Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer this questions on the Alliances case. Discussion Outline the steps you took to value Alliance Discuss the assumpt ions used for Revenues and

Please answer this questions on the Alliances case.

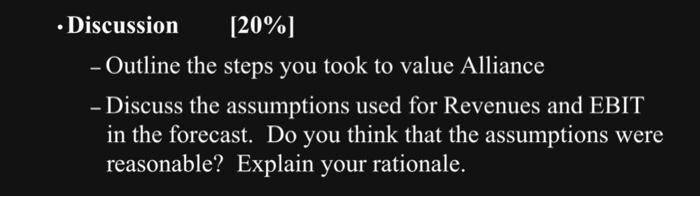

Discussion

Outline the steps you took to value Alliance

Discuss the assumptions used for Revenues and EBITin the forecast. Do you think that the assumptions were reasonable? Explain your rationale.

From here we should answer it.

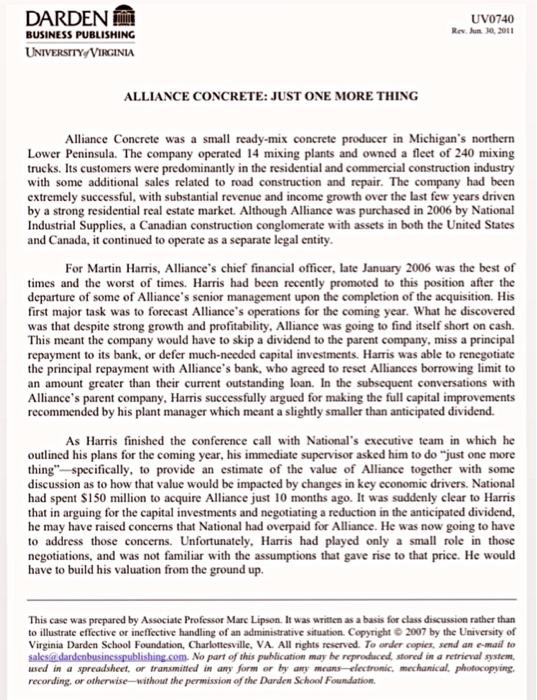

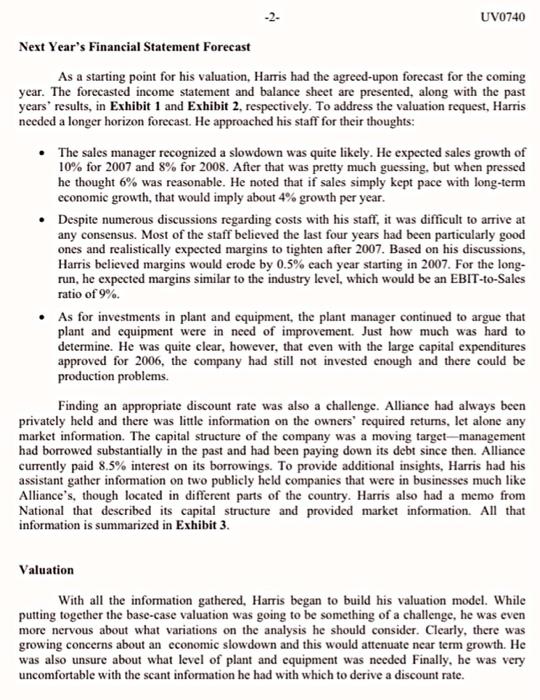

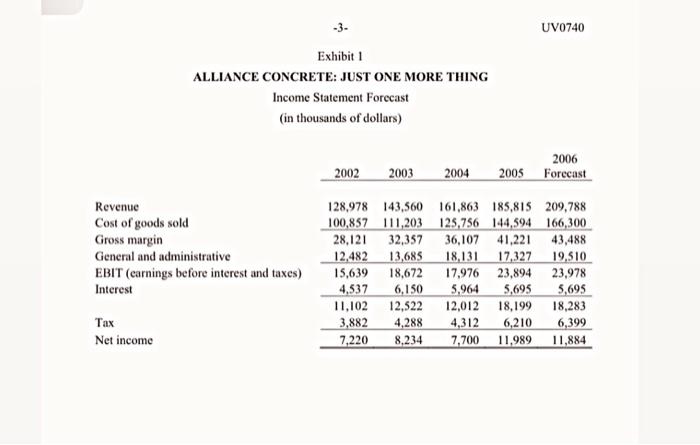

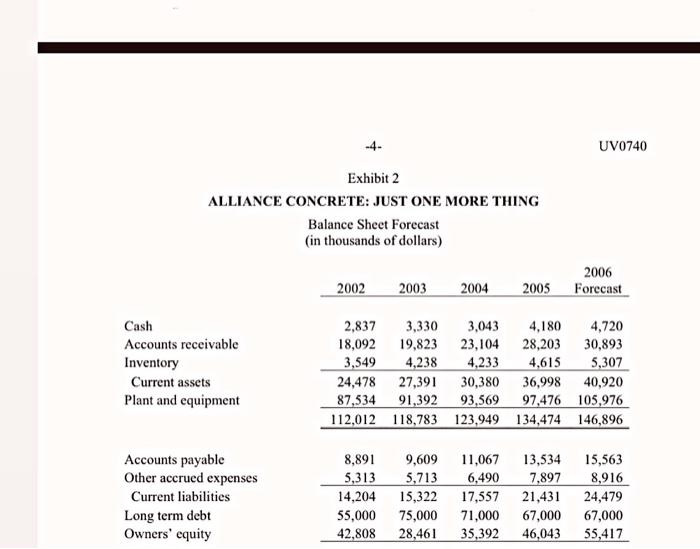

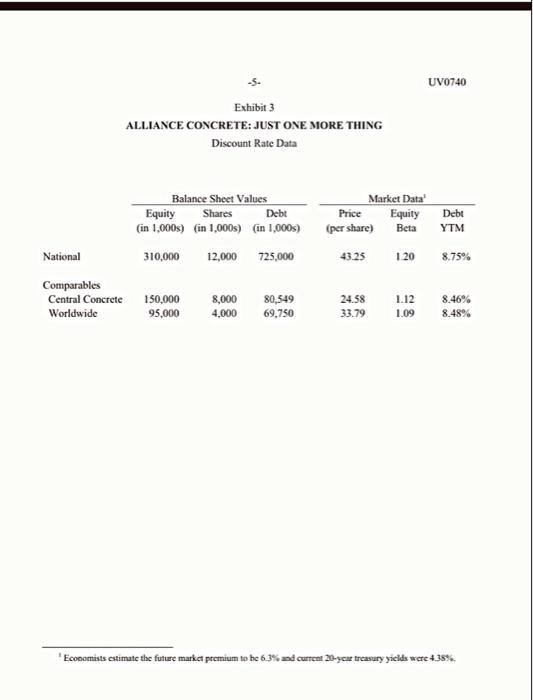

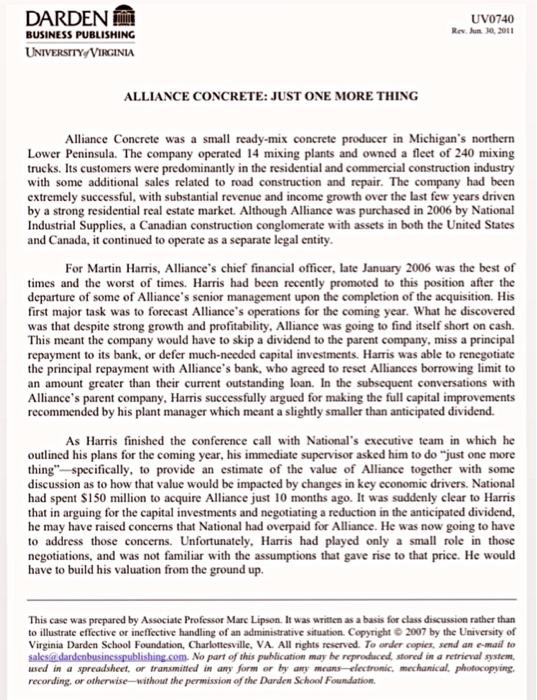

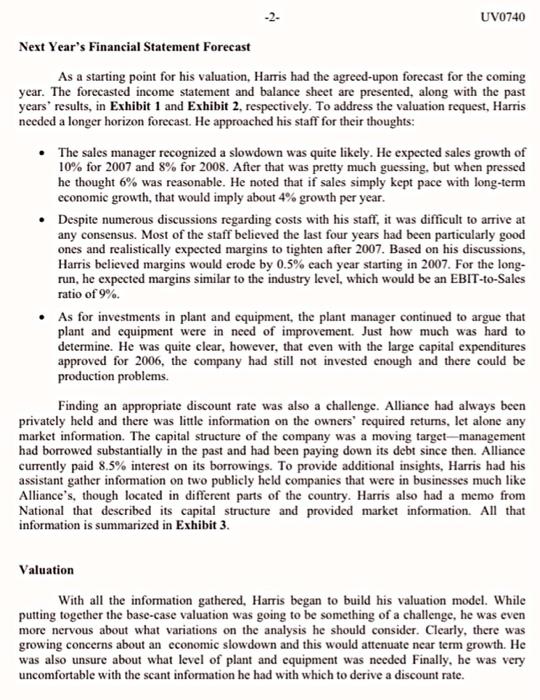

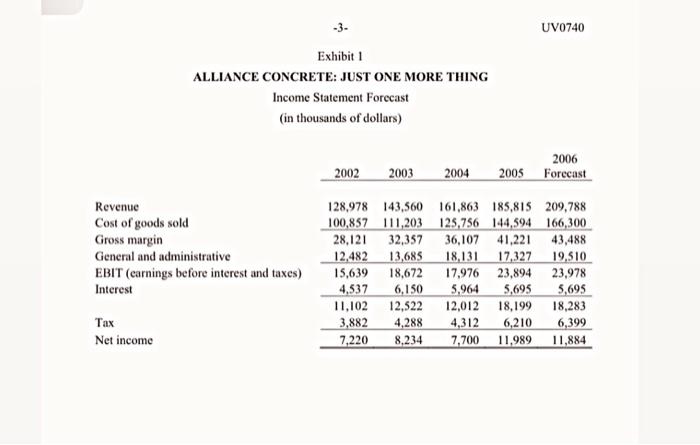

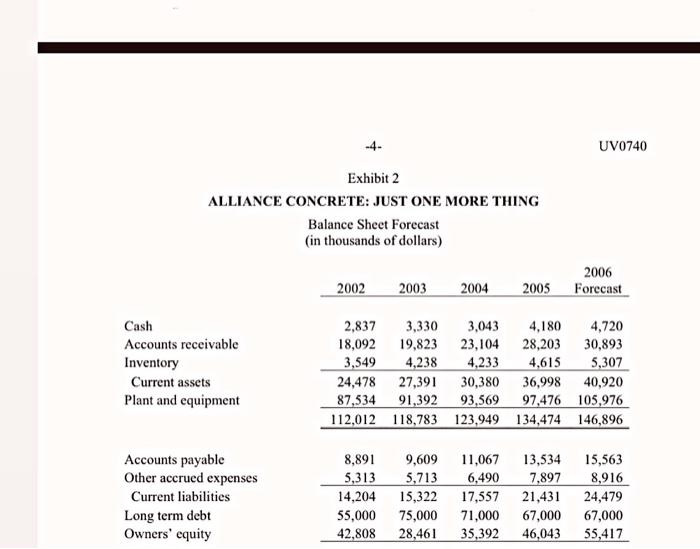

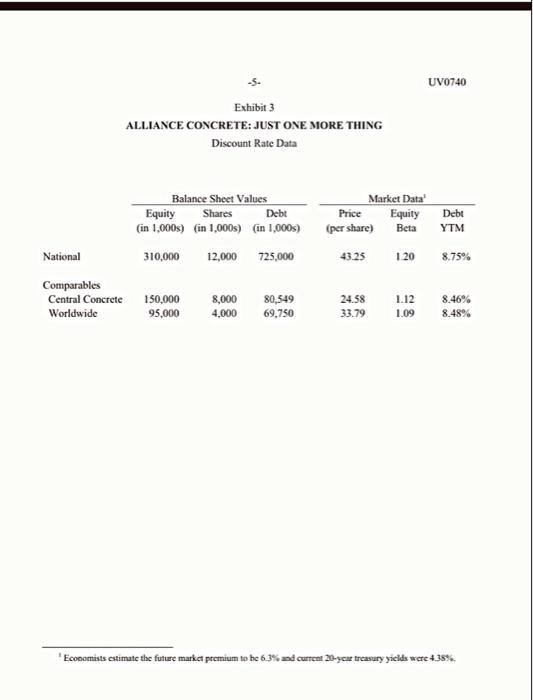

-Discussion [20%] - Outline the steps you took to value Alliance - Discuss the assumptions used for Revenues and EBIT in the forecast. Do you think that the assumptions were reasonable? Explain your rationale. DARDEN UV0740 BUSINESS PUBLISHING Rer. hum 10.2011 UNIVERSTTY VIraini ALLIANCE CONCRETE: JUST ONE MORE THING Alliance Concrete was a small ready-mix concrete producer in Michigan's northern Lower Peninsula. The company operated 14 mixing plants and owned a fleet of 240 mixing trucks. Its customers were predominantly in the residential and commercial construction industry with some additional sales related to road construction and repair. The company had been extremely successful, with substantial revenue and income growth over the last few years driven by a strong residential real estate market. Although Alliance was purchased in 2006 by National Industrial Supplies, a Canadian construction conglomerate with assets in both the United States and Canada, it continued to operate as a separate legal entity. For Martin Harris, Alliance's chief financial officer, late January 2006 was the best of times and the worst of times. Harris had been recently promoted to this position after the departure of some of Alliance's senior management upon the completion of the acquisition. His first major task was to forecast Alliance's operations for the coming year. What he discovered was that despite strong growth and profitability, Alliance was going to find itself short on cash. This meant the company would have to skip a dividend to the parent company, miss a principal repayment to its bank, or defer much-needed capital investments. Harris was able to renegotiate the principal repayment with Alliance's bank, who agreed to reset Alliances borrowing limit to an amount greater than their current outstanding loan. In the subsequent conversations with Alliance's parent company, Harris successfully argued for making the full capital improvements recommended by his plant manager which meant a slightly smaller than anticipated dividend. As Harris finished the conference call with National's executive team in which he outlined his plans for the coming year, his immediate supervisor asked him to do "just one more thing"-specifically, to provide an estimate of the value of Alliance together with some discussion as to how that value would be impacted by changes in key economic drivers. National had spent $150 million to acquire Alliance just 10 months ago. It was suddenly clear to Harris that in arguing for the capital investments and negotiating a reduction in the anticipated dividend, he may have raised concerns that National had overpaid for Alliance. He was now going to have to address those concerns. Unfortunately, Harris had played only a small role in those negotiations, and was not familiar with the assumptions that gave rise to that price. He would have to build his valuation from the ground up. This case was prepared by Associate Professor Mare Lipson. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Cepynight 02007 by the University of Virginia Darden School Foundation, Charlonesville, VA. All nights reserved. To ander capiex, send an e-mail to salesfad dardenbusinesspublishingcom. No part of this publication may be neproducent, stored in a retrienal system, wed in a spreadsheet, or transmitted in any form or by any mrans vlectronic, mechanical, photocopying. recording, or otherwise-without the permission of the Darden School Foundation. UV0740 Next Year's Financial Statement Forecast As a starting point for his valuation, Harris had the agreed-upon forecast for the coming year. The forecasted income statement and balance sheet are presented, along with the past years' results, in Exhibit 1 and Exhibit 2, respectively. To address the valuation request, Harris needed a longer horizon forecast. He approached his staff for their thoughts: - The sales manager recognized a slowdown was quite likely. He expected sales growth of 10% for 2007 and 8% for 2008 . After that was pretty much guessing, but when pressed he thought 6% was reasonable. He noted that if sales simply kept pace with long-term economic growth, that would imply about 4% growth per year. - Despite numerous discussions regarding costs with his staft, it was difficult to arrive at any consensus. Most of the staff believed the last four years had been particularly good ones and realistically expected margins to tighten after 2007. Based on his discussions, Harris believed margins would erode by 0.5% each year starting in 2007 . For the longrun, he expected margins similar to the industry level, which would be an EBIT-to-Sales ratio of 9%. - As for investments in plant and equipment, the plant manager continued to argue that plant and equipment were in need of improvement. Just how much was hard to determine. He was quite clear, however, that even with the large capital expenditures approved for 2006, the company had still not invested enough and there could be production problems. Finding an appropriate discount rate was also a challenge. Alliance had always been privately held and there was little information on the owners' required returns, let alone any market information. The capital structure of the company was a moving target-management had borrowed substantially in the past and had been paying down its debt since then. Alliance currently paid 8.5% interest on its borrowings. To provide additional insights, Harris had his assistant gather information on two publicly held companies that were in businesses much like Alliance's, though located in different parts of the country. Harris also had a memo from National that described its capital structure and provided market information. All that information is summarized in Exhibit 3. Valuation With all the information gathered, Harris began to build his valuation model. While putting together the base-case valuation was going to be something of a challenge, he was even more nervous about what variations on the analysis he should consider. Clearly, there was growing concerns about an economic slowdown and this would attenuate near term growth. He was also unsure about what level of plant and equipment was needed Finally, he was very uncomfortable with the scant information he had with which to derive a discount rate. Exhibit 1 ALLIANCE CONCRETE: JUST ONE MORE THING Income Statement Forecast (in thousands of dollars) ALLIANCE CONCRETE: JUST ONE MORE THING Balance Sheet Forecast (in thousands of dollars) Exhibit 3 ALLIANCE CONCRETE: JUST ONE MORE THING Discount Rate Data Economists cstimale the fulure market prcmium to be 6.3% and curtcat 20 -ycur treasury yiclds were 4.35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started