Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answers for part A QUESTION 2 Bamboo Holdings has decided to expand its business and RM10 million worth of external funds is needed. There

please answers for part A

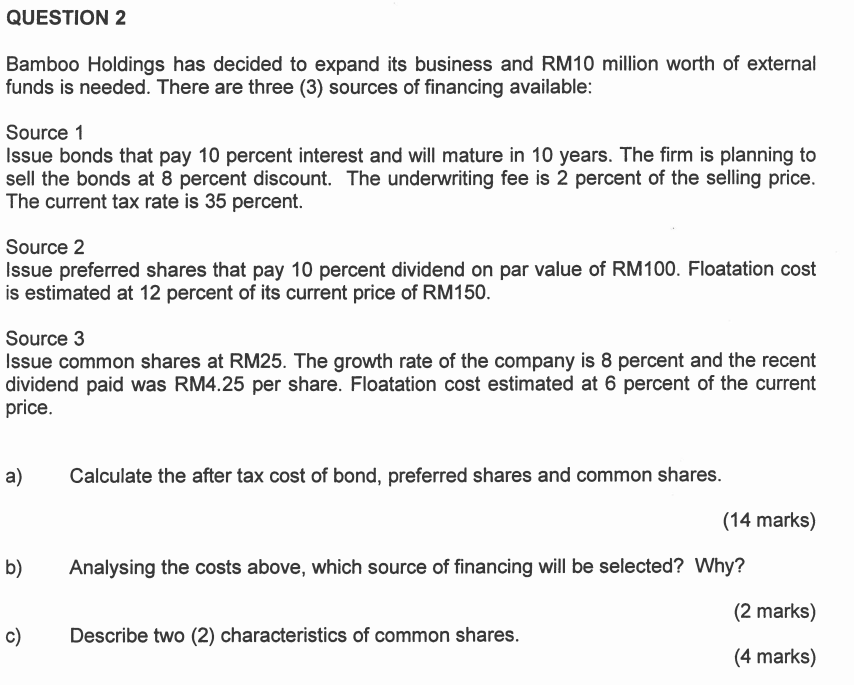

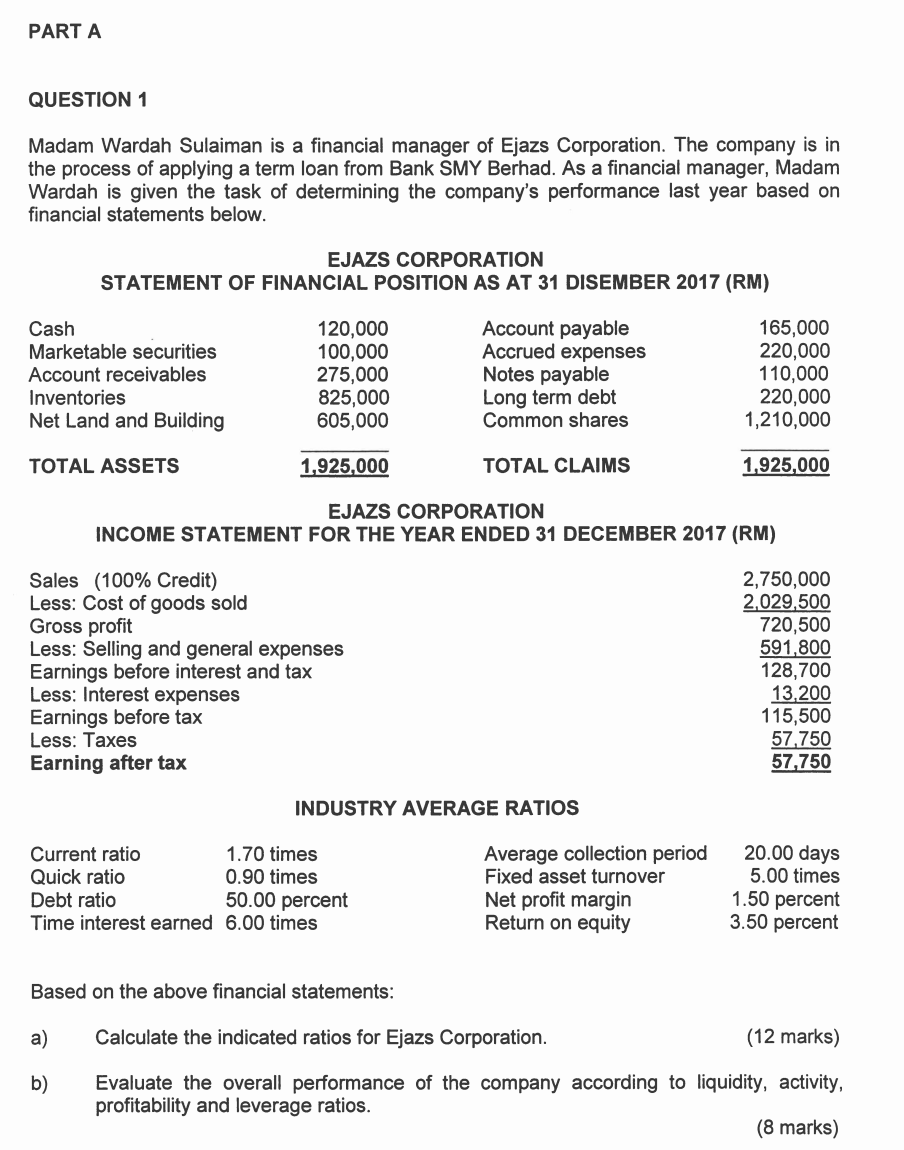

QUESTION 2 Bamboo Holdings has decided to expand its business and RM10 million worth of external funds is needed. There are three (3) sources of financing available: Source 1 Issue bonds that pay 10 percent interest and will mature in 10 years. The firm is planning to sell the bonds at 8 percent discount. The underwriting fee is 2 percent of the selling price. The current tax rate is 35 percent. Source 2 Issue preferred shares that pay 10 percent dividend on par value of RM100. Floatation cost is estimated at 12 percent of its current price of RM150. Source 3 Issue common shares at RM25. The growth rate of the company is 8 percent and the recent dividend paid was RM4.25 per share. Floatation cost estimated at 6 percent of the current price. a) Calculate the after tax cost of bond, preferred shares and common shares. (14 marks) b) Analysing the costs above, which source of financing will be selected? Why? (2 marks) c) Describe two (2) characteristics of common shares. (4 marks) PART A QUESTION 1 Madam Wardah Sulaiman is a financial manager of Ejazs Corporation. The company is in the process of applying a term loan from Bank SMY Berhad. As a financial manager, Madam Wardah is given the task of determining the company's performance last year based on financial statements below. EJAZS CORPORATION STATEMENT OF FINANCIAL POSITION AS AT 31 DISEMBER 2017 (RM) Cash Marketable securities Account receivables Inventories Net Land and Building 120,000 100,000 275,000 825,000 605,000 Account payable Accrued expenses Notes payable Long term debt Common shares 165,000 220,000 110,000 220,000 1,210,000 TOTAL ASSETS 1,925,000 TOTAL CLAIMS 1.925,000 EJAZS CORPORATION INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2017 (RM) Sales (100% Credit) Less: Cost of goods sold Gross profit Less: Selling and general expenses Earnings before interest and tax Less: Interest expenses Earnings before tax Less: Taxes Earning after tax 2,750,000 2,029,500 720,500 591,800 128,700 13.200 115,500 57.750 57,750 INDUSTRY AVERAGE RATIOS Current ratio 1.70 times Quick ratio 0.90 times Debt ratio 50.00 percent Time interest earned 6.00 times Average collection period Fixed asset turnover Net profit margin Return on equity 20.00 days 5.00 times 1.50 percent 3.50 percent Based on the above financial statements: a) Calculate the indicated ratios for Ejazs Corporation. (12 marks) b) Evaluate the overall performance of the company according to liquidity, activity, profitability and leverage ratios. (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started