Answered step by step

Verified Expert Solution

Question

1 Approved Answer

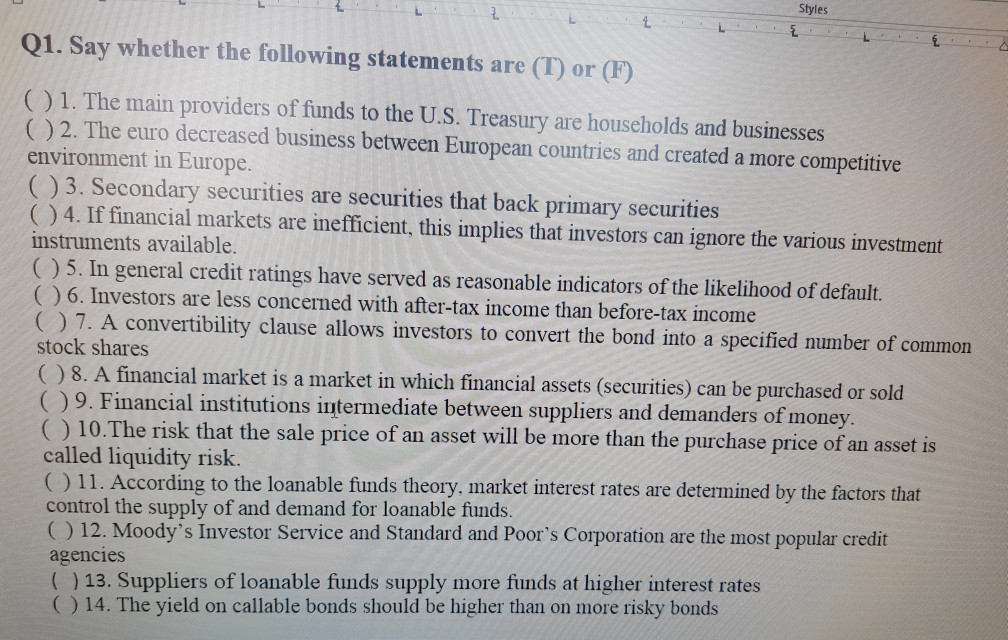

please answer true or false Styles Q1. Say whether the following statements are (T) or (F) ()1. The main providers of funds to the U.S.

please answer true or false

Styles Q1. Say whether the following statements are (T) or (F) ()1. The main providers of funds to the U.S. Treasury are households and businesses ()2. The euro decreased business between European countries and created a more competitive environment in Europe. ()3. Secondary securities are securities that back primary securities )4. If financial markets are inefficient, this implies that investors can ignore the various investmernt instruments available. ) 5. In general credit ratings have served as reasonable indicators of the likelihood of default. ()6. Investors are less concerned with after-tax income than before-tax income ) 7. A convertibility clause allows investors to convert the bond into a specified number of common stock shares ) 8. A financial market is a market in which financial assets (securities) can be purchased or sold (9. Financial institutions intermediate between suppliers and demanders of mon he risk that the sale price of an asset will be more than the purchase price of an asset is () 10.T called liquidity risk. ()11. According to the loanable funds the ory, market interest rates are determined by the factors that control the supply of and demand for loanable funds C) 12. Moody's Investor Service and Standard and Poor's Corporation are the most popular credit agencies )13. Suppliers of loanable funds supply more funds at higher interest rates ) 14. The yield on callable bonds should be higher than on more risky bondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started