Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer with details 1. Studio company is considering a new project that to produce a new line of mobile phone in July 2013. Studio'

please answer with details

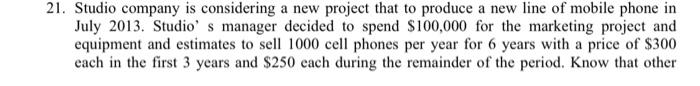

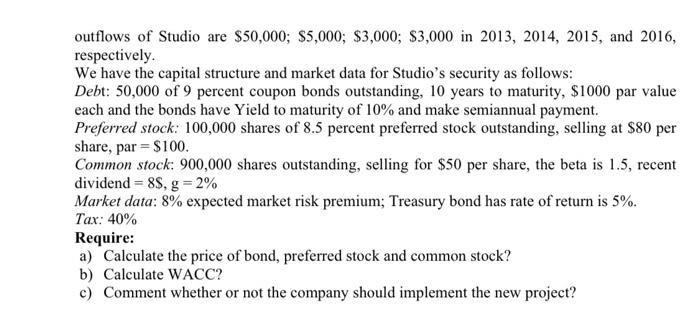

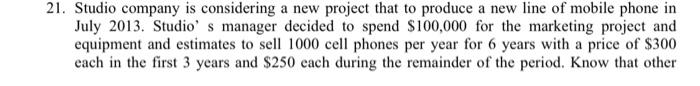

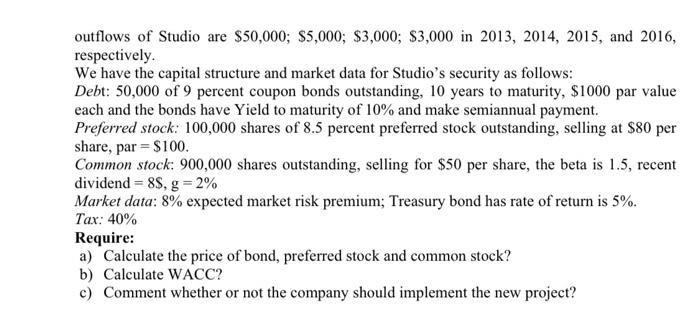

1. Studio company is considering a new project that to produce a new line of mobile phone in July 2013. Studio' s manager decided to spend $100,000 for the marketing project and equipment and estimates to sell 1000 cell phones per year for 6 years with a price of $300 each in the first 3 years and $250 each during the remainder of the period. Know that other outflows of Studio are $50,000;$5,000;$3,000;$3,000 in 2013, 2014, 2015, and 2016, respectively. We have the capital structure and market data for Studio's security as follows: Debt: 50,000 of 9 percent coupon bonds outstanding, 10 years to maturity, $1000 par value each and the bonds have Yield to maturity of 10% and make semiannual payment. Preferred stock: 100,000 shares of 8.5 percent preferred stock outstanding, selling at $80 per share, par =$100 Common stock: 900,000 shares outstanding, selling for $50 per share, the beta is 1.5, recent dividend =8S,g=2% Market data: 8% expected market risk premium; Treasury bond has rate of return is 5%. Tax: 40% Require: a) Calculate the price of bond, preferred stock and common stock? b) Calculate WACC? c) Comment whether or not the company should implement the new project? 1. Studio company is considering a new project that to produce a new line of mobile phone in July 2013. Studio' s manager decided to spend $100,000 for the marketing project and equipment and estimates to sell 1000 cell phones per year for 6 years with a price of $300 each in the first 3 years and $250 each during the remainder of the period. Know that other outflows of Studio are $50,000;$5,000;$3,000;$3,000 in 2013, 2014, 2015, and 2016, respectively. We have the capital structure and market data for Studio's security as follows: Debt: 50,000 of 9 percent coupon bonds outstanding, 10 years to maturity, $1000 par value each and the bonds have Yield to maturity of 10% and make semiannual payment. Preferred stock: 100,000 shares of 8.5 percent preferred stock outstanding, selling at $80 per share, par =$100 Common stock: 900,000 shares outstanding, selling for $50 per share, the beta is 1.5, recent dividend =8S,g=2% Market data: 8% expected market risk premium; Treasury bond has rate of return is 5%. Tax: 40% Require: a) Calculate the price of bond, preferred stock and common stock? b) Calculate WACC? c) Comment whether or not the company should implement the new project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started