Answered step by step

Verified Expert Solution

Question

1 Approved Answer

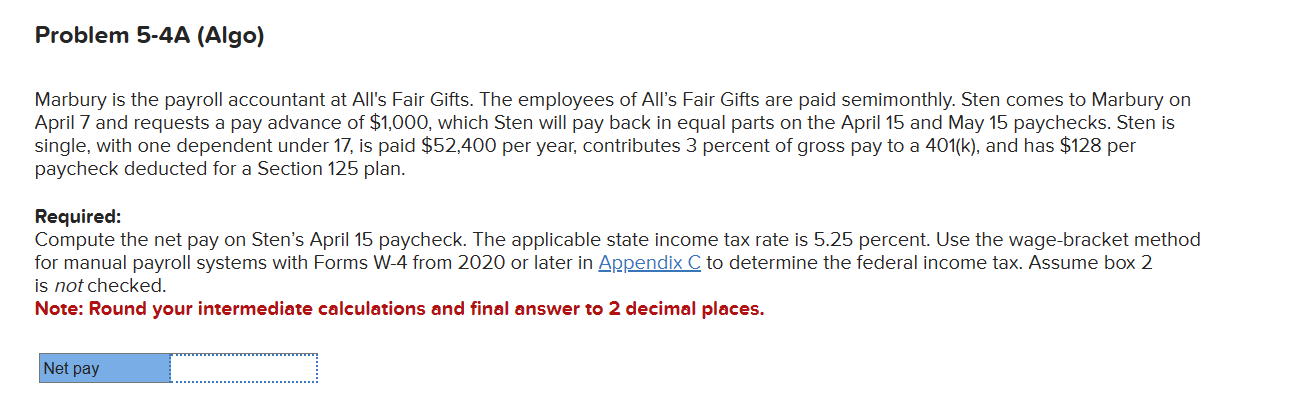

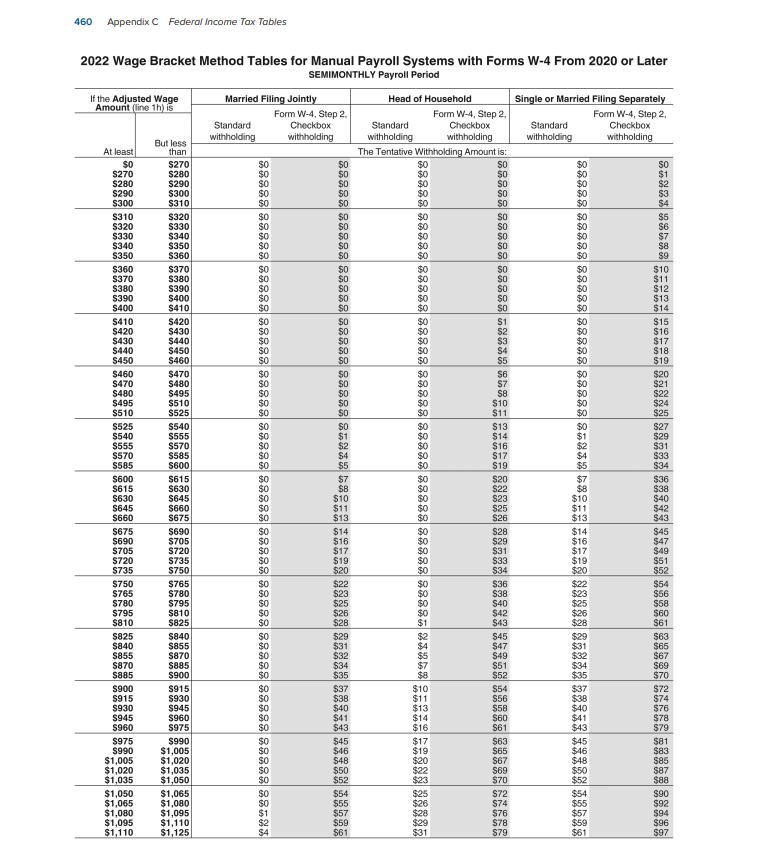

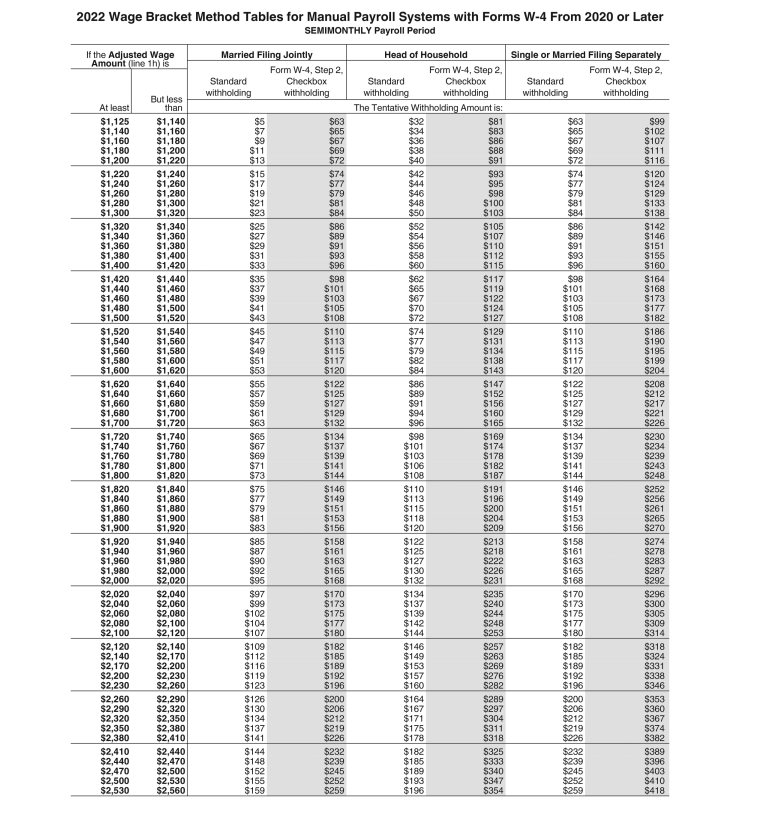

Please assist having trouble calculating the net pay 460 Appendix C Federal Income Tax Tables 2022 Wage Bracket Method Tables for Manual Payroll Systems with

Please assist having trouble calculating the net pay

460 Appendix C Federal Income Tax Tables 2022 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later SEMIMONTHLY Payroll Period \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted Wage \\ Amount (line 1h ) is \end{tabular}} & \multicolumn{2}{|c|}{ Married Filing Jointly } & \multicolumn{2}{|c|}{ Head of Household } & \multicolumn{2}{|c|}{ Single or Married Filing Separately } \\ \hline \multirow[b]{2}{*}{ At least } & \multirow{2}{*}{\begin{tabular}{c} But less \\ than \end{tabular}} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} \\ \hline & & \multicolumn{6}{|c|}{ The Tentative Withholding Amount is: } \\ \hline \begin{tabular}{r} $0 \\ $270 \\ $280 \\ $290 \\ $300 \end{tabular} & \begin{tabular}{l} $270 \\ $280 \\ $290 \\ $300 \\ $310 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} So \\ so \\ So \\ So \\ so \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} \$0 \\ $1 \\ $2 \\ $3 \\ $4 \end{tabular} \\ \hline \begin{tabular}{l} $310 \\ $320 \\ $330 \\ $340 \\ $350 \end{tabular} & \begin{tabular}{l} $320 \\ $330 \\ $340 \\ $350 \\ $360 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $$0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} so \\ so \\ so \\ so \\ so \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $5 \\ $6 \\ $7 \\ $8 \\ $9 \end{tabular} \\ \hline \begin{tabular}{l} $360 \\ $370 \\ $380 \\ $390 \\ $400 \\ \end{tabular} & \begin{tabular}{l} $370 \\ $380 \\ $390 \\ $400 \\ $410 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} S0 \\ s0 \\ S0 \\ S0 \\ so \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $10 \\ $11 \\ $12 \\ $13 \\ $14 \\ \end{tabular} \\ \hline \begin{tabular}{l} $410 \\ $420 \\ $430 \\ $440 \\ $450 \end{tabular} & \begin{tabular}{l} $420 \\ $430 \\ $440 \\ $450 \\ $460 \end{tabular} & \begin{tabular}{l} \$0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $1 \\ $2 \\ $3 \\ $4 \\ $5 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $15 \\ $16 \\ $17 \\ $18 \\ $19 \end{tabular} \\ \hline \begin{tabular}{l} $460 \\ $470 \\ $480 \\ $495 \\ $510 \end{tabular} & \begin{tabular}{l} $470 \\ $480 \\ $495 \\ $510 \\ $525 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{r} $6 \\ $7 \\ $8 \\ $10 \\ $11 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $20 \\ $21 \\ $22 \\ $24 \\ $25 \\ \end{tabular} \\ \hline \begin{tabular}{l} $525 \\ $540 \\ $555 \\ $570 \\ $585 \end{tabular} & \begin{tabular}{l} $540 \\ $555 \\ $570 \\ $585 \\ $600 \end{tabular} & \begin{tabular}{l} \$0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $1 \\ $2 \\ $4 \\ $5 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $13 \\ $14 \\ $16 \\ $17 \\ $19 \end{tabular} & \begin{tabular}{l} $0 \\ $1 \\ $2 \\ $4 \\ $5 \end{tabular} & \begin{tabular}{l} $27 \\ $29 \\ $31 \\ $33 \\ $34 \end{tabular} \\ \hline \begin{tabular}{l} $600 \\ $615 \\ $630 \\ $645 \\ $660 \end{tabular} & \begin{tabular}{l} $615 \\ $630 \\ $645 \\ $660 \\ $675 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{r} $7 \\ $8 \\ $10 \\ $11 \\ $13 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $20 \\ $22 \\ $23 \\ $25 \\ $26 \end{tabular} & \begin{tabular}{r} $7 \\ $8 \\ $10 \\ $11 \\ $13 \\ \end{tabular} & \begin{tabular}{l} $36 \\ $38 \\ $40 \\ $42 \\ $43 \\ \end{tabular} \\ \hline \begin{tabular}{l} $675 \\ 5690 \\ $705 \\ $720 \\ $735 \end{tabular} & \begin{tabular}{l} $690 \\ $705 \\ $720 \\ $735 \\ $750 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $14 \\ $16 \\ $17 \\ $19 \\ $20 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $28 \\ $29 \\ $31 \\ $33 \\ $34 \\ \end{tabular} & \begin{tabular}{l} $14 \\ $16 \\ $17 \\ $19 \\ $20 \\ \end{tabular} & \begin{tabular}{l} $45 \\ $47 \\ $49 \\ $51 \\ $52 \\ \end{tabular} \\ \hline \begin{tabular}{l} $750 \\ $765 \\ $780 \\ $795 \\ $810 \end{tabular} & \begin{tabular}{l} $765 \\ $780 \\ $795 \\ $810 \\ $825 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $22 \\ $23 \\ $25 \\ $26 \\ $28 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $1 \end{tabular} & \begin{tabular}{l} $36 \\ $38 \\ $40 \\ $42 \\ $43 \end{tabular} & \begin{tabular}{l} $22 \\ $23 \\ $25 \\ $26 \\ $28 \end{tabular} & \begin{tabular}{l} $54 \\ $56 \\ $58 \\ $60 \\ $61 \end{tabular} \\ \hline \begin{tabular}{l} $825 \\ $840 \\ $855 \\ $870 \\ $885 \end{tabular} & \begin{tabular}{l} S840 \\ $855 \\ S870 \\ S885 \\ $900 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $29 \\ $31 \\ $32 \\ $34 \\ $35 \\ \end{tabular} & \begin{tabular}{l} $2 \\ $4 \\ $5 \\ $7 \\ $8 \end{tabular} & \begin{tabular}{l} $45 \\ $47 \\ $49 \\ $51 \\ $52 \\ \end{tabular} & \begin{tabular}{l} $29 \\ $31 \\ $32 \\ $34 \\ $35 \end{tabular} & \begin{tabular}{l} $63 \\ $65 \\ $67 \\ $69 \\ $70 \\ \end{tabular} \\ \hline \begin{tabular}{l} $900 \\ $915 \\ $930 \\ $945 \\ $960 \end{tabular} & \begin{tabular}{l} $$915 \\ $930 \\ $945 \\ $960 \\ $975 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $37 \\ $38 \\ $40 \\ $41 \\ $43 \end{tabular} & \begin{tabular}{l} $10 \\ $11 \\ $13 \\ $14 \\ $16 \end{tabular} & \begin{tabular}{l} $54 \\ $56 \\ $58 \\ $60 \\ $61 \end{tabular} & \begin{tabular}{l} $37 \\ $38 \\ $40 \\ $41 \\ $43 \end{tabular} & \begin{tabular}{l} $72 \\ $74 \\ $76 \\ $78 \\ $79 \end{tabular} \\ \hline \begin{tabular}{r} $975 \\ $990 \\ $1,005 \\ $1,020 \\ $1,035 \\ \end{tabular} & \begin{tabular}{r} $990 \\ $1,005 \\ $1,020 \\ $1,035 \\ $1,050 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $45 \\ $46 \\ $48 \\ $50 \\ $52 \\ \end{tabular} & \begin{tabular}{l} $17 \\ $19 \\ $20 \\ $22 \\ $23 \\ \end{tabular} & \begin{tabular}{l} $63 \\ $65 \\ $67 \\ $69 \\ $70 \\ \end{tabular} & \begin{tabular}{l} $45 \\ $46 \\ $48 \\ $50 \\ $52 \\ \end{tabular} & \begin{tabular}{l} $81 \\ $83 \\ $85 \\ $87 \\ $88 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,050 \\ $1,065 \\ $1,080 \\ $1,095 \\ $1,110 \end{tabular} & \begin{tabular}{l} $1,065 \\ $1,080 \\ $1,095 \\ $1,110 \\ $1,125 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $1 \\ $2 \\ $4 \end{tabular} & \begin{tabular}{l} $54 \\ $55 \\ $57 \\ $59 \\ $61 \end{tabular} & \begin{tabular}{l} $25 \\ $26 \\ $28 \\ $29 \\ $31 \end{tabular} & \begin{tabular}{l} $72 \\ $74 \\ $76 \\ $78 \\ $79 \end{tabular} & \begin{tabular}{l} $54 \\ $55 \\ $57 \\ $59 \\ $61 \end{tabular} & \begin{tabular}{l} $90 \\ $92 \\ $94 \\ $96 \\ $97 \end{tabular} \\ \hline \end{tabular} Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Sten comes to Marbury on April 7 and requests a pay advance of $1,000, which Sten will pay back in equal parts on the April 15 and May 15 paychecks. Sten is single, with one dependent under 17 , is paid $52,400 per year, contributes 3 percent of gross pay to a 401(k), and has $128 per paycheck deducted for a Section 125 plan. Required: Compute the net pay on Sten's April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the wage-bracket method for manual payroll systems with Forms W-4 from 2020 or later in to determine the federal income tax. Assume box 2 is not checked. Note: Round your intermediate calculations and final answer to 2 decimal places. 2022 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later SEMIMONTHLY Payroll Period \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted Wage \\ Amount (line 1h ) is \end{tabular}} & \multicolumn{2}{|c|}{ Married Filing Jointly } & \multicolumn{2}{|c|}{ Head of Household } & \multicolumn{2}{|c|}{ Single or Married Filing Separately } \\ \hline \multirow[b]{2}{*}{ At least } & \multirow{2}{*}{\begin{tabular}{r} But less \\ than \end{tabular}} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} \\ \hline & & \multicolumn{6}{|c|}{ The Tentative Withholding Amount is: } \\ \hline \begin{tabular}{l} $1,125 \\ $1,140 \\ $1,160 \\ $1,180 \\ $1,200 \end{tabular} & \begin{tabular}{l} $1,140 \\ $1,160 \\ $1,180 \\ $1,200 \\ $1,220 \end{tabular} & \begin{tabular}{r} $5 \\ $7 \\ $9 \\ $11 \\ $13 \\ \end{tabular} & \begin{tabular}{l} $63 \\ $65 \\ $67 \\ $69 \\ $72 \\ \end{tabular} & \begin{tabular}{l} $32 \\ $34 \\ $36 \\ $38 \\ $40 \end{tabular} & \begin{tabular}{l} $81 \\ $83 \\ $86 \\ $88 \\ $91 \\ \end{tabular} & \begin{tabular}{l} $63 \\ $65 \\ $67 \\ $69 \\ $72 \end{tabular} & \begin{tabular}{r} $99 \\ $102 \\ $107 \\ $111 \\ $116 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,220 \\ $1,240 \\ $1,260 \\ $1,280 \\ $1,300 \end{tabular} & \begin{tabular}{l} $1,240 \\ $1,260 \\ $1,280 \\ $1,300 \\ $1,320 \end{tabular} & \begin{tabular}{l} $15 \\ $17 \\ $19 \\ $21 \\ $23 \\ \end{tabular} & \begin{tabular}{l} $74 \\ $77 \\ $79 \\ $81 \\ $84 \\ \end{tabular} & \begin{tabular}{l} $42 \\ $44 \\ $46 \\ $48 \\ $50 \\ \end{tabular} & \begin{tabular}{r} $93 \\ $95 \\ $98 \\ $100 \\ $103 \\ \end{tabular} & \begin{tabular}{l} $74 \\ $77 \\ $79 \\ $81 \\ $84 \end{tabular} & \begin{tabular}{l} $120 \\ $124 \\ $129 \\ $133 \\ $138 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,320 \\ $1,340 \\ $1,360 \\ $1,380 \\ $1,400 \end{tabular} & \begin{tabular}{l} $1,340 \\ $1,360 \\ $1,380 \\ $1,400 \\ $1,420 \end{tabular} & \begin{tabular}{l} $25 \\ $27 \\ $29 \\ $31 \\ $33 \\ \end{tabular} & \begin{tabular}{l} $86 \\ $89 \\ $91 \\ $93 \\ $96 \\ \end{tabular} & \begin{tabular}{l} $52 \\ $54 \\ $56 \\ $58 \\ $60 \end{tabular} & \begin{tabular}{l} $105 \\ $107 \\ $110 \\ $112 \\ $115 \end{tabular} & \begin{tabular}{l} $86 \\ $89 \\ $91 \\ $93 \\ $96 \end{tabular} & \begin{tabular}{l} $142 \\ $146 \\ $151 \\ $155 \\ $160 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,420 \\ $1,440 \\ $1,460 \\ $1,480 \\ $1,500 \end{tabular} & \begin{tabular}{l} $1,440 \\ $1,460 \\ $1,480 \\ $1,500 \\ $1,520 \end{tabular} & \begin{tabular}{l} $35 \\ $37 \\ $39 \\ $41 \\ $43 \\ \end{tabular} & \begin{tabular}{r} $98 \\ $101 \\ $103 \\ $105 \\ $108 \\ \end{tabular} & \begin{tabular}{l} $62 \\ $65 \\ $67 \\ $70 \\ $72 \\ \end{tabular} & \begin{tabular}{l} $117 \\ $119 \\ $122 \\ $124 \\ $127 \\ \end{tabular} & \begin{tabular}{r} $98 \\ $101 \\ $103 \\ $105 \\ $108 \end{tabular} & \begin{tabular}{l} $164 \\ $168 \\ $173 \\ $177 \\ $182 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,520 \\ $1,540 \\ $1,560 \\ $1,580 \\ $1,600 \end{tabular} & \begin{tabular}{l} $1,540 \\ $1,560 \\ $1,580 \\ $1,600 \\ $1,620 \end{tabular} & \begin{tabular}{l} $45 \\ $47 \\ $49 \\ $51 \\ $53 \\ \end{tabular} & \begin{tabular}{l} $110 \\ $113 \\ $115 \\ $117 \\ $120 \end{tabular} & \begin{tabular}{l} $74 \\ $77 \\ $79 \\ $82 \\ $84 \\ \end{tabular} & \begin{tabular}{l} $129 \\ $131 \\ $134 \\ $138 \\ $143 \\ \end{tabular} & \begin{tabular}{l} $110 \\ $113 \\ $115 \\ $117 \\ $120 \end{tabular} & \begin{tabular}{l} $186 \\ $190 \\ $195 \\ $199 \\ $204 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,620 \\ $1,640 \\ $1,660 \\ $1,680 \\ $1,700 \end{tabular} & \begin{tabular}{l} $1,640 \\ $1,660 \\ $1,680 \\ $1,700 \\ $1,720 \end{tabular} & \begin{tabular}{l} $55 \\ $57 \\ $59 \\ $61 \\ $63 \\ \end{tabular} & \begin{tabular}{l} $122 \\ $125 \\ $127 \\ $129 \\ $132 \\ \end{tabular} & \begin{tabular}{l} $86 \\ $89 \\ $91 \\ $94 \\ $96 \end{tabular} & \begin{tabular}{l} $147 \\ $152 \\ $156 \\ $160 \\ $165 \\ \end{tabular} & \begin{tabular}{l} $122 \\ $125 \\ $127 \\ $129 \\ $132 \\ \end{tabular} & \begin{tabular}{l} $208 \\ $212 \\ $217 \\ $221 \\ $226 \\ \end{tabular} \\ \hline \begin{tabular}{r} $1,720 \\ $1,740 \\ $1,760 \\ $1,780 \\ $1,800 \end{tabular} & \begin{tabular}{l} $1,740 \\ $1,760 \\ $1,780 \\ $1,800 \\ $1,820 \end{tabular} & \begin{tabular}{l} $65 \\ $67 \\ $69 \\ $71 \\ $73 \\ \end{tabular} & \begin{tabular}{l} $134 \\ $137 \\ $139 \\ $141 \\ $144 \\ \end{tabular} & \begin{tabular}{r} $98 \\ $101 \\ $103 \\ $106 \\ $108 \\ \end{tabular} & \begin{tabular}{l} $169 \\ $174 \\ $178 \\ $182 \\ $187 \\ \end{tabular} & \begin{tabular}{l} $134 \\ $137 \\ $139 \\ $141 \\ $144 \\ \end{tabular} & \begin{tabular}{l} $230 \\ $234 \\ $239 \\ $243 \\ $248 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,820 \\ $1,840 \\ $1,860 \\ $1,880 \\ $1,900 \end{tabular} & \begin{tabular}{l} $1,840 \\ $1,860 \\ $1,880 \\ $1,900 \\ $1,920 \end{tabular} & \begin{tabular}{l} $75 \\ $77 \\ $79 \\ $81 \\ $83 \\ \end{tabular} & \begin{tabular}{l} $146 \\ $149 \\ $151 \\ $153 \\ $156 \\ \end{tabular} & \begin{tabular}{l} $110 \\ $113 \\ $115 \\ $118 \\ $120 \\ \end{tabular} & \begin{tabular}{l} $191 \\ $196 \\ $200 \\ $204 \\ $209 \\ \end{tabular} & \begin{tabular}{l} $146 \\ $149 \\ $151 \\ $153 \\ $156 \end{tabular} & \begin{tabular}{l} $252 \\ $256 \\ $261 \\ $265 \\ $270 \\ \end{tabular} \\ \hline \begin{tabular}{r} $1,920 \\ $1,940 \\ $1,960 \\ $1,980 \\ $2,000 \end{tabular} & \begin{tabular}{r} $1,940 \\ $1,960 \\ $1,980 \\ $2,000 \\ $2,020 \end{tabular} & \begin{tabular}{l} $85 \\ $87 \\ $90 \\ $92 \\ $95 \\ \end{tabular} & \begin{tabular}{l} $158 \\ $161 \\ $163 \\ $165 \\ $168 \\ \end{tabular} & \begin{tabular}{l} $122 \\ $125 \\ $127 \\ $130 \\ $132 \\ \end{tabular} & \begin{tabular}{l} $213 \\ $218 \\ $222 \\ $226 \\ $231 \\ \end{tabular} & \begin{tabular}{l} $158 \\ $161 \\ $163 \\ $165 \\ $168 \end{tabular} & \begin{tabular}{l} $274 \\ $278 \\ $283 \\ $287 \\ $292 \\ \end{tabular} \\ \hline \begin{tabular}{l} $2,020 \\ $2,040 \\ $2,060 \\ $2,080 \\ $2,100 \end{tabular} & \begin{tabular}{l} $2,040 \\ $2,060 \\ $2,080 \\ $2,100 \\ $2,120 \end{tabular} & \begin{tabular}{r} $97 \\ $99 \\ $102 \\ $104 \\ $107 \end{tabular} & \begin{tabular}{l} $170 \\ $173 \\ $175 \\ $177 \\ $180 \end{tabular} & \begin{tabular}{l} $134 \\ $137 \\ $139 \\ $142 \\ $144 \\ \end{tabular} & \begin{tabular}{l} $235 \\ $240 \\ $244 \\ $248 \\ $253 \\ \end{tabular} & \begin{tabular}{l} $170 \\ $173 \\ $175 \\ $177 \\ $180 \\ \end{tabular} & \begin{tabular}{l} $296 \\ $300 \\ $305 \\ $309 \\ $314 \\ \end{tabular} \\ \hline \begin{tabular}{l} $2,120 \\ $2,140 \\ $2,170 \\ $2,200 \\ $2,230 \end{tabular} & \begin{tabular}{l} $2,140 \\ $2,170 \\ $2,200 \\ $2,230 \\ $2,260 \end{tabular} & \begin{tabular}{l} $109 \\ $112 \\ $116 \\ $119 \\ $123 \\ \end{tabular} & \begin{tabular}{l} $182 \\ $185 \\ $189 \\ $192 \\ $196 \end{tabular} & \begin{tabular}{l} $146 \\ $149 \\ $153 \\ $157 \\ $160 \end{tabular} & \begin{tabular}{l} $257 \\ $263 \\ $269 \\ $276 \\ $282 \\ \end{tabular} & \begin{tabular}{l} $182 \\ $185 \\ $189 \\ $192 \\ $196 \end{tabular} & \begin{tabular}{l} $318 \\ $324 \\ $331 \\ $338 \\ $346 \\ \end{tabular} \\ \hline \begin{tabular}{l} $2,260 \\ $2,290 \\ $2,320 \\ $2,350 \\ $2,380 \end{tabular} & \begin{tabular}{l} $2,290 \\ $2,320 \\ $2,350 \\ $2,380 \\ $2,410 \end{tabular} & \begin{tabular}{l} $126 \\ $130 \\ $134 \\ $137 \\ $141 \end{tabular} & \begin{tabular}{l} $200 \\ $206 \\ $212 \\ $219 \\ $226 \\ \end{tabular} & \begin{tabular}{l} $164 \\ $167 \\ $171 \\ $175 \\ $178 \\ \end{tabular} & \begin{tabular}{l} $289 \\ $297 \\ $304 \\ $311 \\ $318 \\ \end{tabular} & \begin{tabular}{l} $200 \\ $206 \\ $212 \\ $219 \\ $226 \end{tabular} & \begin{tabular}{l} $353 \\ $360 \\ $367 \\ $374 \\ $382 \\ \end{tabular} \\ \hline \begin{tabular}{l} $2,410 \\ $2,440 \\ $2,470 \\ $2,500 \\ $2,530 \end{tabular} & \begin{tabular}{r} $2,440 \\ $2,470 \\ $2,500 \\ $2,530 \\ $2,560 \end{tabular} & \begin{tabular}{l} $144 \\ $148 \\ $152 \\ $155 \\ $159 \end{tabular} & \begin{tabular}{l} $232 \\ $239 \\ $245 \\ $252 \\ $259 \end{tabular} & \begin{tabular}{l} $182 \\ $185 \\ $189 \\ $193 \\ $196 \end{tabular} & \begin{tabular}{l} \$325 \\ $333 \\ $340 \\ $347 \\ \$354 \end{tabular} & \begin{tabular}{l} $232 \\ $239 \\ $245 \\ $252 \\ $259 \end{tabular} & \begin{tabular}{l} $389 \\ $396 \\ $403 \\ $410 \\ $418 \end{tabular} \\ \hline \end{tabular}

460 Appendix C Federal Income Tax Tables 2022 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later SEMIMONTHLY Payroll Period \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted Wage \\ Amount (line 1h ) is \end{tabular}} & \multicolumn{2}{|c|}{ Married Filing Jointly } & \multicolumn{2}{|c|}{ Head of Household } & \multicolumn{2}{|c|}{ Single or Married Filing Separately } \\ \hline \multirow[b]{2}{*}{ At least } & \multirow{2}{*}{\begin{tabular}{c} But less \\ than \end{tabular}} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} \\ \hline & & \multicolumn{6}{|c|}{ The Tentative Withholding Amount is: } \\ \hline \begin{tabular}{r} $0 \\ $270 \\ $280 \\ $290 \\ $300 \end{tabular} & \begin{tabular}{l} $270 \\ $280 \\ $290 \\ $300 \\ $310 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} So \\ so \\ So \\ So \\ so \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} \$0 \\ $1 \\ $2 \\ $3 \\ $4 \end{tabular} \\ \hline \begin{tabular}{l} $310 \\ $320 \\ $330 \\ $340 \\ $350 \end{tabular} & \begin{tabular}{l} $320 \\ $330 \\ $340 \\ $350 \\ $360 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $$0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} so \\ so \\ so \\ so \\ so \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $5 \\ $6 \\ $7 \\ $8 \\ $9 \end{tabular} \\ \hline \begin{tabular}{l} $360 \\ $370 \\ $380 \\ $390 \\ $400 \\ \end{tabular} & \begin{tabular}{l} $370 \\ $380 \\ $390 \\ $400 \\ $410 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} S0 \\ s0 \\ S0 \\ S0 \\ so \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $10 \\ $11 \\ $12 \\ $13 \\ $14 \\ \end{tabular} \\ \hline \begin{tabular}{l} $410 \\ $420 \\ $430 \\ $440 \\ $450 \end{tabular} & \begin{tabular}{l} $420 \\ $430 \\ $440 \\ $450 \\ $460 \end{tabular} & \begin{tabular}{l} \$0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $1 \\ $2 \\ $3 \\ $4 \\ $5 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $15 \\ $16 \\ $17 \\ $18 \\ $19 \end{tabular} \\ \hline \begin{tabular}{l} $460 \\ $470 \\ $480 \\ $495 \\ $510 \end{tabular} & \begin{tabular}{l} $470 \\ $480 \\ $495 \\ $510 \\ $525 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{r} $6 \\ $7 \\ $8 \\ $10 \\ $11 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $20 \\ $21 \\ $22 \\ $24 \\ $25 \\ \end{tabular} \\ \hline \begin{tabular}{l} $525 \\ $540 \\ $555 \\ $570 \\ $585 \end{tabular} & \begin{tabular}{l} $540 \\ $555 \\ $570 \\ $585 \\ $600 \end{tabular} & \begin{tabular}{l} \$0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $1 \\ $2 \\ $4 \\ $5 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $13 \\ $14 \\ $16 \\ $17 \\ $19 \end{tabular} & \begin{tabular}{l} $0 \\ $1 \\ $2 \\ $4 \\ $5 \end{tabular} & \begin{tabular}{l} $27 \\ $29 \\ $31 \\ $33 \\ $34 \end{tabular} \\ \hline \begin{tabular}{l} $600 \\ $615 \\ $630 \\ $645 \\ $660 \end{tabular} & \begin{tabular}{l} $615 \\ $630 \\ $645 \\ $660 \\ $675 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{r} $7 \\ $8 \\ $10 \\ $11 \\ $13 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $20 \\ $22 \\ $23 \\ $25 \\ $26 \end{tabular} & \begin{tabular}{r} $7 \\ $8 \\ $10 \\ $11 \\ $13 \\ \end{tabular} & \begin{tabular}{l} $36 \\ $38 \\ $40 \\ $42 \\ $43 \\ \end{tabular} \\ \hline \begin{tabular}{l} $675 \\ 5690 \\ $705 \\ $720 \\ $735 \end{tabular} & \begin{tabular}{l} $690 \\ $705 \\ $720 \\ $735 \\ $750 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $14 \\ $16 \\ $17 \\ $19 \\ $20 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $28 \\ $29 \\ $31 \\ $33 \\ $34 \\ \end{tabular} & \begin{tabular}{l} $14 \\ $16 \\ $17 \\ $19 \\ $20 \\ \end{tabular} & \begin{tabular}{l} $45 \\ $47 \\ $49 \\ $51 \\ $52 \\ \end{tabular} \\ \hline \begin{tabular}{l} $750 \\ $765 \\ $780 \\ $795 \\ $810 \end{tabular} & \begin{tabular}{l} $765 \\ $780 \\ $795 \\ $810 \\ $825 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $22 \\ $23 \\ $25 \\ $26 \\ $28 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $1 \end{tabular} & \begin{tabular}{l} $36 \\ $38 \\ $40 \\ $42 \\ $43 \end{tabular} & \begin{tabular}{l} $22 \\ $23 \\ $25 \\ $26 \\ $28 \end{tabular} & \begin{tabular}{l} $54 \\ $56 \\ $58 \\ $60 \\ $61 \end{tabular} \\ \hline \begin{tabular}{l} $825 \\ $840 \\ $855 \\ $870 \\ $885 \end{tabular} & \begin{tabular}{l} S840 \\ $855 \\ S870 \\ S885 \\ $900 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $29 \\ $31 \\ $32 \\ $34 \\ $35 \\ \end{tabular} & \begin{tabular}{l} $2 \\ $4 \\ $5 \\ $7 \\ $8 \end{tabular} & \begin{tabular}{l} $45 \\ $47 \\ $49 \\ $51 \\ $52 \\ \end{tabular} & \begin{tabular}{l} $29 \\ $31 \\ $32 \\ $34 \\ $35 \end{tabular} & \begin{tabular}{l} $63 \\ $65 \\ $67 \\ $69 \\ $70 \\ \end{tabular} \\ \hline \begin{tabular}{l} $900 \\ $915 \\ $930 \\ $945 \\ $960 \end{tabular} & \begin{tabular}{l} $$915 \\ $930 \\ $945 \\ $960 \\ $975 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $37 \\ $38 \\ $40 \\ $41 \\ $43 \end{tabular} & \begin{tabular}{l} $10 \\ $11 \\ $13 \\ $14 \\ $16 \end{tabular} & \begin{tabular}{l} $54 \\ $56 \\ $58 \\ $60 \\ $61 \end{tabular} & \begin{tabular}{l} $37 \\ $38 \\ $40 \\ $41 \\ $43 \end{tabular} & \begin{tabular}{l} $72 \\ $74 \\ $76 \\ $78 \\ $79 \end{tabular} \\ \hline \begin{tabular}{r} $975 \\ $990 \\ $1,005 \\ $1,020 \\ $1,035 \\ \end{tabular} & \begin{tabular}{r} $990 \\ $1,005 \\ $1,020 \\ $1,035 \\ $1,050 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $45 \\ $46 \\ $48 \\ $50 \\ $52 \\ \end{tabular} & \begin{tabular}{l} $17 \\ $19 \\ $20 \\ $22 \\ $23 \\ \end{tabular} & \begin{tabular}{l} $63 \\ $65 \\ $67 \\ $69 \\ $70 \\ \end{tabular} & \begin{tabular}{l} $45 \\ $46 \\ $48 \\ $50 \\ $52 \\ \end{tabular} & \begin{tabular}{l} $81 \\ $83 \\ $85 \\ $87 \\ $88 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,050 \\ $1,065 \\ $1,080 \\ $1,095 \\ $1,110 \end{tabular} & \begin{tabular}{l} $1,065 \\ $1,080 \\ $1,095 \\ $1,110 \\ $1,125 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $1 \\ $2 \\ $4 \end{tabular} & \begin{tabular}{l} $54 \\ $55 \\ $57 \\ $59 \\ $61 \end{tabular} & \begin{tabular}{l} $25 \\ $26 \\ $28 \\ $29 \\ $31 \end{tabular} & \begin{tabular}{l} $72 \\ $74 \\ $76 \\ $78 \\ $79 \end{tabular} & \begin{tabular}{l} $54 \\ $55 \\ $57 \\ $59 \\ $61 \end{tabular} & \begin{tabular}{l} $90 \\ $92 \\ $94 \\ $96 \\ $97 \end{tabular} \\ \hline \end{tabular} Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Sten comes to Marbury on April 7 and requests a pay advance of $1,000, which Sten will pay back in equal parts on the April 15 and May 15 paychecks. Sten is single, with one dependent under 17 , is paid $52,400 per year, contributes 3 percent of gross pay to a 401(k), and has $128 per paycheck deducted for a Section 125 plan. Required: Compute the net pay on Sten's April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the wage-bracket method for manual payroll systems with Forms W-4 from 2020 or later in to determine the federal income tax. Assume box 2 is not checked. Note: Round your intermediate calculations and final answer to 2 decimal places. 2022 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later SEMIMONTHLY Payroll Period \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted Wage \\ Amount (line 1h ) is \end{tabular}} & \multicolumn{2}{|c|}{ Married Filing Jointly } & \multicolumn{2}{|c|}{ Head of Household } & \multicolumn{2}{|c|}{ Single or Married Filing Separately } \\ \hline \multirow[b]{2}{*}{ At least } & \multirow{2}{*}{\begin{tabular}{r} But less \\ than \end{tabular}} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} & \begin{tabular}{c} Standard \\ withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step 2, \\ Checkbox \\ withholding \end{tabular} \\ \hline & & \multicolumn{6}{|c|}{ The Tentative Withholding Amount is: } \\ \hline \begin{tabular}{l} $1,125 \\ $1,140 \\ $1,160 \\ $1,180 \\ $1,200 \end{tabular} & \begin{tabular}{l} $1,140 \\ $1,160 \\ $1,180 \\ $1,200 \\ $1,220 \end{tabular} & \begin{tabular}{r} $5 \\ $7 \\ $9 \\ $11 \\ $13 \\ \end{tabular} & \begin{tabular}{l} $63 \\ $65 \\ $67 \\ $69 \\ $72 \\ \end{tabular} & \begin{tabular}{l} $32 \\ $34 \\ $36 \\ $38 \\ $40 \end{tabular} & \begin{tabular}{l} $81 \\ $83 \\ $86 \\ $88 \\ $91 \\ \end{tabular} & \begin{tabular}{l} $63 \\ $65 \\ $67 \\ $69 \\ $72 \end{tabular} & \begin{tabular}{r} $99 \\ $102 \\ $107 \\ $111 \\ $116 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,220 \\ $1,240 \\ $1,260 \\ $1,280 \\ $1,300 \end{tabular} & \begin{tabular}{l} $1,240 \\ $1,260 \\ $1,280 \\ $1,300 \\ $1,320 \end{tabular} & \begin{tabular}{l} $15 \\ $17 \\ $19 \\ $21 \\ $23 \\ \end{tabular} & \begin{tabular}{l} $74 \\ $77 \\ $79 \\ $81 \\ $84 \\ \end{tabular} & \begin{tabular}{l} $42 \\ $44 \\ $46 \\ $48 \\ $50 \\ \end{tabular} & \begin{tabular}{r} $93 \\ $95 \\ $98 \\ $100 \\ $103 \\ \end{tabular} & \begin{tabular}{l} $74 \\ $77 \\ $79 \\ $81 \\ $84 \end{tabular} & \begin{tabular}{l} $120 \\ $124 \\ $129 \\ $133 \\ $138 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,320 \\ $1,340 \\ $1,360 \\ $1,380 \\ $1,400 \end{tabular} & \begin{tabular}{l} $1,340 \\ $1,360 \\ $1,380 \\ $1,400 \\ $1,420 \end{tabular} & \begin{tabular}{l} $25 \\ $27 \\ $29 \\ $31 \\ $33 \\ \end{tabular} & \begin{tabular}{l} $86 \\ $89 \\ $91 \\ $93 \\ $96 \\ \end{tabular} & \begin{tabular}{l} $52 \\ $54 \\ $56 \\ $58 \\ $60 \end{tabular} & \begin{tabular}{l} $105 \\ $107 \\ $110 \\ $112 \\ $115 \end{tabular} & \begin{tabular}{l} $86 \\ $89 \\ $91 \\ $93 \\ $96 \end{tabular} & \begin{tabular}{l} $142 \\ $146 \\ $151 \\ $155 \\ $160 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,420 \\ $1,440 \\ $1,460 \\ $1,480 \\ $1,500 \end{tabular} & \begin{tabular}{l} $1,440 \\ $1,460 \\ $1,480 \\ $1,500 \\ $1,520 \end{tabular} & \begin{tabular}{l} $35 \\ $37 \\ $39 \\ $41 \\ $43 \\ \end{tabular} & \begin{tabular}{r} $98 \\ $101 \\ $103 \\ $105 \\ $108 \\ \end{tabular} & \begin{tabular}{l} $62 \\ $65 \\ $67 \\ $70 \\ $72 \\ \end{tabular} & \begin{tabular}{l} $117 \\ $119 \\ $122 \\ $124 \\ $127 \\ \end{tabular} & \begin{tabular}{r} $98 \\ $101 \\ $103 \\ $105 \\ $108 \end{tabular} & \begin{tabular}{l} $164 \\ $168 \\ $173 \\ $177 \\ $182 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,520 \\ $1,540 \\ $1,560 \\ $1,580 \\ $1,600 \end{tabular} & \begin{tabular}{l} $1,540 \\ $1,560 \\ $1,580 \\ $1,600 \\ $1,620 \end{tabular} & \begin{tabular}{l} $45 \\ $47 \\ $49 \\ $51 \\ $53 \\ \end{tabular} & \begin{tabular}{l} $110 \\ $113 \\ $115 \\ $117 \\ $120 \end{tabular} & \begin{tabular}{l} $74 \\ $77 \\ $79 \\ $82 \\ $84 \\ \end{tabular} & \begin{tabular}{l} $129 \\ $131 \\ $134 \\ $138 \\ $143 \\ \end{tabular} & \begin{tabular}{l} $110 \\ $113 \\ $115 \\ $117 \\ $120 \end{tabular} & \begin{tabular}{l} $186 \\ $190 \\ $195 \\ $199 \\ $204 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,620 \\ $1,640 \\ $1,660 \\ $1,680 \\ $1,700 \end{tabular} & \begin{tabular}{l} $1,640 \\ $1,660 \\ $1,680 \\ $1,700 \\ $1,720 \end{tabular} & \begin{tabular}{l} $55 \\ $57 \\ $59 \\ $61 \\ $63 \\ \end{tabular} & \begin{tabular}{l} $122 \\ $125 \\ $127 \\ $129 \\ $132 \\ \end{tabular} & \begin{tabular}{l} $86 \\ $89 \\ $91 \\ $94 \\ $96 \end{tabular} & \begin{tabular}{l} $147 \\ $152 \\ $156 \\ $160 \\ $165 \\ \end{tabular} & \begin{tabular}{l} $122 \\ $125 \\ $127 \\ $129 \\ $132 \\ \end{tabular} & \begin{tabular}{l} $208 \\ $212 \\ $217 \\ $221 \\ $226 \\ \end{tabular} \\ \hline \begin{tabular}{r} $1,720 \\ $1,740 \\ $1,760 \\ $1,780 \\ $1,800 \end{tabular} & \begin{tabular}{l} $1,740 \\ $1,760 \\ $1,780 \\ $1,800 \\ $1,820 \end{tabular} & \begin{tabular}{l} $65 \\ $67 \\ $69 \\ $71 \\ $73 \\ \end{tabular} & \begin{tabular}{l} $134 \\ $137 \\ $139 \\ $141 \\ $144 \\ \end{tabular} & \begin{tabular}{r} $98 \\ $101 \\ $103 \\ $106 \\ $108 \\ \end{tabular} & \begin{tabular}{l} $169 \\ $174 \\ $178 \\ $182 \\ $187 \\ \end{tabular} & \begin{tabular}{l} $134 \\ $137 \\ $139 \\ $141 \\ $144 \\ \end{tabular} & \begin{tabular}{l} $230 \\ $234 \\ $239 \\ $243 \\ $248 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,820 \\ $1,840 \\ $1,860 \\ $1,880 \\ $1,900 \end{tabular} & \begin{tabular}{l} $1,840 \\ $1,860 \\ $1,880 \\ $1,900 \\ $1,920 \end{tabular} & \begin{tabular}{l} $75 \\ $77 \\ $79 \\ $81 \\ $83 \\ \end{tabular} & \begin{tabular}{l} $146 \\ $149 \\ $151 \\ $153 \\ $156 \\ \end{tabular} & \begin{tabular}{l} $110 \\ $113 \\ $115 \\ $118 \\ $120 \\ \end{tabular} & \begin{tabular}{l} $191 \\ $196 \\ $200 \\ $204 \\ $209 \\ \end{tabular} & \begin{tabular}{l} $146 \\ $149 \\ $151 \\ $153 \\ $156 \end{tabular} & \begin{tabular}{l} $252 \\ $256 \\ $261 \\ $265 \\ $270 \\ \end{tabular} \\ \hline \begin{tabular}{r} $1,920 \\ $1,940 \\ $1,960 \\ $1,980 \\ $2,000 \end{tabular} & \begin{tabular}{r} $1,940 \\ $1,960 \\ $1,980 \\ $2,000 \\ $2,020 \end{tabular} & \begin{tabular}{l} $85 \\ $87 \\ $90 \\ $92 \\ $95 \\ \end{tabular} & \begin{tabular}{l} $158 \\ $161 \\ $163 \\ $165 \\ $168 \\ \end{tabular} & \begin{tabular}{l} $122 \\ $125 \\ $127 \\ $130 \\ $132 \\ \end{tabular} & \begin{tabular}{l} $213 \\ $218 \\ $222 \\ $226 \\ $231 \\ \end{tabular} & \begin{tabular}{l} $158 \\ $161 \\ $163 \\ $165 \\ $168 \end{tabular} & \begin{tabular}{l} $274 \\ $278 \\ $283 \\ $287 \\ $292 \\ \end{tabular} \\ \hline \begin{tabular}{l} $2,020 \\ $2,040 \\ $2,060 \\ $2,080 \\ $2,100 \end{tabular} & \begin{tabular}{l} $2,040 \\ $2,060 \\ $2,080 \\ $2,100 \\ $2,120 \end{tabular} & \begin{tabular}{r} $97 \\ $99 \\ $102 \\ $104 \\ $107 \end{tabular} & \begin{tabular}{l} $170 \\ $173 \\ $175 \\ $177 \\ $180 \end{tabular} & \begin{tabular}{l} $134 \\ $137 \\ $139 \\ $142 \\ $144 \\ \end{tabular} & \begin{tabular}{l} $235 \\ $240 \\ $244 \\ $248 \\ $253 \\ \end{tabular} & \begin{tabular}{l} $170 \\ $173 \\ $175 \\ $177 \\ $180 \\ \end{tabular} & \begin{tabular}{l} $296 \\ $300 \\ $305 \\ $309 \\ $314 \\ \end{tabular} \\ \hline \begin{tabular}{l} $2,120 \\ $2,140 \\ $2,170 \\ $2,200 \\ $2,230 \end{tabular} & \begin{tabular}{l} $2,140 \\ $2,170 \\ $2,200 \\ $2,230 \\ $2,260 \end{tabular} & \begin{tabular}{l} $109 \\ $112 \\ $116 \\ $119 \\ $123 \\ \end{tabular} & \begin{tabular}{l} $182 \\ $185 \\ $189 \\ $192 \\ $196 \end{tabular} & \begin{tabular}{l} $146 \\ $149 \\ $153 \\ $157 \\ $160 \end{tabular} & \begin{tabular}{l} $257 \\ $263 \\ $269 \\ $276 \\ $282 \\ \end{tabular} & \begin{tabular}{l} $182 \\ $185 \\ $189 \\ $192 \\ $196 \end{tabular} & \begin{tabular}{l} $318 \\ $324 \\ $331 \\ $338 \\ $346 \\ \end{tabular} \\ \hline \begin{tabular}{l} $2,260 \\ $2,290 \\ $2,320 \\ $2,350 \\ $2,380 \end{tabular} & \begin{tabular}{l} $2,290 \\ $2,320 \\ $2,350 \\ $2,380 \\ $2,410 \end{tabular} & \begin{tabular}{l} $126 \\ $130 \\ $134 \\ $137 \\ $141 \end{tabular} & \begin{tabular}{l} $200 \\ $206 \\ $212 \\ $219 \\ $226 \\ \end{tabular} & \begin{tabular}{l} $164 \\ $167 \\ $171 \\ $175 \\ $178 \\ \end{tabular} & \begin{tabular}{l} $289 \\ $297 \\ $304 \\ $311 \\ $318 \\ \end{tabular} & \begin{tabular}{l} $200 \\ $206 \\ $212 \\ $219 \\ $226 \end{tabular} & \begin{tabular}{l} $353 \\ $360 \\ $367 \\ $374 \\ $382 \\ \end{tabular} \\ \hline \begin{tabular}{l} $2,410 \\ $2,440 \\ $2,470 \\ $2,500 \\ $2,530 \end{tabular} & \begin{tabular}{r} $2,440 \\ $2,470 \\ $2,500 \\ $2,530 \\ $2,560 \end{tabular} & \begin{tabular}{l} $144 \\ $148 \\ $152 \\ $155 \\ $159 \end{tabular} & \begin{tabular}{l} $232 \\ $239 \\ $245 \\ $252 \\ $259 \end{tabular} & \begin{tabular}{l} $182 \\ $185 \\ $189 \\ $193 \\ $196 \end{tabular} & \begin{tabular}{l} \$325 \\ $333 \\ $340 \\ $347 \\ \$354 \end{tabular} & \begin{tabular}{l} $232 \\ $239 \\ $245 \\ $252 \\ $259 \end{tabular} & \begin{tabular}{l} $389 \\ $396 \\ $403 \\ $410 \\ $418 \end{tabular} \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started