Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer within 2 hours. I will make sure to rate it. Shamirpet Electricals Ltd (SEL) is a company that manufactures industrial electric motors. The

Please answer within 2 hours. I will make sure to rate it.

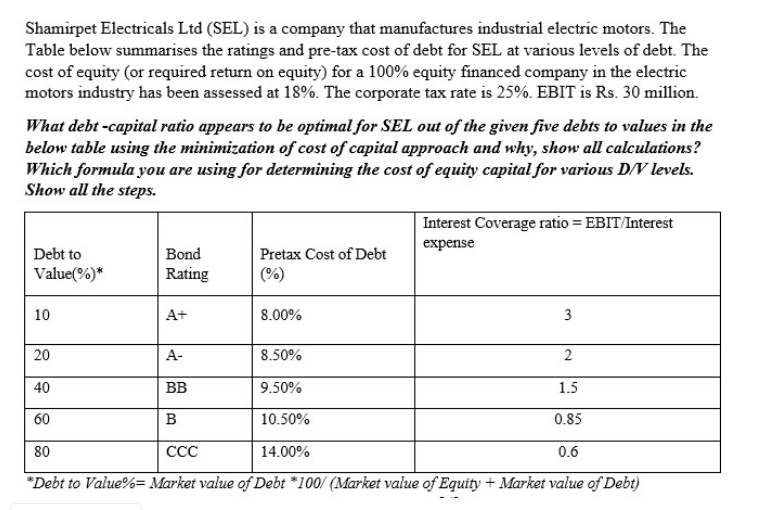

Shamirpet Electricals Ltd (SEL) is a company that manufactures industrial electric motors. The Table below summarises the ratings and pre-tax cost of debt for SEL at various levels of debt. The cost of equity (or required return on equity) for a 100% equity financed company in the electric motors industry has been assessed at 18%. The corporate tax rate is 25%. EBIT is Rs. 30 million. What debt -capital ratio appears to be optimal for SEL out of the given five debts to values in the below table using the minimization of cost of capital approach and why, show all calculations? Which formula you are using for determining the cost of equity capital for various D/V levels. Show all the steps. Interest Coverage ratio = EBIT/Interest expense Debt to Bond Pretax Cost of Debt Value(%)* Rating 10 A+ 8.00% 3 20 A- 8.50% 2 40 BB 9.50% 1.5 60 B 10.50% 0.85 80 14.00% 0.6 * Debt to Value%= Market value of Debt *100/ (Market value of Equity + Market value of Debt) Shamirpet Electricals Ltd (SEL) is a company that manufactures industrial electric motors. The Table below summarises the ratings and pre-tax cost of debt for SEL at various levels of debt. The cost of equity (or required return on equity) for a 100% equity financed company in the electric motors industry has been assessed at 18%. The corporate tax rate is 25%. EBIT is Rs. 30 million. What debt -capital ratio appears to be optimal for SEL out of the given five debts to values in the below table using the minimization of cost of capital approach and why, show all calculations? Which formula you are using for determining the cost of equity capital for various D/V levels. Show all the steps. Interest Coverage ratio = EBIT/Interest expense Debt to Bond Pretax Cost of Debt Value(%)* Rating 10 A+ 8.00% 3 20 A- 8.50% 2 40 BB 9.50% 1.5 60 B 10.50% 0.85 80 14.00% 0.6 * Debt to Value%= Market value of Debt *100/ (Market value of Equity + Market value of Debt)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started