Answered step by step

Verified Expert Solution

Question

1 Approved Answer

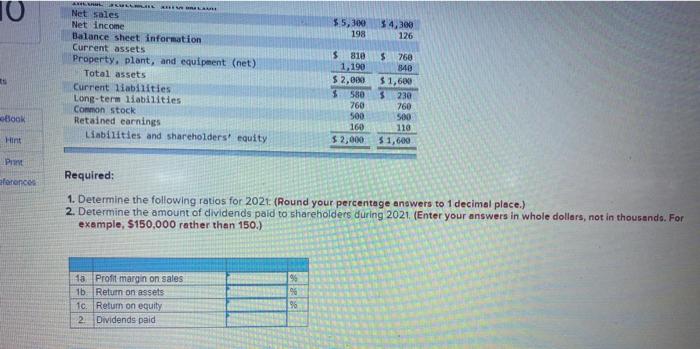

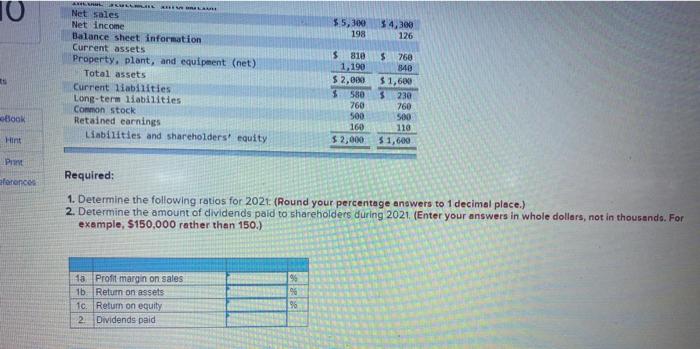

Please answer those questions for. i will give a thumb up. #2. #3 10 $5,300 198 $4,300 126 L Net sales Net income Balance sheet

Please answer those questions for. i will give a thumb up.

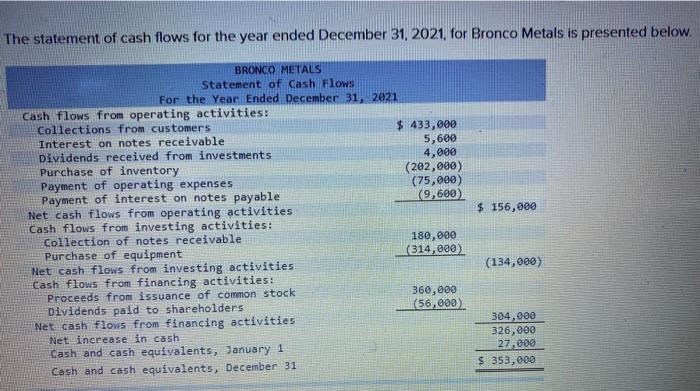

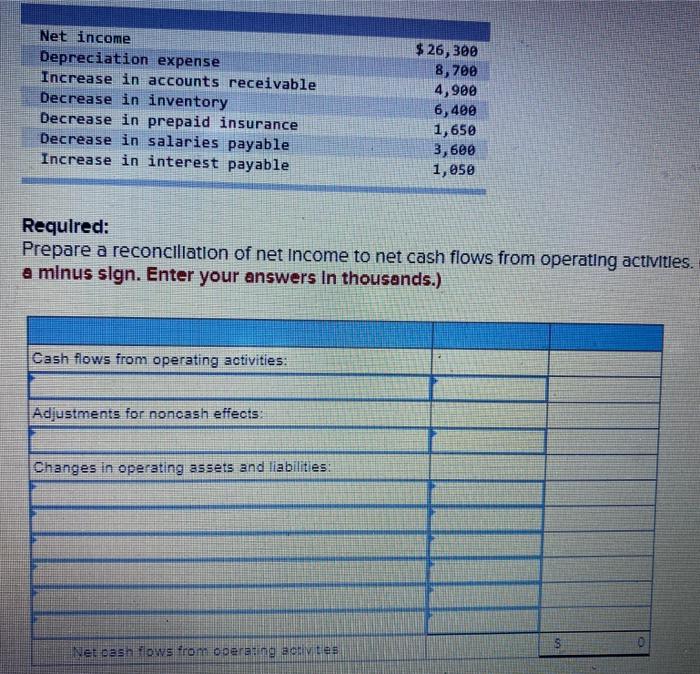

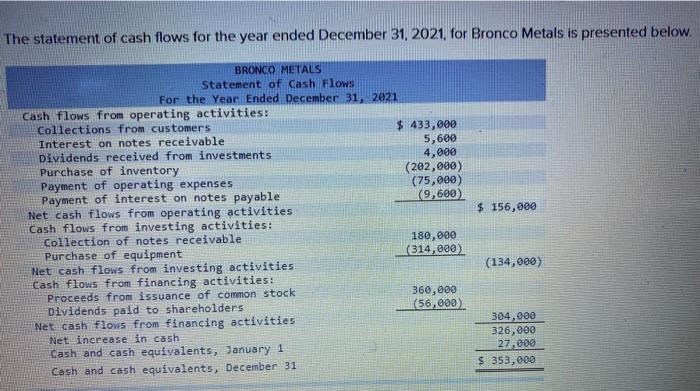

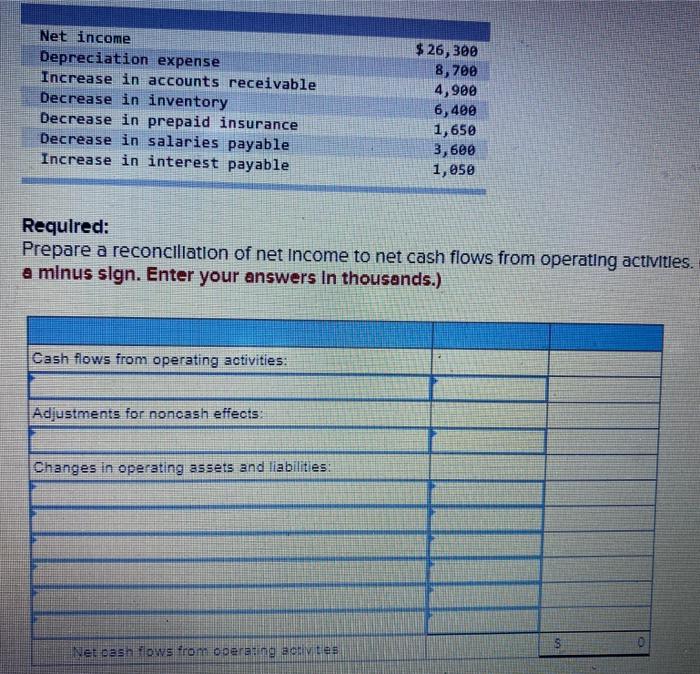

10 $5,300 198 $4,300 126 L Net sales Net income Balance sheet information Current assets Property, plant, and equipment (net) Total assets Current liabilities Long-term liabilities Common stock Retained earnings Liabilities and shareholders' equity $ 810 1,190 $ 2,080 $ 580 760 500 160 $2,000 $ 760 840 $1,600 $ 230 760 500 110 51,600 Book Hint Print forences Required: 1. Determine the following ratios for 202t (Round your percentage answers to 1 decimal place.) 2. Determine the amount of dividends paid to shareholders during 2021 (Enter your answers in whole dollars, not in thousands. For example, $150,000 rather than 150.) 96 1a Profit margin on sales 1b. Return on assets 10. Return on equity 2 Dividends paid 96 The statement of cash flows for the year ended December 31, 2021, for Bronco Metals is presented below. $ 156,000 BRONCO METALS Statement of Cash Flows For the Year Ended December 31, 2021 Cash flows from operating activities: Collections from customers $ 433,000 Interest on notes receivable 5,600 Dividends received from investments 4,000 Purchase of inventory (202,000) Payment of operating expenses (75,000) Payment of interest on notes payable (9,600) Net cash flows from operating activities Cash flows from investing activities: Collection of notes receivable 180,000 Purchase of equipment (314,000) Net cash flows from investing activities Cash flows from financing activities: Proceeds from issuance of common stock 360,000 Dividends paid to shareholders (56,000) Net cash flows from financing activities Net increase in cash Cash and cash equivalents, January 1 Cash and cash equivalents, December 31 (134,000) 304,000 326,000 27.000 $ 353,000 Cash flows from operating activities: Net cash flows from operating activities Cash flows from investing activities: $ O Net cash flows from investing activities Cash flows from financing activities: 0 Net cash flows from financing activities Net increase in cash Cash and cash equivalents. January 1 Cash and cash equivalents, December 31 S Net income Depreciation expense Increase in accounts receivable Decrease in inventory Decrease in prepaid insurance Decrease in salaries payable Increase in interest payable $ 26, 300 8,700 4,900 6,400 1,650 3,600 1,05 Required: Prepare a reconciliation of net Income to net cash flows from operating activities. a minus sign. Enter your answers in thousands.) Cash flows from operating activities: Adjustments for noncash effects: Changes in operating assets and liabilities: S 0 Net pash flows from opera ng activities

#2.

#3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started