Please answers all parts in excel.

sorry about that

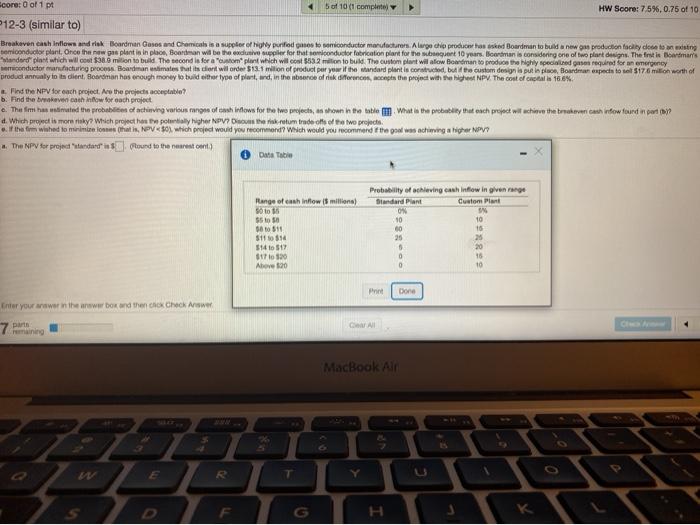

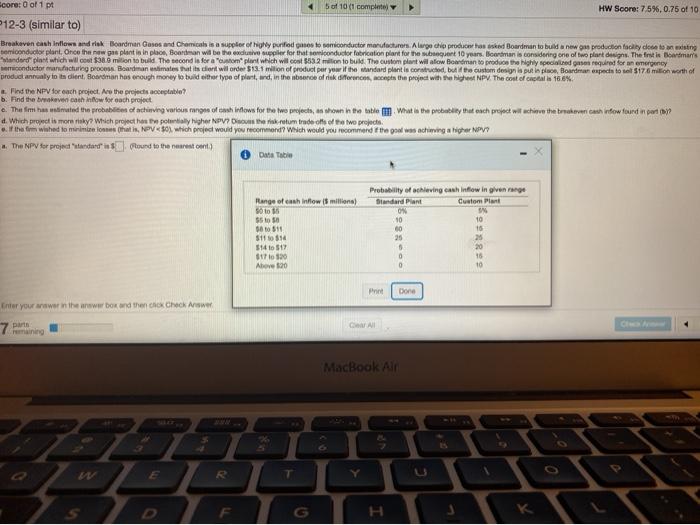

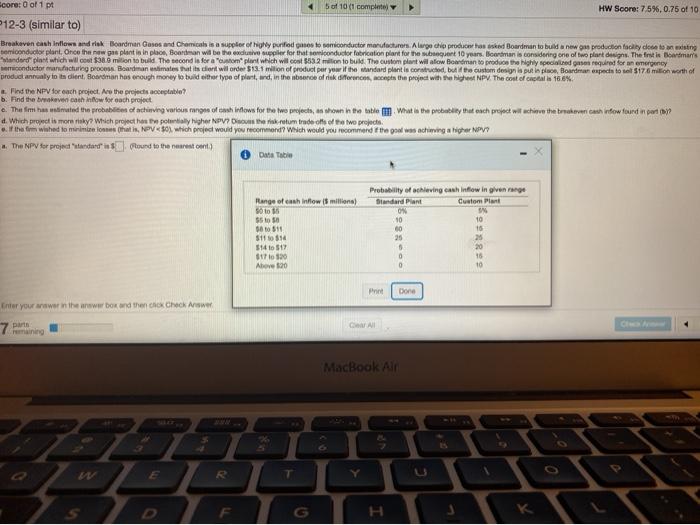

core: 0 of 1 pt 5 of 101 completely HW Scoret 75%, 0.75 of 10 12-3 (similar to) Breakeven cash flows and rek Boardman Gases and Chemicals is a supplier of Nowy purified us to conductor manufacturers A large che productos sed Boardman to build a new production facility to wisting temiconductor plant. Once the new plant is in place Boardman will be the exclusive perforatswoonductor Pobrication plant for the bent 10 years. Hermanis considering one of two plant designs. The first in Badman's Sardord plant which will cost $38.6 milion to build The necond is for a complan which will cost $532 million to build. The custom plant willow Boardman to produce the highly specialized as required for an emergency conductor manufacturo pross. Boardina stimates ratios dient wil order $13.1 milion of product or yow if the Mandard plant in constructed by the custom design a putih, Blonder expect to tel 5176 milion worth of product antally to a client. Boroman has enough money to build either type of plast, and, in the absence of difference, weepin the project with higher NPV. The cost of catall 16.6% Find the NPV for each project. As the projects acceptable? b. Find the braver cash infow for each project The fim has dimated the probabiliten el achining various anome of th now for the the projects, shown in the table in What in the probability that each project will achieve the brakowancash now found on port ham Whed to main con los tralls, Nev5), which project would you recommend? Which would you recommend the pow we aching a higher NV? The NPV for projetandard in Flound to the nearestent Data Table range of cash inflow is millions) Sotto 95 to 50 9810511 5111 $14 to $17 171120 Above 30 Probability of acheving cash flow ingen ange Standard Pant Custom Plant ON 10 10 60 16 25 0 0 15 10 Print Done Enter your answer the aww box and then chox Check Aw Car All running MacBook Air T . Y . K P12-3 (similar to) million to build. The second is for a custom plant which will cost $53.2 million to build. The custom plant willow Boardman to produce the highly specialized gases required for an emergency semiconductor manufacturing process. Boardman estimates that its client will order $13.1 million of product per year if the standard plant is constructed, but the custom design is put in place, Boardman expects to soll $17.6 million worth of product annually to its client. Boardman has enough money to build either type of plant, and in the absence of risk differences, accepts the project with the highest NPV. The cost of capital is 16.6% a. Find the NPV for each project. Are the projects acceptable? b. Find the breakeven cash inflow for each project c. The firm has estimated the probabilities of achieving various ranges of cash inflows for the two projects, as shown in the table What is the probability that each project will achieve the breakeven cash inflow found in part (b)? d. Which project is more risky? Which project has the potentially higher NPV? Discuss the risk return trade-offs of the two projects . If the firm wished to minimize losses (that is, NPV