Please answer with excel or by hand.

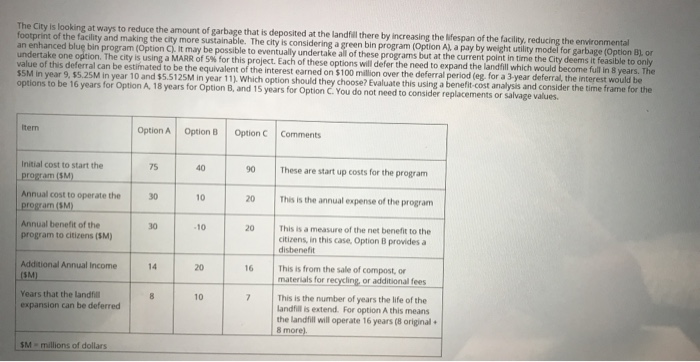

The City is looking at ways to reduce the amount of garbage that is deposited at the land thereby increasing the lifespan of the facility, reducing the environmental footprint of the facility and making the city more sustainable. The city is considering a green bin program (Option Al a pay by weight Utility model for garbage (Option Blor an enhanced blue bin program (Option. It may be possible to eventually undertake all of these programs but at the current point in time the City deems it feasible to only undertake one option. The city is using a MARR of 5% for this project. Each of these options will defer the need to expand the landfill which would become full in 8 years. The value of this deferral can be estimated to be the equivalent of the interest earned on $100 million over the deferral period (eg, for a 3-year deferral the interest would be SSM in year 9, 55.25M in year 10 and $5.5125M in year 11)Which option should they choose? Evaluate this using a benefit-cost analysis and consider the time frame for the options to be 16 years for Option A 18 years for Option B. and 15 years for Option. You do not need to consider replacements or salvage values. Item Option A Option Option Comments 90 These are start up costs for the program Initial cost to start the program (SM) This is the annual expense of the program Annual cost to operate the program (SM) Annual benefit of the program to citizens (SM) This is a measure of the net benefit to the cities in this case Option provides a disbenefit This is from the sale of composto materials for recycling or additional fees Additional Annual Income (5M) Years that the land expansion can be deferred This is the number of years the life of the Landfill is extend. For option this means the landfill will operate 16 years (8 original 8 more) SM-millions of dollars The City is looking at ways to reduce the amount of garbage that is deposited at the land thereby increasing the lifespan of the facility, reducing the environmental footprint of the facility and making the city more sustainable. The city is considering a green bin program (Option Al a pay by weight Utility model for garbage (Option Blor an enhanced blue bin program (Option. It may be possible to eventually undertake all of these programs but at the current point in time the City deems it feasible to only undertake one option. The city is using a MARR of 5% for this project. Each of these options will defer the need to expand the landfill which would become full in 8 years. The value of this deferral can be estimated to be the equivalent of the interest earned on $100 million over the deferral period (eg, for a 3-year deferral the interest would be SSM in year 9, 55.25M in year 10 and $5.5125M in year 11)Which option should they choose? Evaluate this using a benefit-cost analysis and consider the time frame for the options to be 16 years for Option A 18 years for Option B. and 15 years for Option. You do not need to consider replacements or salvage values. Item Option A Option Option Comments 90 These are start up costs for the program Initial cost to start the program (SM) This is the annual expense of the program Annual cost to operate the program (SM) Annual benefit of the program to citizens (SM) This is a measure of the net benefit to the cities in this case Option provides a disbenefit This is from the sale of composto materials for recycling or additional fees Additional Annual Income (5M) Years that the land expansion can be deferred This is the number of years the life of the Landfill is extend. For option this means the landfill will operate 16 years (8 original 8 more) SM-millions of dollars