PLEASE ANSWERR WILL RATEEE

PLEASE ANSWERR WILL RATEEE

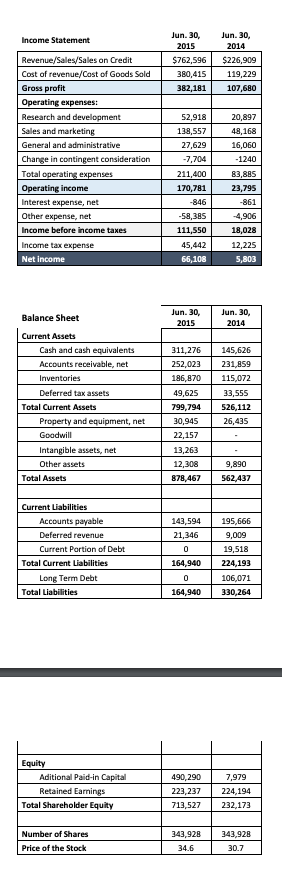

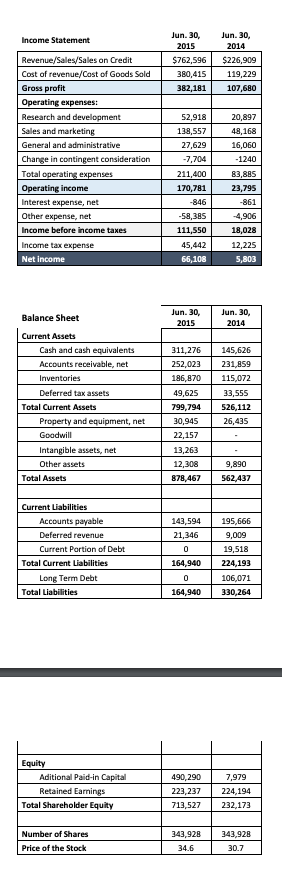

Income Statement Jun 30, 2015 $762,596 380,415 382,181 Jun 30, 2014 $226,909 119,229 107,680 Revenue/Sales/Sales on Credit Cost of revenue/Cost of Goods Sold Gross profit Operating expenses: Research and development Sales and marketing General and administrative Change in contingent consideration Total operating expenses Operating income Interest expense, net Other expense, net Income before income taxes Income tax expense Net income 20,897 48,168 16,060 -1240 52,918 138,557 27,629 -7,704 211,400 170,781 -846 -58,385 111,550 45,442 66,108 83,885 23,795 -861 4,906 18,028 12,225 5,803 Jun 30, 2015 Jun. 30. 2014 Balance Sheet Current Assets Cash and cash equivalents Accounts receivable, net Inventories Deferred tax assets Total Current Assets Property and equipment, net Goodwill Intangible assets, net Other assets Total Assets 311,276 252,023 186,870 49,625 799,794 30,945 22,157 13,263 12,308 878,467 145,626 231,859 115,072 33,555 526,112 26,435 9,890 562,437 143,594 21,346 Current Liabilities Accounts payable Deferred revenue Current Portion of Debt Total Current Liabilities Long Term Debt Total Liabilities 0 195,666 9,009 19,518 224,193 106,071 330,264 164,940 0 164,940 Equity Aditional Paid-in Capital Retained Earnings Total Shareholder Equity 490,290 223,237 713,527 7,979 224,194 232,173 Number of Shares Price of the Stock 343,928 34.6 343,928 30.7 1. Has the international expansion favored FitBit?What has been the effects on costs and net revenue? 2. Is FitBit a healthy company, asses its liquidity, leverage and how it has been managing its assets through financial ratios (Calculate 2 at least for every type). 3. Because FitBit is a new company, the have little control over its suppliers and their policies. What would happen to the company's liquidity, if their suppliers asked to be paid in 90 days? What would be an estimated impact on Cash Balance? 4. How would you increase FitBit revenue? How would those actions reflect on financial statements? (You can make as many assumptions as needed. They need to be backed up with numbers) Income Statement Jun 30, 2015 $762,596 380,415 382,181 Jun 30, 2014 $226,909 119,229 107,680 Revenue/Sales/Sales on Credit Cost of revenue/Cost of Goods Sold Gross profit Operating expenses: Research and development Sales and marketing General and administrative Change in contingent consideration Total operating expenses Operating income Interest expense, net Other expense, net Income before income taxes Income tax expense Net income 20,897 48,168 16,060 -1240 52,918 138,557 27,629 -7,704 211,400 170,781 -846 -58,385 111,550 45,442 66,108 83,885 23,795 -861 4,906 18,028 12,225 5,803 Jun 30, 2015 Jun. 30. 2014 Balance Sheet Current Assets Cash and cash equivalents Accounts receivable, net Inventories Deferred tax assets Total Current Assets Property and equipment, net Goodwill Intangible assets, net Other assets Total Assets 311,276 252,023 186,870 49,625 799,794 30,945 22,157 13,263 12,308 878,467 145,626 231,859 115,072 33,555 526,112 26,435 9,890 562,437 143,594 21,346 Current Liabilities Accounts payable Deferred revenue Current Portion of Debt Total Current Liabilities Long Term Debt Total Liabilities 0 195,666 9,009 19,518 224,193 106,071 330,264 164,940 0 164,940 Equity Aditional Paid-in Capital Retained Earnings Total Shareholder Equity 490,290 223,237 713,527 7,979 224,194 232,173 Number of Shares Price of the Stock 343,928 34.6 343,928 30.7 1. Has the international expansion favored FitBit?What has been the effects on costs and net revenue? 2. Is FitBit a healthy company, asses its liquidity, leverage and how it has been managing its assets through financial ratios (Calculate 2 at least for every type). 3. Because FitBit is a new company, the have little control over its suppliers and their policies. What would happen to the company's liquidity, if their suppliers asked to be paid in 90 days? What would be an estimated impact on Cash Balance? 4. How would you increase FitBit revenue? How would those actions reflect on financial statements? (You can make as many assumptions as needed. They need to be backed up with numbers)

PLEASE ANSWERR WILL RATEEE

PLEASE ANSWERR WILL RATEEE