION USING EXCEL. SHOWING ALL THE WORKING EXPLANATION AND FORMULAS ON THERE. Thats all the information the question contains. Suppose you have

PLEASE ANSWER THIS QUESTION USING EXCEL. SHOWING ALL THE WORKING EXPLANATION AND FORMULAS ON THERE.

PLEASE ANSWER THIS QUESTION USING EXCEL. SHOWING ALL THE WORKING EXPLANATION AND FORMULAS ON THERE.

Thats all the information the question contains.

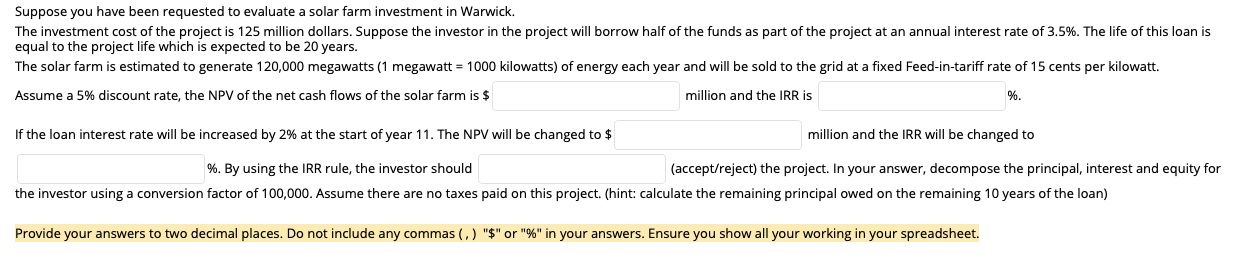

Suppose you have been requested to evaluate a solar farm investment in Warwick. equal to the project life which is expected to be 20 years. Assume a 5% discount rate, the NPV of the net cash flows of the solar farm is $ million and the IRR is \%. If the loan interest rate will be increased by 2% at the start of year 11 . The NPV will be changed to $ million and the IRR will be changed to \%. By using the IRR rule, the investor should (accept/reject) the project. In your answer, decompose the principal, interest and equity for Provide your answers to two decimal places. Do not include any commas (, ) "\$" or "\%" in your answers. Ensure you show all your working in your spreadsheet. Suppose you have been requested to evaluate a solar farm investment in Warwick. equal to the project life which is expected to be 20 years. Assume a 5% discount rate, the NPV of the net cash flows of the solar farm is $ million and the IRR is \%. If the loan interest rate will be increased by 2% at the start of year 11 . The NPV will be changed to $ million and the IRR will be changed to \%. By using the IRR rule, the investor should (accept/reject) the project. In your answer, decompose the principal, interest and equity for Provide your answers to two decimal places. Do not include any commas (, ) "\$" or "\%" in your answers. Ensure you show all your working in your spreadsheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started