Question: please as soon as possible edited Description of the Taski The aim of this task is to give you the opportunity to demonstrate your level

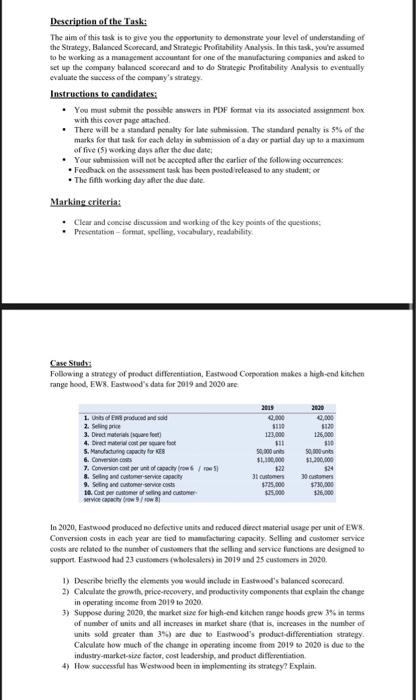

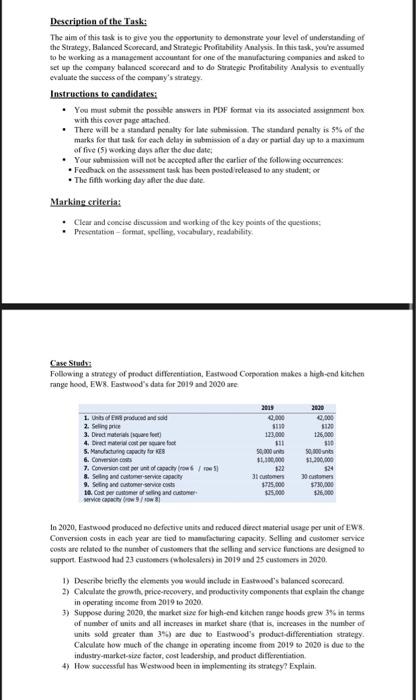

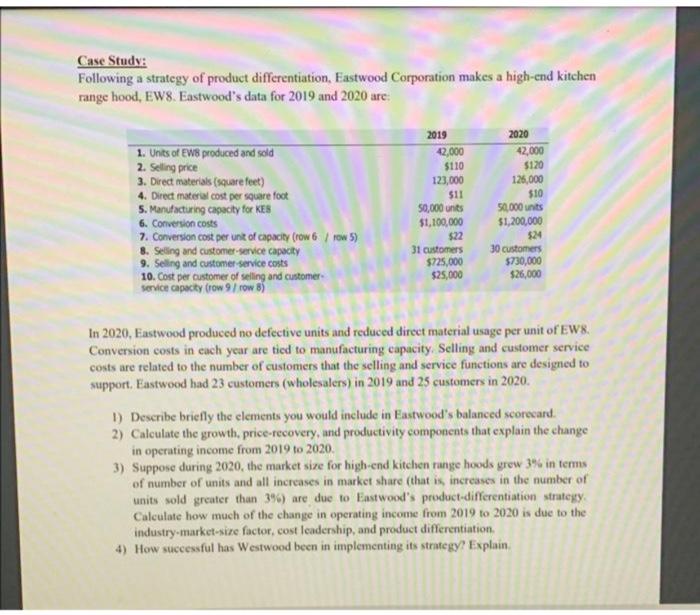

Description of the Taski The aim of this task is to give you the opportunity to demonstrate your level of understanding of the Strategy, Balanced Scorecard, and Strategic Profitability Analysis. In this task, you're assumed to be working as a management accountant for one of the manufacturing companies and asked to set up the company balanced Scorecard and to do Strategic Profitability Analysis to eventually evaluate the success of the company's strategy Instructions to candidates: . You must submit the possible answers in PDF format via its associated assignment box with this cover page attached . There will be a standard penalty for the submission. The standard penalty is S% of the marks for that take for each delay in submission of a day or partial day up to a maximum of five (5) working days after the due date Your submission will not be accepted after the carlier of the following occurrences: Feedback on the assessment task has been posted released to any student, or The fifth working day after the due date. Marking criteria: Clear and concise discussion and working of the key points of the questions Presentation - format pulling vocabulary, readability Case Study Following a strategy of product differentiation, Eastwood Corporation makes a high-end kitchen range hood. EW8. Fastwood's data for 2019 and 2020 are 2015 0.000 1130 127.000 1. On en produced and said 2. Sel 3. Direct materials for 4. Directe con persone fact S. Mary for 6. Conversion cos 7. Convention cost petunt of capuchyfrowe) & Seling and customer service capacity 9. Selling and customer service costs 10. Cost per bustomer al setting and Customer Microw/rowi 111 50,000 100.000 122 3 customers 1725.000 35.000 2000 0.000 5120 126,000 10 30 000 $1.200.000 24 customers $70,000 2.000 In 2020, Eastwood produced no defective units and reduced direct material usage per unit of EW Conversion costs in each year are tied to manufacturing capacity. Selling and customer service costs are related to the number of customers that the selling and service functions are designed 10 support. Eastwood hod 23 customers (wholesalers) in 2019 and 25 customers in 2020 1) Describe bietly the elements you would include in Eastwood's balanced Scorecard. 2) Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2019 to 2020. 3) Suppose during 2020, the market size for high-end kitchen range hoods grew 3% in terms of number of units and all increases in market share (that is increases in the number of units sold greater than 3%) are due to Eastwood's product-differentiation strategy Calculate how much of the change in operating income from 2019 to 2020 is due to the industry-market-stae factor, cost leadership, and product differentiation 4) How successful has Westwood boen in implementing its strategy? Explain Description of the Task The aim of this task is to give you the opportunity to demonstrate your level of understanding of the Strategy, Balanced Scorecard, and Strategic Profitability Analysis. In this task, you're assumed to be working as a management accountant for one of the manufacturing companies and asked to set up the company balanced Scorecard and to do Strategic Profitability Analysis to eventually evaluate the success of the company's strategy Instructions to candidates: . You must submit the possible answers in PDF format vin its associated assignment.box with this cover page attached . There will be a standard penalty for late submission. The standard penalty is 5% of the marks for that task for each delay in submission of a day or partial day up to a maximum of five (5) working days after the due date Your submission will not be accepted after the carlier of the following occurrences: Feedback on the assessment task has been posted released to any student, or The fifth working day after the due date. Marking criteria: Clear and concise discussion and working of the key points of the questions: Presentation format pelling vocabulary, readability Case Study Following a strategy of product differentiation, Eastwood Corporation makes a high-end kitchen range hood, EW8. Fastwood's data for 2019 and 2020 are 2000 1. his produced and said 2. Seine 3. Direct materials 4. Drew.cost perek S. Marci cytore 6. Conversions 7. Convenio con perust of capacity from /res) & Seling and customer service capacity 9. Selling and customer services 10. Coster customer og and Customer Mervice Capacity98 2015 0.000 5150 123.000 111 50,000 1.100.000 122 3 customers 1725.000 5120 126,000 30 50,000 to $1.200,000 24 3 customers $730,000 . In 2020, Eastwood produced no defective units and reduced direct material usage per unit of EW8 Conversion costs in each year are tied to manufacturing capacity. Selling and customer service costs are related to the number of customers that the selling and service functions are designed to support. Eastwood had 23 customers (wholesalers) in 2019 and 25 customers in 2020 1) Describe briefly the elements you would include in Eastwool's balanced Scorecard. 2) Calculate the growth, price recovery, and productivity components that explain the change in operating income from 2019 to 2020. 3) Suppose during 2020, the market size for high-end kitchen mange hoods grew 3% in terms of number of units and all increases in market share (that is increases in the number of units sold greater than 3%) are due to Eastwood's product differentiation strategy Calculate how much of the change in operating income from 2019 to 2020 is due to the industry-market-size factor, cost leadership, and product differentiation 4) How successful has Westwood been in implementing its strategy? Explain Case Study: Following a strategy of product differentiation, Eastwood Corporation makes a high-end kitchen range hood, EW8. Eastwood's data for 2019 and 2020 are: 1. Units of EW8 produced and sold 2. Selling price 3. Direct materials (square feet) 4. Direct material cost per square foot 5. Manufacturing capacity for KES 6. Conversion costs 7. Conversion cost per unit of capacity (row 6 / row 5) 8. Seling and customer service capacity 9. Seling and customer service costs 10. Cost per customer of selling and customer Service Capacity crow 9 row 8) 2019 12,000 $110 123,000 $11 50,000 unts $1,100,000 $22 31 customers $725,000 $25,000 2020 42,000 5120 126,000 $10 50.000 units $1,200,000 524 30 customers 5730,000 $26,000 In 2020, Eastwood produced no defective units and reduced direct material usage per unit of EW8. Conversion costs in each year are tied to manufacturing capacity. Selling and customer service costs are related to the number of customers that the selling and service functions are designed to support. Eastwood had 23 customers (wholesalers) in 2019 and 25 customers in 2020. 1) Describe briefly the elements you would include in Eastwood's balanced scorecard. 2) Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2019 to 2020 3) Suppose during 2020, the market size for high-end kitchen range hoods grow 3% in terms of number of units and all increases in market share that is increases in the number of units sold greater than 3%) are due to Eastwood's product-differentiation strategy Calculate how much of the change in operating income from 2019 to 2020 is due to the industry-market-size factor, cost leadership, and product differentiation 4) How successful has Westwood been in implementing its strategy? Explain Description of the Taski The aim of this task is to give you the opportunity to demonstrate your level of understanding of the Strategy, Balanced Scorecard, and Strategic Profitability Analysis. In this task, you're assumed to be working as a management accountant for one of the manufacturing companies and asked to set up the company balanced Scorecard and to do Strategic Profitability Analysis to eventually evaluate the success of the company's strategy Instructions to candidates: . You must submit the possible answers in PDF format via its associated assignment box with this cover page attached . There will be a standard penalty for the submission. The standard penalty is S% of the marks for that take for each delay in submission of a day or partial day up to a maximum of five (5) working days after the due date Your submission will not be accepted after the carlier of the following occurrences: Feedback on the assessment task has been posted released to any student, or The fifth working day after the due date. Marking criteria: Clear and concise discussion and working of the key points of the questions Presentation - format pulling vocabulary, readability Case Study Following a strategy of product differentiation, Eastwood Corporation makes a high-end kitchen range hood. EW8. Fastwood's data for 2019 and 2020 are 2015 0.000 1130 127.000 1. On en produced and said 2. Sel 3. Direct materials for 4. Directe con persone fact S. Mary for 6. Conversion cos 7. Convention cost petunt of capuchyfrowe) & Seling and customer service capacity 9. Selling and customer service costs 10. Cost per bustomer al setting and Customer Microw/rowi 111 50,000 100.000 122 3 customers 1725.000 35.000 2000 0.000 5120 126,000 10 30 000 $1.200.000 24 customers $70,000 2.000 In 2020, Eastwood produced no defective units and reduced direct material usage per unit of EW Conversion costs in each year are tied to manufacturing capacity. Selling and customer service costs are related to the number of customers that the selling and service functions are designed 10 support. Eastwood hod 23 customers (wholesalers) in 2019 and 25 customers in 2020 1) Describe bietly the elements you would include in Eastwood's balanced Scorecard. 2) Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2019 to 2020. 3) Suppose during 2020, the market size for high-end kitchen range hoods grew 3% in terms of number of units and all increases in market share (that is increases in the number of units sold greater than 3%) are due to Eastwood's product-differentiation strategy Calculate how much of the change in operating income from 2019 to 2020 is due to the industry-market-stae factor, cost leadership, and product differentiation 4) How successful has Westwood boen in implementing its strategy? Explain Description of the Task The aim of this task is to give you the opportunity to demonstrate your level of understanding of the Strategy, Balanced Scorecard, and Strategic Profitability Analysis. In this task, you're assumed to be working as a management accountant for one of the manufacturing companies and asked to set up the company balanced Scorecard and to do Strategic Profitability Analysis to eventually evaluate the success of the company's strategy Instructions to candidates: . You must submit the possible answers in PDF format vin its associated assignment.box with this cover page attached . There will be a standard penalty for late submission. The standard penalty is 5% of the marks for that task for each delay in submission of a day or partial day up to a maximum of five (5) working days after the due date Your submission will not be accepted after the carlier of the following occurrences: Feedback on the assessment task has been posted released to any student, or The fifth working day after the due date. Marking criteria: Clear and concise discussion and working of the key points of the questions: Presentation format pelling vocabulary, readability Case Study Following a strategy of product differentiation, Eastwood Corporation makes a high-end kitchen range hood, EW8. Fastwood's data for 2019 and 2020 are 2000 1. his produced and said 2. Seine 3. Direct materials 4. Drew.cost perek S. Marci cytore 6. Conversions 7. Convenio con perust of capacity from /res) & Seling and customer service capacity 9. Selling and customer services 10. Coster customer og and Customer Mervice Capacity98 2015 0.000 5150 123.000 111 50,000 1.100.000 122 3 customers 1725.000 5120 126,000 30 50,000 to $1.200,000 24 3 customers $730,000 . In 2020, Eastwood produced no defective units and reduced direct material usage per unit of EW8 Conversion costs in each year are tied to manufacturing capacity. Selling and customer service costs are related to the number of customers that the selling and service functions are designed to support. Eastwood had 23 customers (wholesalers) in 2019 and 25 customers in 2020 1) Describe briefly the elements you would include in Eastwool's balanced Scorecard. 2) Calculate the growth, price recovery, and productivity components that explain the change in operating income from 2019 to 2020. 3) Suppose during 2020, the market size for high-end kitchen mange hoods grew 3% in terms of number of units and all increases in market share (that is increases in the number of units sold greater than 3%) are due to Eastwood's product differentiation strategy Calculate how much of the change in operating income from 2019 to 2020 is due to the industry-market-size factor, cost leadership, and product differentiation 4) How successful has Westwood been in implementing its strategy? Explain Case Study: Following a strategy of product differentiation, Eastwood Corporation makes a high-end kitchen range hood, EW8. Eastwood's data for 2019 and 2020 are: 1. Units of EW8 produced and sold 2. Selling price 3. Direct materials (square feet) 4. Direct material cost per square foot 5. Manufacturing capacity for KES 6. Conversion costs 7. Conversion cost per unit of capacity (row 6 / row 5) 8. Seling and customer service capacity 9. Seling and customer service costs 10. Cost per customer of selling and customer Service Capacity crow 9 row 8) 2019 12,000 $110 123,000 $11 50,000 unts $1,100,000 $22 31 customers $725,000 $25,000 2020 42,000 5120 126,000 $10 50.000 units $1,200,000 524 30 customers 5730,000 $26,000 In 2020, Eastwood produced no defective units and reduced direct material usage per unit of EW8. Conversion costs in each year are tied to manufacturing capacity. Selling and customer service costs are related to the number of customers that the selling and service functions are designed to support. Eastwood had 23 customers (wholesalers) in 2019 and 25 customers in 2020. 1) Describe briefly the elements you would include in Eastwood's balanced scorecard. 2) Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2019 to 2020 3) Suppose during 2020, the market size for high-end kitchen range hoods grow 3% in terms of number of units and all increases in market share that is increases in the number of units sold greater than 3%) are due to Eastwood's product-differentiation strategy Calculate how much of the change in operating income from 2019 to 2020 is due to the industry-market-size factor, cost leadership, and product differentiation 4) How successful has Westwood been in implementing its strategy? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts