Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please ASAP and show the work! Below is the most recent financial information for Auster's Books Company. If Auster's Books decides to maintain a constant

Please ASAP and show the work!

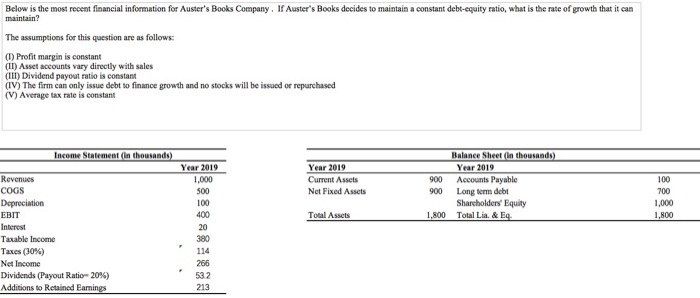

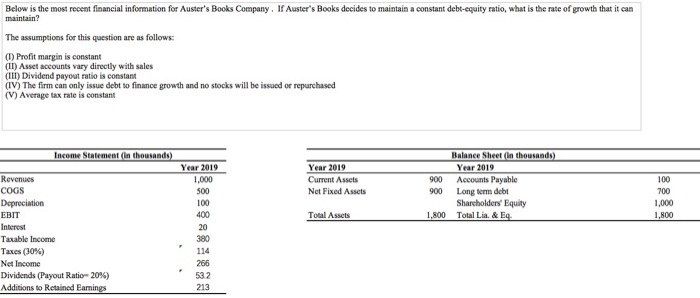

Below is the most recent financial information for Auster's Books Company. If Auster's Books decides to maintain a constant debt-equity ratio, what is the rate of growth that it can maintain? The assumptions for this question are as follows: (I) Profit margin is constant (II) Asset accounts vary directly with sales (III) Dividend payout ratio is constant (IV) The firm can only issue debt to finance growth and no stocks will be issued or repurchased (V) Average tax rate is constant Income Statement (in thousands) Year 2019 1.000 500 100 400 20 Year 2019 Current Assets Net Fixed Assets Total Assets Balance Sheet (In thousands) Year 2019 900 Accounts Payable 900 Long term debt Shareholders' Equity 1.800 Total Lia. & E. 100 700 1,000 1,800 Revenues COGS Depreciation EBIT Interest Taxable income Taxes (30%) Net Income Dividends (Payout Ratio-20%) Additions to Retained Earnings 380 114 266 53.2 213

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started