Answered step by step

Verified Expert Solution

Question

1 Approved Answer

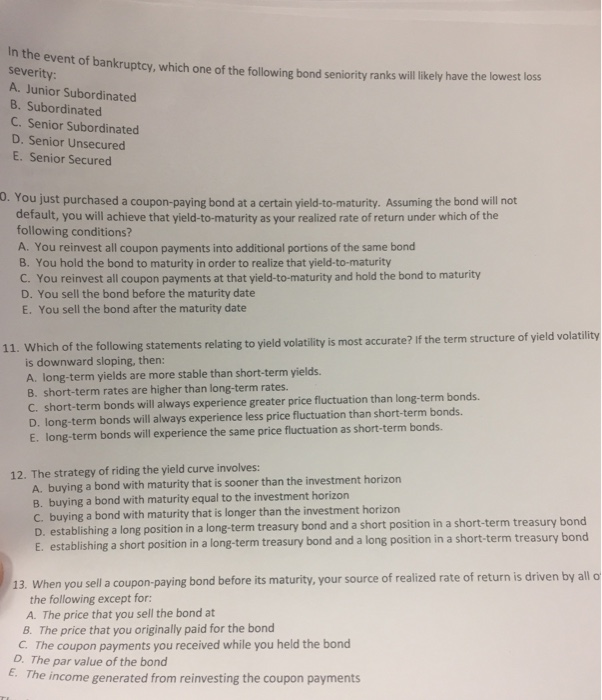

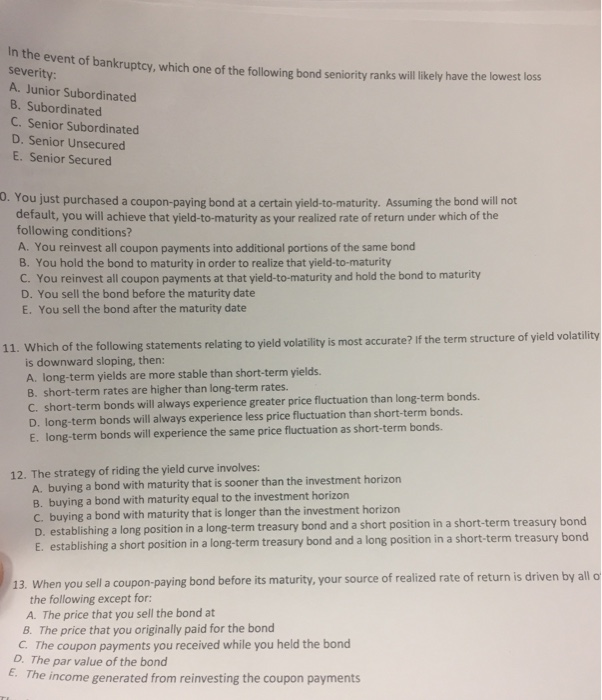

please answrr all In the e event of bankruptcy, which one of the following bond seniority ranks willIkely have the lowest oss severity: A. Junior

please answrr all

In the e event of bankruptcy, which one of the following bond seniority ranks willIkely have the lowest oss severity: A. Junior Subordinated B. Subordinated C. Senior Subordinated D. Senior Unsecured E. Senior Secured 0. You just purchased a coupon-paying bond at a certain yield-to-maturity. Assuming the bond will not default, you will achieve that yield-to-maturity as your realized rate of return under which of the following conditions? A. You reinvest all coupon payments into additional portions of the same bond B. You hold the bond to maturity in order to realize that yield-to-maturity C. You reinvest all coupon payments at that yield-to-maturity and hold the bond to maturity D. You sell the bond before the maturity date E. You sell the bond after the maturity date 11. Which of the following statements relating to yield volatility is most accurate? If the term structure of yield volatil is downward sloping, then: A. long-term yields are more stable than short-term yields B. short-term rates are higher than long-term rates. C. short-term bonds will always experience greater price fluctuation than long-term bonds. D. long-term bonds will always experience less price fluctuation than short-term bonds. E. long-term bonds will experience the same price fluctuation as short-term bonds. 12. The strategy of riding the yield curve involves: A. buying a bond with maturity that is sooner than the investment horizon B. buying a bond with maturity equal to the investment horizon C. buying a bond with maturity that is longer than the investment horizon establishing a long position in a long-term treasury bond and a short position in a short-term treasury bond E. establishing a short position in a long-term treasury bond and a long position in a short-term treasury bond D. 13. When you sell a coupon-paying bond before its maturity, your source of realized rate of return is driven by all the following except for: A. The price that you sell the bond at B. The price that you originally paid for the bond The coupon payments you received while you held the bond D. The par value of the bond C. . The income generated from reinvesting the coupon payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started