Answered step by step

Verified Expert Solution

Question

1 Approved Answer

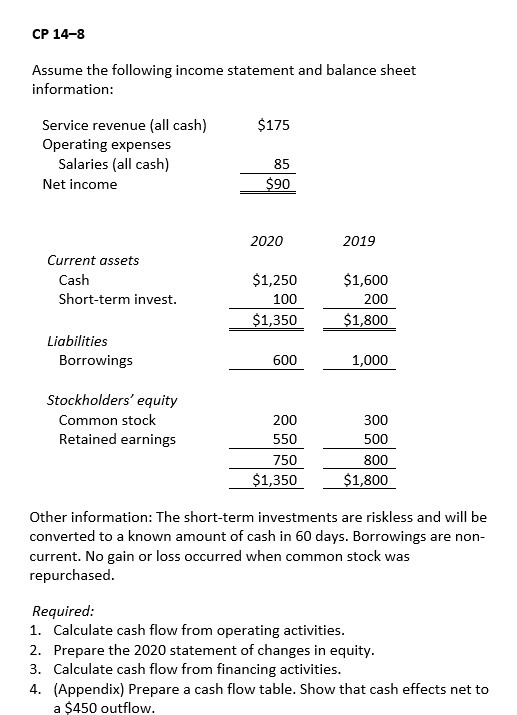

Please answer using workbook pages provided. Thank You CP 14-8 Assume the following income statement and balance sheet information $175 Service revenue (all cash) Operating

Please answer using workbook pages provided.

Thank You

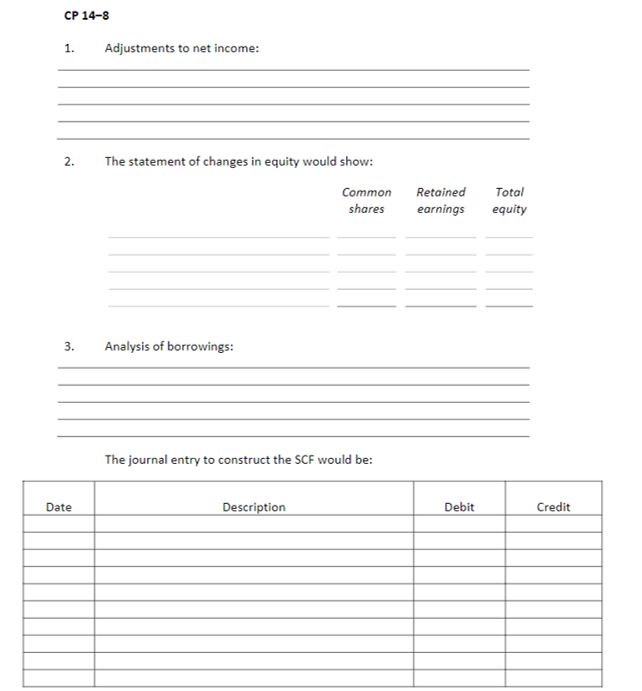

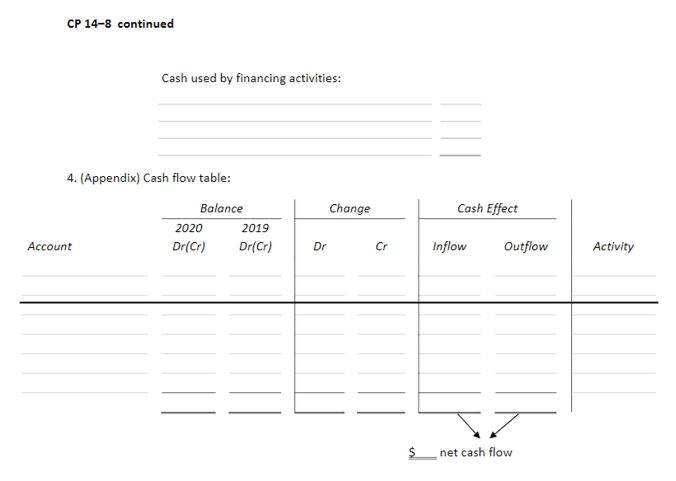

CP 14-8 Assume the following income statement and balance sheet information $175 Service revenue (all cash) Operating expenses 85 90 Salaries (all cash) Net income 2020 2019 Current assets $1,600 200 $1,250 as Short-term invest. 100 $1,350 51800 Liabilities 600 1,000 BorrowingS Stockholders equity Common stock Retained earnings 200 550 750 300 500 800 1,800 $1,35051 Other information: The short-term investments are riskless and will be converted to a known amount of cash in 60 days. Borrowings are non- current. No gain or loss occurred when common stock was repurchased Required 1. Calculate cash flow from operating activities 2. Prepare the 2020 statement of changes in equity 3. Calculate cash flow from financing activities 4. (Appendix) Prepare a cash flow table. Show that cash effects net to a $450 outflow CP 14-8 1. Adjustments to net income: The statement of changes in equity would show: 2. Retained Total shares earnings equity Common 3. alysis of borrowings: The journal entry to construct the SCF would be: Debit Credit Date Description CP 14-8 continued Cash used by financing activities: 4. (Appendix) Cash flow table: Balance 2020 2019 Change Cash Effect Dr(Cr) Dr(C)Dr CrInflow Outflow Activity Account net cash flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started