Answered step by step

Verified Expert Solution

Question

1 Approved Answer

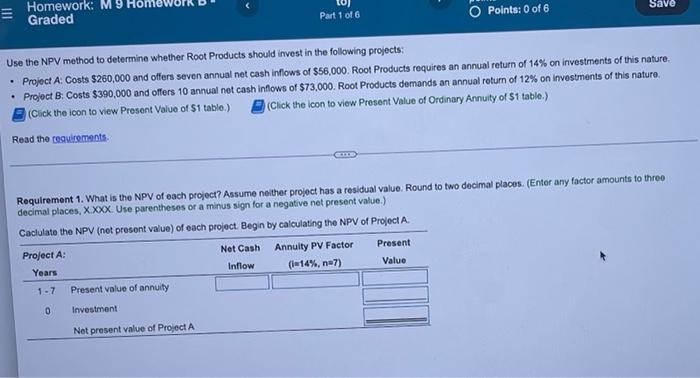

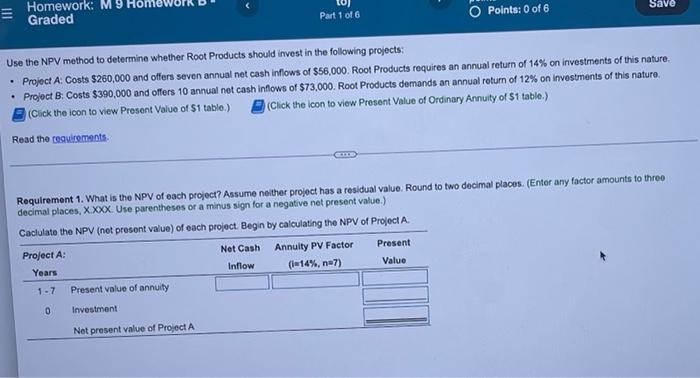

please anwer completly. Homework: M9 Graded Part 1 of 6 Points: 0 of 6 Save Use the NPV method to determine whether Root Products should

please anwer completly.

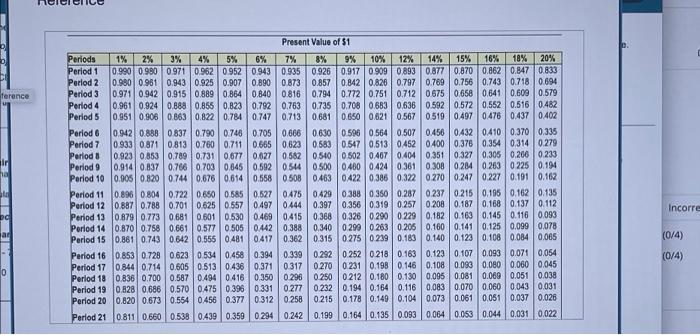

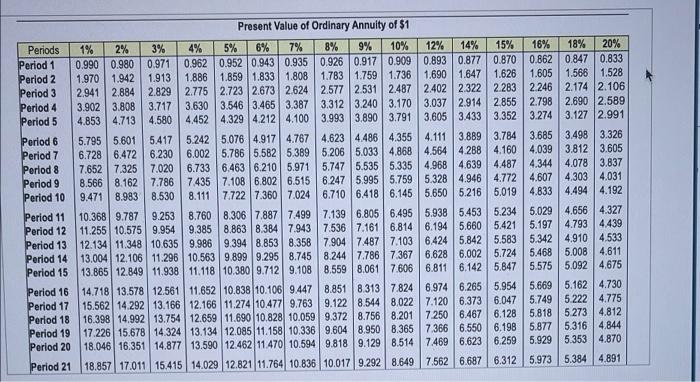

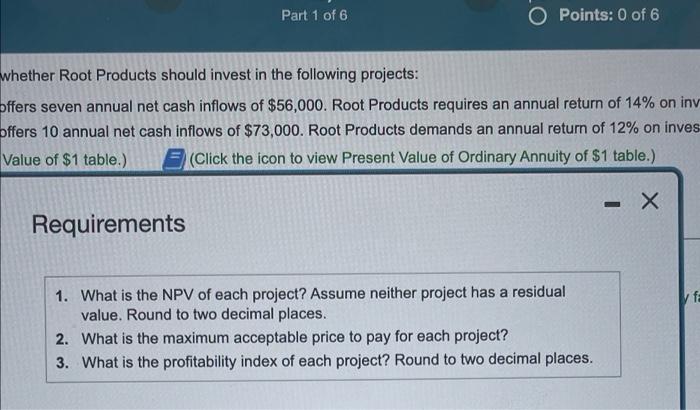

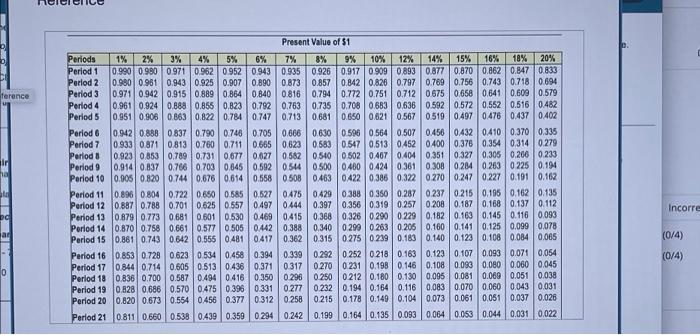

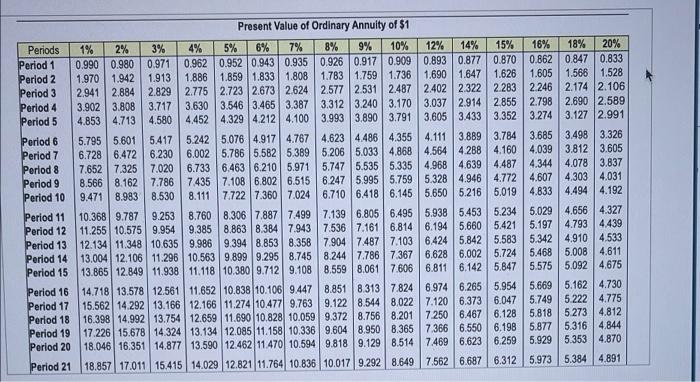

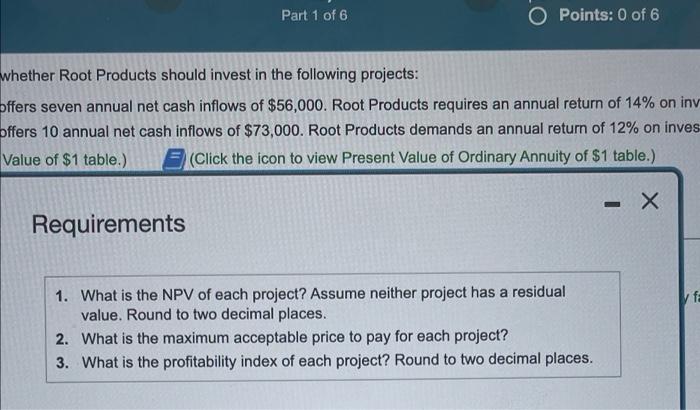

Homework: M9 Graded Part 1 of 6 Points: 0 of 6 Save Use the NPV method to determine whether Root Products should invest in the following projects: Project A: Costs $260,000 and offers seven annual net cash inflows of $56,000. Root Products requires an annual return of 14% on investments of this nature. Project B: Costs $390,000 and offers 10 annual net cash inflows of $73,000. Root Products demands an annual return of 12% on investments of this nature. (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Present Value of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Annuity PV Factor Present Net Cash Inflow Years (14%, n=7) Value 1-7 Present value of annuity 0 Investment Net present value of Project A ference ir ha DC ar INC 0 Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 7% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.943 0.962 0.952 0.907 Period 2 0.980 0.961 0.943 0.925 8% 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 Period 3 0.935 0.890 0.873 0.840 0.816 0.888 0.855 0.823 0.792 0.763 0.863 0.822 0.784 0.747 0.713 0.971 0.942 0.915 0.889 0.864 Period 4 0.961 0.924 Period 5 0.951 0.906 Period 6 Period 7 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0432 0.410 0.370 0.335 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0,452 0.400 0.376 0.354 0.314 0.279 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.544 0.500 0.400 0.424 0.361 0.308 0.284 0.263 0.225 0.194 Period 8 Period 9 0.923 0.853 0.789 0.731 0.677 0.627 0.914 0.837 0.766 0.703 0,645 0.592 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 Period 10 Period 11 0.896 0.804 Period 12 0.887 0.788 Period 13 0.879 0.773 Period 14 Period 15 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.195 0,162 0.135 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0218 0.163 0.123 0.107 0.093 0.071 0.054 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.060 0.060 0.045 0.350 0.296 0.250 0212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 0.073 0.061 0.051 0.037 0.026 Period 16 0.853 0.728 0.844 0.714 Period 17 Period 18 0.836 0.700 0.587 0.494 0.416 Period 19 0.828 0,686 0.570 0.475 0.396 0.820 0.673 0.554 Period 20 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 Period 21 0.811 0.660 0.538 0.439 0.359 0.294 0242 0.199 0.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022 O D. Incorre (0/4) (0/4) Present Value of Ordinary Annuity of $1 1% 3% 4% 15% 16% 18% 20% 5% 6% 2% 0.990 0.980 0.971 0.962 0.952 0.943 10% 8% 7% 9% 0.935 0.926 0.917 0.909 14% 12% 0.893 0.877 0.870 0.862 0.847 0.833 Period 1 Period 2 1.626 1.605 1.566 1.528 Period 3 1.970 1.942 1.913 2.941 2.884 2.829 3.902 3.808 3.717 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 4.853 4.713 4.580 4.452 4.329 4.212 4.100 2.246 2.174 2.106 Period 4 Period 5 3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 4.111 3.889 3.498 3.326 5.076 4.917 4.767 4.623 4.486 4.355 5.786 5.582 5.389 5.206 5.033 4.868 4.564 3.784 3.685 4.160 4.039 3.812 3.605 4.288 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 10.368 9.787 9.253 Period 12 11.255 10.575 9.954 Period 13 12.134 11.348 10.635 Period 14 5.795 5.601 5.417 5.242 6.728 6.472 6.230 6.002 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 4.607 4.303 4.031 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 5.029 4.656 4.327 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.421 5.197 4.793 4.439 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.842 5.583 5.342 4.910 4.533 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.847 5.575 5.092 4.675 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 6.265 5.954 5.669 5.162 4.730 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.120 6.373 6.047 5.749 5.222 4.775 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 6.128 5.818 5.273 4.812 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 6.198 5.877 5.316 4.844 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.469 6.623 6.259 5.929 5.353 4.870 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 7.562 6.687 6.312 13.004 12.106 11.296 13.865 12.849 11.938 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 5.973 5.384 4.8911 Periods Part 1 of 6 O Points: 0 of 6 whether Root Products should invest in the following projects: offers seven annual net cash inflows of $56,000. Root Products requires an annual return of 14% on inv offers 10 annual net cash inflows of $73,000. Root Products demands an annual return of 12% on inves Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) .X Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places. - fa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started