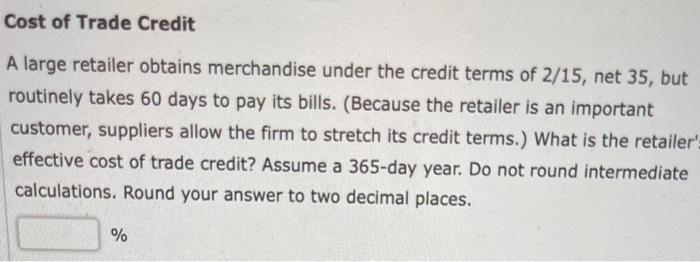

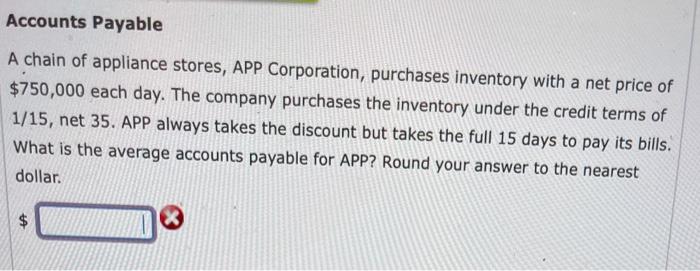

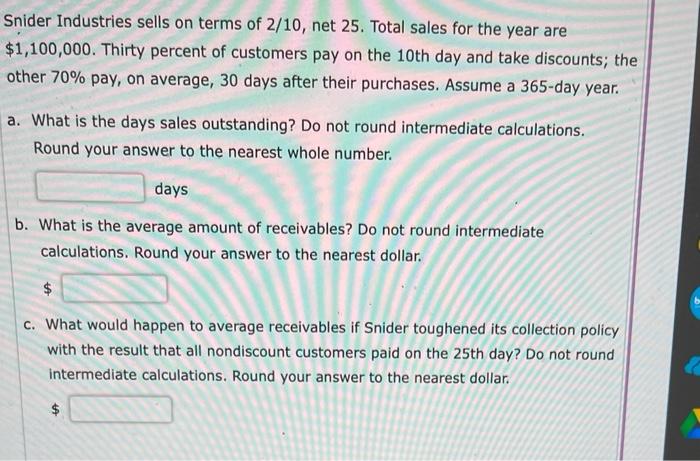

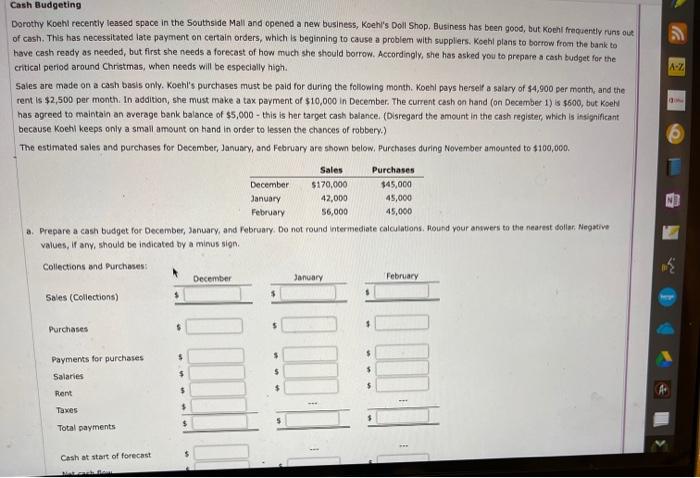

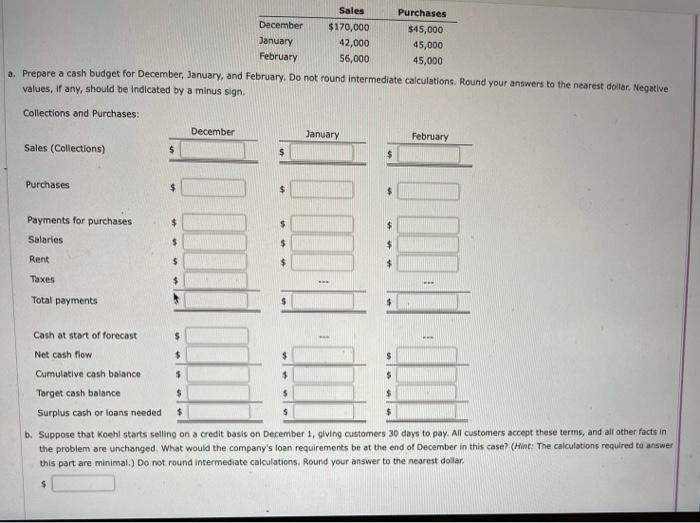

Cost of Trade Credit A large retailer obtains merchandise under the credit terms of 2/15, net 35, but routinely takes 60 days to pay its bills. (Because the retailer is an important customer, suppliers allow the firm to stretch its credit terms.) What is the retailers effective cost of trade credit? Assume a 365-day year. Do not round intermediate calculations. Round your answer to two decimal places. % Accounts Payable A chain of appliance stores, APP Corporation, purchases inventory with a net price of $750,000 each day. The company purchases the inventory under the credit terms of 1/15, net 35. APP always takes the discount but takes the full 15 days to pay its bills. What is the average accounts payable for APP? Round your answer to the nearest dollar. Snider Industries sells on terms of 2/10, net 25. Total sales for the year are $1,100,000. Thirty percent of customers pay on the 10th day and take discounts; the other 70% pay, on average, 30 days after their purchases. Assume a 365-day year. a. What is the days sales outstanding? Do not round intermediate calculations. Round your answer to the nearest whole number. days b. What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest dollar $ c. What would happen to average receivables if Snider toughened its collection policy with the result that all nondiscount customers paid on the 25th day? Do not round intermediate calculations. Round your answer to the nearest dollar. $ A-Z Cash Budgeting Dorothy Koeht recently teased space in the Southside Mall and opened a new business, Koehl's Doll Shop, Business has been good, but Koent frequently runs out of cash. This has necessitated late payment on certain orders, which is beginning to cause a problem with suppliers. Koehl plans to borrow from the bank to have cash ready as needed, but first she needs a forecast of how much she should borrow. Accordingly, she has asked you to prepare a cash budget for the critical period around Christmas, when needs will be especially high. Sales are made on a cash basis only. Koehl's purchases must be paid for during the following month. Koehl pays herself a salary of 54,900 per month, and the rent is $2,500 per month. In addition, she must make a tax payment of $10,000 in December. The current cash on hand (on December 1) $600, but Koh has agreed to maintain an average bank balance of $5,000 - this is har target cash balance (Disregard the amount in the cash register, which is insignificant because Koeht keeps only a small amount on hand in order to lessen the chances of robbery.) The estimated sales and purchases for December, January, and February are shown below, Purchases during November amounted to $100,000. Sales Purchases December $170,000 345,000 42,000 45,000 February 56,000 45,000 a. Prepare a cash budget for December, January, and February. Do not round intermediate calculations. Round your answers to the nearest dollar. Negative values, if any, should be indicated by a minus sign Collections and purchases December January February Sales (Collections) January Purchases $ $ $ $ Payments for purchases Salaries $ S $ 5 $ Rent $ Taxes $ Total payments Cash at start of forecast Sales Purchases December $170,000 $45,000 January 42,000 45,000 February 56,000 45,000 a. Prepare a cash budget for December, January, and February. Do not round intermediate calculations. Round your answers to the nearest doltar. Negative values, if any, should be indicated by a minus sign. Collections and Purchases: December January February Sales (Collections) $ Purchases $ $ $ Payments for purchases Salaries $ $ Rent $ $ Taxes $ Total payments Cash at start of forecast $ $ $ Net cash flow $ Cumulative cash balance $ $ $ Target cash balance $ $ Surplus cash or loans needed $ $ b. Suppose that Koehl starts selling on a credit basis on December 1, giving customers 30 days to pay. All customers accept these terms, and all other facts in the problem are unchanged. What would the company's loan requirements be at the end of December in this case? (Hint: The calculations required to answer this part are minimal.) Do not round intermediate calculations. Round your answer to the nearest dollar $