Please assist if possible

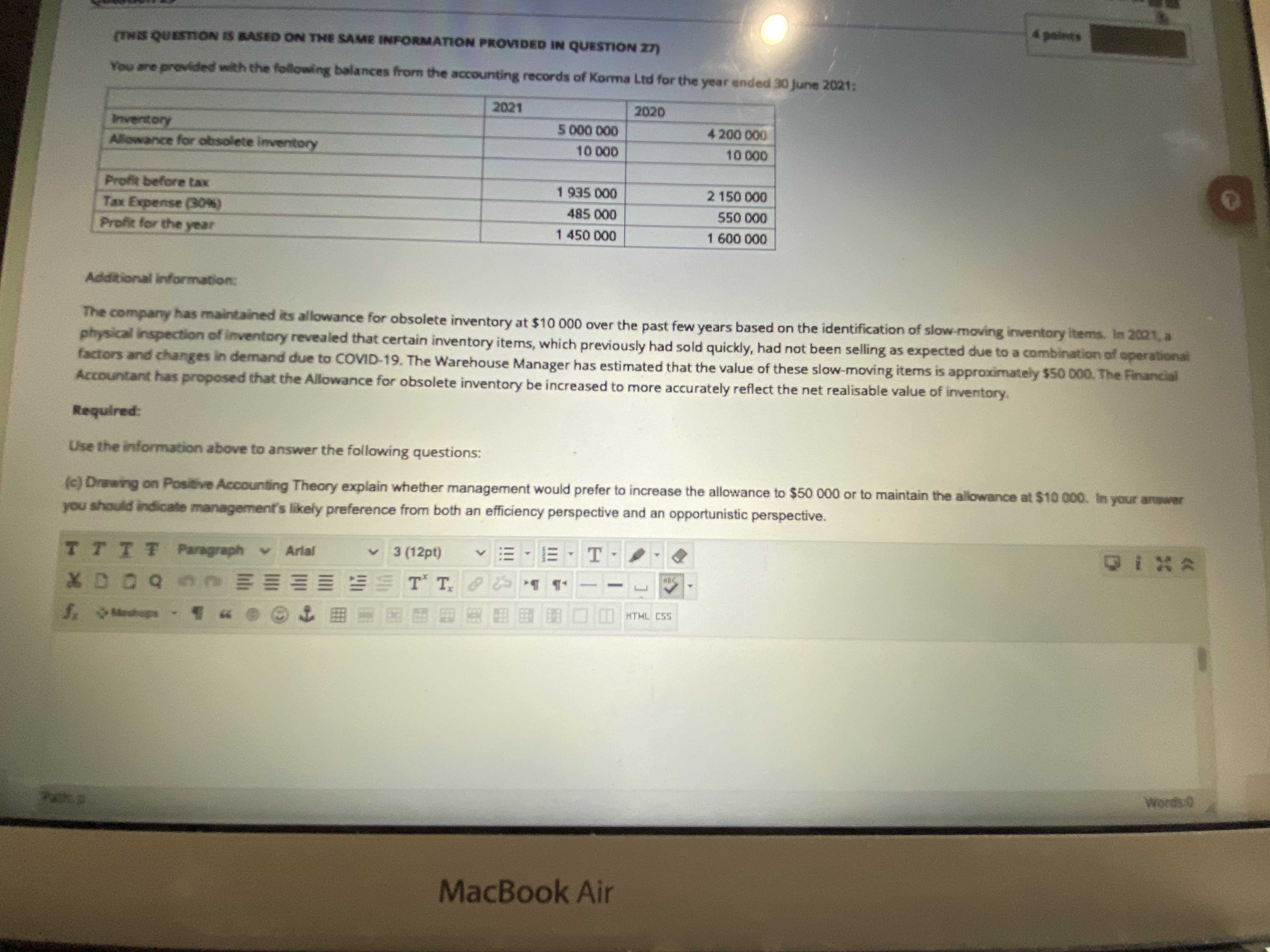

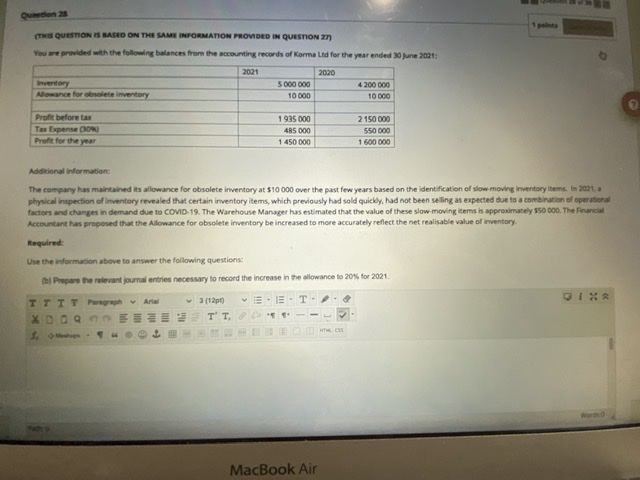

4 points (THIS QUESTION IS BASED ON THE SAME INFORMATION PROVIDED IN QUESTION 27) You are provided with the following balances from the accounting records of Korma Led for the year ended 30 June 2021: 2021 2020 Inventory 5 000 000 4 200 000 Allowance for obsolete inventory 10 DOD 10 000 Profit before tax 1 935 000 2 150 000 Tax Expense (309) 485 000 550 000 Profit for the year 1 450 000 1 600 000 Additional information: The company has maintained its allowance for obsolete inventory at $10 000 over the past few years based on the identification of slow-moving inventory items. In 2021, a physical inspection of inventory revealed that certain inventory items, which previously had sold quickly, had not been selling as expected due to a combination of operational factors and changes in demand due to COVID-19. The Warehouse Manager has estimated that the value of these slow-moving items is approximately $50 000. The Financial Accountant has proposed that the Allowance for obsolete inventory be increased to more accurately reflect the net realisable value of inventory. Required: Use the information above to answer the following questions: (c) Drawing on Positive Accounting Theory explain whether management would prefer to increase the allowance to $50 000 or to maintain the allowance at $10 000. in your answer you should indicate management's likely preference from both an efficiency perspective and an opportunistic perspective. TT TT Paragraph " Arial 3 (12pt) X D O Q O . E 3 3 : SS T' T 0 6 1 1 - - - 3. Words Q MacBook Air(THE QUESTION IS BASED ON THE SAMI INFORMATION PROVIDED IN QUESTION ) You are provided with the following balances from the accounting records of Korma Lid for the year ended 30 June 2021: 202 2020 4000 000 4 300 010 Alamance For obsolete Inventory 10 030 10 0 Profit before tax 1 935 000 2 150 000 To Expense Cos 485 000 550 000 Profit for the year 1 450 000 1 600 008 Additional Information: The company has maintained its allowance for obsolete inventory at $10 000 over the past few years based on the Identification of slow moving inventory items In 2021, a physical inspection of inventory revealed that certain inventory items, which previously had sold quickly. had not been selling as expected due to a combination of operational factors and changes in demand due to COVID-19. The Warehouse Manager has estimated that the value of these slow-moving term is approximately $50 000. The Financial Accountant has proposed that the Allowance for obsolete inventory be increased to more accurately reflect the net realisable value of inventory. Required: Use the Information above In anwever the following questions () Prepare the relevant journal entries necessary to record the increase in the allowance to 20% for 2021. TTTT Pungraph y Arial 3 [12pg) GINA MacBook Air