please answer with workings

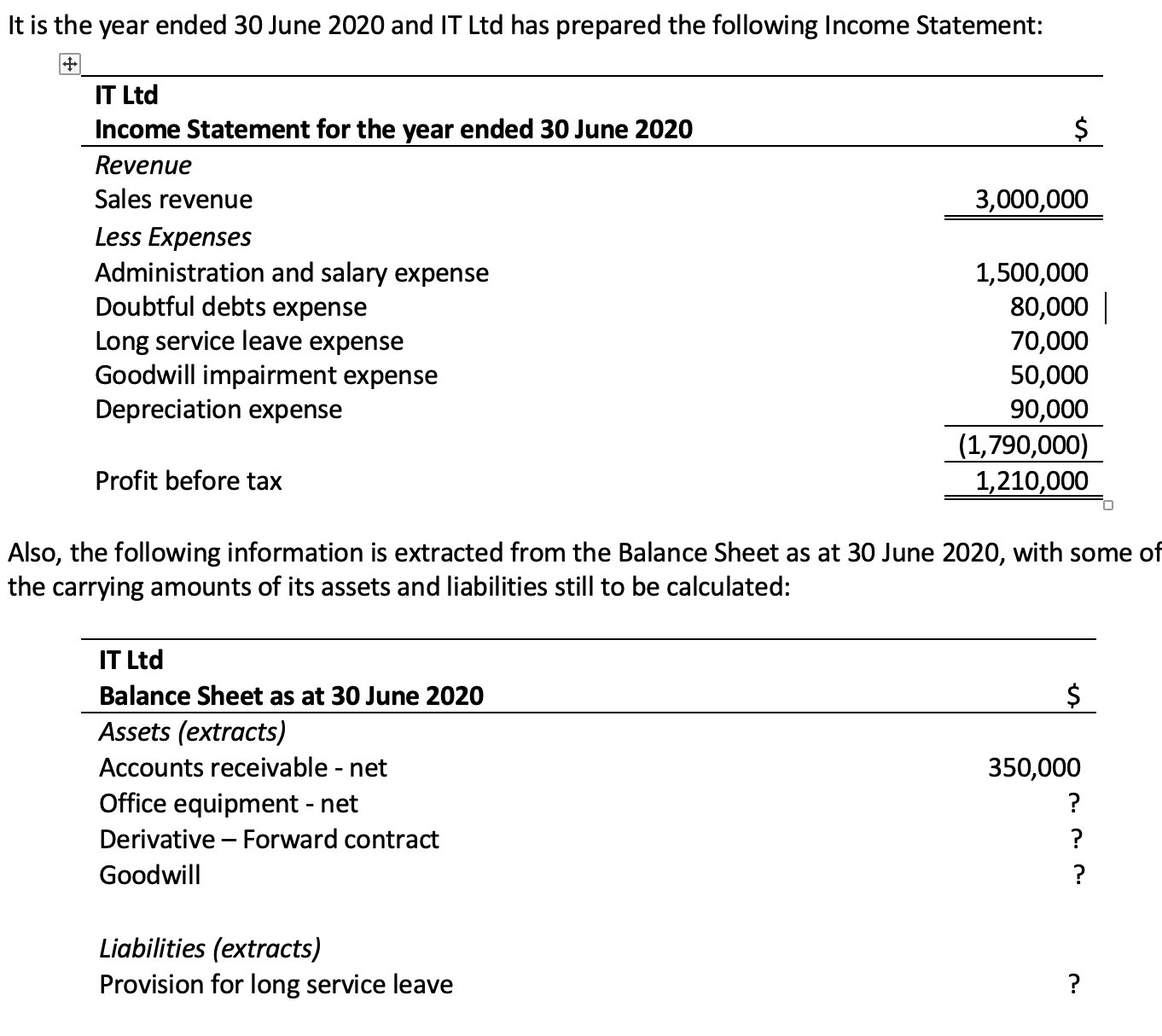

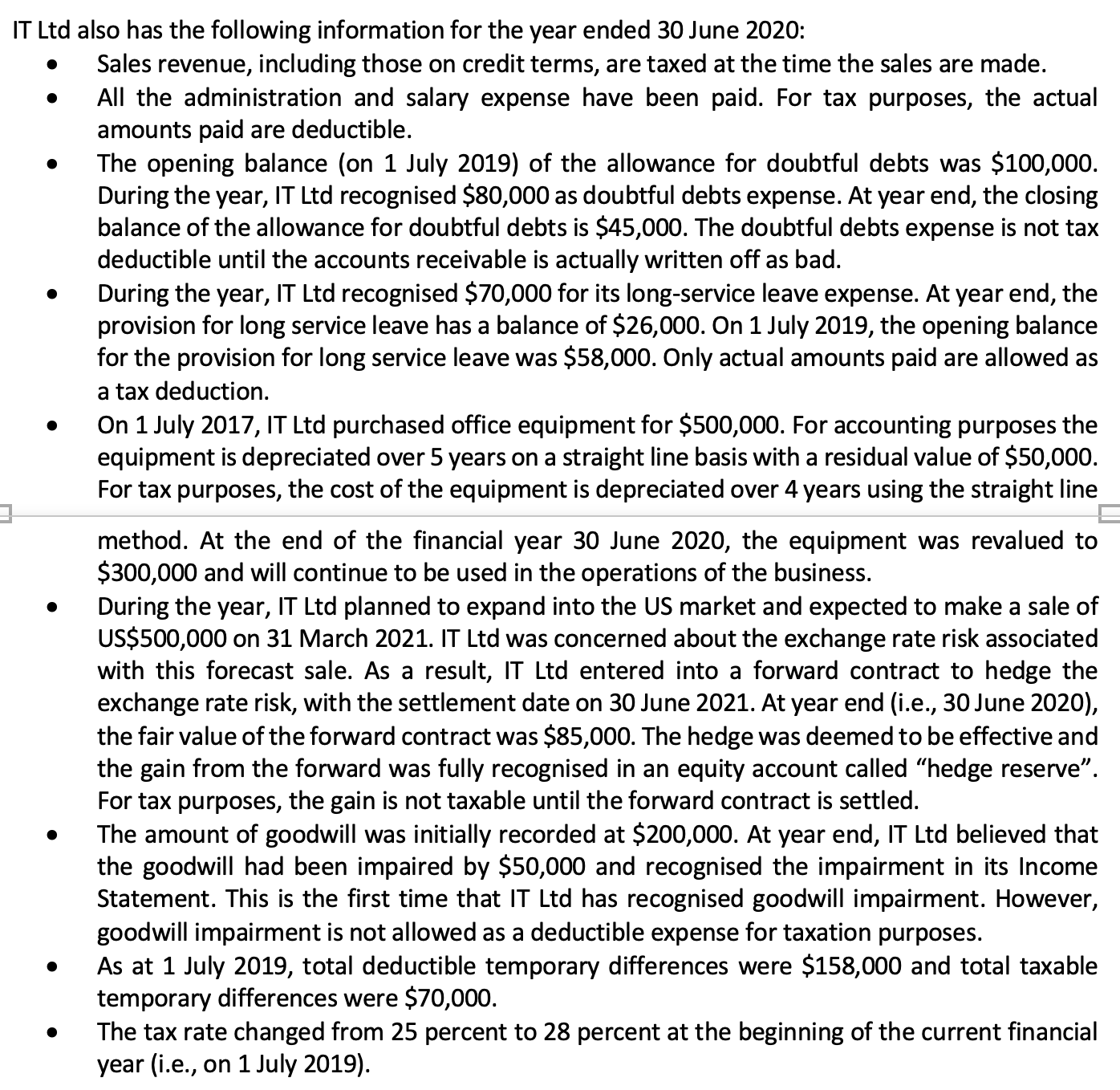

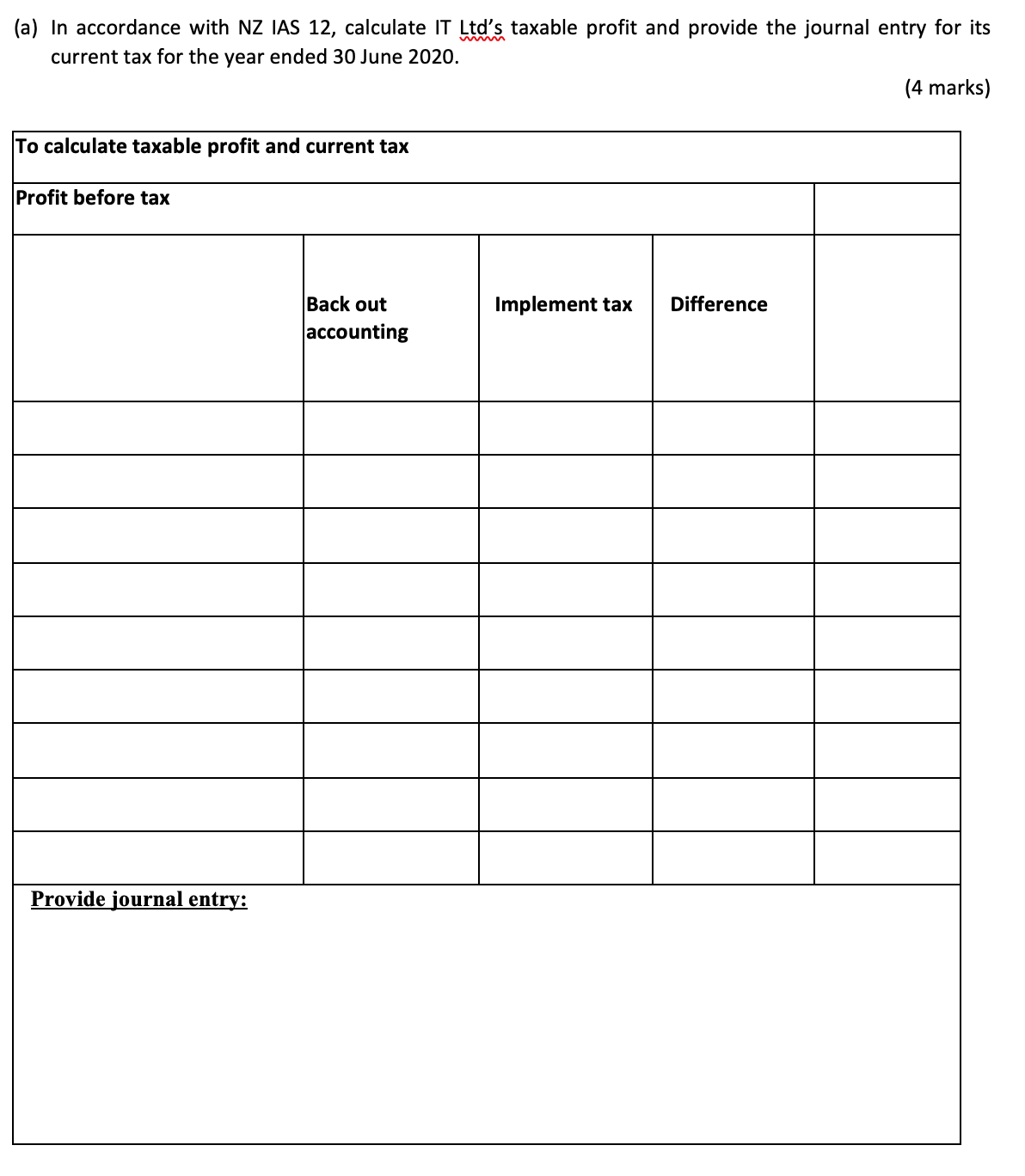

It is the year ended 30 June 2020 and IT Ltd has prepared the following Income Statement: IT Ltd Income Statement for the year ended 30 June 2020 S Revenue Sales revenue 3,000,000 Less Expenses Administration and salary expense 1,500,000 Doubtful debts expense 80,000 | Long service leave expense 70,000 Goodwill impairment expense 50,000 Depreciation expense 90,000 (1,790,000) Profit before tax 1,210,000 Also, the following information is extracted from the Balance Sheet as at 30 June 2020, with some of the carrying amounts of its assets and liabilities still to be calculated: IT Ltd Balance Sheet as at 30 June 2020 S Assets (extracts) Accounts receivable - net 350,000 Office equipment - net ? Derivative Forward contract ? Goodwill ? Liabilities (extracts) Provision for long service leave ? I.J IT Ltd also has the following information for the year ended 30 June 2020: Sales revenue, including those on credit terms, are taxed at the time the sales are made. All the administration and salary expense have been paid. For tax purposes, the actual amounts paid are deductible. The opening balance (on 1 July 2019) of the allowance for doubtful debts was $100,000. During the year, IT Ltd recognised $80,000 as doubtful debts expense. At year end, the closing balance of the allowance for doubtful debts is $45,000. The doubtful debts expense is not tax deductible until the accounts receivable is actually written off as bad. During the yea r, IT Ltd recognised $70,000 for its long-service leave expense. At year end, the provision for long service leave has a balance of $26,000. On 1 July 2019, the opening balance for the provision for long service leave was $58,000. Only actual amounts paid are allowed as a tax deduction. On 1 July 2017, IT Ltd purchased office equipment for $500,000. For accounting purposes the equipment is depreciated over 5 years on a straight line basis with a residual value of $50,000. For tax purposes, the cost of the equipment is depreciated over 4 years using the straight line ' h method. At the end of the financial year 30 June 2020, the equipment was revalued to $300,000 and will continue to be used in the operations of the business. During the year, IT Ltd planned to expand into the US market and expected to make a sale of US$500,000 on 31 March 2021. IT Ltd was concerned about the exchange rate risk associated with this forecast sale. As a result, IT Ltd entered into a forward contract to hedge the exchange rate risk, with the settlement date on 30 June 2021. At year end (i.e., 30 June 2020), the fair value of the forward contract was $85,000. The hedge was deemed to be effective and the gain from the forward was fully recognised in an equity account called \"hedge reserve\". For tax purposes, the gain is not taxable until the fonNard contract is settled. The amount of goodwill was initially recorded at $200,000. At year end, IT Ltd believed that the goodwill had been impaired by $50,000 and recognised the impairment in its Income Statement. This is the first time that IT Ltd has recognised goodwill impairment. However, goodwill impairment is not allowed as a deductible expense for taxation purposes. As at 1 July 2019, total deductible temporary differences were $158,000 and total taxable temporary differences were $70,000. The tax rate changed from 25 percent to 28 percent at the beginning of the current financial year (i.e., on 1 July 2019). (a) In accordance with N2 IAS 12, calculate |T Ltd's taxable profit and provide the journal entry for its m current tax for the year ended 30 June 2020. (4 marks) To calculate taxable profit and current tax Profit before tax Back out accounting Provide iournal entgy