Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer. Will rate. You are given the following information regarding stock of the Amazing Gadget Corporation (AGC). (1) The stock is currently selling for

Please answer. Will rate.

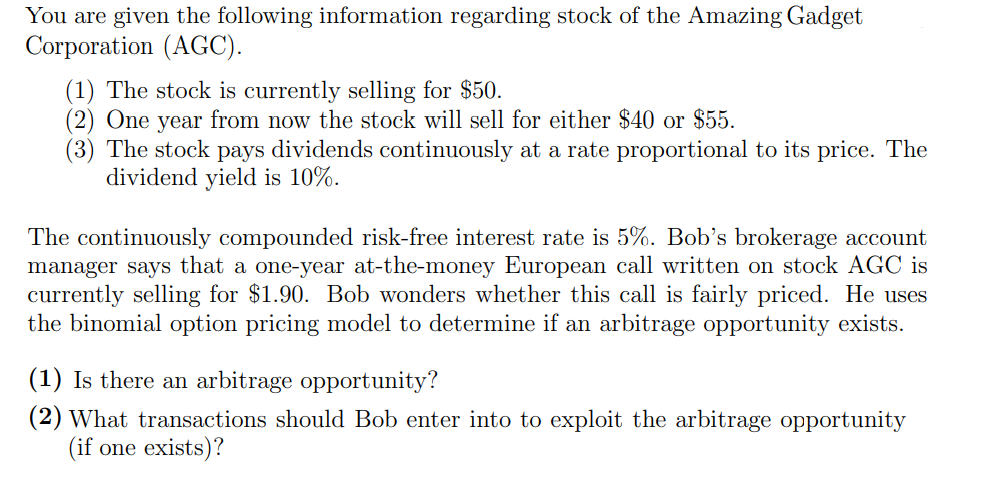

You are given the following information regarding stock of the Amazing Gadget Corporation (AGC). (1) The stock is currently selling for $50. (2) One year from now the stock will sell for either $40 or $55. (3) The stock pays dividends continuously at a rate proportional to its price. The dividend yield is 10%. The continuously compounded risk-free interest rate is 5%. Bob's brokerage account manager says that a one-year at-the-money European call written on stock AGC is currently selling for $1.90. Bob wonders whether this call is fairly priced. He uses the binomial option pricing model to determine if an arbitrage opportunity exists. (1) Is there an arbitrage opportunity? (2) What transactions should Bob enter into to exploit the arbitrage opportunity (if one exists)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started