Answered step by step

Verified Expert Solution

Question

1 Approved Answer

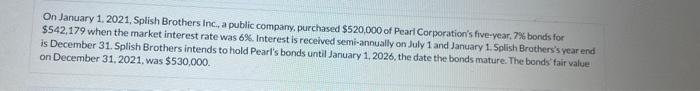

Please Answer urgent On January 1, 2021, Splish Brothers Inc, a public company, purchased $520,000 of Pearl Corporation's five-year, 7% bonds for $542,179 when the

Please Answer urgent

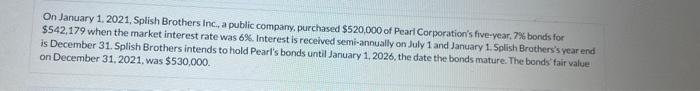

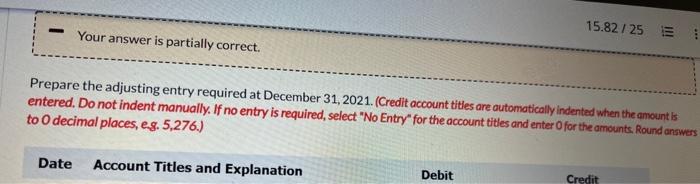

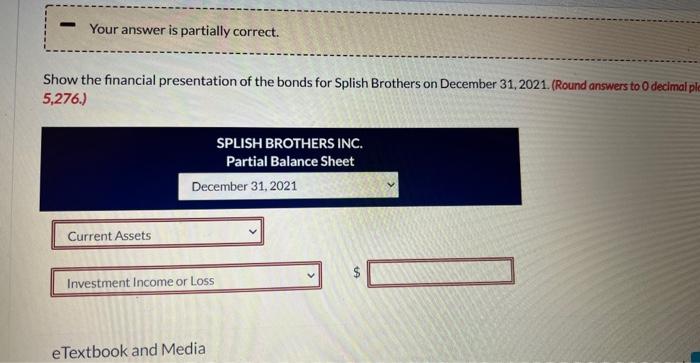

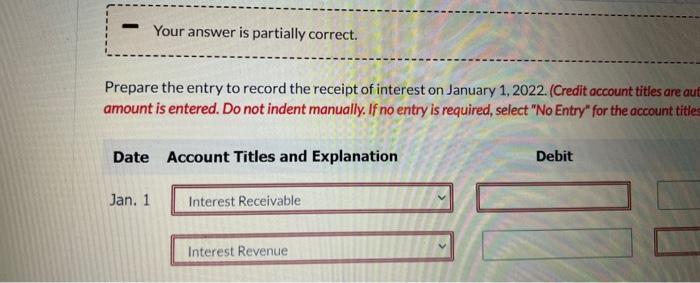

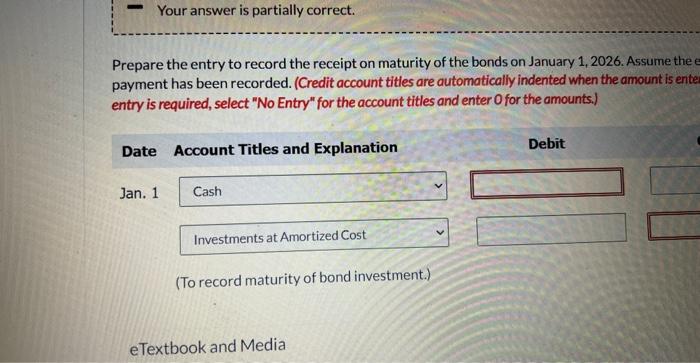

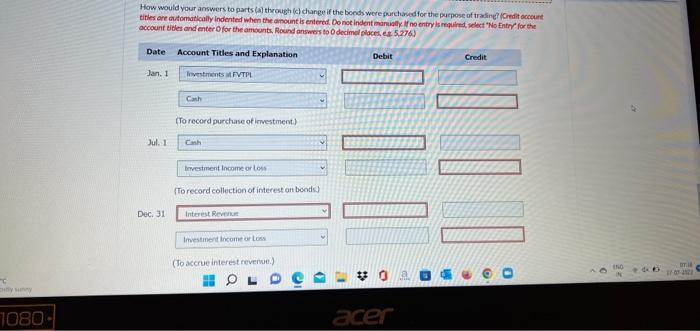

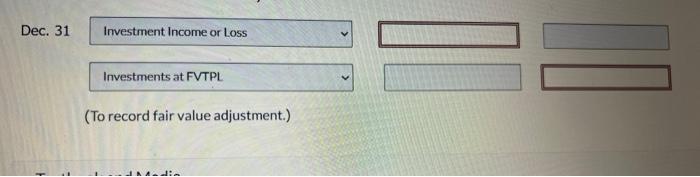

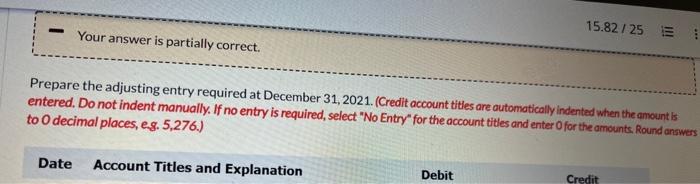

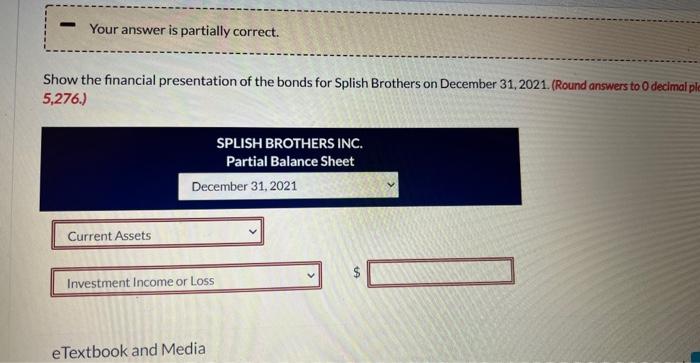

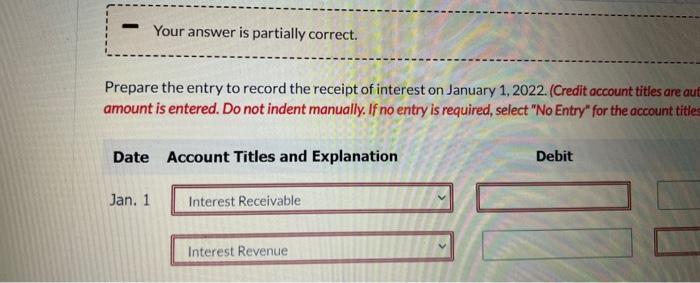

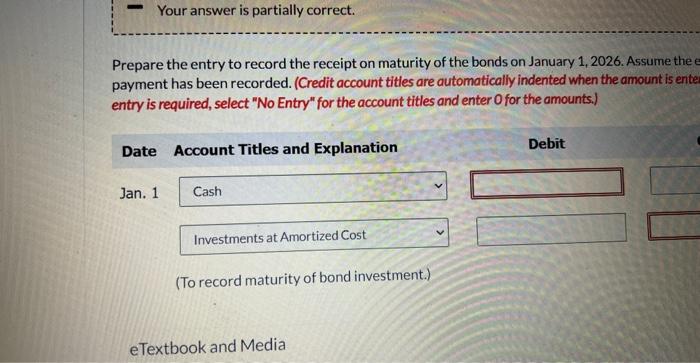

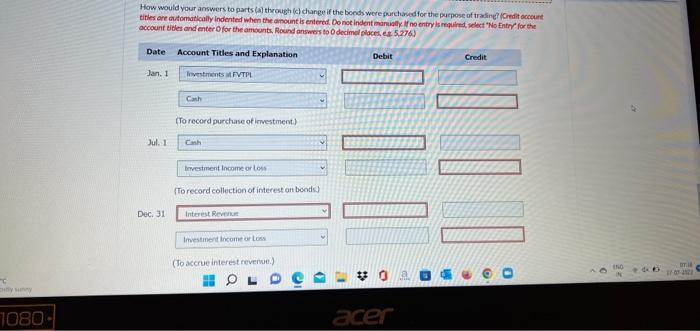

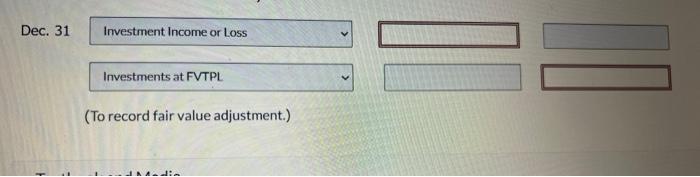

On January 1, 2021, Splish Brothers Inc, a public company, purchased $520,000 of Pearl Corporation's five-year, 7% bonds for $542,179 when the market interest rate was 6%. Interest is received semi-annually on July 1 and January 1.50 ish Brothers's vear end is December 31. Splish Brothers intends to hold Pearl's bonds until January 1, 2026, the date the bonds mature. The bonds' fair value on December 31,2021 , was $530,000. Prepare the adjusting entry required at December 31, 2021. (Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,276.) Show the financial presentation of the bonds for Splish Brothers on December 31,2021 . (Round answers to 0 decimal pli 5,276.) eTextbook and Media Prepare the entry to record the receipt of interest on January 1, 2022. (Credit account titles are au amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account title Prepare the entry to record the receipt on maturity of the bonds on January 1,2026 . Assume the payment has been recorded. (Credit account titles are automatically indented when the amount is ente entry is required, select "No Entry" for the account titles and enter O for the amounts.) (To record maturity of bond investment.) eTextbook and Media How would your answers to parts (s) theough (c) change if the bonds were purchaved for the puepose of trasing? (Credit occeurt account vites and enter ofor the ambant., Round answers to O decimel flacks es 5,276) Dec. 31 Investment Income or Loss Investments at FVTPL (To record fair value adjustment.) On January 1, 2021, Splish Brothers Inc, a public company, purchased $520,000 of Pearl Corporation's five-year, 7% bonds for $542,179 when the market interest rate was 6%. Interest is received semi-annually on July 1 and January 1.50 ish Brothers's vear end is December 31. Splish Brothers intends to hold Pearl's bonds until January 1, 2026, the date the bonds mature. The bonds' fair value on December 31,2021 , was $530,000. Prepare the adjusting entry required at December 31, 2021. (Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,276.) Show the financial presentation of the bonds for Splish Brothers on December 31,2021 . (Round answers to 0 decimal pli 5,276.) eTextbook and Media Prepare the entry to record the receipt of interest on January 1, 2022. (Credit account titles are au amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account title Prepare the entry to record the receipt on maturity of the bonds on January 1,2026 . Assume the payment has been recorded. (Credit account titles are automatically indented when the amount is ente entry is required, select "No Entry" for the account titles and enter O for the amounts.) (To record maturity of bond investment.) eTextbook and Media How would your answers to parts (s) theough (c) change if the bonds were purchaved for the puepose of trasing? (Credit occeurt account vites and enter ofor the ambant., Round answers to O decimel flacks es 5,276) Dec. 31 Investment Income or Loss Investments at FVTPL (To record fair value adjustment.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started