Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer using excel and explain 18) You are offered an investment that will pay the following cash flows at the end of each of

please answer using excel and explain

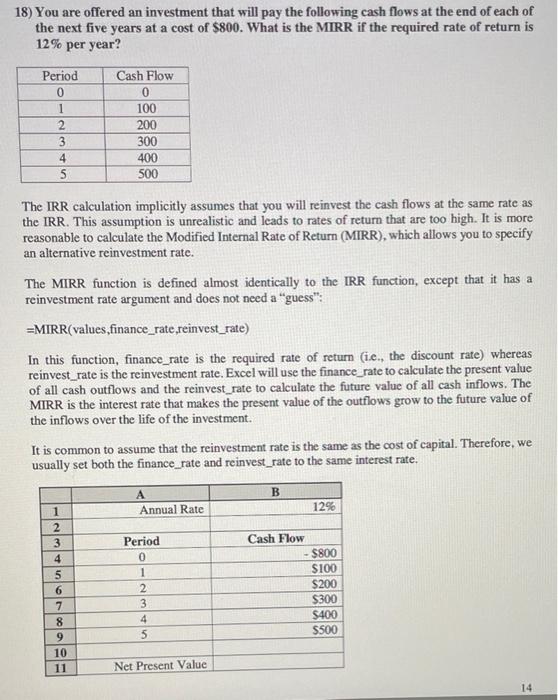

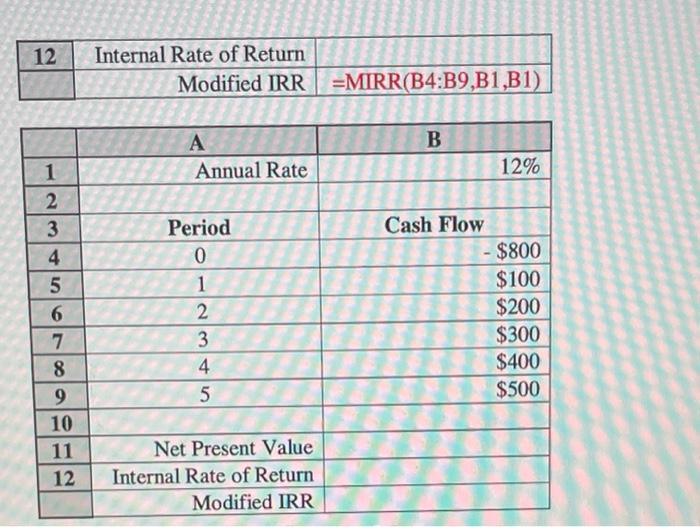

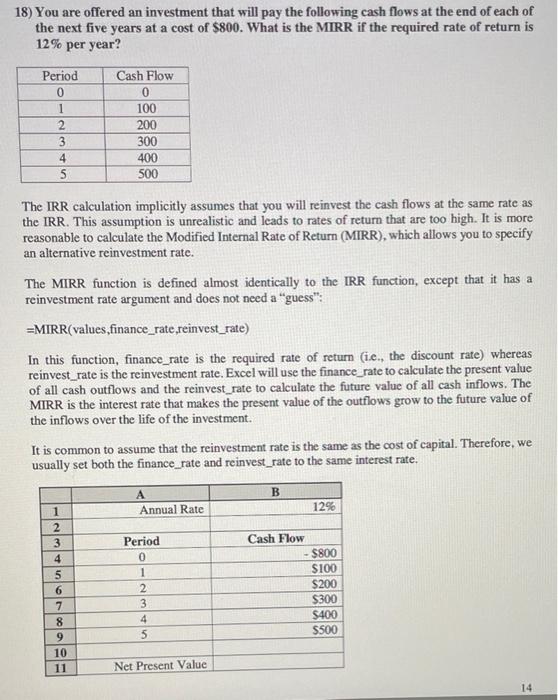

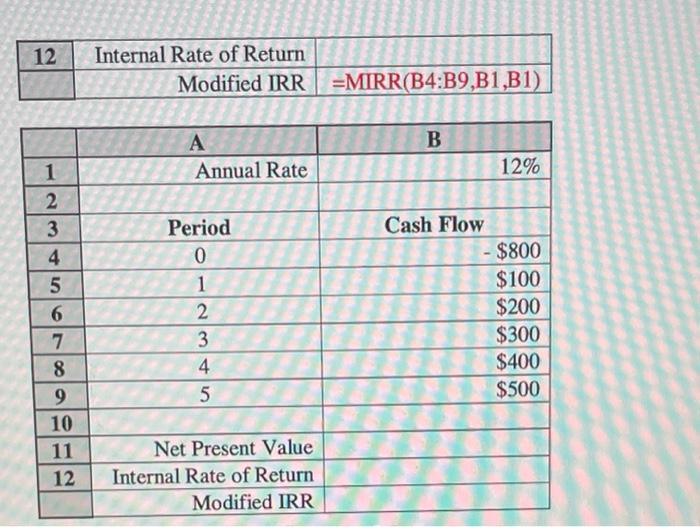

18) You are offered an investment that will pay the following cash flows at the end of each of the next five years at a cost of $800. What is the MIRR if the required rate of return is 12% per year? The IRR calculation implicitly assumes that you will reinvest the cash flows at the same rate as the IRR. This assumption is unrealistic and leads to rates of return that are too high. It is more reasonable to calculate the Modified Internal Rate of Return (MIRR), which allows you to specify an alternative reinvestment rate. The MIRR function is defined almost identically to the IRR function, except that it has a reinvestment rate argument and does not need a "guess": =MIRR(values,finance_rate,reinvest_rate) In this function, finance_rate is the required rate of return (i.e., the discount rate) whereas reinvest_rate is the reinvestment rate. Excel will use the finance_rate to calculate the present value of all cash outflows and the reinvest_rate to calculate the future value of all cash inflows. The MIRR is the interest rate that makes the present value of the outflows grow to the future value of the inflows over the life of the investment. It is common to assume that the reinvestment rate is the same as the cost of capital. Therefore, we usually set both the finance_rate and reinvest_rate to the same interest rate. \begin{tabular}{|r|r|r|} \hline 12 & Internal Rate of Return & \\ \hline & Modified IRR & = MIRR(B4:B9,B1,B1) \\ \hline \end{tabular} \begin{tabular}{|c|c|r|} \hline & A & B \\ \hline 1 & Annual Rate & 12% \\ \hline 2 & & Cash Flow \\ \hline 3 & Period & $800 \\ \hline 4 & 0 & $100 \\ \hline 5 & 1 & $200 \\ \hline 6 & 2 & $300 \\ \hline 7 & 3 & $400 \\ \hline 8 & 4 & $500 \\ \hline 9 & 5 & \\ \hline 10 & & \\ \hline 11 & Net Present Value & \\ \hline 12 & Internal Rate of Return & \\ \hline & Modified IRR & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started