please answer this quetions on blow answer sheet

will share the answers i receive from chegg expert.

pleaae provide answers on above answer sheet

thanks hope to heribg from you soon v soon

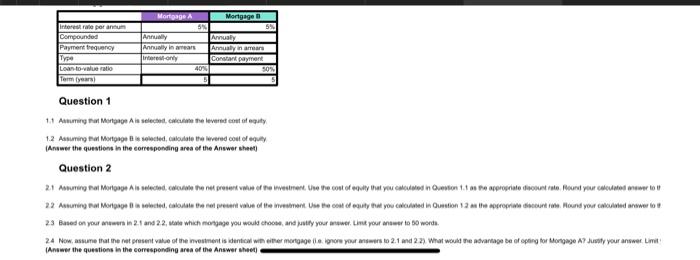

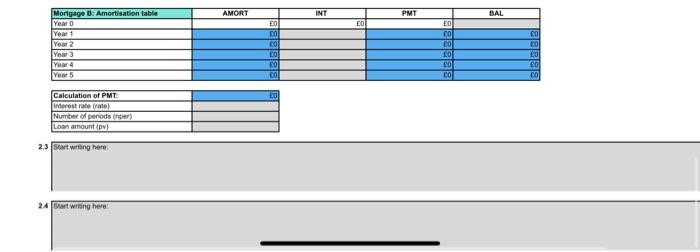

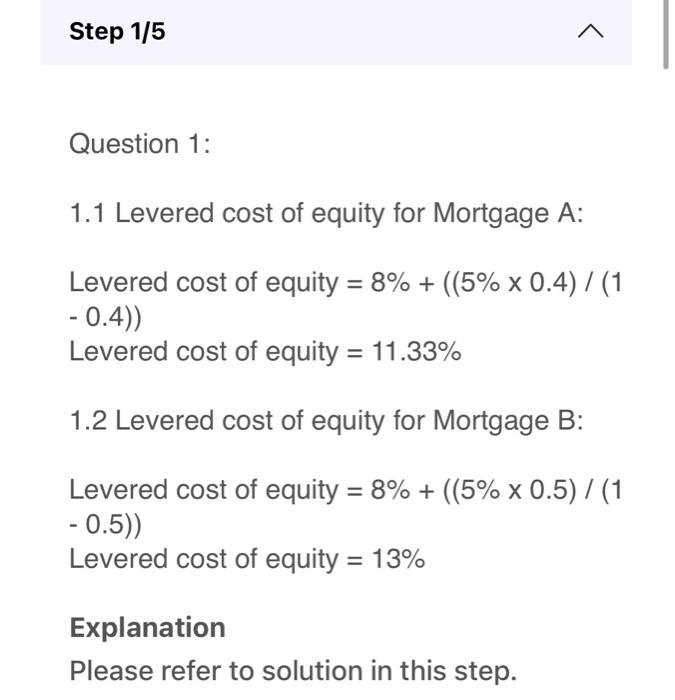

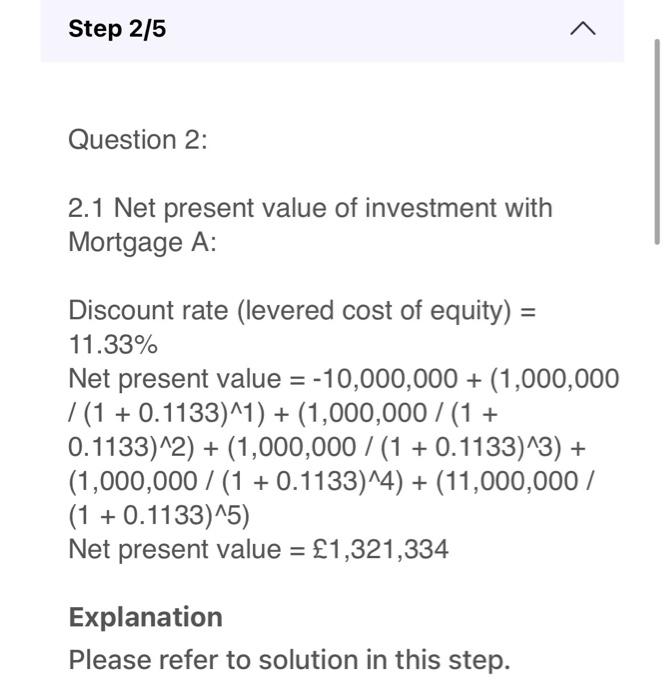

You ane interested in inyesting in a bulding cossing {10,000.000 Voe cas ether tiranoe the purchase of the bulding uting ether 7 Mortgage A and a 49\%w lean-to-salue rabec or > Mortpase 8 and a 50% han-so-value raitio. Further dotais segarding the mongages are provided in Table 1. You reaure an a\% retum on an undevered equily imestment. You anticigate receiving E1,000 ogo in rertal income at the end of every yoat for five yearu. You plan is sell the bulding ahar five years for fil,000.000. Trable It Mortgeng the taln. Question 1 Question 1 1.2 Assiming fal Mortgoge A is solecied, taboulate the lerered ood of equty (Answer the questions in the eorresponding area ef the Answer sheet] Question 2 2.3 Eased on your andews in 2.1 and 2.2, stale which modgage you would choobd, and justry your acquer. Lime your andesr to 50 worda. (Answer the questions in the corresponding arsa of the Answer sheet] 2.3 Fart wring here. 2.4 Geart weinng here. Question 1: 1.1 Levered cost of equity for Mortgage A: Levered cost of equity =8%+((5%0.4)/(1 0.4)) Levered cost of equity =11.33% 1.2 Levered cost of equity for Mortgage B: Levered cost of equity =8%+((5%0.5)/(1 0.5)) Levered cost of equity =13% Explanation Please refer to solution in this step. Question 2: 2.1 Net present value of investment with Mortgage A: Discount rate (levered cost of equity) = 11.33% Net present value =10,000,000+(1,000,000 /(1+0.1133)1)+(1,000,000/(1+ 0.1133)2)+(1,000,000/(1+0.1133)3)+ (1,000,000/(1+0.1133)4)+(11,000,000/ (1+0.1133)5) Net present value =1,321,334 Explanation Please refer to solution in this step. 2.2 Net present value of investment with Mortgage B: Discount rate (levered cost of equity) =13% Net present value =5,000,000+(500,000/ (1+0.13)1)+(500,000/(1+0.13)2)+ (500,000/(1+0.13)3)+(500,000/(1+ 0.13)4)+(11,000,000/(1+0.13)5) Net present value =1,243,916 Explanation Please refer to solution in this step. 2.3 Based on the net present values calculated, I would choose Mortgage A as it provides a higher net present value of 1,321,334, compared to Mortgage B which has a net present value of 1,243,916. 2.4 The advantage of opting for Mortgage A would be a lower loan-to-value ratio of 40% compared to Mortgage B's 50%. This means that with Mortgage A, there is less debt to be repaid, which leads to a lower financial risk. Additionally, Mortgage A has a lower levered cost of equity, which leads to a higher net present value of the investment. Therefore, Mortgage A provides a better value for the investment in terms of risk and return. Explanation Please refer to solution in this step. Answers only I hope it's helpful to you , Please like, Thanks in advance . You ane interested in inyesting in a bulding cossing {10,000.000 Voe cas ether tiranoe the purchase of the bulding uting ether 7 Mortgage A and a 49\%w lean-to-salue rabec or > Mortpase 8 and a 50% han-so-value raitio. Further dotais segarding the mongages are provided in Table 1. You reaure an a\% retum on an undevered equily imestment. You anticigate receiving E1,000 ogo in rertal income at the end of every yoat for five yearu. You plan is sell the bulding ahar five years for fil,000.000. Trable It Mortgeng the taln. Question 1 Question 1 1.2 Assiming fal Mortgoge A is solecied, taboulate the lerered ood of equty (Answer the questions in the eorresponding area ef the Answer sheet] Question 2 2.3 Eased on your andews in 2.1 and 2.2, stale which modgage you would choobd, and justry your acquer. Lime your andesr to 50 worda. (Answer the questions in the corresponding arsa of the Answer sheet] 2.3 Fart wring here. 2.4 Geart weinng here. Question 1: 1.1 Levered cost of equity for Mortgage A: Levered cost of equity =8%+((5%0.4)/(1 0.4)) Levered cost of equity =11.33% 1.2 Levered cost of equity for Mortgage B: Levered cost of equity =8%+((5%0.5)/(1 0.5)) Levered cost of equity =13% Explanation Please refer to solution in this step. Question 2: 2.1 Net present value of investment with Mortgage A: Discount rate (levered cost of equity) = 11.33% Net present value =10,000,000+(1,000,000 /(1+0.1133)1)+(1,000,000/(1+ 0.1133)2)+(1,000,000/(1+0.1133)3)+ (1,000,000/(1+0.1133)4)+(11,000,000/ (1+0.1133)5) Net present value =1,321,334 Explanation Please refer to solution in this step. 2.2 Net present value of investment with Mortgage B: Discount rate (levered cost of equity) =13% Net present value =5,000,000+(500,000/ (1+0.13)1)+(500,000/(1+0.13)2)+ (500,000/(1+0.13)3)+(500,000/(1+ 0.13)4)+(11,000,000/(1+0.13)5) Net present value =1,243,916 Explanation Please refer to solution in this step. 2.3 Based on the net present values calculated, I would choose Mortgage A as it provides a higher net present value of 1,321,334, compared to Mortgage B which has a net present value of 1,243,916. 2.4 The advantage of opting for Mortgage A would be a lower loan-to-value ratio of 40% compared to Mortgage B's 50%. This means that with Mortgage A, there is less debt to be repaid, which leads to a lower financial risk. Additionally, Mortgage A has a lower levered cost of equity, which leads to a higher net present value of the investment. Therefore, Mortgage A provides a better value for the investment in terms of risk and return. Explanation Please refer to solution in this step. Answers only I hope it's helpful to you , Please like, Thanks in advance