Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer with details 22. The KCOM Company is considering a new project that produces a new series of in 5 -year period. In order

please answer with details

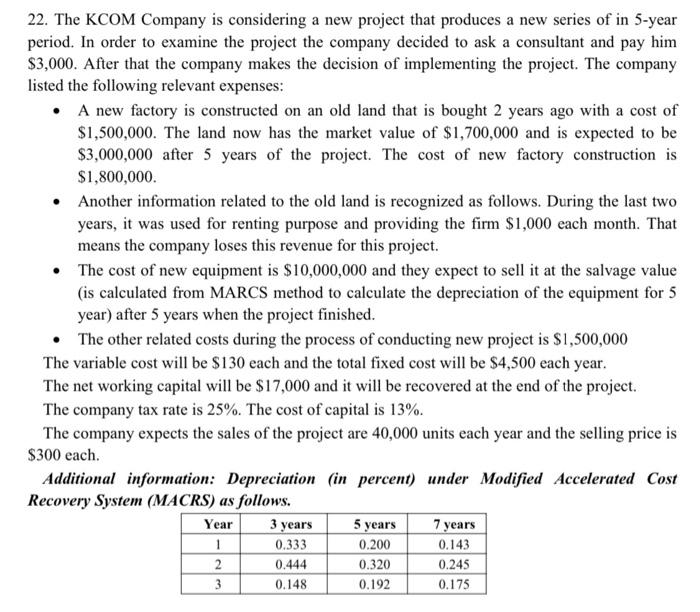

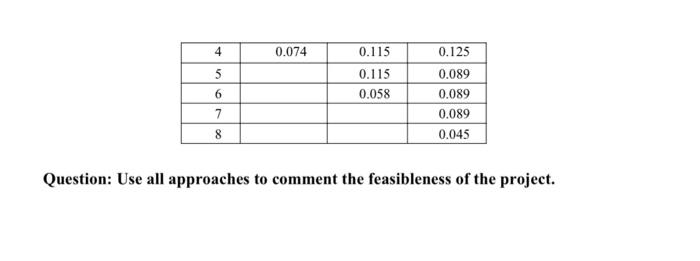

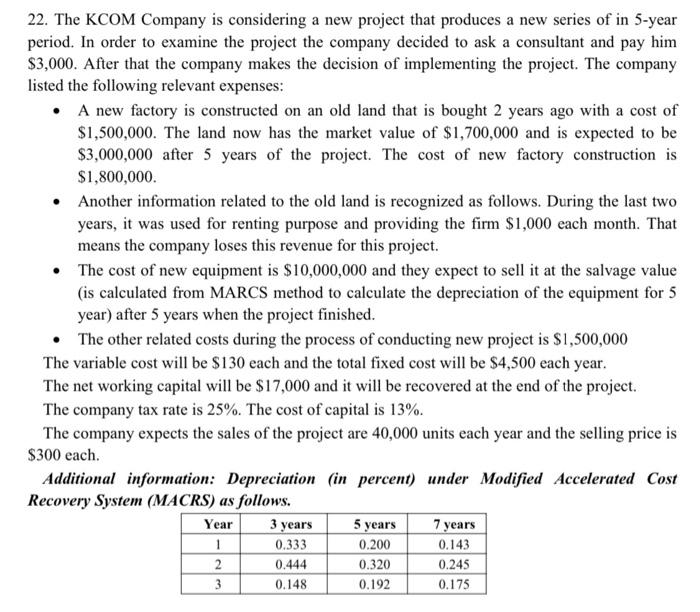

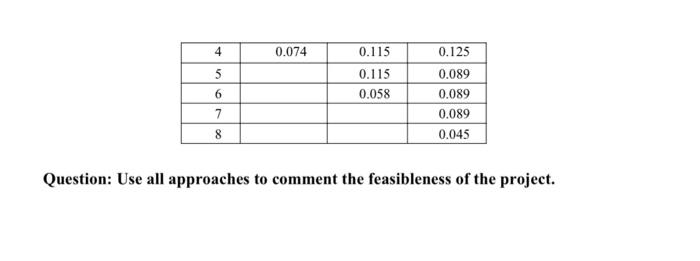

22. The KCOM Company is considering a new project that produces a new series of in 5 -year period. In order to examine the project the company decided to ask a consultant and pay him $3,000. After that the company makes the decision of implementing the project. The company listed the following relevant expenses: - A new factory is constructed on an old land that is bought 2 years ago with a cost of $1,500,000. The land now has the market value of $1,700,000 and is expected to be $3,000,000 after 5 years of the project. The cost of new factory construction is $1,800,000. - Another information related to the old land is recognized as follows. During the last two years, it was used for renting purpose and providing the firm $1,000 each month. That means the company loses this revenue for this project. - The cost of new equipment is $10,000,000 and they expect to sell it at the salvage value (is calculated from MARCS method to calculate the depreciation of the equipment for 5 year) after 5 years when the project finished. - The other related costs during the process of conducting new project is $1,500,000 The variable cost will be $130 each and the total fixed cost will be $4,500 each year. The net working capital will be $17,000 and it will be recovered at the end of the project. The company tax rate is 25%. The cost of capital is 13%. The company expects the sales of the project are 40,000 units each year and the selling price is $300 each. Additional information: Depreciation (in percent) under Modified Accelerated Cost Recovery System (MACRS) as follows. Question: Use all approaches to comment the feasibleness of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started