Please answer this question with the right amount of boxes given in the question.

1.

2.

3.

4.

5.

6.

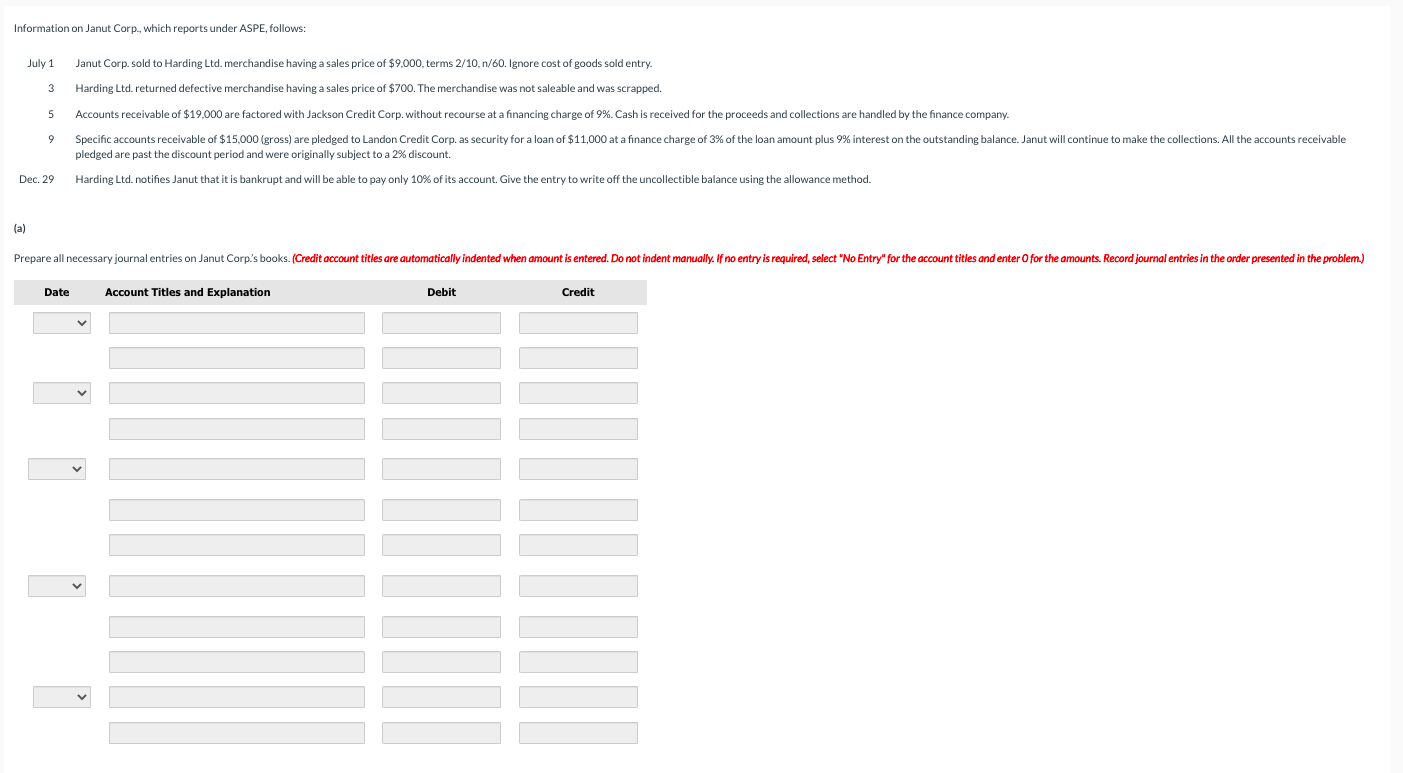

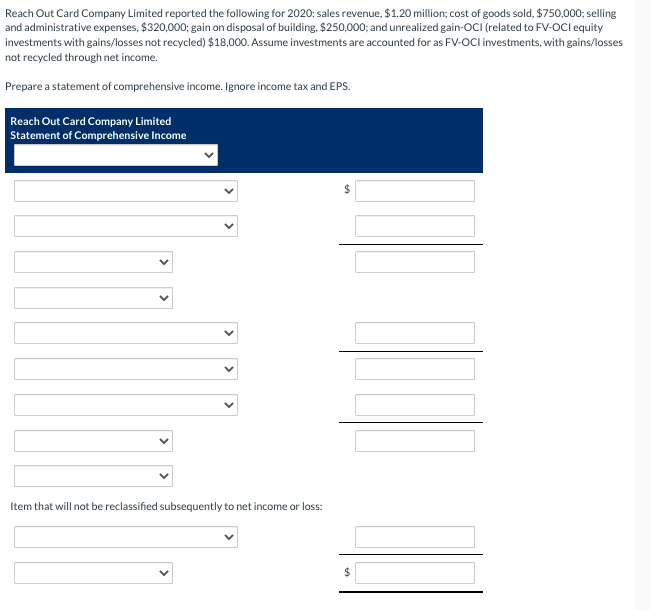

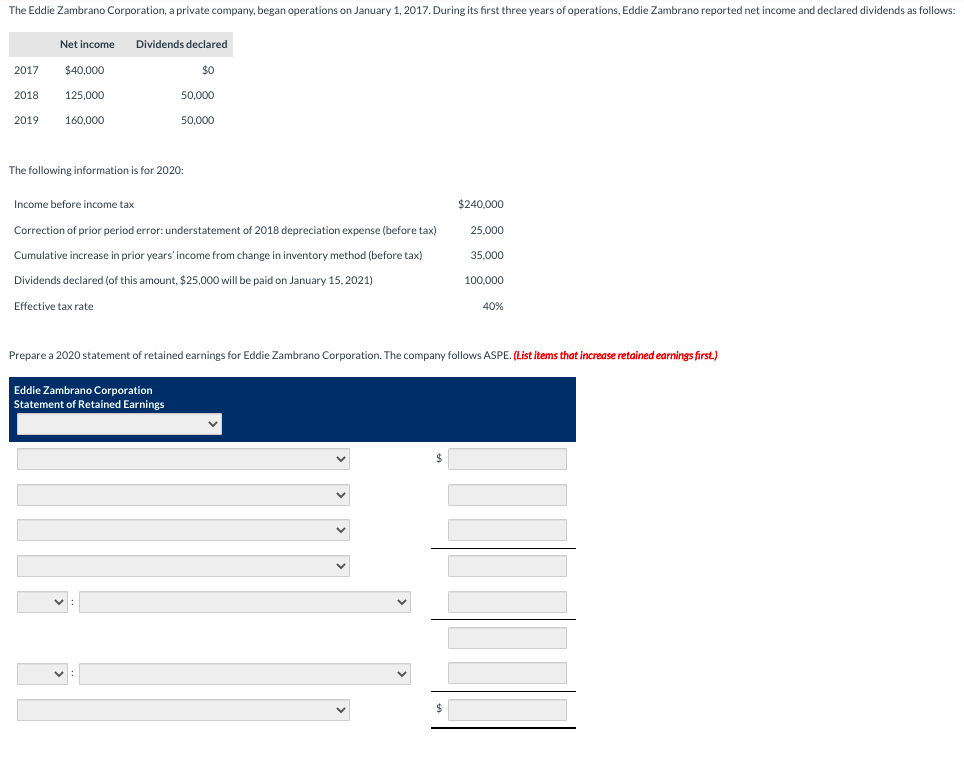

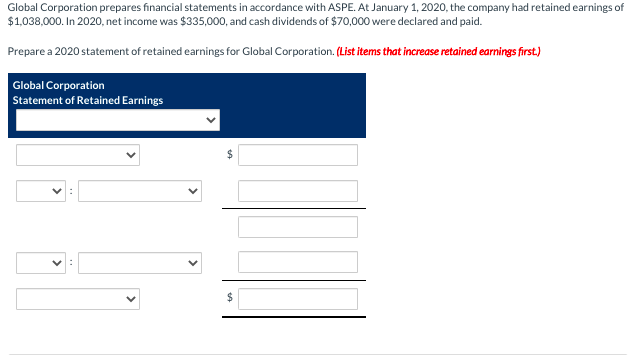

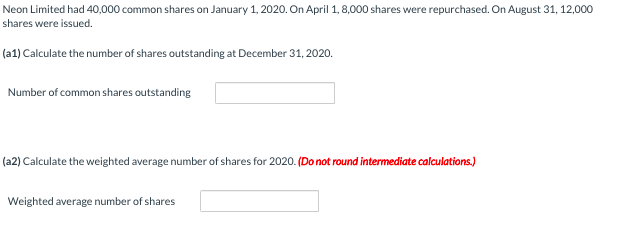

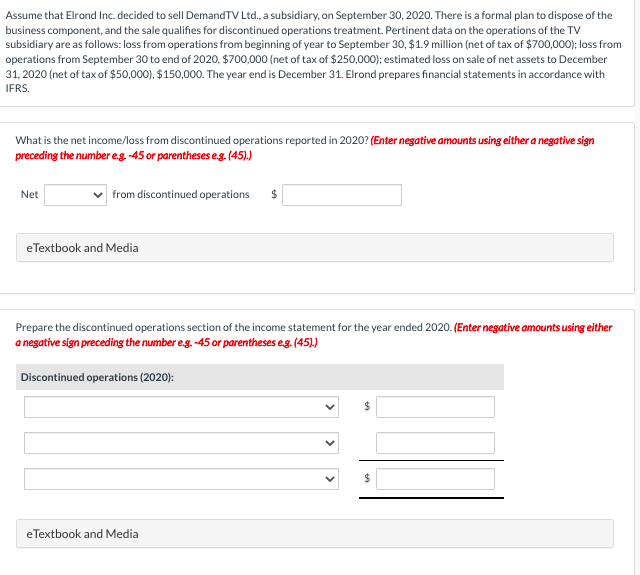

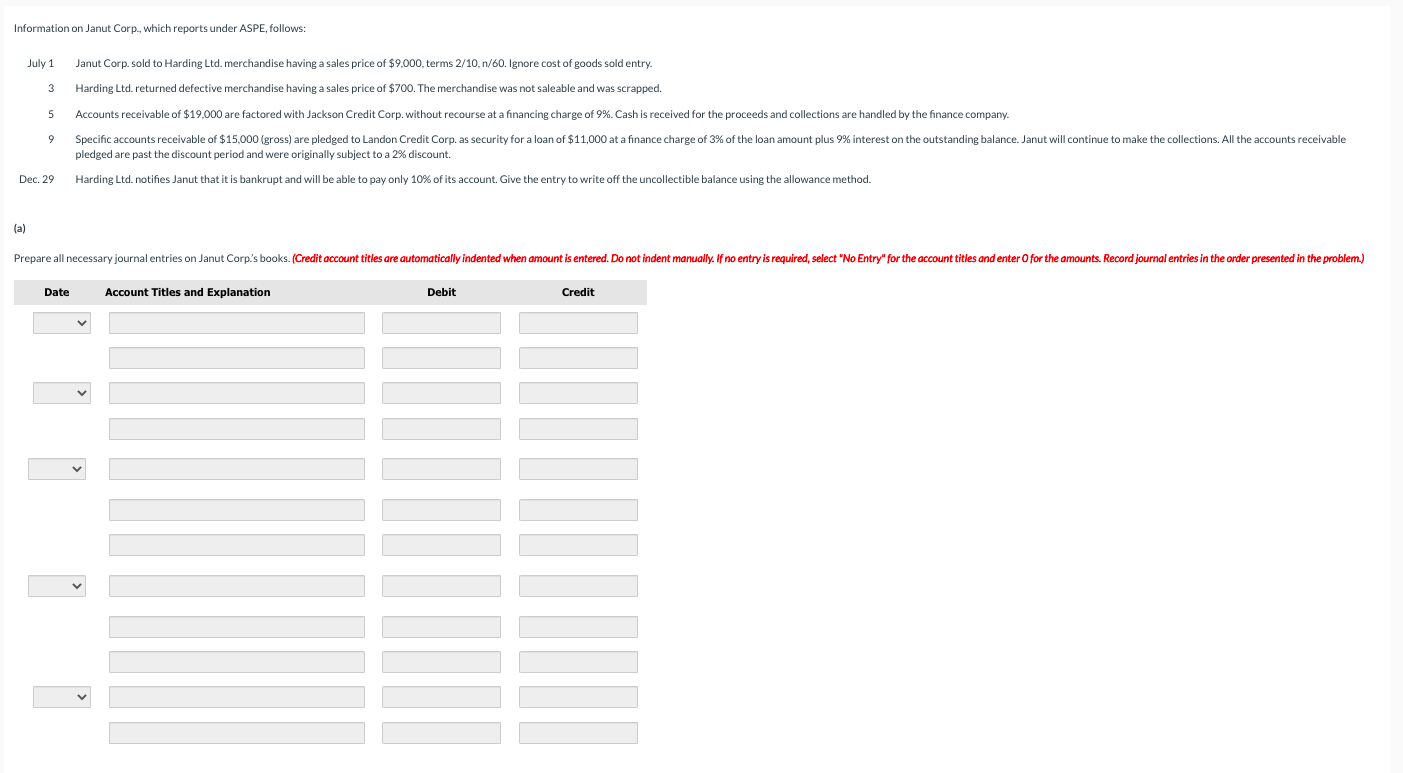

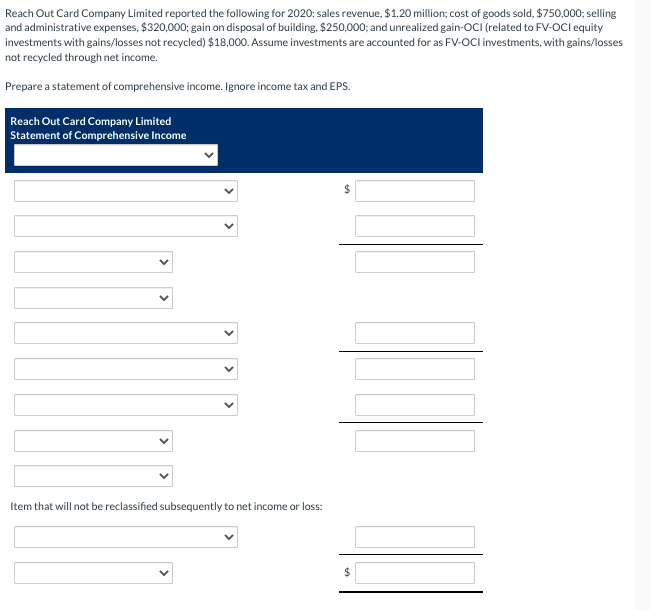

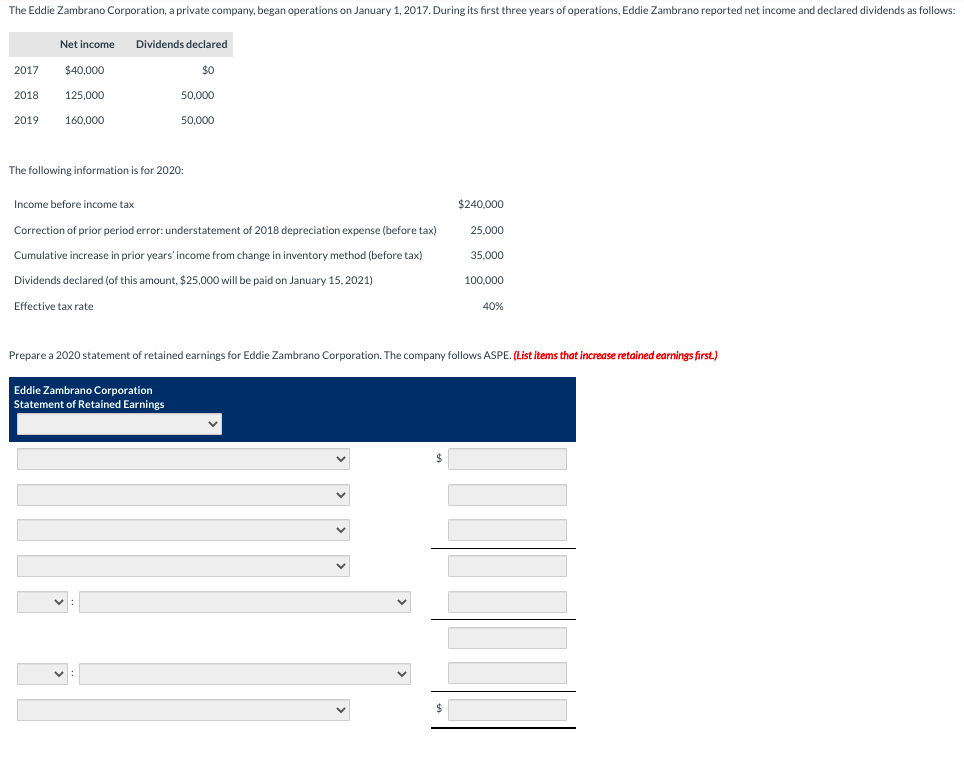

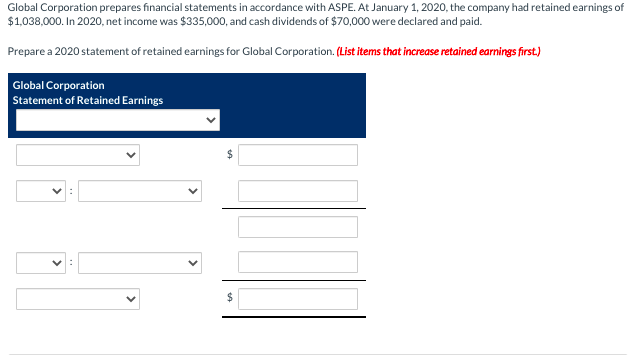

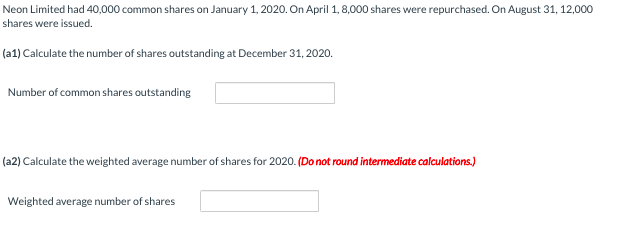

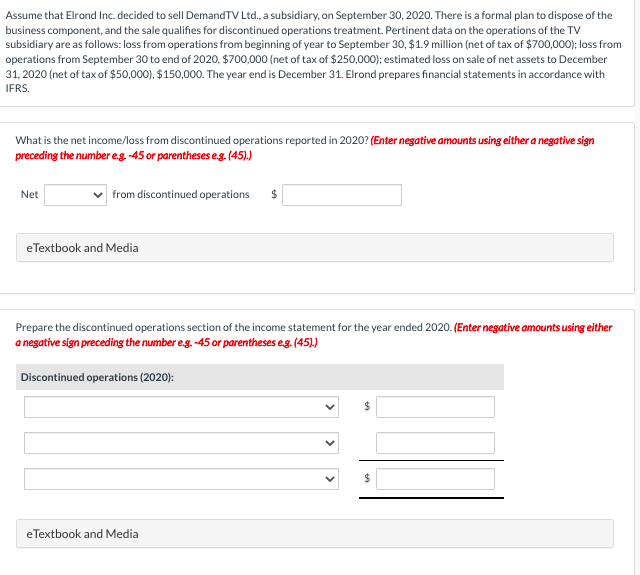

Information on Janut Corp., which reports under ASPE, follows: July 1 Janut Corp. sold to Harding Ltd. merchandise having a sales price of $9,000, terms 2/10, n/60. Ignore cost of goods sold entry. 3 Harding Ltd. returned defective merchandise having a sales price of $700. The merchandise was not saleable and was scrapped. 5 Accounts receivable of $19,000 are factored with Jackson Credit Corp. without recourse at a financing charge of 9%. Cash is received for the proceeds and collections are handled by the finance company. 9 Specific accounts receivable of $15,000 (gross) are pledged to Landon Credit Corp. as security for a loan of $11,000 at a finance charge of 3% of the loan amount plus 9% interest on the outstanding balance. Janut will continue to make the collections. All the accounts receivable pledged are past the discount period and were originally subject to a 2% discount. Dec. 29 Harding Ltd. notifies Janut that it is bankrupt and will be able to pay only 10% of its account. Give the entry to write off the uncollectible balance using the allowance method. (a) Prepare all necessary journal entries on Janut Corp.'s books. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Date Debit Credit Account Titles and Explanation Reach Out Card Company Limited reported the following for 2020: sales revenue, $1.20 million; cost of goods sold, $750,000; selling and administrative expenses, $320,000; gain on disposal of building, $250,000; and unrealized gain-OCI (related to FV-OCI equity investments with gains/losses not recycled) $18,000. Assume investments are accounted for as FV-OCI investments, with gains/losses not recycled through net income. Prepare a statement of comprehensive income. Ignore income tax and EPS. Reach Out Card Company Limited Statement of Comprehensive Income Item that will not be reclassified subsequently to net income or loss: $ > The Eddie Zambrano Corporation, a private company, began operations on January 1, 2017. During its first three years of operations, Eddie Zambrano reported net income and declared dividends as follows: Net income Dividends declared 2017 $40,000 $0 2018 125,000 50,000 2019 160,000 50,000 The following information is for 2020: Income before income tax $240,000 25,000 Correction of prior period error: understatement of 2018 depreciation expense (before tax) Cumulative increase in prior years' income from change in inventory method (before tax) 35,000 100,000 Dividends declared (of this amount, $25,000 will be paid on January 15, 2021) Effective tax rate 40% Prepare a 2020 statement of retained earnings for Eddie Zambrano Corporation. The company follows ASPE. (List items that increase retained earnings first.) Eddie Zambrano Corporation Statement of Retained Earnings Global Corporation prepares financial statements in accordance with ASPE. At January 1, 2020, the company had retained earnings of $1,038,000. In 2020, net income was $335,000, and cash dividends of $70,000 were declared and paid. Prepare a 2020 statement of retained earnings for Global Corporation. (List items that increase retained earnings first.) Global Corporation Statement of Retained Earnings $ Neon Limited had 40,000 common shares on January 1, 2020. On April 1, 8,000 shares were repurchased. On August 31, 12,000 shares were issued. (a1) Calculate the number of shares outstanding at December 31, 2020. Number of common shares outstanding (a2) Calculate the weighted average number of shares for 2020. (Do not round intermediate calculations.) Weighted average number of shares Assume that Elrond Inc. decided to sell DemandTV Ltd., a subsidiary, on September 30, 2020. There is a formal plan to dispose of the business component, and the sale qualifies for discontinued operations treatment. Pertinent data on the operations of the TV subsidiary are as follows: loss from operations from beginning of year to September 30, $1.9 million (net of tax of $700,000); loss from operations from September 30 to end of 2020, $700,000 (net of tax of $250,000); estimated loss on sale of net assets to December 31, 2020 (net of tax of $50,000), $150,000. The year end is December 31. Elrond prepares financial statements in accordance with IFRS. What is the net income/loss from discontinued operations reported in 2020? (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net from discontinued operations eTextbook and Media Prepare the discontinued operations section of the income statement for the year ended 2020. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Discontinued operations (2020): $ eTextbook and Media