Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer with the reason each point Thx all 126000 depreciation should charged and Allowance is 150000 Exercise 5.3 Happy Ltd ('The Company'), a Hong

Please answer with the reason each point

Thx

all 126000 depreciation should charged and Allowance is 150000

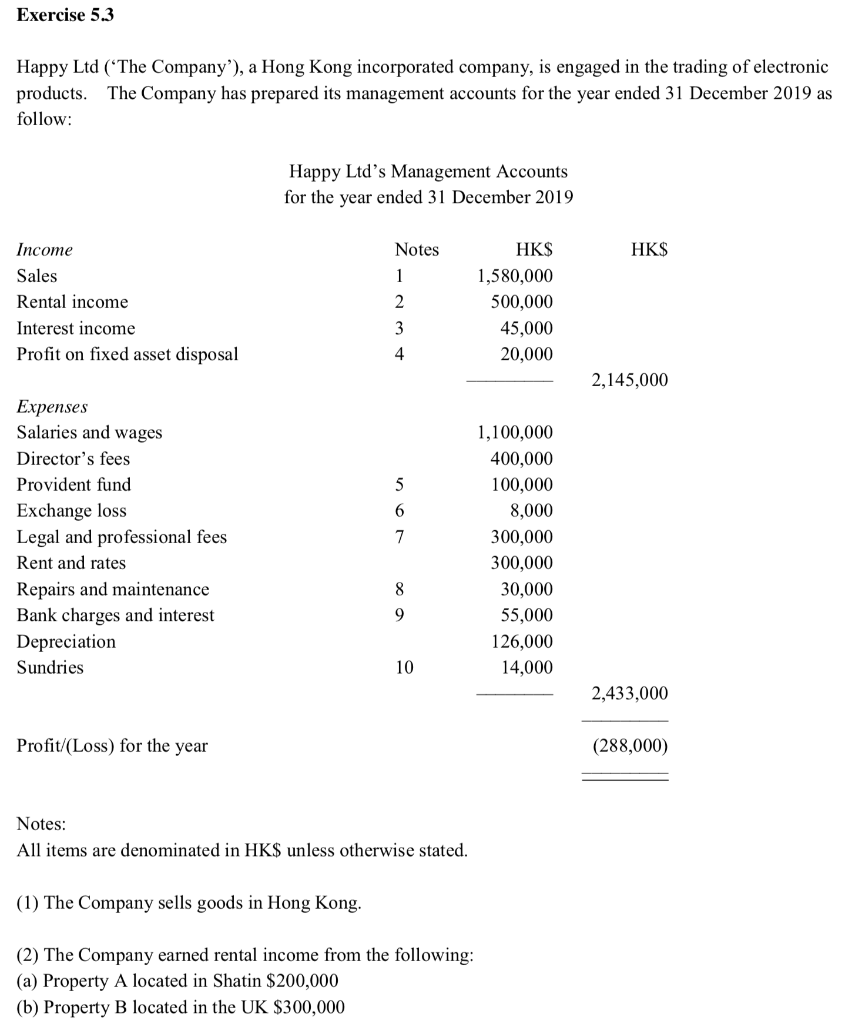

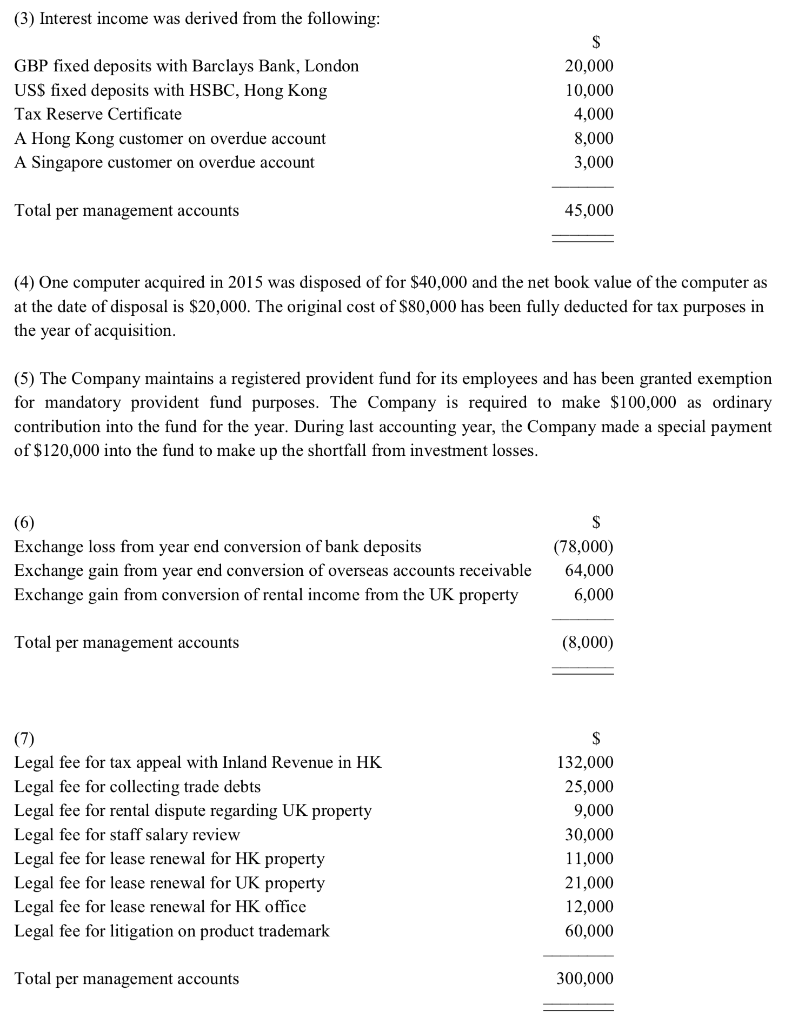

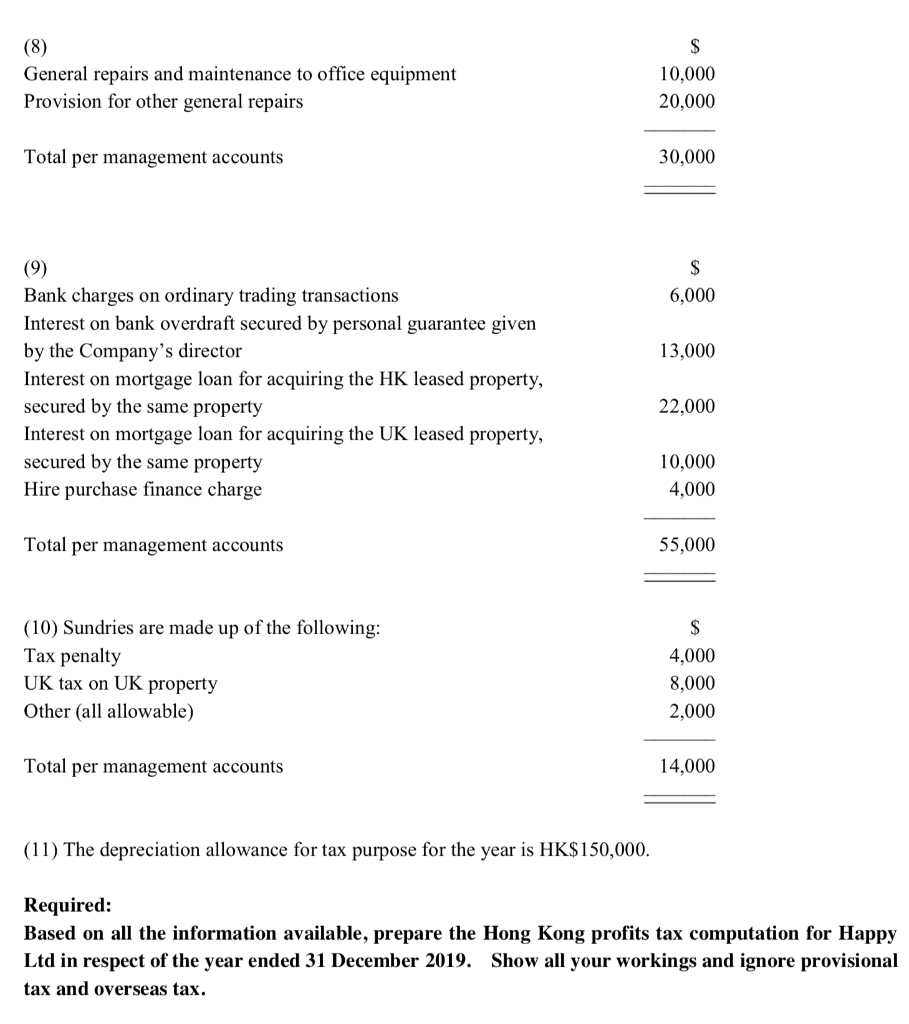

Exercise 5.3 Happy Ltd ('The Company'), a Hong Kong incorporated company, is engaged in the trading of electronic products. The Company has prepared its management accounts for the year ended 31 December 2019 as follow: Happy Ltd's Management Accounts for the year ended 31 December 2019 HK$ Income Sales Rental income Interest income Profit on fixed asset disposal Notes 1 2 3 4 HK$ 1,580,000 500,000 45,000 20,000 2,145,000 Expenses Salaries and wages Director's fees Provident fund Exchange loss Legal and professional fees Rent and rates Repairs and maintenance Bank charges and interest Depreciation Sundries 5 6 7 1,100,000 400,000 100,000 8,000 300,000 300,000 30,000 55,000 126,000 14,000 8 9 10 2,433,000 Profit/(Loss) for the year (288,000) Notes: All items are denominated in HK$ unless otherwise stated. (1) The Company sells goods in Hong Kong. (2) The Company earned rental income from the following: (a) Property A located in Shatin $200,000 (b) Property B located in the UK $300,000 (3) Interest income was derived from the following: GBP fixed deposits with Barclays Bank, London USS fixed deposits with HSBC, Hong Kong Tax Reserve Certificate A Hong Kong customer on overdue account A Singapore customer on overdue account $ 20,000 10,000 4,000 8,000 3,000 Total per management accounts 45,000 (4) One computer acquired in 2015 was disposed of for $40,000 and the net book value of the computer as at the date of disposal is $20,000. The original cost of $80,000 has been fully deducted for tax purposes in the year of acquisition. (5) The Company maintains a registered provident fund for its employees and has been granted exemption for mandatory provident fund purposes. The Company is required to make $100,000 as ordinary contribution into the fund for the year. During last accounting year, the Company made a special payment of $120,000 into the fund to make up the shortfall from investment losses. (6) Exchange loss from year end conversion of bank deposits Exchange gain from year end conversion of overseas accounts receivable Exchange gain from conversion of rental income from the UK property $ (78,000) 64.000 6,000 Total per management accounts (8,000) (7) Legal fee for tax appeal with Inland Revenue in HK Legal fee for collecting trade debts Legal fee for rental dispute regarding UK property Legal fee for staff salary review Legal fee for lease renewal for HK property Legal fee for lease renewal for UK property Legal fee for lease renewal for HK office Legal fee for litigation on product trademark $ 132,000 25,000 9,000 30,000 11,000 21,000 12,000 60,000 Total per management accounts 300,000 S (8) General repairs and maintenance to office equipment Provision for other general repairs 10,000 20,000 Total per management accounts 30,000 $ 6,000 13,000 (9) Bank charges on ordinary trading transactions Interest on bank overdraft secured by personal guarantee given by the Company's director Interest on mortgage loan for acquiring the HK leased property, secured by the same property Interest on mortgage loan for acquiring the UK leased property, secured by the same property Hire purchase finance charge 22,000 10,000 4,000 Total per management accounts 55,000 (10) Sundries are made up of the following: Tax penalty UK tax on UK property Other (all allowable) $ 4,000 8,000 2,000 Total per management accounts 14,000 (11) The depreciation allowance for tax purpose for the year is HK$150,000. Required: Based on all the information available, prepare the Hong Kong profits tax computation for Happy Ltd in respect of the year ended 31 December 2019. Show all your workings and ignore provisional tax and overseas taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started