Answered step by step

Verified Expert Solution

Question

1 Approved Answer

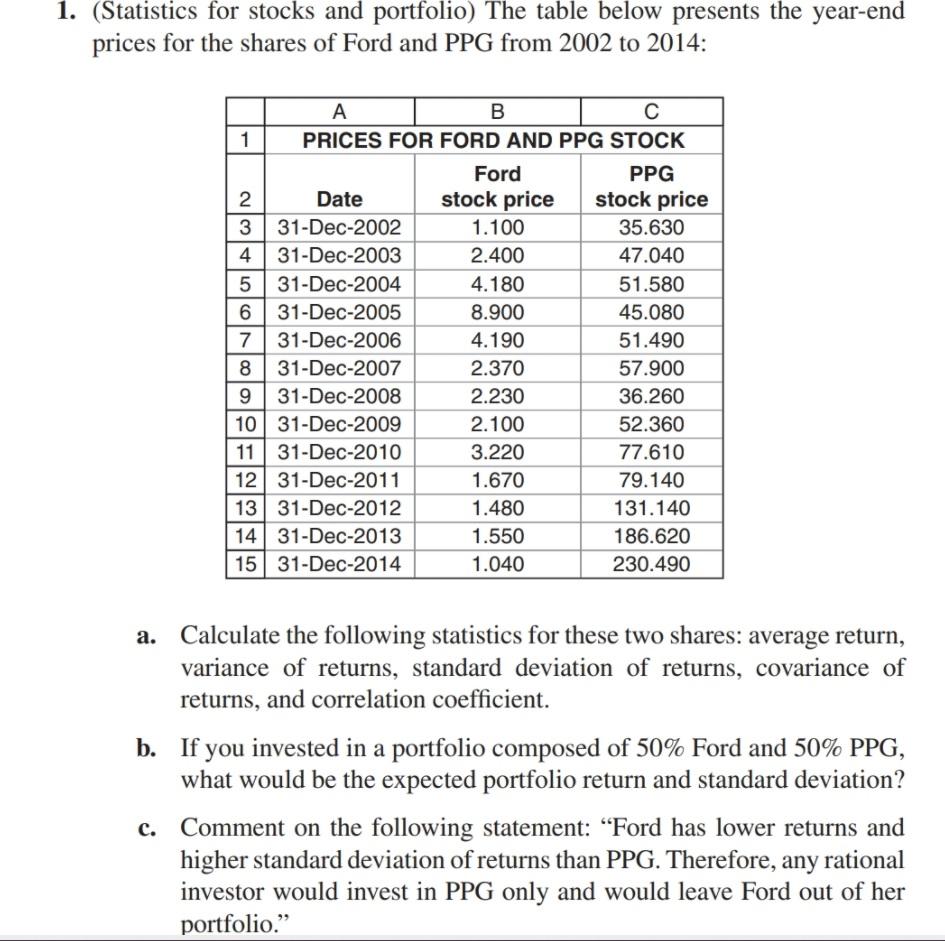

PLEASE ANSWER USING EXCEL. THANK YOU! 1. (Statistics for stocks and portfolio) The table below presents the year-end prices for the shares of Ford and

PLEASE ANSWER USING EXCEL. THANK YOU!

1. (Statistics for stocks and portfolio) The table below presents the year-end prices for the shares of Ford and PPG from 2002 to 2014: A B 1 PRICES FOR FORD AND PPG STOCK Ford PPG 2 Date stock price stock price 3 31-Dec-2002 1.100 35.630 431-Dec-2003 2.400 47.040 531-Dec-2004 4.180 51.580 6 31-Dec-2005 8.900 45.080 731-Dec-2006 4.190 51.490 831-Dec-2007 2.370 57.900 9 31-Dec-2008 2.230 36.260 10 31-Dec-2009 2.100 52.360 11 31-Dec-2010 3.220 77.610 12 31-Dec-2011 1.670 79.140 13 31-Dec-2012 1.480 131.140 14 31-Dec-2013 1.550 186.620 15 31-Dec-2014 1.040 230.490 a. Calculate the following statistics for these two shares: average return, variance of returns, standard deviation of returns, covariance of returns, and correlation coefficient. b. If you invested in a portfolio composed of 50% Ford and 50% PPG, what would be the expected portfolio return and standard deviation? c. Comment on the following statement: Ford has lower returns and higher standard deviation of returns than PPG. Therefore, any rational investor would invest in PPG only and would leave Ford out of her portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started