Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist PART A: Contract 3 Implications on the deferred tax balance calculation If the leave pay is not taken in this current year, it

Please assist

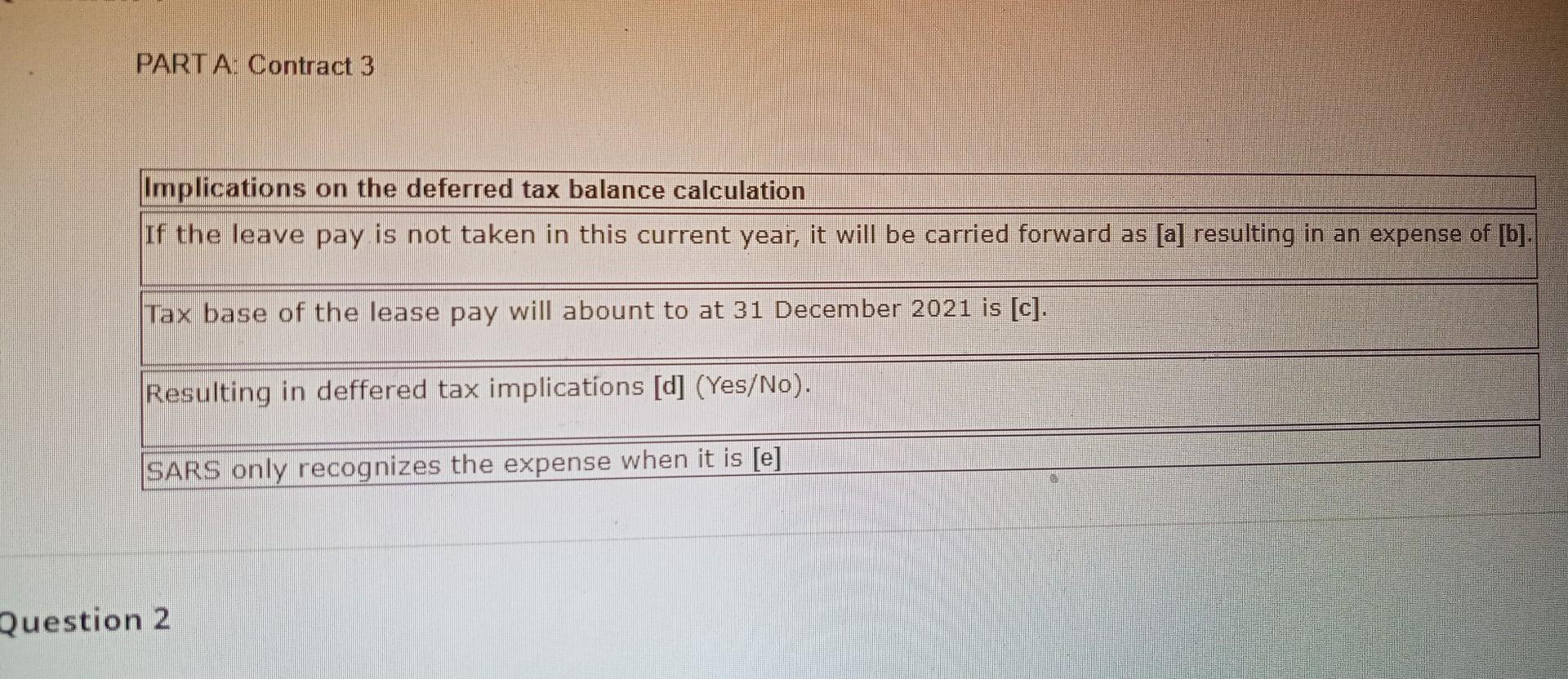

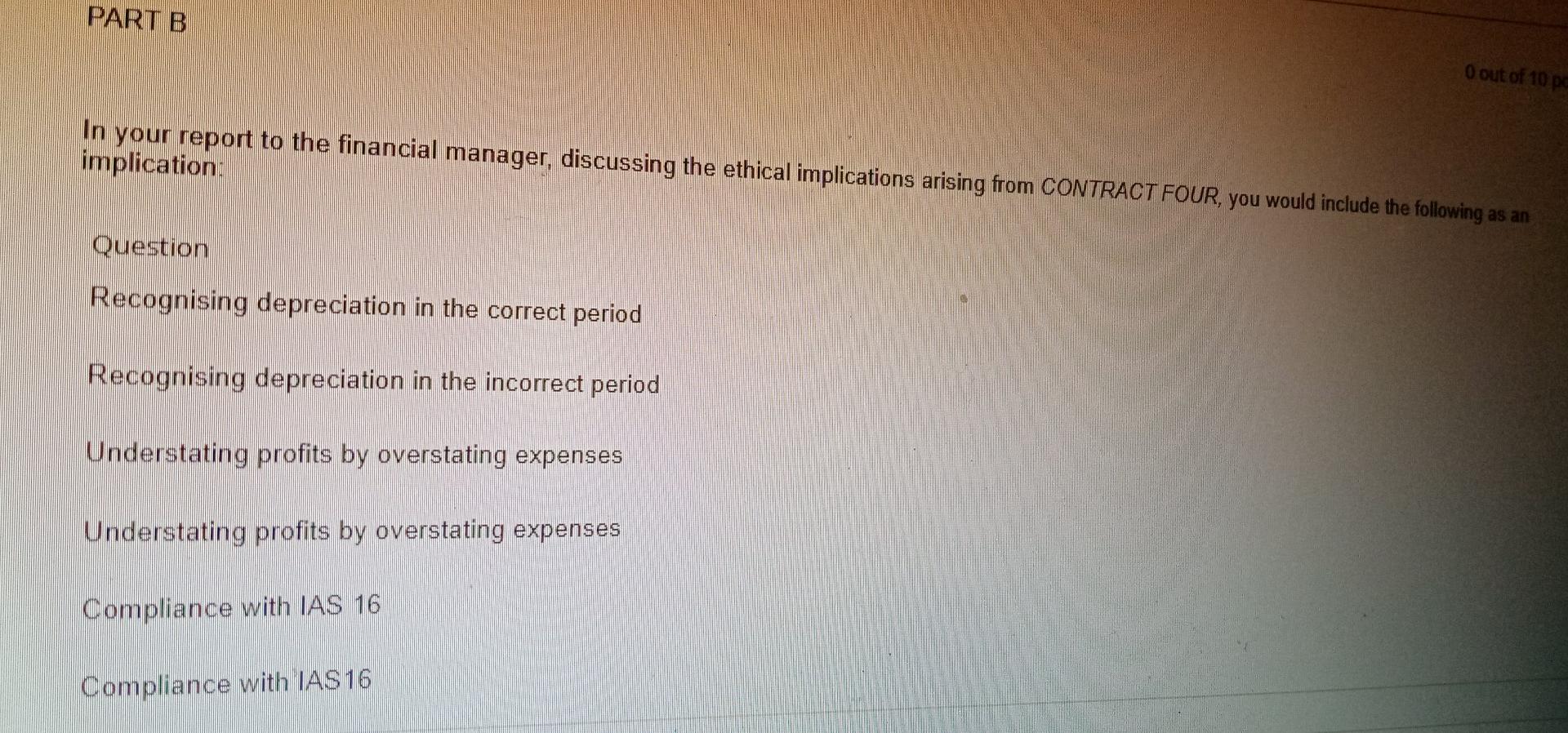

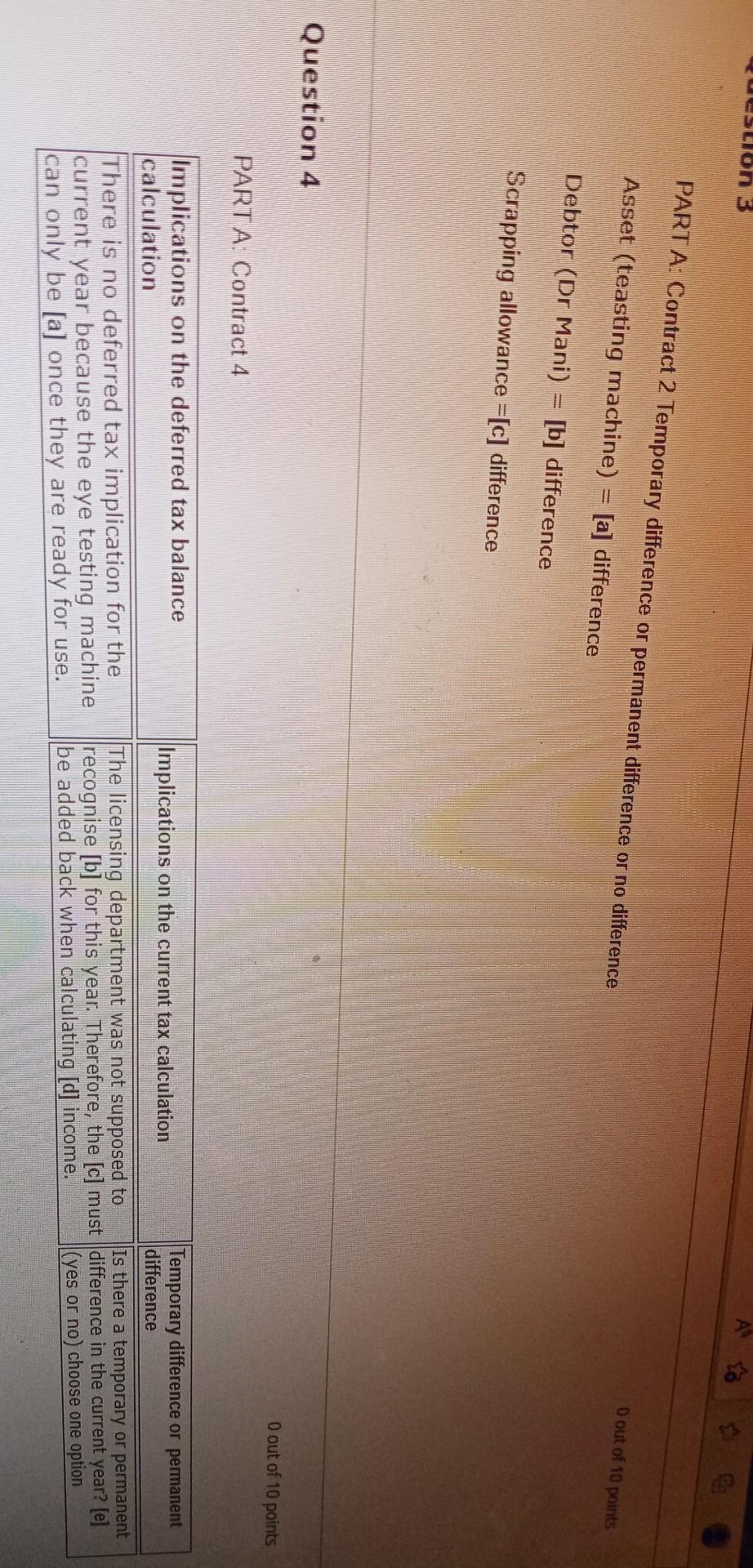

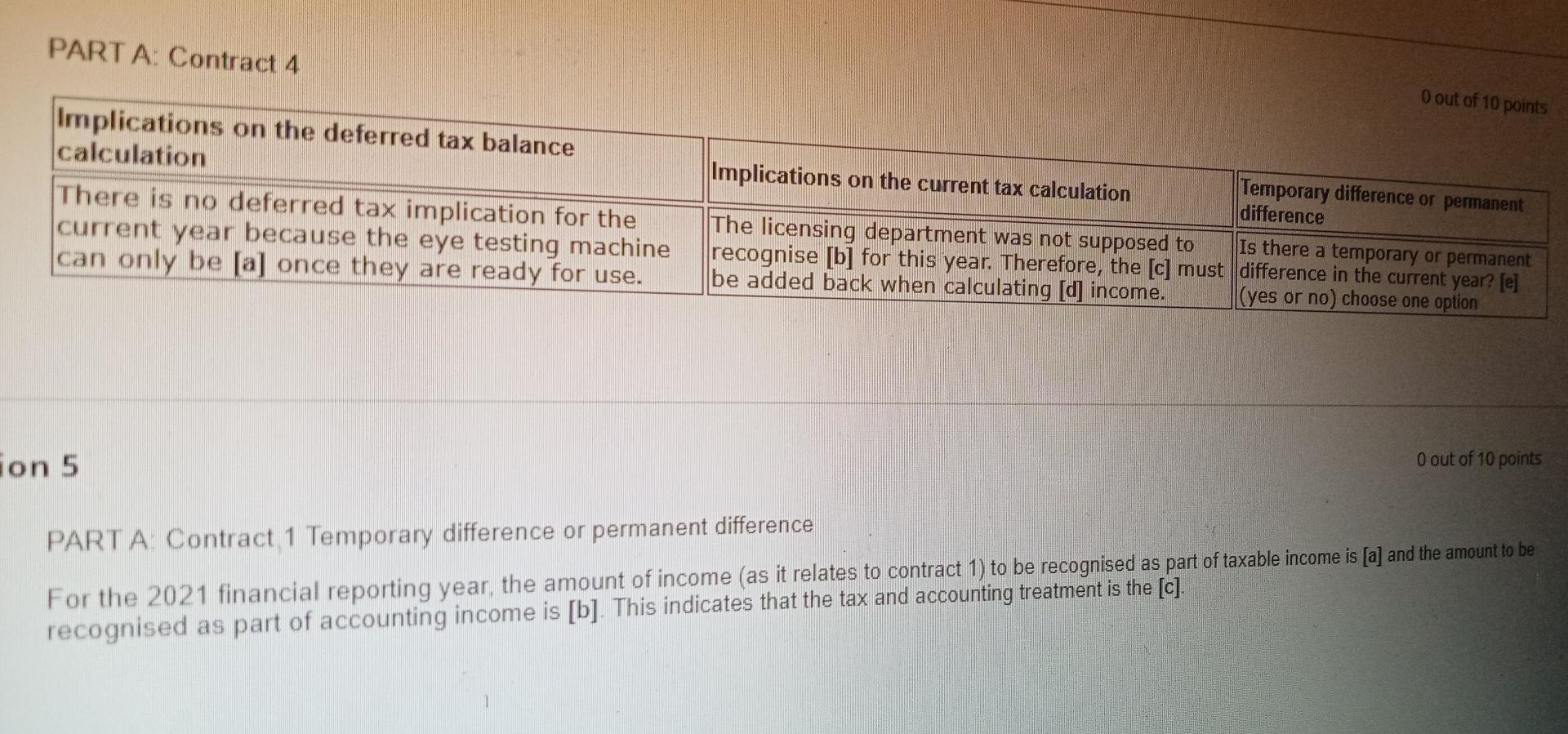

PART A: Contract 3 Implications on the deferred tax balance calculation If the leave pay is not taken in this current year, it will be carried forward as [a] resulting in an expense of [b]. Tax base of the lease pay will abount to at 31 December 2021 is [c]. Resulting in deffered tax implications [d] (Yes/No). SARS only recognizes the expense when it is [e] Question 2 PART B O out of 10 pc In your report to the financial manager, discussing the ethical implications arising from CONTRACT FOUR, you would include the following as an implication: Question Recognising depreciation in the correct period Recognising depreciation in the incorrect period Understating profits by overstating expenses Understating profits by overstating expenses Compliance with IAS 16 Compliance with IAS 16 3 tid PART A: Contract 2 Temporary difference or permanent difference or no difference Asset (teasting machine) = [a] difference O out of 10 points Debtor (Dr Mani) = [b] difference Scrapping allowance =[c] difference Question 4 O out of 10 points PART A: Contract 4 Implications on the deferred tax balance calculation There is no deferred tax implication for the current year because the eye testing machine can only be [a] once they are ready for use. Implications on the current tax calculation || Temporary difference or permanent difference The licensing department was not supposed to Is there a temporary or permanent recognise [b] for this year. Therefore, the [c] must difference in the current year? [e] be added back when calculating [d] income. (yes or no) choose one option PARTA: Contract 4 0 out of 10 points Implications on the deferred tax balance calculation There is no deferred tax implication for the current year because the eye testing machine can only be al once they are ready for use. Implications on the current tax calculation Temporary difference or permanent difference The licensing department was not supposed to Is there a temporary or permanent recognise [b] for this year. Therefore, the [c] must difference in the current year? [el be added back when calculating (d income. (yes or no) choose one option ion 5 0 out of 10 points PARTA Contract 1 Temporary difference or permanent difference For the 2021 financial reporting year, the amount of income (as it relates to contract 1) to be recognised as part of taxable income is [a] and the amount to be recognised as part of accounting income is [b]. This indicates that the tax and accounting treatment is the [c]. PART A: Contract 3 Implications on the deferred tax balance calculation If the leave pay is not taken in this current year, it will be carried forward as [a] resulting in an expense of [b]. Tax base of the lease pay will abount to at 31 December 2021 is [c]. Resulting in deffered tax implications [d] (Yes/No). SARS only recognizes the expense when it is [e] Question 2 PART B O out of 10 pc In your report to the financial manager, discussing the ethical implications arising from CONTRACT FOUR, you would include the following as an implication: Question Recognising depreciation in the correct period Recognising depreciation in the incorrect period Understating profits by overstating expenses Understating profits by overstating expenses Compliance with IAS 16 Compliance with IAS 16 3 tid PART A: Contract 2 Temporary difference or permanent difference or no difference Asset (teasting machine) = [a] difference O out of 10 points Debtor (Dr Mani) = [b] difference Scrapping allowance =[c] difference Question 4 O out of 10 points PART A: Contract 4 Implications on the deferred tax balance calculation There is no deferred tax implication for the current year because the eye testing machine can only be [a] once they are ready for use. Implications on the current tax calculation || Temporary difference or permanent difference The licensing department was not supposed to Is there a temporary or permanent recognise [b] for this year. Therefore, the [c] must difference in the current year? [e] be added back when calculating [d] income. (yes or no) choose one option PARTA: Contract 4 0 out of 10 points Implications on the deferred tax balance calculation There is no deferred tax implication for the current year because the eye testing machine can only be al once they are ready for use. Implications on the current tax calculation Temporary difference or permanent difference The licensing department was not supposed to Is there a temporary or permanent recognise [b] for this year. Therefore, the [c] must difference in the current year? [el be added back when calculating (d income. (yes or no) choose one option ion 5 0 out of 10 points PARTA Contract 1 Temporary difference or permanent difference For the 2021 financial reporting year, the amount of income (as it relates to contract 1) to be recognised as part of taxable income is [a] and the amount to be recognised as part of accounting income is [b]. This indicates that the tax and accounting treatment is the [c]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started