Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist with all the questions Contract One Sylvester and Ndumiso have decided to start up a small driving school. They work together with the

Please assist with all the questions

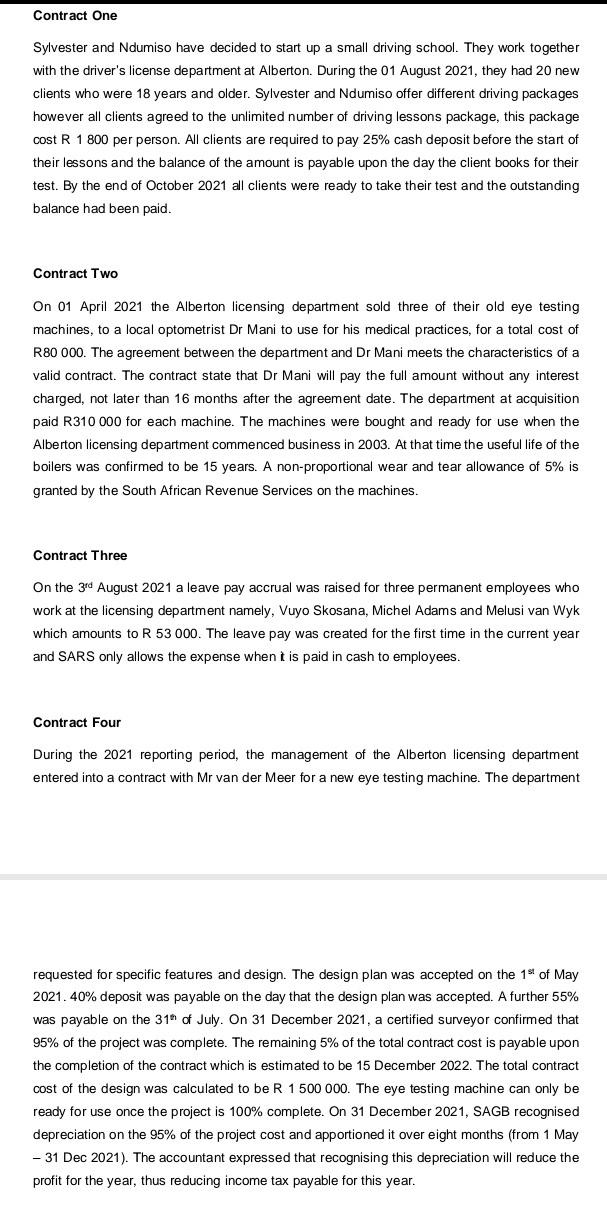

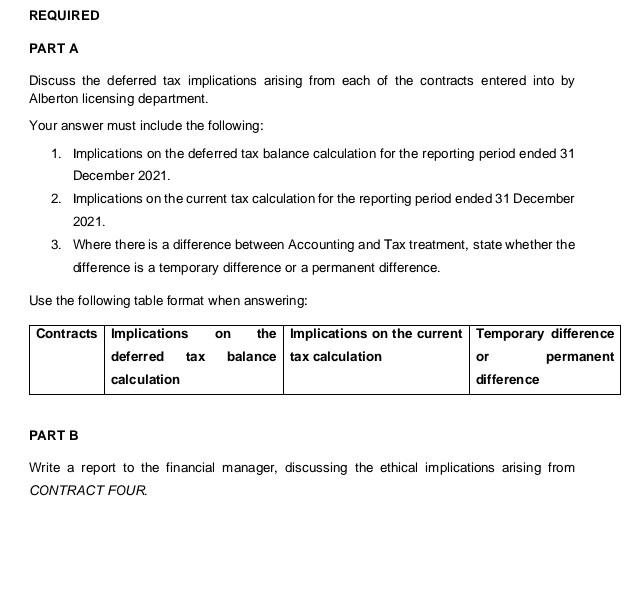

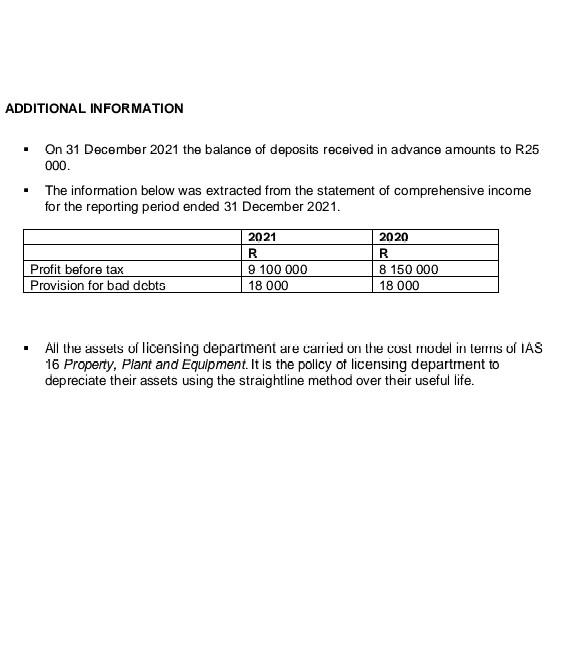

Contract One Sylvester and Ndumiso have decided to start up a small driving school. They work together with the driver's license department at Alberton. During the 01 August 2021, they had 20 new clients who were 18 years and older. Sylvester and Ndumiso offer different driving packages however all clients agreed to the unlimited number of driving lessons package, this package cost R 1 800 per person. All clients are required to pay 25% cash deposit before the start of their lessons and the balance of the amount is payable upon the day the client books for their test. By the end of October 2021 all clients were ready to take their test and the outstanding balance had been paid. Contract Two On 01 April 2021 the Alberton licensing department sold three of their old eye testing machines, to a local optometrist Dr Mani to use for his medical practices, for a total cost of R80 000. The agreement between the department and Dr Mani meets the characteristics of a valid contract. The contract state that Dr Mani will pay the full amount without any interest charged, not later than 16 months after the agreement date. The department at acquisition paid R310 000 for each machine. The machines were bought and ready for use when the Alberton licensing department commenced business in 2003. At that time the useful life of the boilers was confirmed to be 15 years. A non-proportional wear and tear allowance of 5% is granted by the South African Revenue Services on the machines. Contract Three On the 3rd August 2021 a leave pay accrual was raised for three permanent employees who work at the licensing department namely, Vuyo Skosana, Michel Adams and Melusi van Wyk which amounts to R 53 000. The leave pay was created for the first time in the current year and SARS only allows the expense when t is paid in cash to employees. Contract Four During the 2021 reporting period, the management of the Alberton licensing department entered into a contract with Mr van der Meer for a new eye testing machine. The department requested for specific features and design. The design plan was accepted on the 1 of May 2021.40% deposit was payable on the day that the design plan was accepted. A further 55% was payable on the 31 of July. On 31 December 2021, a certified surveyor confirmed that 95% of the project was complete. The remaining 5% of the total contract cost is payable upon the completion of the contract which is estimated to be 15 December 2022. The total contract cost of the design was calculated to be R 1 500 000. The eye testing machine can only be ready for use once the project is 100% complete. On 31 December 2021, SAGB recognised depreciation on the 95% of the project cost and apportioned it over eight months (from 1 May - 31 Dec 2021). The accountant expressed that recognising this depreciation will reduce the profit for the year, thus reducing income tax payable for this year. REQUIRED PARTA Discuss the deferred tax implications arising from each of the contracts entered into by Alberton licensing department. Your answer must include the following: 1. Implications on the deferred tax balance calculation for the reporting period ended 31 December 2021 2. Implications on the current tax calculation for the reporting period ended 31 December 2021. 3. Where there is a difference between Accounting and Tax treatment, state whether the difference is a temporary difference or a permanent difference. Use the following table format when answering: Contracts Implications the Implications on the current Temporary difference deferred balance tax calculation permanent calculation difference on tax or PART B Write a report to the financial manager, discussing the ethical implications arising from CONTRACT FOUR ADDITIONAL INFORMATION . On 31 December 2021 the balance of deposits received in advance amounts to R25 000 The information below was extracted from the statement of comprehensive income for the reporting period ended 31 December 2021. Profit before tax Provision for bad dcbts 2021 R 9 100 000 18 000 2020 R 8 150 000 18 000 . All the assets u licensing department are carried on the cost model in terms of IAS 16 Property, Plant and Equipment. It is the policy of licensing department to depreciate their assets using the straightline method over their useful life. Contract One Sylvester and Ndumiso have decided to start up a small driving school. They work together with the driver's license department at Alberton. During the 01 August 2021, they had 20 new clients who were 18 years and older. Sylvester and Ndumiso offer different driving packages however all clients agreed to the unlimited number of driving lessons package, this package cost R 1 800 per person. All clients are required to pay 25% cash deposit before the start of their lessons and the balance of the amount is payable upon the day the client books for their test. By the end of October 2021 all clients were ready to take their test and the outstanding balance had been paid. Contract Two On 01 April 2021 the Alberton licensing department sold three of their old eye testing machines, to a local optometrist Dr Mani to use for his medical practices, for a total cost of R80 000. The agreement between the department and Dr Mani meets the characteristics of a valid contract. The contract state that Dr Mani will pay the full amount without any interest charged, not later than 16 months after the agreement date. The department at acquisition paid R310 000 for each machine. The machines were bought and ready for use when the Alberton licensing department commenced business in 2003. At that time the useful life of the boilers was confirmed to be 15 years. A non-proportional wear and tear allowance of 5% is granted by the South African Revenue Services on the machines. Contract Three On the 3rd August 2021 a leave pay accrual was raised for three permanent employees who work at the licensing department namely, Vuyo Skosana, Michel Adams and Melusi van Wyk which amounts to R 53 000. The leave pay was created for the first time in the current year and SARS only allows the expense when t is paid in cash to employees. Contract Four During the 2021 reporting period, the management of the Alberton licensing department entered into a contract with Mr van der Meer for a new eye testing machine. The department requested for specific features and design. The design plan was accepted on the 1 of May 2021.40% deposit was payable on the day that the design plan was accepted. A further 55% was payable on the 31 of July. On 31 December 2021, a certified surveyor confirmed that 95% of the project was complete. The remaining 5% of the total contract cost is payable upon the completion of the contract which is estimated to be 15 December 2022. The total contract cost of the design was calculated to be R 1 500 000. The eye testing machine can only be ready for use once the project is 100% complete. On 31 December 2021, SAGB recognised depreciation on the 95% of the project cost and apportioned it over eight months (from 1 May - 31 Dec 2021). The accountant expressed that recognising this depreciation will reduce the profit for the year, thus reducing income tax payable for this year. REQUIRED PARTA Discuss the deferred tax implications arising from each of the contracts entered into by Alberton licensing department. Your answer must include the following: 1. Implications on the deferred tax balance calculation for the reporting period ended 31 December 2021 2. Implications on the current tax calculation for the reporting period ended 31 December 2021. 3. Where there is a difference between Accounting and Tax treatment, state whether the difference is a temporary difference or a permanent difference. Use the following table format when answering: Contracts Implications the Implications on the current Temporary difference deferred balance tax calculation permanent calculation difference on tax or PART B Write a report to the financial manager, discussing the ethical implications arising from CONTRACT FOUR ADDITIONAL INFORMATION . On 31 December 2021 the balance of deposits received in advance amounts to R25 000 The information below was extracted from the statement of comprehensive income for the reporting period ended 31 December 2021. Profit before tax Provision for bad dcbts 2021 R 9 100 000 18 000 2020 R 8 150 000 18 000 . All the assets u licensing department are carried on the cost model in terms of IAS 16 Property, Plant and Equipment. It is the policy of licensing department to depreciate their assets using the straightline method over their useful lifeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started